April 17, 2015

Please vote AGAINST the “Say-on-Pay” proposal at the Service Corporation International (NYSE:SCI) Annual Meeting on May 13, 2015

Dear Service Corp. shareholder:

At SCI’s upcoming annual shareholder meeting, we urge you to Vote AGAINST the Advisory Vote to Approve Executive Compensation (“Say-on-Pay”) owing to a litany of pay issues that include:

-

A Bloated Pay Structure: With CEO Thomas Ryan and COO Michael Webb handsomely paid to lead the company, shareholders should not in addition be paying former CEO R. L. Waltrip over $5 million a year as Executive Chairman, a position he has held for a decade and for which SCI proxy statements indicate that he has received more than $50 million in compensation.

-

Weak Pay Oversight: The Compensation Committee, like the board as a whole, bears hallmarks of entrenchment with average director tenure exceeding 17 years, and a lack of responsiveness to shareholders’ say-on-pay opposition (22% last year, 18% in 2013).

-

Undermined Performance Metrics: For a company facing material risks from claims and litigation over its burial practices, adjusting the annual bonus plan to exclude most legal costs removes a potentially key cost of doing business and distorts the incentive to drive sustainable profitability. The long-term performance units, meanwhile, pay out against the relative performance of a motley array of “peer” companies (e.g., banks, oil and gas, industrials, restaurants) that omits any of SCI’s publicly-traded competitors.

The CtW Investment Group works with pension funds in order to enhance long-term shareholder value through active ownership. These funds invest over $250 billion in the global capital markets and are substantial investors in SCI.

SCI’s Bloated Pay Structure

With the highly paid tandem of CEO Ryan ($9.9 million in 2014) and COO Webb ($5.2 million), it is unclear why shareholders should be paying 84 year-old founder and former CEO R. L. Waltrip in excess of $5 million per year as Executive Chair. Since he resigned as CEO a decade ago –at which time Ryan and Webb assumed their current roles – Waltrip has received compensation worth over $50 million for serving as Executive Chair. Not only is his 2014 pay similar to the level he received as CEO, but it is on a par with the median CEO pay at peer companies selected by Equilar, an executive compensation analytics provider, in its Pay for Performance Profile report for SCI.

As SCI’s founder, Waltrip has obviously been instrumental to the historical success of the company and he may still provide valuable insights. But with the role of Executive Chair typically viewed as a less-than-full-time occupation and varying in precise responsibilities by company, it is decidedly unclear for what services investors are currently paying him based on current disclosures.

Moreover, while according to the proxy, senior executive pay levels are compared to market data for similar positions among its peer group to ensure competitiveness, we note that Waltrip is being paid more than 150% of the average pay of other “permanent” non-CEO Executive Chairs in this peer group

2

according to data from ISS1. In fact, based on a recent Equilar Report, Waltrip’s compensation exceeds the median paid to Executive Chairs at S&P 500 companies who had made the transition from CEO/chair to Executive Chair within the last five years, even though SCI is only a Russell 3000 company2. To take just one example, Waltrip’s compensation is approximately the same as the 2015 total target compensation to be paid to Yum! Brands’ David Novak in his new capacity as Executive Chair, following his recent resignation as Yum! CEO; Yum! is a company with a market capitalization seven times that of SCI. It should be noted, too, that according to Yum!’s proxy, the board targeted Novak’s pay at the 50th percentile of Executive Chairs in the Fortune 250.

According to a PWC survey, a majority of investors surveyed believe a board should consider modifying executive pay structures if the negative vote on say-on-pay is between at least 21% and 30%3. With SCI within this range in 2014, it is troubling that the Compensation Committee states in the proxy that the voting “results did not impact” its pay decisions for 2015.

The Compensation Committee, it seems, is making the mistake of compensating Waltrip more on the basis of his past services to the company as founder and CEO than on a competitive basis for his current services to the company – a concern compounded by the board’s composition.

Weak Pay Oversight

SCI’s governance structure suggests weak oversight, especially on pay issues. The board includes

Waltrip’s son, and the average tenure of “independent” directors is 16 years (18 years for the Nominating and Governance Committee members and 17 years for the Compensation Committee). Moreover, rather than seek a diversity of viewpoints, there is a strong bias for Houston-based directors (six of the nine outside directors), as well as a reliance on personal connections to recruit new directors.

Add up all these factors, and SCI bears many of the hallmarks of an entrenched, if not founder-dominated, board (even though the Waltrip family own less than 2% of the company’s shares).

It should also be noted that up until last year – when CtW Investment Group flagged the issue in a letter to the board – outside directors enjoyed the personal use of the company aircraft (up to 30 hours annually); even with the elimination of this perk, SCI directors received $300,000 in compensation last year, making them exceedingly well paid directors indeed, well above the 75th percentile of Fortune 500 companies4.

Flawed Implementation of Performance Metrics

SCI makes numerous adjustments to the annual performance measures it employs, including the exclusion of litigation or settlements exceeding $5 million for an individual class of legal cases. This seems unwise for a company that continues to face challenges over its burial practices, including one

1 This analysis is based on the 141 constituents of SCI’s selected peer group for which data could be obtained from ISS. In the analysis, the CtW Investment Group identified non-CEO Executive Chairs that had assumed the role pursuant to a board decision that the Chair should be a different person than the CEO, as opposed to an Executive Chair who has relinquished the additional post of CEO and who is remaining on the board as the company transitions to a new CEO.

2 “Key Compensation Trends for CEO to Executive Chairman Transitions,” March 4, 2015, Equilar – available at http://www.equilar.com/publications/47-key-compensation-trends.html.

3 Through the investor lens: perspectives on risk & governance: PwC’s Investor Survey 2013.

4 Towers Watson Executive Compensation Bulletin: Equity Strikes Back, published September 24, 2014.

3

lawsuit that was settled for $35 million in February. Also, SCI warns in its 10-K that claims against burial practices could have a “material adverse impact” on the company’s financial position.” We believe that excluding these costs can set up potentially distortive incentives in the running of the company. Indeed, given the unfavorable publicity the company has received over its burial practices, adding an explicit measure of the company’s burial practices (e.g., customer satisfaction or litigation) would appear eminently sensible.

The selection of companies for the peer group used to calculate the relative TSR performance is also perplexing. SCI is the nation’s largest “deathcare” business, and thus it should be pretty clear that SCI has unique growth dynamics, truly shared only by its publicly-traded competitors (e.g., Carriage Services, Inc., NYSE: CSV; StoneMore Partners, NASDAQ:STON). Yet, SCI’s current proxy lists 147 companies in its TSR reference group, but not a single one is a direct competitor of SCI. Instead, its peer group includes a range of companies from energy companies, financials, food services, industrial companies, IT, medical device companies and REITs, among others, which have very different exposures to current and future economic conditions. SCI has undoubtedly had strong share performance over the past three years, but given the significant payout opportunity (200% of target, or $3.32 million in the case of CEO Ryan) it is vital to use a more appropriately constructed peer group.

We urge you to join us by voting AGAINST approval of the advisory vote on executive compensation (Item 3). If you would like to discuss our concerns directly with us, please contact my colleague Michael Pryce-Jones at (202) 721-6079 or michael.pryce-jones@changetowin.org.

Sincerely

Executive Director, CtW Investment Group

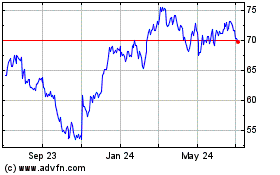

Service (NYSE:SCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Service (NYSE:SCI)

Historical Stock Chart

From Apr 2023 to Apr 2024