Current Report Filing (8-k)

January 06 2016 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: January 4, 2016

(Date of earliest event reported)

SALLY BEAUTY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-33145 |

|

36-2257936 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission file number) |

|

(I.R.S. Employer

Identification Number) |

3001 Colorado Boulevard

Denton, Texas 76210

(Address of principal executive offices)

(940) 898-7500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointments of Certain Officers; Compensatory Arrangements of Certain Officers

On January 4, 2016, the Board of Directors (the “Board”) of Sally Beauty Holdings, Inc. (the “Company”) appointed Ms. Sharon M. Leite as President of Sally Beauty Supply LLC, one of the Company’s two business units, effective February 1, 2016. Prior to Ms. Leite’s appointment, the position of President of Sally Beauty Supply LLC had been vacant since the resignation of Tobin Anderson on May 14, 2014.

In connection with Ms. Leite’s appointment as an executive officer of the Company, the Compensation Committee of the Board has approved an annual base salary for Ms. Leite of $525,000 and a sign-on bonus of $100,000. In addition, Ms. Leite’s target annual bonus under the Company’s Annual Incentive Plan will be 60% of her base salary, with the amount of such bonus to be determined based on the achievement of performance metrics to be approved by the Compensation Committee for fiscal year 2016 and pro-rated from Ms. Leite’s start date through the end of the 2016 fiscal year. Ms. Leite’s annual bonus for fiscal 2016 will have a guaranteed minimum payout of 50% of her annualized base salary prorated by her start date through the end of the fiscal year. Ms. Leite will also receive an award of non-qualified stock options with a grant date value of $312,500 and an award of restricted stock with a grant date value of $312,500 under the Company’s Amended and Restated 2010 Omnibus Incentive Plan. The awards will vest ratably over three years subject to Ms. Leite’s continued employment and otherwise upon the terms and conditions of the standard award agreement for the fiscal year 2016 long-term incentive awards to other officers. Ms. Leite has also entered into the Company’s standard form of change-in-control severance agreement for executive officers, which provides for, among other benefits, (a) a lump sum payment due to Ms. Leite upon termination of employment (except for certain non-qualifying terminations, including termination for cause) following certain change-in-control transactions, in the amount of 1.99 times her annual base salary plus 1.99 times her average bonus over the previous five fiscal years of the Company and (b) for a period of 24 months following such termination, the continuation of all policies of medical, accident, disability and life insurance with respect to Ms. Leite and her dependents with the same level of coverage as provided by the Company prior to such termination, subject to certain other terms and conditions.

Prior to her appointment at Sally Beauty Supply LLC, Ms. Leite, age 53, held various executive leadership roles since 2007 at Pier 1 Imports, Inc. as an Executive Vice President. She has led that company’s Sales and Customer Experience strategy with over 20,000 field associates in over 1,000 stores in the U.S. and Canada. In addition, her responsibilities included E-commerce, Operations & Real Estate. Pier 1 Imports is a global importer of decorative home furnishings and gifts with over 1,000 stores in the United States and Canada. Prior to joining Pier 1 Imports, Ms. Leite served as Vice President, Sales & Associate Marketing (2007), Vice President, Store Operations (2001-2006) and Director, Store Operations & Sales Support (1999-2001), of Bath and Body Works, LLC, an international retailer specializing in bath and beauty products.

With respect to the disclosure required by Item 401(d) of Regulation S-K, there are no family relationships between Ms. Leite and any director or executive officer of the Company. With respect to Item 404(a) of Regulation S-K, there are no relationships or related transactions between Ms. Leite and the Company that would be required to be reported.

Item 9.01. Financial Statement and Exhibits

(d) See exhibit index.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

SALLY BEAUTY HOLDINGS, INC. |

|

|

|

|

|

|

|

|

|

|

|

January 6, 2016 |

|

By: |

/s/ Matthew O. Haltom |

|

|

|

|

Name: Matthew O. Haltom |

|

|

|

|

Title: Senior Vice President, General Counsel and Secretary |

3

EXIBIT INDEX

|

Exhibit Number |

|

Description |

|

|

|

|

|

Exhibit 99.1 |

|

News release announcing the appointment of a President of Sally Beauty Supply LLC on January 6, 2016 |

4

Exhibit 99.1

Sally Beauty Holdings, Inc. names Sharon M. Leite as President of Sally Beauty, U.S. and Canada

DENTON, Texas January 6, 2016 - Sally Beauty Holdings, Inc. (NYSE:SBH) (the “Company”) announced today that retail executive Sharon M. Leite has been appointed president of the Sally Beauty Supply LLC, U.S. and Canada business, effective February 1, 2016.

“Sharon is a dynamic executive with deep retail experience” said Chris Brickman, President and CEO of Sally Beauty Holdings. “She brings a keen understanding of customer engagement and a proven track record of building and driving sales in a demanding retail environment. I am confident that her consumer-led approach will accelerate our progress in becoming the leading provider of salon quality products in the retail sector. Under Sharon’s leadership, and with the help from our talented team of retail executives at Sally, we believe the team can take the business to the next level of growth and performance.”

Ms. Leite, age 53, is a retail veteran with over 25-years of experience. Prior to joining Sally Beauty, she held various executive leadership roles since 2007 at Pier 1 Imports, Inc. as an Executive Vice President. She has led that company’s Sales & Customer Experience strategy with over 20,000 field associates in over 1000 stores in the U.S. and Canada. In addition her responsibilities included E-commerce, Operations & Real Estate. Prior to joining Pier 1 Imports, Ms. Leite served as Vice President, Sales & Associate Marketing (2007), Vice President, Store Operations (2001-2006) and Director, Store Operations & Sales Support (1999-2001), of Bath and Body Works, LLC, an international retailer specializing in bath and beauty products.

“It is an honor to be named President of Sally Beauty,” Ms. Leite said. “Sally Beauty has taken great strides to articulate its value proposition to the consumer and improve the in-store shopping experience, resulting in a strong foundation for continued success. I look forward to working with the Sally Beauty executive team and store team. I share their passion for superior customer service and support their initiatives already underway. Given the Company’s long-term history in a very resilient industry, I have great confidence that we can continue our growth trajectory and succeed.”

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. (NYSE: SBH) is an international specialty retailer and distributor of professional beauty supplies with revenues of $3.8 billion annually. Through the Sally Beauty Supply and Beauty Systems Group businesses, the Company sells and distributes through approximately 5,000 stores, including approximately 175 franchised units, throughout the United States, the United Kingdom, Belgium, Chile, Peru, Colombia, France, the Netherlands, Canada, Puerto Rico, Mexico, Ireland, Spain and Germany. Sally Beauty Supply stores offer up to 10,000 products for hair, skin, and nails through professional lines such as Clairol, L’Oreal, Wella and Conair, as well as an extensive selection of proprietary merchandise. Beauty Systems Group stores, branded as CosmoProf or Armstrong McCall stores, along with its outside sales consultants, sell up to 10,000 professionally branded products including Paul Mitchell, Wella, Sebastian, Goldwell, Joico, and Aquage which are targeted exclusively for professional and salon use and resale to their customers. For more information about Sally Beauty Holdings, Inc., please visit sallybeautyholdings.com.

Cautionary Notice Regarding Forward-Looking Statements

Statements in this news release and the schedules hereto which are not purely historical facts or which depend upon future events may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” or similar expressions may also identify such forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements as such statements speak only as of the date they were made. Any forward-looking statements involve risks and uncertainties that could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including, but not limited to, risks and uncertainties related to: the highly competitive nature of, and the increasing consolidation of, the beauty products distribution industry; anticipating and effectively responding to changes in consumer preferences and buying trends in a timely manner; potential fluctuation in our same store sales and quarterly financial performance; our dependence upon manufacturers who may be unwilling or unable to continue to supply products to us; the possibility of material interruptions in the supply of products by our third-party manufacturers or distributors or increases in the prices of products we purchase from our third-party manufacturers or distributors; products sold by us being found to be defective in labeling or content; compliance with current laws and regulations or becoming subject to additional or more stringent laws and regulations; the success of our strategic initiatives including our store refresh program and increased marketing efforts, to enhance the customer experience, attract new customers, drive brand awareness and improve customer loyalty; the success of our e-commerce businesses; product diversion to mass retailers or other unauthorized resellers; the operational and financial performance of our franchise-based business; successfully identifying acquisition candidates and successfully completing desirable acquisitions; integrating acquired businesses; the success of our existing stores, and our ability to increase sales at existing stores; opening and operating new stores profitably; the volume of traffic to our stores; the impact of the health of the economy upon our business; the success of our cost control plans; rising labor and rental costs; protecting our intellectual property rights, particularly our trademarks; the risk that our products may infringe on the intellectual property of others or that we may be required to defend our intellectual property rights; conducting business outside the United States; successfully updating and integrating our information technology systems; disruption in our information technology systems; a significant data security breach, including misappropriation of our customers’, or employees’ or suppliers’ confidential information, and the potential costs related thereto; the negative impact on our reputation and loss of confidence of our customers, suppliers and others arising from a significant data security breach; the costs and diversion of management’s attention required to investigate and remediate a data security breach and to continuously upgrade our information technology security systems to address evolving cyber security threats; the ultimate determination of the extent or scope of the potential liabilities relating to our past data security incidents; our ability to attract or retain highly skilled management and other personnel; severe weather, natural disasters or acts of violence or terrorism; the preparedness of our accounting and other management systems to meet financial reporting and other requirements and the upgrade of our existing financial reporting system; being a holding company, with no operations of our own, and depending on our subsidiaries for cash; our ability to execute and implement our common stock repurchase program; our substantial indebtedness; the possibility that we may incur substantial additional debt, including secured debt, in the future; restrictions and limitations in the agreements and instruments governing our debt; generating the significant amount of cash needed to service all of our debt and refinancing all or a portion of our indebtedness or obtaining additional financing; changes in interest rates increasing the cost of servicing our debt; the potential impact on us if the financial institutions we deal with become impaired; and the costs and effects of litigation.

Additional factors that could cause actual events or results to differ materially from the events or results described in the forward-looking statements can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K for the year ended September 30, 2015, as filed with the Securities and Exchange Commission. Consequently, all forward-looking statements in this release are qualified by the factors, risks and uncertainties contained therein. We assume no obligation to publicly update or revise any forward-looking statements.

CONTACT: Sally Beauty Holdings, Inc. Investor Relations

Karen Fugate, 940-297-3877

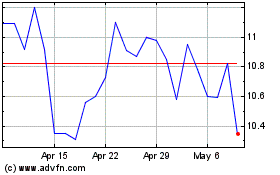

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

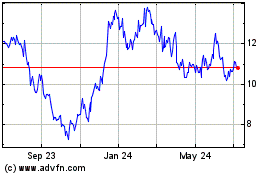

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024