Brent Crude Dips Below $50 a Barrel

June 13 2016 - 12:20AM

Dow Jones News

Brent crude briefly fell below $50 a barrel for the first time

in a week after U.S. drilling data showed another uptick,

reinforcing views that the recent rally may restrain the

rebalancing of oil markets.

Oil prices have surged nearly 90% since dropping to 10-year lows

in February, thanks to unplanned production outages world-wide and

falling output in the U.S.

However, some market participants say the rally could encourage

producers to ramp up production, keeping well-supplied markets in

surplus.

On the New York Mercantile Exchange, light, sweet crude futures

for delivery in July recently traded at $48.60 a barrel, down $0.47

in the Globex electronic session. August Brent crude on London's

ICE Futures exchange fell $0.37 to $50.17 a barrel.

On Friday, Baker Hughes Inc. said the number of rigs drilling

for oil in the U.S. rose by three for the week ended June 10, the

second consecutive increase.

Some analysts say although the latest uptick doesn't indicate a

material change in U.S. production, it does suggest the $50 a

barrel price was "enough to prompt at least some shift at the

margin of the market from taking rigs offline to standing them back

up," said Timothy Evans, a Citi Futures analyst.

However, he said that despite the increase, the number of

drilling U.S. oil rigs is still 48% lower than a year earlier. "We

don't see the increase off the bottom as doing much more than

slightly slowing the rate of production decline."

Still, other analysts say given the lack of positive catalysts

in the market, even a marginal increase in shale production will

prompt investors to take profits.

In addition, demand growth—particularly in China—could ease in

the second half of the year as crude prices edge up, said Gao Jian,

an energy analyst at the Shandong-based SCI International.

China has been a crucial driver of global crude demand as the

government has granted more small private refiners— known as

teapots—unprecedented access to buy foreign crude. In May, China

crude imports rose 39% from a year earlier to 7.6 million barrels a

day. However, it fell 4.3% from the month before, mainly due to

port congestion.

"As crude oil prices are rising, many of the teapots are trying

to capture the still-low prices by maxing their import quotas now.

This is why the port is so congested and why China crude imports

might slow down later in the year," Mr. Gao said.

For this week, market participants will be looking at a monthly

report from the Organization of the Petroleum Exporting Countries,

which will be released later today. Some energy research firms

expect that OPEC production dropped slightly in May due to outages

in Nigeria and Libya. The International Energy Agency will also

release its monthly outlook report on Tuesday. Market participants

will also be looking to see what the U.S. Federal Reserve will do

with rates this week.

Write to Jenny W. Hsu at jenny.hsu@wsj.com

(END) Dow Jones Newswires

June 13, 2016 00:05 ET (04:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

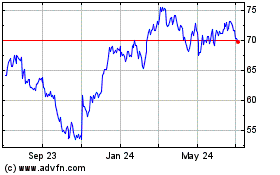

Service (NYSE:SCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Service (NYSE:SCI)

Historical Stock Chart

From Apr 2023 to Apr 2024