SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: November 12, 2015

(Date of earliest event reported)

SALLY BEAUTY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation) |

|

1-33145

(Commission file number) |

|

36-2257936

(I.R.S. Employer

Identification Number) |

3001 Colorado Boulevard

Denton, Texas 76210

(Address of principal executive offices)

(940) 898-7500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On November 12, 2015, Sally Beauty Holdings, Inc. (the “Company”) issued the news release attached hereto as Exhibit 99.1 reporting the financial results of the Company for the quarter and the full year ended September 30, 2015 (the “Earnings Release”).

Item 7.01 Regulation FD Disclosure

The Earnings Release also provides an update on the Company’s strategy and business outlook.

Item 9.01 Financial Statement and Exhibits

(d) See exhibit index.

All of the information furnished in Items 2.02 and 7.01 of this report and the accompanying exhibit shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, unless expressly incorporated by reference therein.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SALLY BEAUTY HOLDINGS, INC. |

|

|

|

|

|

|

|

|

|

November 12, 2015 |

By: |

/s/ Matthew O. Haltom |

|

|

|

Name: Matthew O. Haltom |

|

|

|

Title: Senior Vice President,

General Counsel and Secretary |

3

EXHIBIT INDEX

|

Exhibit Number |

|

Description |

|

|

|

|

|

Exhibit 99.1 |

|

News release reporting financial results for the quarter and full year ended September 30, 2015, issued by Sally Beauty Holdings, Inc. on November 12, 2015 |

4

Exhibit 99.1

|

|

Contact: |

Karen Fugate |

|

|

|

Investor Relations |

|

|

|

940-297-3877 |

|

|

|

|

Sally Beauty Holdings, Inc. Reports Fourth Quarter and Full Year Results

· Same store sales growth in 4Q15 and FY2015 of 3.5% and 2.9%, respectively

· 4Q15 net sales up 2.1% to $964 million; FY2015 net sales up 2.2% to $3.8 billion

· GAAP and Adjusted 4Q15 net earnings of $56.2 million and $59.2 million, respectively

· GAAP and Adjusted 4Q15 diluted earnings per share of $0.36 and $0.38, respectively

· GAAP and Adjusted FY2015 net earnings of $235 million and $242 million, respectively

· GAAP and Adjusted FY2015 diluted earnings per share of $1.49 and $1.53, respectively

· During fiscal 2015, repurchased $228 million, or 8.1 million shares of common stock

DENTON, Texas, November 12, 2015 — Sally Beauty Holdings, Inc. (NYSE: SBH) (the “Company”) today announced financial results for the fourth quarter and fiscal year ended September 30, 2015. The Company will hold a conference call today at 10:00 a.m. (Central) to discuss these results and its business.

“We finished the year with solid consolidated same store sales growth of 3.5% in the fourth quarter,” stated Chris Brickman, President and Chief Executive Officer. “In addition, we generated $301 million in operating cash flow in fiscal 2015 and repurchased approximately $228 million, or 8.1 million shares of our common stock.”

“In the back half of fiscal 2015, we implemented sales and profit improvement initiatives that we now expect will largely offset anticipated cost headwinds and allow for steady profit growth for SBH in fiscal 2016,” Brickman added. “In addition, we are excited about the pipeline of sales growth initiatives for the coming fiscal year, including the completion of owned-brand packaging upgrades, the reset of haircare and hair color categories, as well as the introduction of local TV and radio advertising. These new investments, combined with all of the projects and upgrades completed during fiscal 2015, will create significant points of difference and a modern image for Sally. As a result, we believe we are well on our way to reframing and repositioning the Sally brand to be more meaningful to the next generation of consumers.”

Fiscal 2015 Fourth Quarter and Full Year 2015 Financial Highlights

Net Sales: For the fiscal 2015 fourth quarter, consolidated net sales were $964.2 million, an increase of 2.1% from the fiscal 2014 fourth quarter. The fiscal 2015 fourth quarter sales increase is primarily attributed to same store sales growth and the addition of new stores. The impact from unfavorable changes in foreign currency exchange rates in the fiscal 2015 fourth quarter was $27.6 million, or 2.9%. Consolidated same store sales growth in the fiscal 2015 fourth quarter was 3.5% compared to 2.6% in the fiscal 2014 fourth quarter.

1

Consolidated net sales for fiscal year 2015 were $3.8 billion, an increase of 2.2% from fiscal year 2014. Fiscal 2015 sales increased primarily due to same store sales growth and the addition of new stores. The impact from unfavorable foreign currency exchange in the 2015 fiscal year was $87.3 million, or 2.3%. Consolidated same store sales growth in fiscal year 2015 was 2.9% compared to 2.0% in fiscal year 2014.

GAAP and Adjusted Gross Profit: Consolidated GAAP gross profit for the fiscal 2015 fourth quarter was $475.3 million, an increase of 1.7% over gross profit of $467.5 million for the fiscal 2014 fourth quarter. Gross profit, as a percentage of sales (gross profit margin), was 49.3%, a 20 basis point decline from the fiscal 2014 fourth quarter.

Adjusted consolidated gross profit for the fiscal 2015 fourth quarter, excluding a $1.4 million impact from the Germany restructuring, was $476.7 million, an increase of 2.0%. Gross profit as a percentage of sales was 49.4%, a 10 basis point decline from the fiscal 2014 fourth quarter.

For fiscal year 2015, consolidated gross profit was $1.9 billion, an increase of 2.0% over fiscal 2014 gross profit. Adjusted gross profit as a percentage of sales was 49.5%, down 10 basis points when compared to fiscal year 2014.

GAAP and Adjusted Selling, General and Administrative Expenses: For the fiscal 2015 fourth quarter, consolidated GAAP selling, general and administrative (SG&A) expenses, including unallocated corporate expenses and share-based compensation, were $330.9 million, or 34.3% of sales, a 40 basis point increase from the fiscal 2014 fourth quarter metric of 33.9% of sales and total SG&A expenses of $320.5 million. Excluding expenses associated with the previously disclosed data security incidents of $0.6 million, pre-tax, and charges for the Sally Germany restructure of $2.8 million, pre-tax, adjusted SG&A expenses in the fiscal 2015 fourth quarter were $327.5 million, or 34.0% of sales.

For fiscal year 2015, GAAP SG&A expenses were $1.31 billion, which includes $148.2 million of unallocated corporate expenses and share-based expenses and $9.5 million, pre-tax, of charges from the data security incidents and the Sally Germany restructure. SG&A expenses as a percentage of sales was 34.2%, compared to fiscal year 2014 metric of 33.9% of sales and total SG&A expenses of $1.27 billion.

Excluding expenses associated with the data security incidents and Sally Germany restructure initiative, adjusted SG&A expenses in fiscal year 2015 were $1.30 billion or 34.0% of sales.

Interest Expense: Interest expense, net of interest income, for the fiscal 2015 fourth quarter was $29.2 million, down $0.1 million from the fiscal 2014 fourth quarter of $29.3 million.

For fiscal year 2015, interest expense, net of interest income, was $116.8 million, up $0.5 million from the fiscal year 2014 interest expense of $116.3 million.

Provision for Income Taxes: For the fiscal 2015 fourth quarter, income taxes were $33.9 million. The effective tax rate for the fiscal 2015 fourth quarter was 37.6% compared to 36.2% for the fiscal 2014 fourth quarter.

For fiscal year 2015, income taxes were $143.4 million versus $144.7 million in fiscal 2014. The Company’s effective tax rate for fiscal year 2015 was 37.9% compared to 37.0% for fiscal 2014.

In fiscal year 2016, the Company anticipates the effective tax rate to be in the range of 37.5% to 38.5%.

2

GAAP and Adjusted Net Earnings and Diluted Net Earnings Per Share (EPS) (1): GAAP net earnings were $56.2 million in the fiscal 2015 fourth quarter, compared to fiscal 2014 fourth quarter net earnings of $61.8 million, down 9.0%. Excluding expenses from the Sally Germany restructure of $2.6 million, net of tax, and the data security incident of $0.4 million, net of tax, adjusted net earnings for the fiscal 2015 fourth quarter were $59.2 million, down 4.6% from adjusted net earnings of $62.1 in the fiscal 2014 fourth quarter.

GAAP and Adjusted diluted earnings per share for the fiscal 2015 fourth quarter were $0.36 and $0.38, respectively, compared to GAAP and adjusted fiscal 2014 fourth quarter diluted earnings per share of $0.39.

In fiscal year 2015, GAAP net earnings were $235.1 million compared to fiscal year 2014 net earnings of $246.0 million, down 4.4% from the prior year. Excluding charges from the Germany restructuring and expenses from the Company’s data security incidents of $6.8 million, net of tax, adjusted net earnings in fiscal year 2015 were $241.9 million, a decrease of 3.1% from the prior year.

GAAP diluted earnings per share in fiscal year 2015 were $1.49 compared to fiscal year 2014 diluted earnings per share of $1.51, a decrease of 1.3%. Adjusted diluted earnings per share in fiscal 2015 were $1.53, flat when compared to the prior year.

Fiscal year 2015 adjusted net earnings includes adjustments of $6.8 million, net of tax, and are described in detail on Schedule E.

Adjusted (Non-GAAP) EBITDA(1): Adjusted EBITDA for the fiscal 2015 fourth quarter was $152.6 million, an increase of 0.8% from $151.4 million for the fiscal 2014 fourth quarter.

Fiscal year 2015 Adjusted EBITDA was $612.4 million, an increase of 0.2% from $611.3 million in fiscal 2014.

(1)See Supplemental Schedule C, D and E for a reconciliation of these non-GAAP financial measures.

Financial Position, Capital Expenditures and Working Capital: Cash and cash equivalents as of September 30, 2015, were $140.0 million. The Company ended fiscal year 2015 with no outstanding borrowings on its asset-based loan (ABL) revolving credit facility. Borrowing capacity on the ABL facility was approximately $476.9 million at the end of fiscal year 2015. The Company’s debt, excluding capital leases, totaled $1.8 billion as of September 30, 2015. Net cash provided by operating activities for fiscal year 2015 was $300.8 million.

During the fiscal 2015 fourth quarter, the Company repurchased (and subsequently retired) a total of 5.8 million shares of its common stock at an aggregate cost of $153.3 million under the Company’s $1 billion share repurchase program.

For the 2015 fiscal year, the Company repurchased (and subsequently retired) a total of 8.1 million shares of its common stock at an aggregate cost of $227.6 million under the Company’s $1 billion share repurchase program.

For the full year ended September 30, 2015, the Company’s capital expenditures, excluding acquisitions, totaled $106.5 million.

3

Working capital (current assets less current liabilities) increased $54.8 million to $695.4 million at September 30, 2015, compared to $640.6 million at September 30, 2014. The ratio of current assets to current liabilities was 2.41 to 1.00 at September 30, 2015, compared to 2.38 to 1.00 at September 30, 2014.

Inventory as of September 30, 2015 was $885.2 million, an increase of $56.8 million or growth of 6.9% from September 30, 2014 inventory of $828.4 million. This increase is primarily due to sales growth from new store openings and the introduction of new brands in the Beauty Systems Group segment.

Business Segment Results:

Sally Beauty Supply

Fiscal 2015 Fourth Quarter Results for Sally Beauty Supply

· Sales of $582.3 million, up 0.2% from $581.3 million in the fiscal 2014 fourth quarter. The unfavorable impact of foreign currency exchange on net sales was $21.7 million, or 3.7% of sales.

· Same store sales grew 1.8% versus 2.1% growth in the fiscal 2014 fourth quarter.

· Gross margin of 54.6%, a 20 basis point decline from 54.8% in the fiscal 2014 fourth quarter. Gross profit includes an unfavorable charge of $1.4 million, pre-tax, from the Germany restructuring.

· Segment operating earnings of $97.9 million, down 9.3% from $107.9 million in the fiscal 2014 fourth quarter. Segment operating margins declined 180 basis points to 16.8% of sales from 18.6% of sales in the fiscal 2014 fourth quarter. Segment operating earnings and margin were negatively impacted by $4.2 million, pre-tax, of charges associated with the Germany restructuring.

Sales growth in the fiscal 2015 fourth quarter was driven by new store openings and same store sales growth. This growth was offset by the unfavorable impact of foreign currency exchange of $21.7 million, or 3.7% of sales. Gross profit margin declined by 20 basis points due to the restructuring charge of $1.4 million. Segment operating margin decline was primarily due to higher SG&A expenses and the Germany restructuring charge of $4.2 million, pre-tax.

Fiscal 2015 Results for Sally Beauty Supply

· Sales of $2.3 billion, up 0.9% over fiscal year 2014. The unfavorable impact of foreign currency exchange was $70.9 million, or 3.1% of sales.

· Same store sales grew 1.7% versus 1.3% growth in fiscal year 2014.

· Sales, on a USD basis, from international locations (Mexico, Canada, the United Kingdom, Ireland, Belgium, the Netherlands, France, Germany, Spain, Chile, Peru and Colombia) represented 24% of segment sales versus 25% in fiscal 2014.

· Gross margin of 54.8% was flat when compared to fiscal 2014. Gross profit includes an unfavorable charge of $1.4 million, pre-tax, from the Germany restructuring.

· Segment operating earnings of $412.4 million, down 4.5% from $431.7 million in fiscal 2014. Segment operating margins decreased 100 basis points to 17.7% of sales from 18.7% in fiscal 2014. Segment operating earnings and margin were negatively impacted by $5.3 million, pre-tax, of charges associated with the Germany restructuring.

4

· Net store base increased by 110 or 3.1% for total store count of 3,673. Store growth in the U.S. business was 2.7% while store growth in the international business was 4.5%.

Sales growth in fiscal 2015 was driven by new store openings and same store sales growth. This growth was offset by the impact of unfavorable foreign currency exchange of $70.9 million, or 3.1% of sales. Gross profit margin and operating margin were negatively impacted by the Germany restructure.

Beauty Systems Group

Fiscal 2015 Fourth Quarter Results for Beauty Systems Group

· Sales of $381.9 million, up 5.2% from $363.0 million in the fiscal 2014 fourth quarter. The impact of unfavorable foreign currency exchange on net sales was $5.9 million, or 1.6% of sales.

· Same store sales growth of 7.4% versus 3.8% in the fiscal 2014 fourth quarter.

· Gross margin of 41.2%, up 10 basis points when compared to the fiscal 2014 fourth quarter of 41.1%.

· Segment operating earnings of $57.9 million, up 7.1% from $54.0 million in the fiscal 2014 fourth quarter.

· Segment operating margins increased by 20 basis points to 15.1% of sales from 14.9% in the fiscal 2014 fourth quarter.

Sales growth for Beauty Systems Group was driven by growth in same store sales, the full service business and new store openings. Segment operating earnings growth is primarily due to sales growth, gross margin expansion and favorable SG&A leverage.

Fiscal 2015 Results for Beauty Systems Group

· Sales of $1.5 billion, up 4.2% from $1.4 billion in fiscal 2014. The unfavorable impact of foreign currency exchange on net sales was $16.5 million, or 1.1% of sales. Sales growth in the store business was 5.5% and sales growth in the full service business was 1.7%.

· Same store sales growth of 5.7% versus 3.5% in fiscal 2014.

· Gross margin of 41.3%, up 20 basis points from 41.1% in fiscal 2014.

· Segment operating earnings of $231.2 million, up 6.5% from $217.0 million in fiscal 2014.

· Segment operating margins increased to 15.4% of sales from 15.0% in fiscal 2014, a 40 basis point improvement.

· Net store base increased by 29 or 2.3% for total store count of 1,294, including 157 franchised locations.

· Total BSG distributor sales consultants at the end of fiscal 2015 were 958 versus 981 at the end of fiscal 2014.

Sales growth in fiscal year 2015 for the Beauty Systems Group was primarily due to growth in same store sales, the full service business and new store openings. This growth was partially offset by the unfavorable impact of foreign currency exchange of $16.5 million. Segment earnings growth is primarily due to sales growth, gross margin expansion and favorable SG&A leverage.

5

Fiscal Year 2016 Outlook

· Consolidated same store sales growth for fiscal 2016 is expected to be in the low 3% range. Sequential improvement is expected throughout the year in Sally with slower growth in BSG than the prior fiscal year as they anniversary a very strong year.

· Consolidated gross profit margin expansion is expected to be in the range of 35 bps to 45 bps.

· Fiscal year 2016 unallocated corporate expenses, including approximately $16 million in share-based compensation, are expected to be in the range of $150 million to $155 million.

· Consolidated SG&A as a percent to sales, including unallocated expenses, is expected to be up 10 bps to 20 bps from fiscal 2015 GAAP metric of 34.2%. SG&A includes approximately $16 million in new business development including initiatives in South America and Loxa Beauty.

· The effective tax rate for fiscal year 2016 is expected to be in the range of 37.5% to 38.5%.

· Capital expenditures for fiscal year 2016 are projected to be in the range of $125 million to $135 million. Capital expenditure projects include investments in new payment terminals for Sally U.S., merchandise resets in the Sally U.S. stores, as well as the continuation of refreshing stores and upgrades to the U.S. distribution centers.

· Consolidated organic store growth is expected to be approximately 3.0%.

Conference Call and Where You Can Find Additional Information

As previously announced, at approximately 10:00 a.m. (Central) today the Company will hold a conference call and audio webcast to discuss its financial results and its business. During the conference call, the Company may discuss and answer one or more questions concerning business and financial matters and trends affecting the Company. The Company’s responses to these questions, as well as other matters discussed during the conference call, may contain or constitute material information that has not been previously disclosed. Simultaneous to the conference call, an audio webcast of the call will be available via a link on the Company’s website, investor.sallybeautyholdings.com. The conference call can be accessed by dialing 800-230-1096 (International: (612) 288-0329). The teleconference will be held in a “listen-only” mode for all participants other than the Company’s current sell-side and buy-side investment professionals. If you are unable to listen in to this conference call, the replay will be available at about 12:00 p.m. (Central) November 12, 2015 through November 26, 2015 by dialing 800-475-6701 or if international dial 320-365-3844 and reference the conference ID number 371967. Also, a website replay will be available on investor.sallybeautyholdings.com.

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. (NYSE: SBH) is an international specialty retailer and distributor of professional beauty supplies with revenues of $3.8 billion annually. Through the Sally Beauty Supply and Beauty Systems Group businesses, the Company sells and distributes through approximately 5,000 stores, including approximately 175 franchised units, throughout the United States, the United Kingdom, Belgium, Chile, Peru, Colombia, France, the Netherlands, Canada, Puerto Rico, Mexico, Ireland, Spain and Germany. Sally Beauty Supply stores offer up to 10,000 products for hair, skin, and nails through professional lines such as Clairol, L’Oreal, Wella and Conair, as well as an extensive selection of proprietary merchandise. Beauty Systems Group stores, branded as CosmoProf or Armstrong McCall stores, along with its outside sales consultants, sell up to 10,000 professionally branded products

6

including Paul Mitchell, Wella, Sebastian, Goldwell, Joico, and Aquage which are targeted exclusively for professional and salon use and resale to their customers. For more information about Sally Beauty Holdings, Inc., please visit sallybeautyholdings.com.

Cautionary Notice Regarding Forward-Looking Statements

Statements in this news release and the schedules hereto which are not purely historical facts or which depend upon future events may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” or similar expressions may also identify such forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements as such statements speak only as of the date they were made. Any forward-looking statements involve risks and uncertainties that could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including, but not limited to, risks and uncertainties related to: the highly competitive nature of, and the increasing consolidation of, the beauty products distribution industry; anticipating and effectively responding to changes in consumer preferences and buying trends in a timely manner; potential fluctuation in our same store sales and quarterly financial performance; our dependence upon manufacturers who may be unwilling or unable to continue to supply products to us; the possibility of material interruptions in the supply of products by our third-party manufacturers or distributors or increases in the prices of products we purchase from our third-party manufacturers or distributors; products sold by us being found to be defective in labeling or content; compliance with current laws and regulations or becoming subject to additional or more stringent laws and regulations; the success of our strategic initiatives including our store refresh program and increased marketing efforts, to enhance the customer experience, attract new customers, drive brand awareness and improve customer loyalty; the success of our e-commerce businesses; product diversion to mass retailers or other unauthorized resellers; the operational and financial performance of our franchise-based business; successfully identifying acquisition candidates and successfully completing desirable acquisitions; integrating acquired businesses; the success of our existing stores, and our ability to increase sales at existing stores; opening and operating new stores profitably; the volume of traffic to our stores; the impact of the health of the economy upon our business; the success of our cost control plans; rising labor and rental costs; protecting our intellectual property rights, particularly our trademarks; the risk that our products may infringe on the intellectual property of others or that we may be required to defend our intellectual property rights; conducting business outside the United States; successfully updating and integrating our information technology systems; disruption in our information technology systems; a significant data security breach, including misappropriation of our customers’, or employees’ or suppliers’ confidential information, and the potential costs related thereto; the negative impact on our reputation and loss of confidence of our customers, suppliers and others arising from a significant data security breach; the costs and diversion of management’s attention required to investigate and remediate a data security breach and to continuously upgrade our information technology security systems to address evolving cyber security threats; the ultimate determination of the extent or scope of the potential liabilities relating to our past data security incidents; our ability to attract or retain highly skilled management and other personnel; severe weather, natural disasters or acts of violence or terrorism; the preparedness of our accounting and other management systems to meet financial reporting and other requirements and the upgrade of our existing

7

financial reporting system; being a holding company, with no operations of our own, and depending on our subsidiaries for cash; our ability to execute and implement our common stock repurchase program; our substantial indebtedness; the possibility that we may incur substantial additional debt, including secured debt, in the future; restrictions and limitations in the agreements and instruments governing our debt; generating the significant amount of cash needed to service all of our debt and refinancing all or a portion of our indebtedness or obtaining additional financing; changes in interest rates increasing the cost of servicing our debt; the potential impact on us if the financial institutions we deal with become impaired; and the costs and effects of litigation.

Additional factors that could cause actual events or results to differ materially from the events or results described in the forward-looking statements can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K for the year ended September 30, 2015, as filed with the Securities and Exchange Commission. Consequently, all forward-looking statements in this release are qualified by the factors, risks and uncertainties contained therein. We assume no obligation to publicly update or revise any forward-looking statements.

Use of Non-GAAP Financial Measures

This news release and the schedules hereto include the following financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S., or GAAP, and are therefore referred to as non-GAAP financial measures: (1) Adjusted EBITDA; (2) Adjusted net earnings, earnings per share and diluted earnings per share; (3) Adjusted Gross Profit and (4) Adjusted SG&A expenses. We have provided definitions below for these non-GAAP financial measures and have provided tables in the schedules hereto to reconcile these non-GAAP financial measures to the comparable GAAP financial measures.

Adjusted EBITDA - We define the measure Adjusted EBITDA as GAAP net earnings before depreciation and amortization, interest expense, income taxes, share-based compensation, costs related to the Company’s previously disclosed data security incidents, management transition plan and restructuring of the Sally Germany business.

Adjusted Net Earnings, Earnings Per Share, Diluted Earnings Per Share and SG&A Expenses — Adjusted net earnings, earnings per share, diluted earnings per share and SG&A expenses are GAAP net earnings, earnings per share, diluted earnings per share and SG&A expenses that exclude costs related to the Company’s previously disclosed management transition plan, data security incidents and restructuring of the Sally Germany business for the relevant time periods as indicated in the accompanying non-GAAP reconciliations to the comparable GAAP financial measures.

Adjusted Gross Profit — Adjusted gross profit is GAAP gross profit that excludes costs related to the Company’s restructuring of the Sally Germany business for the relevant time periods as indicated in the accompanying non-GAAP reconciliations to the comparable GAAP financial measures.

We have provided these non-GAAP financial measures as supplemental information to our GAAP financial measures and believe these non-GAAP measures provide investors with additional meaningful financial information regarding our operating performance. Our management and Board of Directors also use these non-GAAP measures as supplemental measures in the evaluation of our businesses and believe that these non-GAAP measures provide a meaningful measure to evaluate our historical and prospective financial performance. These non-GAAP measures should not be considered a substitute for or superior

8

to GAAP results. Furthermore, the non-GAAP measures presented by us may not be comparable to similarly titled measures of other companies.

|

Supplemental Schedules |

|

|

|

|

|

Consolidated Statements of Earnings |

|

A |

|

Segment Information |

|

B |

|

Non-GAAP Financial Measures Reconciliations (Adjusted EBITDA) |

|

C |

|

Non-GAAP Financial Measures Reconciliations (Continued) |

|

D, E |

|

Store Count and Same Store Sales |

|

F |

|

Selected Financial Data and Debt |

|

G |

9

Supplemental Schedule A

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Earnings

(In thousands, except per share data)

(Unaudited)

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

% CHG |

|

2015 |

|

2014 |

|

% CHG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

964,230 |

|

$ |

944,288 |

|

2.1 |

% |

$ |

3,834,343 |

|

$ |

3,753,498 |

|

2.2 |

% |

|

Cost of products sold and distribution expenses (3) |

|

488,919 |

|

476,748 |

|

2.6 |

% |

1,936,492 |

|

1,893,326 |

|

2.3 |

% |

|

Gross profit |

|

475,311 |

|

467,540 |

|

1.7 |

% |

1,897,851 |

|

1,860,172 |

|

2.0 |

% |

|

Selling, general and administrative expenses (1)(2)(3) |

|

330,855 |

|

320,496 |

|

3.2 |

% |

1,313,134 |

|

1,273,513 |

|

3.1 |

% |

|

Depreciation and amortization |

|

25,223 |

|

20,924 |

|

20.5 |

% |

89,391 |

|

79,663 |

|

12.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating earnings |

|

119,233 |

|

126,120 |

|

-5.5 |

% |

495,326 |

|

506,996 |

|

-2.3 |

% |

|

Interest expense |

|

29,152 |

|

29,263 |

|

-0.4 |

% |

116,842 |

|

116,317 |

|

0.5 |

% |

|

Earnings before provision for income taxes |

|

90,081 |

|

96,857 |

|

-7.0 |

% |

378,484 |

|

390,679 |

|

-3.1 |

% |

|

Provision for income taxes |

|

33,901 |

|

35,107 |

|

-3.4 |

% |

143,397 |

|

144,686 |

|

-0.9 |

% |

|

Net earnings |

|

$ |

56,180 |

|

$ |

61,750 |

|

-9.0 |

% |

$ |

235,087 |

|

$ |

245,993 |

|

-4.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.36 |

|

$ |

0.40 |

|

-10.0 |

% |

$ |

1.50 |

|

$ |

1.54 |

|

-2.6 |

% |

|

Diluted |

|

$ |

0.36 |

|

$ |

0.39 |

|

-7.7 |

% |

$ |

1.49 |

|

$ |

1.51 |

|

-1.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

154,725 |

|

154,690 |

|

|

|

156,353 |

|

159,933 |

|

|

|

|

Diluted |

|

156,457 |

|

158,124 |

|

|

|

158,226 |

|

163,419 |

|

|

|

|

|

|

|

|

|

|

Basis Pt Chg |

|

|

|

|

|

Basis Pt Chg |

|

|

Comparison as a % of Net sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sally Beauty Supply Segment Gross Profit Margin |

|

54.6 |

% |

54.8 |

% |

(20 |

) |

54.8 |

% |

54.8 |

% |

0 |

|

|

BSG Segment Gross Profit Margin |

|

41.2 |

% |

41.1 |

% |

10 |

|

41.3 |

% |

41.1 |

% |

20 |

|

|

Consolidated Gross Profit Margin |

|

49.3 |

% |

49.5 |

% |

(20 |

) |

49.5 |

% |

49.6 |

% |

(10 |

) |

|

Selling, general and administrative expenses |

|

34.3 |

% |

33.9 |

% |

40 |

|

34.2 |

% |

33.9 |

% |

30 |

|

|

Consolidated Operating Profit Margin |

|

12.4 |

% |

13.4 |

% |

(100 |

) |

12.9 |

% |

13.5 |

% |

(60 |

) |

|

Net Earnings Margin |

|

5.8 |

% |

6.5 |

% |

(70 |

) |

6.1 |

% |

6.6 |

% |

(50 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective Tax Rate |

|

37.6 |

% |

36.2 |

% |

140 |

|

37.9 |

% |

37.0 |

% |

90 |

|

(1) Selling, general and administrative expenses include share-based compensation expenses of $3.3 million and $3.8 million for the three months ended September 30, 2015 and 2014, respectively; and $16.8 million and $22.1 million for the twelve months ended September 30, 2015 and 2014, respectively, including, for the twelve months ended September 30, 2014, expense of $3.5 million in connection with the executive management transition plan disclosed earlier.

(2) For the three months ended September 30, 2015 and 2014, selling, general and administrative expenses include expenses of $0.6 million (net of related insurance recovery) and $0.5 million, respectively; and for the twelve months ended September 30, 2015 and 2014, expenses of $5.6 million (net of related insurance recovery) and $2.5 million, respectively, incurred in connection with the data security incidents disclosed earlier.

(3) Results for the three and twelve months ended September 30, 2015, reflect $4.2 million and $5.3 million, respectively, in expenses resulting from a restructuring of the Company’s operations in Germany that was approved by our Board of Directors in June 2015. These amounts include $1.4 million reported in cost of products sold and distribution expenses for the three and twelve months ended September 30, 2015, with the remaining expenses reported in selling, general and administrative expenses.

Supplemental Schedule B

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Segment Information

(In thousands)

(Unaudited)

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

% CHG |

|

2015 |

|

2014 |

|

% CHG |

|

|

Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sally Beauty Supply |

|

$ |

582,301 |

|

$ |

581,270 |

|

0.2 |

% |

$ |

2,329,523 |

|

$ |

2,308,743 |

|

0.9 |

% |

|

Beauty Systems Group |

|

381,929 |

|

363,018 |

|

5.2 |

% |

1,504,820 |

|

1,444,755 |

|

4.2 |

% |

|

Total net sales |

|

$ |

964,230 |

|

$ |

944,288 |

|

2.1 |

% |

$ |

3,834,343 |

|

$ |

3,753,498 |

|

2.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sally Beauty Supply (1) |

|

$ |

97,860 |

|

$ |

107,865 |

|

-9.3 |

% |

$ |

412,393 |

|

$ |

431,655 |

|

-4.5 |

% |

|

Beauty Systems Group |

|

57,862 |

|

54,007 |

|

7.1 |

% |

231,151 |

|

216,971 |

|

6.5 |

% |

|

Segment operating earnings |

|

155,722 |

|

161,872 |

|

-3.8 |

% |

643,544 |

|

648,626 |

|

-0.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unallocated expenses (2) |

|

(33,177 |

) |

(31,942 |

) |

3.9 |

% |

(131,440 |

) |

(119,523 |

) |

10.0 |

% |

|

Share-based compensation (3) |

|

(3,312 |

) |

(3,810 |

) |

-13.1 |

% |

(16,778 |

) |

(22,107 |

) |

-24.1 |

% |

|

Interest expense |

|

(29,152 |

) |

(29,263 |

) |

-0.4 |

% |

(116,842 |

) |

(116,317 |

) |

0.5 |

% |

|

Earnings before provision for income taxes |

|

$ |

90,081 |

|

$ |

96,857 |

|

-7.0 |

% |

$ |

378,484 |

|

$ |

390,679 |

|

-3.1 |

% |

|

|

|

|

|

|

|

Basis Pt Chg |

|

|

|

|

|

Basis Pt Chg |

|

|

Segment operating profit margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sally Beauty Supply |

|

16.8 |

% |

18.6 |

% |

(180 |

) |

17.7 |

% |

18.7 |

% |

(100 |

) |

|

Beauty Systems Group |

|

15.1 |

% |

14.9 |

% |

20 |

|

15.4 |

% |

15.0 |

% |

40 |

|

|

Consolidated operating profit margin |

|

12.4 |

% |

13.4 |

% |

(100 |

) |

12.9 |

% |

13.5 |

% |

(60 |

) |

(1) For the three and twelve months ended September 30, 2015, Sally Beauty Supply reflects $4.2 million and $5.3 million, respectively, in expenses resulting from a restructuring of the its operations in Germany that was approved by our Board of Directors in June 2015. These amounts include $1.4 million reported in cost of products sold and distribution expenses for the three and twelve months ended September 30, 2015, with the remaining expenses reported in selling, general and administrative expenses.

(2) Unallocated expenses consist of corporate and shared costs, and are included in selling, general and administrative expenses. For the three months ended September 30, 2015 and 2014, unallocated expenses include $0.6 million (net of related insurance recovery) and $0.5 million, respectively. For the twelve months ended September 30, 2015 and 2014, $5.6 million (net of related insurance recovery) and $2.5 million, respectively, in expenses incurred in connection with the data security incidents disclosed earlier.

(3) For the twelve months ended September 30, 2014, share-based compensation expense includes $3.5 million in connection with the executive management transition plan disclosed earlier.

Supplemental Schedule C

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Non-GAAP Financial Measures Reconciliations

(In thousands)

(Unaudited)

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

% CHG |

|

2015 |

|

2014 |

|

% CHG |

|

|

Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (per GAAP) |

|

$ |

56,180 |

|

$ |

61,750 |

|

-9.0 |

% |

$ |

235,087 |

|

$ |

245,993 |

|

-4.4 |

% |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

25,223 |

|

20,924 |

|

20.5 |

% |

89,391 |

|

79,663 |

|

12.2 |

% |

|

Share-based compensation (1) |

|

3,312 |

|

3,810 |

|

-13.1 |

% |

16,778 |

|

22,107 |

|

-24.1 |

% |

|

Germany business restructure charges (2) |

|

4,190 |

|

— |

|

100.0 |

% |

5,307 |

|

— |

|

100.0 |

% |

|

Loss from data security incidents (3) |

|

604 |

|

529 |

|

14.2 |

% |

5,564 |

|

2,504 |

|

122.2 |

% |

|

Interest expense |

|

29,152 |

|

29,263 |

|

-0.4 |

% |

116,842 |

|

116,317 |

|

0.5 |

% |

|

Provision for income taxes |

|

33,901 |

|

35,107 |

|

-3.4 |

% |

143,397 |

|

144,686 |

|

-0.9 |

% |

|

Adjusted EBITDA (Non-GAAP) |

|

$ |

152,562 |

|

$ |

151,383 |

|

0.8 |

% |

$ |

612,366 |

|

$ |

611,270 |

|

0.2 |

% |

(1) For the twelve months ended September 30, 2015 and 2014, share-based compensation includes $4.8 million and $8.8 million, respectively, of accelerated expense related to certain retirement-eligible employees who are eligible to continue vesting awards upon retirement, including, for the twelve months ended September 30, 2014, expense of $3.5 million in connection with the executive management transition plan disclosed earlier.

(2) Results for the three and twelve months ended September 30, 2015, reflect $4.2 million and $5.3 million, respectively, in pre-tax expenses resulting from a restructuring of the Company’s operations in Germany that was approved by our Board of Directors in June 2015. These amounts include $1.4 million reported in cost of products sold and distribution expenses for the three and twelve months ended September 30, 2015, with the remaining expenses reported in selling, general and administrative expenses.

(3) For the three months ended September 30, 2015 and 2014, selling, general and administrative expenses include $0.6 million (net of related insurance recovery) and $0.5 million, respectively; and for the twelve months ended September 30, 2015 and 2014, $5.6 million (net of related insurance recovery) and $2.5 million, respectively, in pre-tax expenses incurred in connection with the data security incidents disclosed earlier.

Supplemental Schedule D

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Non-GAAP Financial Measures Reconciliations, Continued

(In thousands)

(Unaudited)

|

|

|

Three Months Ended September 30, 2015 |

|

|

|

|

As Reported |

|

Charges for

Germany

Restructure (1) |

|

Charges from

Data Security

Incidents (2) |

|

As Adjusted

(Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Gross profit (1) |

|

$ |

475,311 |

|

$ |

1,404 |

|

$ |

— |

|

$ |

476,715 |

|

|

Consolidated Gross Profit Margin |

|

49.3 |

% |

|

|

|

|

49.4 |

% |

|

Selling, general and administrative expenses |

|

330,855 |

|

(2,786 |

) |

(604 |

) |

327,465 |

|

|

SG&A expenses, as a percentage of sales |

|

34.3 |

% |

|

|

|

|

34.0 |

% |

|

Operating earnings |

|

119,233 |

|

4,190 |

|

604 |

|

124,027 |

|

|

Operating Profit Margin |

|

12.4 |

% |

|

|

|

|

12.9 |

% |

|

Earnings before provision for income taxes |

|

90,081 |

|

4,190 |

|

604 |

|

94,875 |

|

|

Provision for income taxes (3) |

|

33,901 |

|

1,550 |

|

223 |

|

35,674 |

|

|

Net earnings |

|

$ |

56,180 |

|

$ |

2,640 |

|

$ |

381 |

|

$ |

59,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.36 |

|

$ |

0.02 |

|

$ |

0.00 |

|

$ |

0.38 |

|

|

Diluted |

|

$ |

0.36 |

|

$ |

0.02 |

|

$ |

0.00 |

|

$ |

0.38 |

|

|

|

|

Three Months Ended September 30, 2014 |

|

|

|

|

As Reported |

|

Charges from

Data Security

Incidents (2) |

|

As Adjusted

(Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

Consolidated Gross profit (1) |

|

$ |

467,540 |

|

$ |

— |

|

$ |

467,540 |

|

|

Consolidated Gross Profit Margin |

|

49.5 |

% |

|

|

49.5 |

% |

|

Selling, general and administrative expenses |

|

320,496 |

|

(529 |

) |

319,967 |

|

|

SG&A expenses, as a percentage of sales |

|

33.9 |

% |

|

|

33.9 |

% |

|

Operating earnings |

|

126,120 |

|

529 |

|

126,649 |

|

|

Operating Profit Margin |

|

13.4 |

% |

|

|

13.4 |

% |

|

Earnings before provision for income taxes |

|

96,857 |

|

529 |

|

97,386 |

|

|

Provision for income taxes (3) |

|

35,107 |

|

206 |

|

35,313 |

|

|

Net earnings |

|

$ |

61,750 |

|

$ |

323 |

|

$ |

62,073 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.40 |

|

$ |

0.00 |

|

$ |

0.40 |

|

|

Diluted |

|

$ |

0.39 |

|

$ |

0.00 |

|

$ |

0.39 |

|

(1) Results for the three months ended September 30, 2015, reflect $4.2 million in expenses resulting from a restructuring of the Company’s operations in Germany that was approved by our Board of Directors in June 2015. This amount includes $1.4 million reported in cost of products sold and distribution expenses, with the remaining expenses reported in selling, general and administrative expenses.

(2) For the three months ended September 30, 2015 and 2014, selling, general and administrative expenses include expenses of $0.6 million (net of related insurance recovery) and $0.5 million, respectively, incurred in connection with the data security incidents disclosed earlier.

(3) The tax provision for the adjustments to net earnings was calculated using an effective tax rate of 37.0% and 39.0% for the three months ended September 30, 2015 and 2014, respectively.

Supplemental Schedule E

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Non-GAAP Financial Measures Reconciliations, Continued

(In thousands)

(Unaudited)

|

|

|

Twelve Months Ended September 30, 2015 |

|

|

|

|

As Reported |

|

Charges for

Germany

Restructure (2) |

|

Charges from

Data Security

Incidents (3) |

|

As Adjusted

(Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Gross profit (2) |

|

$ |

1,897,851 |

|

$ |

1,404 |

|

$ |

— |

|

$ |

1,899,255 |

|

|

Consolidated Gross Profit Margin |

|

49.5 |

% |

|

|

|

|

49.5 |

% |

|

Selling, general and administrative expenses |

|

1,313,134 |

|

(3,903 |

) |

(5,564 |

) |

1,303,667 |

|

|

SG&A expenses, as a percentage of sales |

|

34.2 |

% |

|

|

|

|

34.0 |

% |

|

Operating earnings |

|

495,326 |

|

5,307 |

|

5,564 |

|

506,197 |

|

|

Operating Profit Margin |

|

12.9 |

% |

|

|

|

|

13.2 |

% |

|

Earnings before provision for income taxes |

|

378,484 |

|

5,307 |

|

5,564 |

|

389,355 |

|

|

Provision for income taxes (4) |

|

143,397 |

|

1,964 |

|

2,059 |

|

147,420 |

|

|

Net earnings |

|

$ |

235,087 |

|

$ |

3,343 |

|

$ |

3,505 |

|

$ |

241,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.504 |

|

$ |

0.021 |

|

$ |

0.022 |

|

$ |

1.55 |

|

|

Diluted |

|

$ |

1.486 |

|

$ |

0.021 |

|

$ |

0.022 |

|

$ |

1.53 |

|

|

|

|

Twelve Months Ended September 30, 2014 |

|

|

|

|

As Reported |

|

Management

Transition

Costs (1) |

|

Charges from

Data Security

Incidents (3) |

|

As Adjusted

(Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Gross profit (2) |

|

$ |

1,860,172 |

|

$ |

— |

|

$ |

— |

|

$ |

1,860,172 |

|

|

Consolidated Gross Profit Margin |

|

49.6 |

% |

|

|

|

|

49.6 |

% |

|

Selling, general and administrative expenses |

|

1,273,513 |

|

(3,500 |

) |

(2,504 |

) |

1,267,509 |

|

|

SG&A expenses, as a percentage of sales |

|

33.9 |

% |

|

|

|

|

33.8 |

% |

|

Operating earnings |

|

506,996 |

|

3,500 |

|

2,504 |

|

513,000 |

|

|

Operating Profit Margin |

|

13.5 |

% |

|

|

|

|

13.7 |

% |

|

Earnings before provision for income taxes |

|

390,679 |

|

3,500 |

|

2,504 |

|

396,683 |

|

|

Provision for income taxes (4) |

|

144,686 |

|

1,365 |

|

977 |

|

147,028 |

|

|

Net earnings |

|

$ |

245,993 |

|

$ |

2,135 |

|

$ |

1,527 |

|

$ |

249,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.54 |

|

$ |

0.01 |

|

$ |

0.01 |

|

$ |

1.56 |

|

|

Diluted |

|

$ |

1.51 |

|

$ |

0.01 |

|

$ |

0.01 |

|

$ |

1.53 |

|

(1) For the twelve months ended September 30, 2014, selling, general and administrative expenses include share-based compensation expense of $3.5 million in connection with the executive management transition plan disclosed earlier.

(2) Results for the twelve months ended September 30, 2015, reflect $5.3 million in expenses resulting from a restructuring of the Company’s operations in Germany that was approved by our Board of Directors in June 2015. This amount includes $1.4 million reported in cost of products sold and distribution expenses, with the remaining expenses reported in selling, general and administrative expenses.

(3) For the twelve months ended September 30, 2015 and 2014, selling, general and administrative expenses include expenses of $5.6 million (net of related insurance recovery) and $2.5 million, respectively, incurred in connection with the data security incidents disclosed earlier.

(4) The tax provision for the adjustments to net earnings was calculated using an effective tax rate of 37.0% and 39.0% for the twelve months ended September 30, 2015 and 2014, respectively.

Supplemental Schedule F

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Store Count and Same Store Sales

(Unaudited)

|

|

|

As of September 30, |

|

|

|

|

|

|

2015 |

|

2014 |

|

CHG |

|

|

|

|

|

|

|

|

|

|

|

Number of retail stores (end of period): |

|

|

|

|

|

|

|

|

Sally Beauty Supply: |

|

|

|

|

|

|

|

|

Company-operated stores |

|

3,655 |

|

3,544 |

|

111 |

|

|

Franchise stores |

|

18 |

|

19 |

|

(1 |

) |

|

Total Sally Beauty Supply |

|

3,673 |

|

3,563 |

|

110 |

|

|

Beauty Systems Group: |

|

|

|

|

|

|

|

|

Company-operated stores |

|

1,137 |

|

1,103 |

|

34 |

|

|

Franchise stores |

|

157 |

|

162 |

|

(5 |

) |

|

Total Beauty System Group |

|

1,294 |

|

1,265 |

|

29 |

|

|

Total |

|

4,967 |

|

4,828 |

|

139 |

|

|

|

|

|

|

|

|

|

|

|

BSG distributor sales consultants (end of period) (1) |

|

958 |

|

981 |

|

(23 |

) |

|

|

|

2015 |

|

2014 |

|

Basis Pt Chg |

|

|

Fourth quarter company-operated same store sales growth (2) |

|

|

|

|

|

|

|

|

Sally Beauty Supply |

|

1.8 |

% |

2.1 |

% |

(30 |

) |

|

Beauty Systems Group |

|

7.4 |

% |

3.8 |

% |

360 |

|

|

Consolidated |

|

3.5 |

% |

2.6 |

% |

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basis Pt Chg |

|

|

Twelve months ended September 30 company-operated same store sales growth (2) |

|

|

|

|

|

|

|

|

Sally Beauty Supply |

|

1.7 |

% |

1.3 |

% |

40 |

|

|

Beauty Systems Group |

|

5.7 |

% |

3.5 |

% |

220 |

|

|

Consolidated |

|

2.9 |

% |

2.0 |

% |

90 |

|

(1) Includes 318 and 339 distributor sales consultants as reported by our franchisees at September 30, 2015 and 2014, respectively.

(2) For the purpose of calculating our same store sales metrics, we compare the current period sales for stores open for 14 months or longer as of the last day of a month with the sales for these stores for the comparable period in the prior fiscal year. Our same store sales are calculated in constant U.S. dollars and include internet-based sales and the effect of store expansions, if applicable, but do not generally include the sales of stores relocated until 14 months after the relocation. The sales of stores acquired are excluded from our same store sales calculation until 14 months after the acquisition.

Supplemental Schedule G

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Selected Financial Data and Debt

(In thousands)

(Unaudited)

|

|

|

As of September 30, |

|

|

|

|

2015 |

|

2014 |

|

|

Financial condition information (at period end): |

|

|

|

|

|

|

Working capital |

|

$ |

695,403 |

|

$ |

640,612 |

|

|

Cash and cash equivalents |

|

140,038 |

|

106,575 |

|

|

Property and equipment, net |

|

270,847 |

|

238,111 |

|

|

Total assets |

|

2,094,351 |

|

2,029,973 |

|

|

Total debt, including capital leases (1) |

|

1,787,594 |

|

1,785,987 |

|

|

Total stockholders’ (deficit) equity |

|

$ |

(297,821 |

) |

$ |

(347,053 |

) |

|

|

|

As of September 30, |

|

|

|

|

|

|

2015 |

|

Interest Rates (2) |

|

|

Debt position, excluding capital leases: |

|

|

|

|

|

|

Revolving ABL facility |

|

$ |

— |

|

(i) Prime + 0.50-0.75% or

(ii) LIBOR + 1.50-1.75% |

|

|

Senior notes due 2019 |

|

750,000 |

|

6.875% |

|

|

Senior notes due 2022 |

|

850,000 |

|

5.750% |

|

|

Senior notes due 2023 |

|

200,000 |

|

5.500% |

|

|

|

|

|

|

|

|

|

Total debt, excluding capital leases (3) |

|

$ |

1,800,000 |

|

|

|

|

|

|

|

|

|

|

|

Debt maturities, excluding capital leases: |

|

|

|

|

|

|

Twelve months ending September 30, |

|

|

|

|

|

|

2016-2019 |

|

$ |

— |

|

|

|

|

2020 |

|

750,000 |

|

|

|

|

Thereafter |

|

1,050,000 |

|

|

|

|

Total debt, excluding capital leases (3) |

|

$ |

1,800,000 |

|

|

|

(1) Total debt, including capital leases, is net of unamortized debt issuance costs of $21.8 million and $25.7 million at September 30, 2015 and 2014, respectively.

(2) Interest rates represent the coupon or contractual rates related to each indebtedness shown.

(3) Amounts do not include capital lease obligations, unamortized premium of $6.5 million related to senior notes due 2022 in an aggregate principal amount of $150.0 million, or unamortized debt issuance costs in the aggregate amount of $21.8 million in connection with the senior notes due 2019, 2022 and 2023.

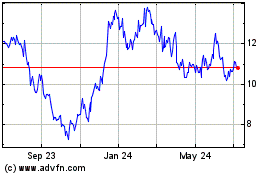

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

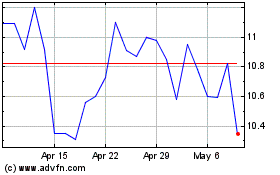

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024