Report of Foreign Issuer (6-k)

April 02 2015 - 4:35PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For March 25, 2015

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

Companhia de Saneamento Básico do Estado de São Paulo

Board of Directors

|

|

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP

CORPORATE TAXPAYER’S ID (CNPJ) 43.776.517/0001-80

COMPANY REGISTRY (NIRE): 35.3000.1683-1

EXCERPT FROM THE MINUTES OF THE 803RD BOARD OF DIRECTORS’ MEETING

On March 18, 2015, at 9:00 a.m., convened by the Chairman of the Board of Directors, Benedito Pinto Ferreira Braga Junior, extraordinarily, in accordance with Article 12 of the Bylaws, in the conference room of the Company’s headquarters, located at Rua Costa Carvalho n° 300, São Paulo, there was a meeting of the members of the Board of Directors of Companhia de Saneamento Básico do Estado de São Paulo (SABESP) named and signed below. Opening the meeting, Dr. Benedito Braga Junior greeted everyone, stating that the Board Members Jerônimo Antunes and Francisco Luna were participating via conference call, and justifying the absence of Board Member Sidnei Franco da Rocha. Immediately thereafter, he gave the floor to the Chief Financial Officer and Investor Relations Officer, Rui de Britto Álvares Affonso, to the Head of Accounting Marcelo Miyagui, and to the Advisor to the Financial and Investor Relations Office, Flavio Fernandes Naccache, to present item 1 on the agenda – the Agreement between the State of São Paulo, Companhia de Saneamento Básico do Estado de São Paulo and the Department of Water and Electricity (DAEE) (Time: 60’), which was based on the proposal of the Board of Directors, of March 17, 2015, the Executive Board Resolution 0041/2015, of March 17, 2015, Internal Communications 06/2015, of March 13, 2015, and 07/2015, of March 17, 2015, Legal Opinion 125/2015, of March 15, 2015, Legal Opinion 126/2015, of March 17, 2015, the PowerPoint presentation made by the Financial Office and Investor Relations Office, and the draft Agreement, which has been filed with the Secretary of the Company. The Chief Financial Officer and Investors Relations Officer Rui Affonso presented the main points and the context of the Agreement, after which Advisor Flavio Naccache explained that the total amount of Sabesp’s financial credit with the State, related to the portion of the Undisputed Amount that would be paid off with the transfer of the ownership of the Taiaçupeba, Jundiaí, Biritiba, Paraitinga and Ponte Nova reservoirs of the Alto Tietê System (Reservoirs), under the terms of the “Third Amendment of the Term of Recognition and Consolidation of Obligations, Payment Commitment and Other Covenants”, of November 17, 2008, updated to February 2015, is one billion, twelve million, three hundred and ten thousand and ninety-five reais and sixteen centavos (R$1,012,310,095.16), composed of:

(A) the Principle Amount of six hundred and ninety-six million, two hundred and eighty-three thousand, four hundred and sixty-five reais and forty-nine centavos (R$696,283,465.49); and

(B) a Monetary Adjustment Credit of three hundred and sixteen million, twenty-six thousand, six hundred and twenty-nine reais and sixty-seven centavos (R$316,026,629.67).

As there has not yet been a resolution in the courts that would allow the ownership transfer of the Reservoirs, this Agreement will allow the ownership transfer of the Reservoirs to be substituted with the payment of the Principal Amount in one hundred and eighty (180) monthly installments, as follows:

1

|

Companhia de Saneamento Básico do Estado de São Paulo

Board of Directors

|

|

(a) the first twenty-four (24) installments will be settled through the immediate transfer of 2,221,000 shares of preferred stock issued by Companhia de Transmissão de Energia Elétrica Paulista (CTEEP), type TRPL4, at the closing quote on March 17, 2015, of thirty-nine reais and twenty-five centavos (R$39.25) per share, totaling eighty-seven million, one hundred and seventy-four thousand, two hundred and fifty reais (R$87,174,250.00).

(b) the balance of six hundred and nine million, one hundred and nine thousand, two hundred and fifteen reais and forty-nine centavos (R$609,109,215.49) will be adjusted in accordance with the IPCA until the initial payment date, and paid in one hundred and fifty-six (156) installments; the individual installments will be adjusted in accordance with the IPCA, plus interest of 0.5% per month.

The agreement also allows that, in the event of a final judgement in the case challenging the transfer of the Reservoirs:

(i) if the decision allows, and the ownership of the Reservoirs is transferred to Sabesp and registered with the competent real estate division, Sabesp will reimburse the State for the amount received, in sixty (60) consecutive monthly installments, adjusted in accordance with the IPCA; and

(ii) if the decision prevents the transfer of the Reservoirs, after the payment of the final installment of the Principal Amount, the Monetary Adjustment Credit will be adjusted in accordance with the IPCA, and the State will pay Sabesp in sixty (60) installments; the individual amounts of the installments will be updated in accordance with the IPCA, plus interest of 0.5% per month.

The proposal was discussed and put to a vote, in accordance with section XIII of Article 13 of the Company’s Bylaws, with unanimous approval for the Agreement between the State of São Paulo, Companhia de Saneamento Básico do Estado de São Paulo and the Department of Water and Electricity (DAEE).

(...)

|

Companhia de Saneamento Básico do Estado de São Paulo

Board of Directors

|

|

These minutes, after approved, were signed by the Board members Benedito Pinto Ferreira Braga Junior, Alberto Goldman, Claudia Polto da Cunha, Francisco Vidal Luna, Jerônimo Antunes, Jerson Kelman, Luis Eduardo de Assis, Reinaldo Guerreiro and Walter Tesch.

This is a free English translation of the original instrument drawn up in the Book of Minutes of the Board of Directors.

São Paulo, March 18, 2015.

|

Benedito Pinto Ferreira Braga Junior |

Celina Y. Ozawa |

|

Chairman of the

Board of Directors |

Acting Executive Secretary of the

Board of Directors |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: March 25, 2015

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Rui de Britto Álvares Affonso

|

|

| |

Name: Rui de Britto Álvares Affonso

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

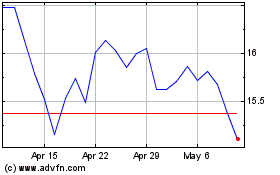

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024