Current Report Filing (8-k)

February 05 2016 - 1:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 4, 2016

SABINE ROYALTY TRUST

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Texas |

|

1-8424 |

|

75-6297143 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| Southwest Bank

P. O. Box 962020 Fort

Worth, Texas |

|

|

|

76162 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, including area code: (855) 588-7839

Not Applicable

(Former

name, former address and former fiscal year, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On February 4, 2016, the Registrant

issued a press release announcing its monthly cash distribution to unitholders of record on February 16, 2016. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This Report on Form 8-K is being furnished pursuant to Item 2.02, Results of Operations and Financial Condition. The information

furnished is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the

Securities Act of 1933, as amended.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

99.1 |

Press Release dated February 4, 2016. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

| Sabine Royalty Trust |

|

|

| By: |

|

Southwest Bank, Trustee |

|

|

|

|

|

By: |

|

/s/ RON E. HOOPER |

|

|

|

|

Ron E. Hooper |

|

|

|

|

SVP Royalty Trust Management |

Date: February 5, 2016

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

| 99.1 |

|

Press Release dated February 4, 2016. |

Exhibit 99.1

Sabine Royalty Trust

SABINE ROYALTY TRUST ANNOUNCES

MONTHLY CASH DISTRIBUTION FOR FEBRUARY

Dallas, Texas, February 4, 2016 – Southwest Bank, as Trustee of the Sabine Royalty Trust (NYSE: SBR), today declared a cash

distribution to the holders of its units of beneficial interest of $0.13361 per unit, payable on February 29, 2016, to unit holders of record on February 16, 2016. Sabine’s cash distribution history, current and prior year financial

reports and tax information booklets, a link to filings made with the Securities and Exchange Commission and more can be found on its website at http://www.sbr-sabine.com/.

This distribution reflects primarily the oil production for November 2015 and the gas production for October 2015. Preliminary production

volumes are approximately 35,643 barrels of oil and 495,635 Mcf of gas. Preliminary prices are approximately $38.17 per barrel of oil and $2.35 per Mcf of gas.

The table below compares this month’s production and prices to the previous month’s:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net to Trust Sales |

|

|

|

|

| |

|

Volumes |

|

|

Average Price |

|

| |

|

Oil

(bbls) |

|

|

Gas

(Mcf) |

|

|

Oil

(per bbl) |

|

|

Gas

(per Mcf) |

|

| Current Month |

|

|

35,643 |

|

|

|

495,635 |

|

|

$ |

38.17 |

|

|

$ |

2.35 |

|

| Prior Month |

|

|

69,889 |

|

|

|

703,025 |

|

|

$ |

44.27 |

|

|

$ |

2.67 |

|

Revenues are only posted and distributed when they are received. Most energy companies normally issue payment

of royalties on or about the 25th of every month, and depending on mail delivery, a varying amount of royalties are not received until after the revenue posting on the last business day of the

month. The revenues received after that date will be posted within 30 days of receipt.

Due to the timing of the end of the month of

January, approximately $272,000 of revenue received will be posted in the following month of February in addition to normal receipts during February. Since the close of business in January and prior to this press release, approximately $494,000

revenue has been received.

The 2015 tax information packets are expected to begin mailing directly to unitholders in early March 2016. A

copy of Sabine’s 2015 tax information booklet will be posted on Sabine’s website by March 1, 2016. In addition to the tax booklet the Sabine website will also offer two simple calculators for computing the income and expense amounts

and the cost depletion. The calculators are currently expected to be updated with the 2015 tax information by February 15, 2016.

* **

| |

|

SVP, Royalty Trust Services |

|

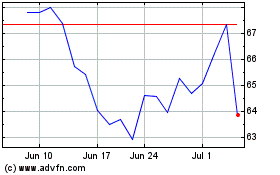

Sabine Royalty (NYSE:SBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

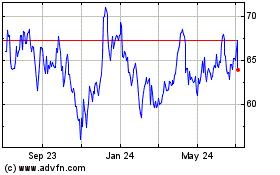

Sabine Royalty (NYSE:SBR)

Historical Stock Chart

From Apr 2023 to Apr 2024