SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For November 12, 2015

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

SABESP announces 3Q15 results

São Paulo, November 12, 2015 - Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BM&FBovespa: SBSP3; NYSE: SBS), one of the largest water and sewage services providers in the world based on the number of costumers, announces today its results for the third quarter of 2015 (3Q15). The Company’s operating and financial information, except when indicated otherwise is presented in Brazilian Reais, in accordance with the Brazilian Corporate Law. All comparisons in this release, unless otherwise stated, refer to the same period of 2014. |

|

SBSP3: R$ 17.88/share

SBS: US$ 4.63 (ADR=1 share)

Total shares: 683,509,869

Market value: R$ 12.2 billion

Closing quote: 11/12/2015

|

1. Financial highlights

| |

|

|

|

|

|

|

|

R$ million |

|

|

|

3Q15 |

3Q14 |

Chg. (R$) |

% |

9M15 |

9M14 |

Chg. (R$) |

% |

|

|

Gross operating revenue |

2,327.2 |

2,165.6 |

161.6 |

7.5 |

6,378.9 |

6,834.1 |

(455.2) |

(6.7) |

|

|

Construction revenue |

1,015.2 |

799.7 |

215.5 |

26.9 |

2,508.5 |

2,009.7 |

498.8 |

24.8 |

|

|

COFINS and PASEP taxes |

(145.4) |

(141.8) |

(3.6) |

2.5 |

(398.9) |

(474.2) |

75.3 |

(15.9) |

|

(=) |

Net operating revenue |

3,197.0 |

2,823.5 |

373.5 |

13.2 |

8,488.5 |

8,369.6 |

118.9 |

1.4 |

|

|

Costs and expenses |

(1,570.8) |

(1,541.0) |

(29.8) |

1.9 |

(3,825.1) |

(4,707.3) |

882.2 |

(18.7) |

|

|

Construction costs |

(993.0) |

(782.1) |

(210.9) |

27.0 |

(2,454.6) |

(1,966.9) |

(487.7) |

24.8 |

|

|

Equity result |

(1.3) |

(1.2) |

(0.1) |

- |

(0.4) |

(1.5) |

1.1 |

(73.3) |

| |

Other operating revenue (expenses), net |

54.3 |

(6.2) |

60.5 |

(975.8) |

98.1 |

(44.1) |

142.2 |

(322.4) |

|

(=) |

Earnings before financial result, income tax and social contribution |

686.2 |

493.0 |

193.2 |

39.2 |

2,306.5 |

1,649.8 |

656.7 |

39.8 |

|

|

Financial result |

(1,539.4) |

(337.8) |

(1,201.6) |

355.7 |

(2,369.7) |

(331.8) |

(2,037.9) |

614.2 |

|

(=) |

Earnings before income tax and social contribution |

(853.2) |

155.2 |

(1,008.4) |

(649.7) |

(63.2) |

1,318.0 |

(1,381.2) |

(104.8) |

|

|

Income tax and social contribution |

273.1 |

(63.7) |

336.8 |

(528.7) |

138.5 |

(446.5) |

585.0 |

(131.0) |

|

(=) |

Net income (loss) |

(580.1) |

91.5 |

(671.6) |

(734.0) |

75.3 |

871.5 |

(796.2) |

(91.4) |

|

|

Earnings (loss) per share* (R$) |

(0.85) |

0.13 |

|

|

0.11 |

1.28 |

|

|

| |

* Total shares = 683,509,869 |

|

|

|

|

|

|

|

|

Adjusted EBITDA Reconciliation (Non-accounting measures)

| |

|

|

|

|

|

|

|

R$ million |

|

|

|

3Q15 |

3Q14 |

Chg. (R$) |

% |

9M15 |

9M14 |

Chg. (R$) |

% |

|

|

Net income (loss) |

(580.1) |

91.5 |

(671.6) |

(734.0) |

75.3 |

871.5 |

(796.2) |

(91.4) |

| |

Income tax and social contribution |

(273.1) |

63.7 |

(336.8) |

(528.7) |

(138.5) |

446.5 |

(585.0) |

(131.0) |

|

|

Financial result |

1,539.4 |

337.8 |

1,201.6 |

355.7 |

2,369.7 |

331.8 |

2,037.9 |

614.2 |

| |

Other operating revenues (expenses), net |

(54.3) |

6.2 |

(60.5) |

(975.8) |

(98.1) |

44.1 |

(142.2) |

(322.4) |

|

(=) |

Adjusted EBIT* |

631.9 |

499.2 |

132.7 |

26.6 |

2,208.4 |

1,693.9 |

514.5 |

30.4 |

| |

Depreciation and amortization |

271.3 |

243.2 |

28.1 |

11.6 |

808.7 |

726.0 |

82.7 |

11.4 |

|

(=) |

Adjusted EBITDA ** |

903.2 |

742.4 |

160.8 |

21.7 |

3,017.1 |

2,419.9 |

597.2 |

24.7 |

|

|

(%) Adjusted EBITDA margin |

28.3 |

26.3 |

|

|

35.5 |

28.9 |

|

|

(*) Adjusted EBIT is net income before: (i) other operating revenues/expenses; (ii) financial result; and (iii) income tax and social contribution.

(**) Adjusted EBITDA is net income before: (i) depreciation and amortization expenses; (ii) income tax and social contribution; (iii) financial result; and (iv) other operating revenues/expenses, net.

In 3Q15, net operating revenue, including construction revenue, reached R$ 3.2 billion; a 13.2% increase compared to 3Q14.

Costs and expenses, including construction costs, totaled R$ 2.6 billion, up by 10.4% compared to R$ 2.3 billion recorded in 3Q14.

Adjusted EBIT, in the amount of R$ 631.9 million, grew 26.6% from R$ 499.2 million recorded in the same quarter of the previous year.

Adjusted EBITDA, in the amount of R$ 903.2 million, increased 21.7% from R$ 742.4 million recorded in 3Q14 (R$ 3,017.1 million in the last 9 months and R$ 3,515.9 million in the last 12 months).

The adjusted EBITDA margin was 28.3% in 3Q15, versus 26.3% in 3Q14 (35.5% in the last 9 months and 31.0% in the last 12 months). Excluding construction revenues and construction costs, the adjusted EBITDA margin was 40.4% in 3Q15 (35.8% in 3Q14, 49.6% in the last 9 months and 43.5% in the last 12 months).

In 3Q15 the Company recorded a net loss of R$ 580.1 million, in comparison to a net income of R$ 91.5 million recorded in 3Q14.

2. Gross operating revenue

Gross operating revenue from water and sewage, not including construction revenue, totaled R$ 2.3 billion, an increase of R$ 161.6 million or 7.5%, when compared to the R$ 2.2 billion recorded in 3Q14.

The main factors that led to this variation were:

· 6.5% repositioning tariff index since December 2014;

· 15.2% tariff increase (7.8% ordinary tariff adjustment and 6.9% extraordinary tariff revision) since June 2015; and

· Application of contingency tariff, with a R$ 144.8 million impact in 3Q15.

The increase in gross operating revenue was mitigated by:

· Bonus granted within the Water Consumption Reduction Incentive Program, with a R$ 248.8 million impact in 3Q15, versus the R$ 129.4 million granted in 3Q14, leading to a decrease of 5.5% in gross operating revenue; and

· Decrease of 5.8% in the Company’s total billed volume (6.8% in water and 4.4% in sewage).

3. Construction revenue

Construction revenue increased R$ 215.5 million or 26.9%, when compared to 3Q14. The variation was mainly due to higher investments in the concessions.

4. Billed volume

The following tables show the water and sewage billed volume, quarter-on-quarter and year-to-date, per customer category and region.

|

WATER AND SEWAGE BILLED VOLUME (1) PER CUSTOMER CATEGORY - million m3 |

|

|

|

Water |

|

|

Sewage |

|

Water + Sewage |

|

|

Category |

3Q15 |

3Q14 |

% |

3Q15 |

3Q14 |

% |

3Q15 |

3Q14 |

% |

|

Residential |

363.1 |

379.6 |

(4.3) |

306.1 |

318.2 |

(3.8) |

669.2 |

697.8 |

(4.1) |

|

Commercial |

39.6 |

42.4 |

(6.6) |

37.8 |

40.1 |

(5.7) |

77.4 |

82.5 |

(6.2) |

|

Industrial |

8.0 |

9.6 |

(16.7) |

9.6 |

10.7 |

(10.3) |

17.6 |

20.3 |

(13.3) |

|

Public |

9.6 |

12.9 |

(25.6) |

8.4 |

9.9 |

(15.2) |

18.0 |

22.8 |

(21.1) |

|

Total retail |

420.3 |

444.5 |

(5.4) |

361.9 |

378.9 |

(4.5) |

782.2 |

823.4 |

(5.0) |

|

Wholesale (3) |

52.8 |

63.1 |

(16.3) |

5.8 |

5.8 |

- |

58.6 |

68.9 |

(14.9) |

|

Total |

473.1 |

507.6 |

(6.8) |

367.7 |

384.7 |

(4.4) |

840.8 |

892.3 |

(5.8) |

|

|

9M15 |

9M14 |

% |

9M15 |

9M14 |

% |

9M15 |

9M14 |

% |

|

Residential |

1,090.1 |

1,172.3 |

(7.0) |

916.0 |

977.8 |

(6.3) |

2,006.1 |

2,150.1 |

(6.7) |

|

Commercial |

119.5 |

130.1 |

(8.1) |

113.4 |

122.4 |

(7.4) |

232.9 |

252.5 |

(7.8) |

|

Industrial |

24.5 |

29.7 |

(17.5) |

29.2 |

32.7 |

(10.7) |

53.7 |

62.4 |

(13.9) |

|

Public |

30.8 |

39.8 |

(22.6) |

24.8 |

30.8 |

(19.5) |

55.6 |

70.6 |

(21.2) |

|

Total retail |

1,264.9 |

1,371.9 |

(7.8) |

1,083.4 |

1,163.7 |

(6.9) |

2,348.3 |

2,535.6 |

(7.4) |

|

Wholesale (3) |

164.9 |

208.0 |

(20.7) |

18.3 |

18.9 |

(3.2) |

183.2 |

226.9 |

(19.3) |

|

Total |

1,429.8 |

1,579.9 |

(9.5) |

1,101.7 |

1,182.6 |

(6.8) |

2,531.5 |

2,762.5 |

(8.4) |

| |

|

|

|

|

|

|

|

|

|

|

WATER AND SEWAGE BILLED VOLUME (1) PER REGION - million m3 |

|

|

Water |

|

Sewage |

|

Water + Sewage |

|

|

Region |

3Q15 |

3Q14 |

% |

3Q15 |

3Q14 |

% |

3Q15 |

3Q14 |

% |

|

Metropolitan |

271.6 |

289.4 |

(6.2) |

235.7 |

249.1 |

(5.4) |

507.3 |

538.5 |

(5.8) |

|

Regional (2) |

148.7 |

155.1 |

(4.1) |

126.2 |

129.8 |

(2.8) |

274.9 |

284.9 |

(3.5) |

|

Total retail |

420.3 |

444.5 |

(5.4) |

361.9 |

378.9 |

(4.5) |

782.2 |

823.4 |

(5.0) |

|

Wholesale (3) |

52.8 |

63.1 |

(16.3) |

5.8 |

5.8 |

- |

58.6 |

68.9 |

(14.9) |

|

Total |

473.1 |

507.6 |

(6.8) |

367.7 |

384.7 |

(4.4) |

840.8 |

892.3 |

(5.8) |

|

|

9M15 |

9M14 |

% |

9M15 |

9M14 |

% |

9M15 |

9M14 |

% |

|

Metropolitan |

806.6 |

891.2 |

(9.5) |

698.2 |

763.3 |

(8.5) |

1,504.8 |

1,654.5 |

(9.0) |

|

Regional (2) |

458.3 |

480.7 |

(4.7) |

385.2 |

400.4 |

(3.8) |

843.5 |

881.1 |

(4.3) |

|

Total retail |

1,264.9 |

1,371.9 |

(7.8) |

1,083.4 |

1,163.7 |

(6.9) |

2,348.3 |

2,535.6 |

(7.4) |

|

Wholesale (3) |

164.9 |

208.0 |

(20.7) |

18.3 |

18.9 |

(3.2) |

183.2 |

226.9 |

(19.3) |

|

Total |

1,429.8 |

1,579.9 |

(9.5) |

1,101.7 |

1,182.6 |

(6.8) |

2,531.5 |

2,762.5 |

(8.4) |

(1) Unaudited

(2) Including coastal and interior region

(3) Reused water and non-domestic sewage are included in wholesale

5. Costs, administrative, selling and construction expenses

In 3Q15, costs, administrative, selling and construction expenses, grew 10.4% (R$ 240.7 million). Excluding construction costs, total costs and expenses grew by 1.9%. As a percentage of net revenue, cost and expenses were 82.3% in 3Q14 and 80.2% in 3Q15.

| |

|

|

|

|

|

|

R$ million |

|

|

3Q15 |

3Q14 |

Chg. (R$) |

% |

9M15 |

9M14 |

Chg. (R$) |

% |

|

Payroll and benefits |

552.0 |

535.9 |

16.1 |

3.0 |

1,615.3 |

1,584.0 |

31.3 |

2.0 |

|

Supplies |

42.0 |

54.7 |

(12.7) |

(23.2) |

133.7 |

148.8 |

(15.1) |

(10.1) |

|

Treatment supplies |

62.9 |

65.6 |

(2.7) |

(4.1) |

198.8 |

199.9 |

(1.1) |

(0.6) |

|

Services |

296.6 |

301.1 |

(4.5) |

(1.5) |

862.5 |

967.4 |

(104.9) |

(10.8) |

|

Electric power |

220.0 |

156.3 |

63.7 |

40.8 |

587.4 |

440.8 |

146.6 |

33.3 |

|

General expenses |

144.5 |

187.6 |

(43.1) |

(23.0) |

247.7 |

530.3 |

(282.6) |

(53.3) |

|

Tax expenses |

19.6 |

18.2 |

1.4 |

7.7 |

57.9 |

55.4 |

2.5 |

4.5 |

|

São Paulo state government reimbursement |

- |

- |

- |

- |

(696.3) |

- |

(696.3) |

- |

|

Sub-total |

1,337.6 |

1,319.4 |

18.2 |

1.4 |

3,007.0 |

3,926.6 |

(919.6) |

(23.4) |

|

Depreciation and amortization |

271.3 |

243.2 |

28.1 |

11.6 |

808.7 |

726.0 |

82.7 |

11.4 |

|

Credit write-offs |

(38.1) |

(21.6) |

(16.5) |

76.4 |

9.4 |

54.7 |

(45.3) |

(82.8) |

|

Sub-total |

233.2 |

221.6 |

11.6 |

5.2 |

818.1 |

780.7 |

37.4 |

4.8 |

|

Costs, administrative and selling expenses |

1,570.8 |

1,541.0 |

29.8 |

1.9 |

3,825.1 |

4,707.3 |

(882.2) |

(18.7) |

|

Construction costs |

993.0 |

782.1 |

210.9 |

27.0 |

2,454.6 |

1,966.9 |

487.7 |

24.8 |

|

Costs, adm., selling and construction expenses |

2,563.8 |

2,323.1 |

240.7 |

10.4 |

6,279.7 |

6,674.2 |

(394.5) |

(5.9) |

|

% of net revenue |

80.2 |

82.3 |

|

|

74.0 |

79.7 |

|

|

5.1. Payroll and benefits

In 3Q15 payroll and benefits increased R$ 16.1 million or 3.0%, due to the following:

· R$ 20.5 million, mainly due to the average wage increase of 9.7% in May 2015 and by the application of 1% related to the career and wage plan, since July 2015;

· R$ 10.3 million in the provision for the pension plan, arising from changes in actuarial assumptions; and

· R$ 8.3 million severance payments, due to dismissal in 3Q15.

Despite the above factors, there was a decrease of R$ 24.9 million, due to the smaller number of employees entitled to retirement (TAC).

5.2. Supplies

In 3Q15, expenses with supplies decreased R$ 12.7 million or 23.2%, from R$ 54.7 million to R$ 42.0 million, mostly due to lower use of materials in preventive and corrective maintenance in water and sewage systems, expansion of computerized systems and conservation of properties and installations, in the amount of R$ 8.7 million.

5.3. Services

Services expenses, in the amount of R$ 296.6 million, dropped R$ 4.5 million or 1.5%, in comparison to R$ 301.1 million in 3Q14. The main factors that led to this decrease were lower expenses with the Program for the Rational Use of Water (PURA), in the amount of R$ 2.4 million and with surveillance services, in the amount of R$ 2.3 million.

5.4. Electric power

Electric power expenses totaled R$ 220.0 million, an increase of R$ 63.7 million or 40.8% in comparison to the R$ 156.3 million in 3Q14, chiefly due to the following:

· Average increase of 76.4% in the regulated market tariffs, with a 8.3% decrease in consumption; and

· Average increase of 196.4% in the grid market tariffs (TUSD), with a 4.0% decrease in consumption.

The increases were partially offset by the 11.1% drop in tariffs and the 2.6% drop in the free market consumption.

In 3Q15 the regulated market accounted for 67.1% of the total electric power consumed by the Company, the free market accounted for 17.4% and the grid market (TUSD) accounted for 15.5% of total consumption.

5.5. General expenses

General expenses dropped R$ 43.1 million or 23.0%, totaling R$ 144.5 million, versus the R$ 187.6 million recorded in 3Q14 mainly due to:

· Reversal of the provision, totaling R$ 17.9 million, related to the recovery of amounts with the Government of the State of São Paulo – GESP due to the disposal of employees; and

· R$ 17.7 million decrease in the provision for lawsuits.

5.6. Depreciation and amortization

R$ 28.1 million increase or 11.6%, reaching R$ 271.3 million in comparison to the R$ 243.2 million recorded in 3Q14, largely due to the beginning of operations of intangible assets, in the amount of R$ 2.5 billion.

5.7. Credit write-offs

Credit write-offs decreased R$ 16.5 million, especially due to the reversal of the provision for losses with the municipality of Santos, in the amount of R$ 70.5 million, as a result of the settlement of an agreement.

The decrease was offset by the additional provisions for losses in the amount of R$ 54.0 million, mostly with public entities and private clients.

6. Other operating revenues and expenses, net

Other net operational revenues and expenses reported an upturn of R$ 60.5 million, mainly due to the following:

· An increase of R$ 42.7 million in other operating revenues, largely due to the proceeds of R$ 22.1 million related to the Depollution Program of Hydrographic Basins and the sale of real estate in 3Q15, totaling R$ 16.6 million; and

· A decrease of R$ 17.8 million on other operating expenses, as a result of the decrease in the write-off of obsolete goods during 3Q15, in the amount of R$ 14.6 million.

7. Financial result

| |

|

|

R$ million |

|

|

3Q15 |

3Q14 |

Chg. |

% |

|

Financial expenses, net of revenues |

(105.6) |

(36.7) |

(68.9) |

187.7 |

|

Net monetary and exchange variation |

(1,433.8) |

(301.1) |

(1,132.7) |

376.2 |

|

Financial result |

(1,539.4) |

(337.8) |

(1,201.6) |

355.7 |

7.1. Financial revenues and expenses

| |

|

|

R$ million |

|

|

3Q15 |

3Q14 |

Chg. |

% |

|

Financial expenses |

|

|

|

|

|

Interest and charges on international loans and financing |

(39.2) |

(27.1) |

(12.1) |

44.6 |

|

Interest and charges on domestic loans and financing |

(80.9) |

(46.6) |

(34.3) |

73.6 |

|

Other financial expenses |

(50.4) |

(43.9) |

(6.5) |

14.8 |

|

Total financial expenses |

(170.5) |

(117.6) |

(52.9) |

45.0 |

|

Financial revenues |

64.9 |

80.9 |

(16.0) |

(19.8) |

|

Financial expenses net of revenues |

(105.6) |

(36.7) |

(68.9) |

187.7 |

7.1.1. Financial expenses

Financial expenses grew R$ 52.9 million. The main reasons were:

· R$ 34.3 million in interest and charges on domestic loans and financing, especially due to the higher appreciation of the CDI in 3Q15, in comparison to 3Q14 (14.13% and 10.81%, respectively); and

· R$ 12.1 million in interest and charges on international loans and financing, due to the higher appreciation of US dollar and the Yen versus the Brazilian Real in 3Q15 (28.1% and 30.5%, respectively), when compared to 3Q14 (11.3% and 2.8%, respectively).

7.1.2. Financial revenues

Financial revenues decreased R$ 16.0 million, largely due to lower financial investments held in the period.

7.2. Monetary and exchange rate variation on assets and liabilities

| |

|

|

|

R$ million |

|

|

3Q15 |

3Q14 |

Chg. |

% |

|

Monetary variation on loans and financing |

(25.9) |

(10.2) |

(15.7) |

153.9 |

|

Currency exchange variation on loans and financing |

(1,448.9) |

(312.9) |

(1,136.0) |

363.1 |

|

Other monetary variations |

(18.6) |

(6.8) |

(11.8) |

173.5 |

|

Monetary/exchange rate variation on liabilities |

(1,493.4) |

(329.9) |

(1,163.5) |

352.7 |

|

Monetary/exchange rate variation on assets |

59.6 |

28.8 |

30.8 |

106.9 |

|

Monetary/exchange rate variation, net |

(1,433.8) |

(301.1) |

(1,132.7) |

376.2 |

7.2.1. Monetary/currency exchange variation on liabilities

The effect on the monetary/currency exchange variation on liabilities in 3Q15 was R$ 1,163.5 million, higher than in 3Q14, especially due to:

· Negative variation of R$ 1,136.0 million in expenses with exchange rate variation on loans and financing, due to a higher appreciation of the US dollar and the Yen versus the Brazilian Real in 3Q15 (28.1% and 30.5%, respectively), when compared to 3Q14 (11.3% and 2.8%, respectively); and

· An upturn of R$ 15.7 million in expenses with monetary variation on loans and financing, due to the increase in the IPCA (Amplified Consumer Price Index) in 3Q15 compared to 3Q14 (1.4% and 0.8%, respectively).

7.2.2. Monetary/Exchange rate variation on assets

An increase of R$ 30.8 million, especially due to the monetary update on the agreement with the municipality of Santos, in 3Q15.

8. Income tax and social contribution

Recorded a R$ 336.8 million upturn, due to the decrease in taxable income in 3Q15, versus 3Q14.

9. Indicators

9.1. Operating

As a result of the water crisis, there was a substantial reduction in the water production volume, down by 11.1% in the quarter and 15.9% in the nine month period.

There was also a substantial decline in the index that measures water losses per connection per day (IPDT) which came to 261 liters/connection x day versus 340 liters/connection x day on the same period last year. This reduction was the result not only of loss control initiatives, but also of the water crisis and the consequent need to reduce the network pressure as a demand management mechanism.

|

Operating indicators * |

3Q15 |

3Q14 |

% |

|

Water connections (1) |

8,366 |

8,156 |

2.6 |

|

Sewage connections (1) |

6,806 |

6,607 |

3.0 |

|

Population directly served - water (2) |

25.5 |

25.2 |

1.2 |

|

Population directly served - sewage (2) |

22.7 |

22.2 |

2.3 |

|

Number of employees |

14,056 |

14,766 |

(4.8) |

|

Water volume produced - quarter (3) |

615 |

692 |

(11.1) |

|

Water volume produced - nine months (3) |

1,834 |

2,180 |

(15.9) |

|

IPM - Measured water loss (%) |

28.3 |

30.2 |

(6.3) |

|

IPDt (liters/connection x day) |

261 |

340 |

(23.2) |

(1) Total connections, active and inactive, in thousand units at the end of the period

(2) In million inhabitants, at the end of the period. Not including wholesale

(3) In millions of cubic meters

(*) Unaudited

9.2. Financial

|

Economic Indexes * (quarter end) |

3Q15 |

3Q14 |

|

Amplified Consumer Price Index (IPCA) - % |

0.54 |

0.57 |

|

Referential Rate (TR) - % |

0.19 |

0.09 |

|

Interbank Deposit Certificate (CDI) - % |

14.13 |

10.81 |

|

US DOLAR (R$) |

3.9729 |

2.4510 |

|

YEN (R$) |

0.03316 |

0.02235 |

(*) Unaudited

10. Loans and financing

On September 30, 2015, the Company and the IDB entered into a Letter Agreement related to the AB Loan 1983AB Loan Agreement, in which the IDB irrevocably agreed not to exercise its right to accelerate the debt, in the period between September 30, 2015 and October 1, 2016, in the case of non-compliance, in a single quarter, with the “Adjusted net debt / EBITDA” ratio, which should be lower than 3.65. The IDB may exercise its right to accelerate repayment in the case of non-compliance with said ratio for more than one quarter. The Company’s ratio this quarter was 3.54, in line with the contractual requirement.

| |

|

|

|

|

|

|

R$ million |

|

INSTITUTION |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 and onwards |

Total |

|

Local market |

|

|

|

|

|

|

|

|

|

Caixa Econômica Federal |

11.1 |

48.0 |

52.5 |

55.9 |

57.6 |

59.7 |

749.5 |

1,034.3 |

|

Debentures |

38.4 |

360.8 |

889.4 |

604.9 |

698.7 |

388.9 |

597.8 |

3,578.9 |

|

BNDES |

13.5 |

70.1 |

75.5 |

75.5 |

75.5 |

57.8 |

299.2 |

667.1 |

|

Commercial Leasing |

2.8 |

20.1 |

21.2 |

22.4 |

23.6 |

25.0 |

407.2 |

522.3 |

|

Others |

0.2 |

0.6 |

0.7 |

0.5 |

- |

- |

- |

2.0 |

|

Interest and charges |

45.3 |

66.9 |

- |

- |

- |

- |

- |

112.2 |

|

Local market total |

111.3 |

566.5 |

1,039.3 |

759.2 |

855.4 |

531.4 |

2,053.7 |

5,916.8 |

|

International market |

|

|

|

|

|

|

|

|

|

BID |

5.5 |

151.6 |

223.3 |

123.6 |

123.5 |

123.6 |

1,435.7 |

2,186.8 |

|

BIRD |

- |

- |

- |

- |

7.7 |

15.3 |

206.6 |

229.6 |

|

Eurobonds |

- |

556.1 |

- |

- |

- |

1,386.2 |

- |

1,942.3 |

|

JICA |

- |

72.6 |

74.0 |

75.3 |

114.0 |

114.0 |

1,329.6 |

1,779.5 |

|

BID 1983AB |

- |

95.1 |

95.1 |

94.9 |

70.3 |

69.6 |

90.8 |

515.8 |

|

Interest and charges |

55.9 |

6.9 |

- |

- |

- |

- |

- |

62.8 |

|

International market total |

61.4 |

882.3 |

392.4 |

293.8 |

315.5 |

1,708.7 |

3,062.7 |

6,716.8 |

|

Total |

172.7 |

1,448.8 |

1,431.7 |

1,053.0 |

1,170.9 |

2,240.1 |

5,116.4 |

12,633.6 |

11. Capex

In the third quarter of 2015 R$ 1.0 billion were invested, totaling R$ 2.6 billion investments in the first nine months of 2015.

12. Conference calls

|

In Portuguese

November 13, 2015

7:30 am (US EST) / 10:30 am (Brasília)

Dial in: 55 (11) 2188-0155

Code: Sabesp

Replay available for 7 days

Dial in: 55 (11) 2188-0400

Code: Sabesp

Click here to access the webcast

|

In English

November 13, 2015

2:00 pm (Brasília) / 11:00 am (US EST)

Dial in: 1 (412) 317-6776

Code: Sabesp

Replay available for 7 days

Dial in: 1(412) 317-0088

Code: 10071645

Click here to access the webcast

|

For more information, please contact:

Mario Arruda Sampaio

Head of Capital Markets and Investor Relations

Phone.(55 11) 3388-8664

E-mail: maasampaio@sabesp.com.br

Angela Beatriz Airoldi

Investor Relations Manager

Phone.(55 11) 3388-8793

E-mail: abairoldi@sabesp.com.br

Statements contained in this press release may contain information that is forward-looking and reflects management's current view and estimates of future economic circumstances, industry conditions, SABESP performance, and financial results. Any statements, expectations, capabilities, plans and assumptions contained in this press release that do not describe historical facts, such as statements regarding the declaration or payment of dividends, the direction of future operations, the implementation of principal operating and financing strategies and capital expenditure plans, the factors or trends affecting financial condition, liquidity or results of operations are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties. There is no guarantee that these results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Income Statement

|

Brazilian Corporate Law |

|

R$ '000 |

|

|

3Q15 |

3Q14 |

|

Gross Operating Revenue |

3,342,404 |

2,965,408 |

|

Water Supply - Retail |

1,257,278 |

1,126,959 |

|

Water Supply - Wholesale |

26,644 |

40,730 |

|

Sewage Collection and Treatment |

998,435 |

955,781 |

|

Sewage Collection and Treatment - Wholesale |

5,615 |

5,574 |

|

Construction Revenue - Water |

732,144 |

374,240 |

|

Construction Revenue - Sewage |

283,094 |

425,491 |

|

Other Services |

39,194 |

36,633 |

|

Taxes on Sales and Services - COFINS and PASEP |

(145,412) |

(141,876) |

|

Net Operating Revenue |

3,196,992 |

2,823,532 |

|

Operating Costs |

(2,261,459) |

(1,985,938) |

|

Gross Profit |

935,533 |

837,594 |

|

Operating Expenses |

|

|

|

Selling |

(109,709) |

(126,564) |

|

Administrative |

(192,637) |

(210,716) |

|

Other operating revenue (expenses), net |

54,315 |

(6,168) |

|

Operating Income Before Shareholdings |

687,502 |

494,146 |

|

Equity Result |

(1,375) |

(1,167) |

|

Earnings Before Financial Results, net |

686,127 |

492,979 |

|

Financial, net |

(90,482) |

(24,633) |

|

Exchange gain (loss), net |

(1,448,928) |

(313,139) |

|

Earnings before Income Tax and Social Contribution |

(853,283) |

155,207 |

|

Income Tax and Social Contribution |

|

|

|

Current |

(674) |

(41,608) |

|

Deferred |

273,813 |

(22,098) |

|

Net Income (loss) for the period |

(580,144) |

91,501 |

|

Registered common shares ('000) |

683,509 |

683,509 |

|

Earnings per shares - R$ (per share) |

(0.85) |

0.13 |

|

Depreciation and Amortization |

(271,311) |

(243,199) |

|

Adjusted EBITDA |

903,123 |

742,346 |

|

% over net revenue |

28.2% |

26.3% |

Balance Sheet

|

Brazilian Corporate Law |

|

|

R$ '000 |

|

ASSETS |

09/30/2015 |

|

12/31/2014 |

|

Current assets |

|

|

|

|

Cash and cash equivalents |

889,933 |

|

1,722,991 |

|

Trade accounts receivable |

1,236,982 |

|

1,034,820 |

|

Accounts receivable from related parties |

137,515 |

|

121,965 |

|

Inventories |

56,739 |

|

66,487 |

|

Restricted cash |

29,331 |

|

19,750 |

|

Recoverable taxes |

66,097 |

|

148,768 |

|

Other accounts receivable |

196,136 |

|

100,664 |

|

Total current assets |

2,612,733 |

|

3,215,445 |

|

|

|

|

|

|

Noncurrent assets |

|

|

|

|

Trade accounts receivable |

164,311 |

|

189,458 |

|

Accounts receivable from related parties |

678,337 |

|

102,018 |

|

Escrow deposits |

78,041 |

|

69,488 |

|

Deferred income tax and social contribution |

348,913 |

|

209,478 |

|

Water National Agency – ANA |

88,267 |

|

122,634 |

|

Other accounts receivable |

83,860 |

|

87,286 |

|

|

|

|

|

|

Investments |

22,759 |

|

21,223 |

|

Investment properties |

59,240 |

|

54,039 |

|

Intangible assets |

28,020,539 |

|

25,979,526 |

|

Property, plant and equipment |

299,526 |

|

304,845 |

|

Total noncurrent assets |

29,843,793 |

|

27,139,995 |

|

|

|

|

|

|

Total assets |

32,456,526 |

|

30,355,440 |

|

|

|

|

|

|

LIABILITIES AND EQUITY |

09/30/2015 |

|

12/31/2014 |

|

Current liabilities |

|

|

|

|

Trade payables and contractors |

225,804 |

|

323,513 |

|

Current portion of long-term loans and financing |

973,726 |

|

1,207,126 |

|

Accrued payroll and related charges |

397,105 |

|

387,971 |

|

Taxes and contributions |

75,724 |

|

74,138 |

|

Interest on shareholders' equity payable |

81 |

|

214,523 |

|

Provisions |

617,185 |

|

625,092 |

|

Services payable |

328,281 |

|

318,973 |

|

Public-Private Partnership – PPP |

39,456 |

|

38,047 |

|

Program Contract Commitments |

256,944 |

|

189,551 |

|

Other liabilities |

76,683 |

|

101,642 |

|

Total current liabilities |

2,990,989 |

|

3,480,576 |

|

|

|

|

|

|

Noncurrent liabilities |

|

|

|

|

Loans and financing |

11,659,836 |

|

9,578,641 |

|

Deferred Cofins and Pasep |

132,779 |

|

129,351 |

|

Provisions |

389,511 |

|

595,255 |

|

Pension obligations |

2,849,389 |

|

2,729,598 |

|

Public-Private Partnership – PPP |

832,203 |

|

330,236 |

|

Program Contract Commitments |

98,506 |

|

18,208 |

|

Other liabilities |

145,563 |

|

189,172 |

|

Total noncurrent liabilities |

16,107,787 |

|

13,570,461 |

|

|

|

|

|

|

Total liabilities |

19,098,776 |

|

17,051,037 |

|

|

|

|

|

|

Equity |

|

|

|

|

Capital stock |

10,000,000 |

|

10,000,000 |

|

Earnings reserves |

3,672,149 |

|

3,694,151 |

|

Other comprehensive income |

(389,748) |

|

(389,748) |

|

Accrued earnings |

75,349 |

|

- |

|

Total equity |

13,357,750 |

|

13,304,403 |

|

|

|

|

|

|

Total equity and liabilities |

32,456,526 |

|

30,355,440 |

Cash Flow

|

Brazilian Corporate Law |

|

|

R$ '000 |

|

|

|

Jan-Sep/2015 |

|

Jan-Sep/2014 |

|

Cash flow from operating activities |

|

|

|

| |

Profit before income tax and social contribution |

(63,187) |

|

1,317,996 |

|

Adjustment for: |

|

|

|

| |

Depreciation and amortization |

808,706 |

|

726,051 |

| |

Residual value of property, plant and equipment and intangible assets written-off |

18,214 |

|

28,887 |

| |

Allowance for doubtful accounts |

9,389 |

|

54,688 |

| |

Provision and inflation adjustment |

(116,292) |

|

151,776 |

| |

GESP Agreement |

(696,283) |

|

- |

| |

Interest calculated on loans and financing payable |

357,306 |

|

293,000 |

| |

Inflation adjustment and foreign exchange gains (losses) on loans and financing |

2,247,653 |

|

183,808 |

| |

Interest and inflation adjustment losses |

17,469 |

|

13,942 |

| |

Interest and inflation adjustment gains |

(36,514) |

|

(24,564) |

| |

Financial charges from customers |

(199,994) |

|

(142,996) |

| |

Margin on intangible assets arising from concession |

(53,881) |

|

(42,775) |

| |

Provision for Consent Decree (TAC) |

(17,916) |

|

40,977 |

| |

Equity result |

376 |

|

1,486 |

| |

Provision from São Paulo agreement |

8,012 |

|

(17,504) |

| |

Provision for defined contribution plan |

5,908 |

|

7,105 |

| |

Pension obligations |

246,346 |

|

216,970 |

| |

Other adjustments |

(13,731) |

|

57,086 |

| |

|

2,521,581 |

|

2,865,933 |

|

Changes in assets |

|

|

|

| |

Trade accounts receivable |

17,731 |

|

277,581 |

| |

Accounts receivable from related parties |

15,364 |

|

40,940 |

| |

Inventories |

9,366 |

|

5,096 |

| |

Recoverable taxes |

82,671 |

|

- |

| |

Escrow deposits |

25,696 |

|

598 |

| |

Other accounts receivable |

(26) |

|

(30,621) |

|

Changes in liabilities |

|

|

|

| |

Trade payables and contractors |

(31,968) |

|

1,694 |

| |

Services received |

1,296 |

|

22,070 |

| |

Accrued payroll and related charges |

27,050 |

|

49,815 |

| |

Taxes and contributions payable |

15,776 |

|

(100,753) |

| |

Deferred Cofins/Pasep |

3,428 |

|

953 |

| |

Provisions |

(97,359) |

|

(150,331) |

| |

Pension obligations |

(126,555) |

|

(119,580) |

| |

Other liabilities |

(71,732) |

|

(18,437) |

| |

|

|

|

|

|

Cash generated from operations |

2,392,319 |

|

2,844,958 |

| |

|

|

|

|

| |

Interest paid |

(521,566) |

|

(415,829) |

| |

Income tax and contribution paid |

(17,743) |

|

(422,193) |

| |

|

|

|

|

|

Net cash generated from operating activities |

1,853,010 |

|

2,006,936 |

| |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

| |

Acquisition of intangibles |

(1,856,910) |

|

(1,834,304) |

| |

Restricted cash |

(9,581) |

|

(10,247) |

| |

Investment increase |

- |

|

(24) |

| |

Purchases of tangible assets |

(21,902) |

|

(85,031) |

| |

Dividends received |

1,526 |

|

- |

|

Net cash used in investing activities |

(1,886,867) |

|

(1,929,606) |

| |

|

|

|

|

|

Cash flow from financing activities |

|

|

|

| |

Loans and financing |

|

|

|

| |

Proceeds from loans |

684,586 |

|

940,215 |

| |

Repayments of loans |

(1,219,588) |

|

(418,963) |

| |

Payment of interest on shareholders'equity |

(202,108) |

|

(467,470) |

| |

Public-Private Partnership – PPP |

(17,169) |

|

(15,030) |

| |

Program Contract Commitments |

(44,922) |

|

(38,393) |

|

Net cash generated by financing activities |

(799,201) |

|

359 |

| |

|

|

|

|

|

Cash reduce and cash equivalents |

(833,058) |

|

77,689 |

| |

|

|

|

|

|

Represented by: |

|

|

|

|

Cash and cash equivalents at beginning of the period |

1,722,991 |

|

1,782,001 |

|

Cash and cash equivalents at end of the period |

889,933 |

|

1,859,690 |

|

Cash reduce and cash equivalents |

(833,058) |

|

77,689 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: November 12, 2015

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Rui de Britto Álvares Affonso

|

|

| |

Name: Rui de Britto Álvares Affonso

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

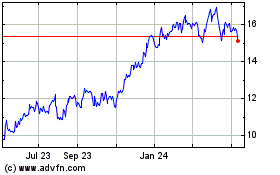

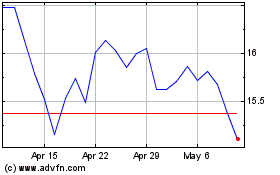

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024