- Consolidated net sales of $964.5

million, up 2.6%

- 1Q15 same store sales growth of 2.3%

versus 2.2% in 1Q14

- Consolidated gross margin expansion of

10 basis points

- 1Q15 net earnings of $54.9 million with

earnings per share of $0.35

Sally Beauty Holdings, Inc. (NYSE: SBH) (the “Company”) today

announced financial results for the fiscal 2015 first quarter. The

Company will hold a conference call today at 10:00 a.m. (Central)

to discuss these results and its business.

“As we continue to invest in and drive improvements in support

of our core business, we anticipated first quarter results

might fall below our full year expectations and that subsequent

quarters would show steady improvement as our strategic initiatives

were fully implemented,” stated Chris Brickman, President and Chief

Executive Officer. “Consistent with these expectations, our

consolidated same store sales for the fiscal 2015 first quarter

were 2.3% and sales growth was 2.6%, which includes a 120 basis

point unfavorable impact due to foreign currency exchange.

Consolidated gross margin expanded 10 basis points driven by both

our business segments. SG&A expense growth was higher this

quarter than we anticipate going forward due to the final quarter

of incremental healthcare expenses and investments made to lay the

foundation for our strategic initiatives. As a result, we do not

believe this quarter’s deleverage is indicative of how the

remainder of the year will progress. Overall, we are very pleased

with the early results of all our initiatives including CRM,

marketing, the nail studio, our store refresh program and the

acquisition of new brands/territories for our BSG business. We will

continue to work on these initiatives for the remainder of FY2015,

and I look forward to sharing the results with you.”

FISCAL 2015 FIRST QUARTER FINANCIAL HIGHLIGHTS

Net Sales: For the fiscal 2015 first quarter,

consolidated net sales were $964.5 million, an increase of 2.6%

from the fiscal 2014 first quarter. Fiscal 2015 first quarter sales

increase is attributed to same store sales growth and the addition

of new stores. The unfavorable impact from changes in foreign

currency exchange rates in the fiscal 2015 first quarter was $12.0

million, or 1.2% of sales. Consolidated same store sales growth in

the fiscal 2015 first quarter was 2.3%.

Gross Profit: Consolidated gross profit for the fiscal

2015 first quarter was $473.8 million, an increase of 2.9% over

gross profit of $460.5 million for the fiscal 2014 first quarter.

Gross profit as a percentage of sales was 49.1%, a 10 basis point

improvement from the fiscal 2014 first quarter.

Selling, General and Administrative Expenses: For the

fiscal 2015 first quarter, consolidated selling, general and

administrative (SG&A) expenses, including unallocated corporate

expenses and share-based compensation, were $337.0 million, or

34.9% of sales, a 90 basis point increase from the fiscal 2014

first quarter metric of 34.0% of sales and total SG&A expenses

of $319.5 million. Fiscal 2015 first quarter SG&A expenses

increased $17.5 million in part due to expenses associated with the

opening of new stores such as rent, occupancy and payroll

expenses.

In addition, the increase reflects higher expenses associated

with our self-funded employee healthcare benefits program in the

U.S., certain compensation-related expenses primarily in connection

with our ongoing management transition plan, higher advertising

expenses and higher expenses associated with the Sally Beauty

Supply store remodels.

Note: SG&A expenses include unallocated corporate expenses,

as detailed in the Company’s segment information on schedule B.

Interest Expense: Interest expense for the fiscal 2015

first quarter was $29.2 million, up $0.8 million from the fiscal

2014 first quarter of $28.5 million.

Provision for Income Taxes: Income taxes were $32.1

million for the fiscal 2015 first quarter versus $35.3 million in

the fiscal 2014 first quarter. The Company’s effective tax rate in

the fiscal 2015 first quarter was 36.9% versus 37.8% in the fiscal

2014 first quarter.

In fiscal year 2015, the Company’s effective tax rate is

expected to be in the range of 37.5% to 38.5%.

Net Earnings and Diluted Net Earnings Per Share

(EPS)(1): In the fiscal 2015 first quarter, net

earnings were $54.9 million, a 5.3% decrease from fiscal 2014 first

quarter net earnings of $58.0 million. In the fiscal 2015 first

quarter, diluted earnings per share were $0.35, flat when compared

to fiscal 2014 first quarter diluted earnings per share.

Adjusted (Non-GAAP) EBITDA(1): Adjusted

EBITDA for the fiscal 2015 first quarter was $144.8 million, a

decrease of 3.2% from $149.6 million for the fiscal 2014 first

quarter.

Financial Position, Capital Expenditures and Working

Capital: Cash and cash equivalents as of December 31, 2014,

were $190.7 million. The Company’s asset-based loan (ABL) revolving

credit facility ended the fiscal 2015 first quarter with no

outstanding borrowings. The Company’s debt, excluding capital

leases, totaled $1.8 billion as of December 31, 2014.

For the fiscal 2015 first quarter, the Company’s capital

expenditures totaled $19.4 million. Capital expenditures for the

fiscal year 2015 are projected to be in the previously stated range

of $95 million to $100 million, excluding acquisitions.

Working capital (current assets less current liabilities)

increased $113.1 million to $753.8 million at December 31, 2014

compared to $640.6 million at September 30, 2014. Borrowing

capacity on the ABL facility was approximately $478.1 million at

the end of fiscal 2015 fist quarter. The ratio of current assets to

current liabilities was 2.75 to 1.00 at December 31, 2014 compared

to 2.38 to 1.00 at September 30, 2014.

Inventory as of December 31, 2014 was $837.8 million, an

increase of $23.6 million or growth of 2.9% from December 31, 2013

inventory. This increase is primarily due to sales growth from

existing stores and additional inventory from new store

openings.

During the period of October 1, 2014 through December 31, 2014,

the Company repurchased (and subsequently retired) 243 thousand

shares of its common stock at an aggregate cost of $7.25 million

and had approximately $992.7 million of additional share repurchase

authorization remaining under its $1 billion share repurchase

authorization announced on August 20, 2014. The Company remains

committed to deploying excess cash flow, after investments to grow

the business, in the form of stock repurchases.

Business Segment Results:

Sally Beauty Supply

Fiscal 2015 First Quarter Results for Sally Beauty

Supply

- Sales of $586.5 million, up 2.3% from

$573.4 million in the fiscal 2014 first quarter. Sales growth was

from net new store openings and same store sales growth. The

unfavorable impact of foreign currency exchange on sales was $9.3

million, or 1.6%.

- Same store sales growth of 1.6% versus

growth of 0.9% in the fiscal 2014 first quarter.

- Gross margin of 54.4%, a 10 basis point

increase from 54.3% in the fiscal 2014 first quarter.

- Segment earnings of $101.2 million,

down 2.3% from $103.5 million in the fiscal 2014 first

quarter.

- Segment operating margins decreased 80

basis points to 17.3% of sales from 18.1% in the fiscal 2014 first

quarter.

- Net store count increased by 161 over

the fiscal 2014 first quarter for total store count of 3,605.

Sales growth in the fiscal 2015 first quarter was driven by new

store openings and same store sales; this growth was partially

offset by the unfavorable impact of foreign currency exchange.

Gross profit margin improvement of 10 basis points primarily

resulted from favorable product and customer mix shift. Segment

operating earnings and margin were negatively impacted by higher

SG&A expenses associated with store remodel costs, higher

advertising expenses and higher expenses associated with our

self-funded employee healthcare benefits program.

Beauty Systems Group

Fiscal 2015 First Quarter Results for Beauty Systems

Group

- Sales of $377.9 million, up 3.0% from

$367.1 million in the fiscal 2014 first quarter. The unfavorable

impact of foreign currency exchange on sales was $2.8 million, or

0.7%.

- Same store sales growth of 3.9% versus

5.2% in the fiscal 2014 first quarter.

- Gross margin of 40.9%, up 20 basis

points when compared to the fiscal 2014 first quarter of

40.7%.

- Segment earnings of $56.6 million, up

3.2% from $54.8 million in the fiscal 2014 first quarter.

- Segment operating margins increased by

10 basis points to 15.0% of sales from 14.9% in the fiscal 2014

first quarter.

- Net store count was 1,275, an increase

of 26 stores over the fiscal 2014 first quarter.

- Total BSG distributor sales consultants

at the end of the fiscal 2015 first quarter were 967 versus 992 at

the end of the fiscal 2014 first quarter.

Sales growth for the Beauty Systems Group was primarily driven

by growth in same store sales and net new store openings; this

growth was partially offset by the unfavorable impact of foreign

currency. Growth in segment operating earnings and margin expansion

was primarily due to gross margin and SG&A leverage improvement

while partially offset by expenses associated with new store

openings and investments in the LoxaBeauty website.

(1) A detailed table reconciling 2015 and 2014 adjusted EBITDA

is included in Supplemental Schedule C.

Conference Call and Where You Can Find Additional

Information

As previously announced, at approximately 10:00 a.m. (Central)

today the Company will hold a conference call and audio webcast to

discuss its financial results and its business. During the

conference call, the Company may discuss and answer one or more

questions concerning business and financial matters and trends

affecting the Company. The Company’s responses to these questions,

as well as other matters discussed during the conference call, may

contain or constitute material information that has not been

previously disclosed. Simultaneous to the conference call, an audio

webcast of the call will be available via a link on the Company’s

website, investor.sallybeautyholdings.com. The conference call can

be accessed by dialing 800-230-1092 (International: 612-288-0337).

The teleconference will be held in a “listen-only” mode for all

participants other than the Company’s current sell-side and

buy-side investment professionals. If you are unable to listen to

this conference call, the replay will be available at about 12:00

p.m. (Central) February 5, 2015 through February 19, 2015 by

dialing 1-800-475-6701 or if international dial 320-365-3844 and

reference the conference ID number 340569. Also, a website replay

will be available on investor.sallybeautyholdings.com.

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. (NYSE: SBH) is an international

specialty retailer and distributor of professional beauty supplies

with revenues of $3.8 billion annually. Through the Sally Beauty

Supply and Beauty Systems Group businesses, the Company sells and

distributes through 4,800 stores, including approximately 200

franchised units, throughout the United States, the United Kingdom,

Belgium, Chile, Peru, France, the Netherlands, Canada, Puerto Rico,

Mexico, Ireland, Spain and Germany. Sally Beauty Supply stores

offer up to 10,000 products for hair, skin, and nails through

professional lines such as Clairol, L’Oreal, Wella and Conair, as

well as an extensive selection of proprietary merchandise. Beauty

Systems Group stores, branded as CosmoProf or Armstrong McCall

stores, along with its outside sales consultants, sell up to 10,000

professionally branded products including Paul Mitchell, Wella,

Sebastian, Goldwell, Joico, and Aquage which are targeted

exclusively for professional and salon use and resale to their

customers. For more information about Sally Beauty Holdings, Inc.,

please visit sallybeautyholdings.com.

Cautionary Notice Regarding Forward-Looking

Statements

Statements in this news release and the schedules hereto which

are not purely historical facts or which depend upon future events

may be forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Words such as

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,”

“project,” “target,” “can,” “could,” “may,” “should,” “will,”

“would,” or similar expressions may also identify such

forward-looking statements.

Readers are cautioned not to place undue reliance on

forward-looking statements as such statements speak only as of the

date they were made. Any forward-looking statements involve risks

and uncertainties that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements, including, but not limited to, risks

and uncertainties related to: the highly competitive nature of, and

the increasing consolidation of, the beauty products distribution

industry; anticipating and effectively responding to changes in

consumer preferences and buying trends in a timely manner;

potential fluctuation in our same store sales and quarterly

financial performance; our dependence upon manufacturers who may be

unwilling or unable to continue to supply products to us; the

possibility of material interruptions in the supply of beauty

supply products by our third-party manufacturers or distributors;

products sold by us being found to be defective in labeling or

content; compliance with current laws and regulations or becoming

subject to additional or more stringent laws and regulations; the

success of our e-commerce business; product diversion to mass

retailers or other unauthorized retailers; the operational and

financial performance of our franchise-based business; successfully

identifying acquisition candidates and successfully completing

desirable acquisitions; integrating acquired businesses; opening

and operating new stores profitably; the impact of the health of

the economy upon our business; the success of our cost control

plans; protecting our intellectual property rights, particularly

our trademarks; the risk that our products may infringe on the

intellectual property of others or that we may be required to

defend our intellectual property rights; conducting business

outside the United States; disruption in our information technology

systems; a significant data security breach, including

misappropriation of our customers’ or employees’ personal

information, and the potential costs related thereto; the negative

impact on our reputation and loss of confidence of our customers,

suppliers and others arising from a significant data security

breach; the costs and diversion of management attention required to

investigate and remediate a data security breach; the ultimate

determination of the extent or scope of the potential liabilities

relating to our recent data security incident; our ability to

attract or retain highly skilled management and other personnel;

severe weather, natural disasters or acts of violence or terrorism;

the preparedness of our accounting and other management systems to

meet financial reporting and other requirements and the upgrade of

our financial reporting system; being a holding company, with no

operations of our own, and depending on our subsidiaries for cash;

our ability to execute and implement our common stock repurchase

program; our substantial indebtedness; the possibility that we may

incur substantial additional debt, including secured debt, in the

future; restrictions and limitations in the agreements and

instruments governing our debt; generating the significant amount

of cash needed to service all of our debt and refinancing all or a

portion of our indebtedness or obtaining additional financing;

changes in interest rates increasing the cost of servicing our

debt; the potential impact on us if the financial institutions we

deal with become impaired; and the costs and effects of

litigation.

Additional factors that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements can be found in our filings with the

Securities and Exchange Commission, including our most recent

Annual Report on Form 10-K for the year ended September 30, 2014,

as filed with the Securities and Exchange Commission. Consequently,

all forward-looking statements in this release are qualified by the

factors, risks and uncertainties contained therein. We assume no

obligation to publicly update or revise any forward-looking

statements.

Use of Non-GAAP Financial Measures

This news release and the schedules hereto include the following

financial measures that have not been calculated in accordance with

accounting principles generally accepted in the U.S., or GAAP, and

are therefore referred to as non-GAAP financial measures: (1)

Adjusted EBITDA; (2) Adjusted net earnings, earnings per share and

diluted earnings per share and (3) Adjusted SG&A expenses. We

have provided definitions below for these non-GAAP financial

measures and have provided tables in the schedules hereto to

reconcile these non-GAAP financial measures to the comparable GAAP

financial measures.

Adjusted EBITDA – We define the measure Adjusted EBITDA as GAAP

net earnings before depreciation and amortization, interest

expense, income taxes, share-based compensation (which includes

costs related to the Company’s executive management transition) and

costs related to the Company’s previously disclosed data security

incident.

Adjusted Net Earnings, Earnings Per Share, Diluted Earnings Per

Share and SG&A Expenses – Adjusted net earnings, earnings per

share, diluted earnings per share and SG&A expenses are GAAP

net earnings, earnings per share, diluted earnings per share and

SG&A expenses that exclude costs related to the Company’s

previously disclosed executive management transition and data

security incident for the relevant time periods as indicated in the

accompanying non-GAAP reconciliations to the comparable GAAP

financial measures.

We have provided these non-GAAP financial measures as

supplemental information to our GAAP financial measures and believe

these non-GAAP measures provide investors with additional

meaningful financial information regarding our operating

performance. Our management and Board of Directors also use these

non-GAAP measures as supplemental measures in the evaluation of our

businesses and believe that these non-GAAP measures provide a

meaningful measure to evaluate our historical and prospective

financial performance. These non-GAAP measures should not be

considered a substitute for or superior to GAAP results.

Furthermore, the non-GAAP measures presented by us may not be

comparable to similarly titled measures of other companies.

Supplemental Schedules Consolidated Statement of Earnings

A Segment Information B Non-GAAP Financial

Measures Reconciliations (Adjusted EBITDA) C Non-GAAP Financial

Measures Reconciliations (Continued) D Store Count and Same Store

Sales E Selected Financial Data and Debt

F

Supplemental Schedule A

SALLY BEAUTY

HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of

Earnings (In thousands, except per share data) (Unaudited)

Three Months Ended December 31,

2014 2013 % CHG

Net sales $ 964,468 $ 940,464 2.6 % Cost of products sold and

distribution expenses 490,699

479,938 2.2 % Gross profit

473,769 460,526 2.9 % Selling, general and administrative expenses

(1)(2) 336,954 319,478 5.5 % Depreciation and amortization

20,579 19,255

6.9 % Operating earnings 116,236 121,793 -4.6 %

Interest expense 29,241

28,489 2.6 % Earnings before provision

for income taxes 86,995 93,304 -6.8 % Provision for income taxes

32,086 35,309

-9.1 % Net earnings $ 54,909

$ 57,995 -5.3 %

Earnings per share: Basic $ 0.35 $ 0.35 0.0 % Diluted $ 0.35 $ 0.35

0.0 % Weighted average shares: Basic 156,104 163,603 Diluted

158,545 167,755

Basis Pt Chg

Comparison as a % of

Net sales

Sally Beauty Supply Segment Gross Profit Margin 54.4 % 54.3 % 10

BSG Segment Gross Profit Margin 40.9 % 40.7 % 20 Consolidated Gross

Profit Margin 49.1 % 49.0 % 10 Selling, general and administrative

expenses 34.9 % 34.0 % 90 Consolidated Operating Profit Margin 12.1

% 13.0 % (90 ) Net Earnings Margin 5.7 % 6.2 % (50 )

Effective Tax

Rate

36.9 % 37.8 % (90 )

(1) Selling, general and administrative expenses include

share-based compensation expenses of $7.8 million and $8.5 million

for the three months ended December 31, 2014 and 2013,

respectively. (2) For the three months ended December 31,

2014, selling, general and administrative expenses include expenses

of $0.2 million incurred in connection with the data security

incident disclosed in March 2014. Supplemental

Schedule B

SALLY BEAUTY HOLDINGS,

INC. AND SUBSIDIARIES Segment Information (In thousands)

(Unaudited) Three Months Ended December 31,

2014 2013 % CHG Net sales: Sally

Beauty Supply $ 586,519 $ 573,355 2.3 % Beauty Systems Group

377,949 367,109

3.0 % Total net sales $ 964,468

$ 940,464 2.6 % Operating

earnings: Sally Beauty Supply $ 101,179 $ 103,543 -2.3 % Beauty

Systems Group 56,589

54,834 3.2 % Segment operating earnings

157,768 158,377

-0.4 % Unallocated corporate expenses

(1) (33,772 ) (28,062 ) 20.3 % Share-based compensation (7,760 )

(8,522 ) -8.9 % Interest expense (29,241 )

(28,489 ) 2.6 % Earnings before

provision for income taxes $ 86,995

$ 93,304 -6.8 % Segment

operating profit margin:

Basis Pt Chg Sally Beauty Supply

17.3 % 18.1 % (80 ) Beauty Systems Group 15.0 % 14.9 % 10

Consolidated operating profit margin 12.1 %

13.0 % (90 )

(1)

Unallocated expenses consist of corporate and shared costs. For the

three months ended December 31, 2014, unallocated corporate

expenses include expenses of $0.2 million incurred in connection

with the data security incident disclosed in March 2014.

Supplemental Schedule C

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Non-GAAP

Financial Measures Reconciliations (In thousands) (Unaudited)

Three Months Ended December 31, 2014

2013 % CHG Adjusted EBITDA: Net

earnings (per GAAP) $ 54,909 $ 57,995 -5.3 % Add: Depreciation and

amortization 20,579 19,255 6.9 % Share-based compensation (1) 7,760

8,522 -8.9 % Expenses from data security incident (2) 241 - -

Interest expense 29,241 28,489 2.6 % Provision for income taxes

32,086 35,309

-9.1 % Adjusted EBITDA (Non-GAAP) $ 144,816

$ 149,570 -3.2 %

(1)

For the three months ended December 31, 2014 and 2013, share-based

compensation includes $4.8 million and $5.3 million, respectively,

of accelerated expense related to certain retirement-eligible

employees who are eligible to continue vesting awards upon

retirement.

(2)

For the three months ended December 31, 2014, selling, general and

administrative expenses include expenses of $0.2 million incurred

in connection with the data security incident disclosed in March

2014. Supplemental Schedule D

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Non-GAAP Financial Measures Reconciliations, Continued (In

thousands) (Unaudited) Three Months

Ended December 31, 2014 As Reported

Expenses fromData SecurityIncident (1)

As Adjusted(Non-GAAP)

Selling, general and administrative expenses $ 336,954 $

(241 ) $ 336,713 SG&A expenses, as a percentage of sales 34.9 %

34.9 % Operating earnings 116,236 241 116,477 Operating Profit

Margin 12.1 % 12.1 % Earnings before provision for income taxes

86,995 241 87,236 Provision for income taxes (2)

32,086 89

32,175 Net earnings $ 54,909

$ 152 $ 55,061

Earnings per share: Basic $ 0.35 $ - $ 0.35 Diluted $ 0.35 $ - $

0.35

(1)

For the three months ended December 31, 2014, selling, general and

administrative expenses include expenses of $0.2 million incurred

in connection with the data security incident disclosed in March

2014.

(2)

The provision for income taxes related to the adjustment to net

earnings was calculated using an estimated effective tax rate of

37.0%. Supplemental Schedule E

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Store Count and Same Store Sales (Unaudited) As of December

31, 2014 2013 CHG

Number of retail stores (end of period): Sally Beauty

Supply: Company-operated stores 3,586 3,423 163 Franchise stores 19

21 (2 ) Total Sally Beauty Supply 3,605 3,444 161

Beauty Systems Group: Company-operated stores 1,109 1,092 17

Franchise stores 166 157 9 Total Beauty System

Group 1,275 1,249 26 Total 4,880 4,693

187 BSG distributor sales consultants (end of

period) (1) 967 992 (25 )

2014 2013 First quarter

company-operated same store sales growth (2)

Basis Pt

Chg Sally Beauty Supply 1.6 % 0.9 % 70 Beauty Systems

Group 3.9 % 5.2 % (130 ) Consolidated 2.3 % 2.2 % 10 (1)

Includes 333 and 324 distributor sales consultants as reported by

our franchisees at December 31, 2014 and 2013, respectively.

(2) For the purpose of calculating our same store sales metrics, we

compare the current period sales for stores open for 14 months or

longer as of the last day of a month with the sales for these

stores for the comparable period in the prior fiscal year. Our same

store sales are calculated in constant U.S. dollars and include

internet-based sales (which are not separately material for each of

the periods reported herein) and the effect of store expansions, if

applicable, but do not generally include the sales of stores

relocated until 14 months after the relocation. The sales of stores

acquired are excluded from our same store sales calculation until

14 months after the acquisition. Supplemental

Schedule F

SALLY BEAUTY HOLDINGS, INC. AND

SUBSIDIARIES Selected Financial Data and Debt (In thousands)

(Unaudited) As of December 31, As of September 30, 2014 2014

Financial condition information (at period end): Working capital $

753,753 $ 640,612 Cash and cash equivalents 190,681 106,575

Property and equipment, net 236,678 238,111 Total assets 2,097,034

2,029,973 Total debt, including capital leases 1,810,992 1,811,641

Total stockholders' (deficit) equity ($255,556 ) ($347,053 )

As of December 31,

2014 Interest Rates Debt position excluding capital leases:

Revolving ABL facility $ -

(i) Prime + 0.50-0.75% or(ii) LIBOR +

1.50-1.75%

Senior notes due 2019 750,000 6.875 % Senior notes due 2022 (1)

857,213 5.750 % Senior notes due 2023 200,000 5.500 % Other (2)

51 5.790 % Total debt, excluding capital leases $

1,807,264

Debt maturities, excluding capital leases: Twelve months

ending December 31, 2015 $ 51 2016-2018 - 2019 750,000 Thereafter

(1) 1,057,213 Total debt, excluding capital leases $

1,807,264 (1) Amount includes unamortized premium of

$7.2 million related to notes in the aggregate principal amount of

$150.0 million. The 5.75% interest rate relates to notes in the

aggregate principal amount of $850.0 million. (2) Represents

pre-acquisition debt of businesses acquired.

Sally Beauty Holdings, Inc.Karen Fugate, 940-297-3877Investor

Relations

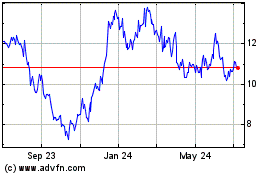

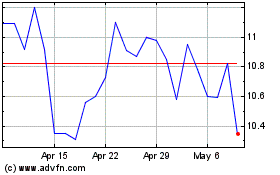

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024