Santander Profit Beats Forecasts

October 26 2016 - 1:43AM

Dow Jones News

By Jeannette Neumann

MADRID-- Banco Santander SA said Wednesday that net profit rose

in the third quarter from a year earlier as the bank confronts

turmoil in the British pound but a brightening outlook for Brazil's

economy and currency.

Santander, one of Europe's largest lenders, said net profit was

EUR1.70 billion ($1.85 billion) in the third quarter of this year

compared with EUR1.68 billion reported a year earlier.

Analysts had anticipated that slightly lower lending income and

weaker returns from its bond portfolio would lead Santander to

report a net profit of EUR1.55 billion in the third quarter,

according to a poll by data provider FactSet.

In the U.K., where Santander generates around one-fifth of its

net profit, investors' concerns about the impact of Britain's exit

from the European Union has battered the British pound, chipping

away at Santander's earnings when reported in euros. In Brazil, on

the other hand, where Santander also generates around one-fifth of

its net profit, the economy is starting to show signs of recovery

from a devastating downturn.

The Spanish lender, run by Executive Chairwoman Ana Botín, said

net interest income in the third quarter was EUR7.80 billion

compared with EUR7.98 billion a year earlier.

Net interest income, a key profit driver for retail banks, is

the difference between what lenders earn from loans and pay for

deposits. Analysts had anticipated net interest income of EUR7.72

billion, according to FactSet.

Santander's third-quarter results come less than a month after

bank executives presented investors with a profitability outlook

that was more downbeat than previous projections, but more in line

with analysts' expectations for the lender.

Santander lowered the target for its return on tangible equity,

a measure of profitability, to above 11% by 2018 from a previous

target of around 13% because of scaled-back expectations in Britain

and Spain.

The bank also raised the target range for its cost-to-income

ratio--a key measure of efficiency--to 45%-47% by 2018. The bank

had said last year it aimed for a cost-to-income ratio of below

45%. The lower the figure the better.

Santander executives pledged to increase the bank's dividend per

share and earnings per share during the next three years.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

October 26, 2016 01:28 ET (05:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

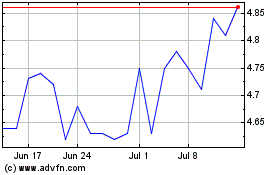

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

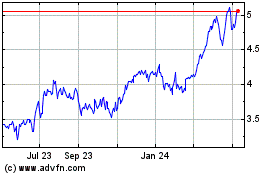

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024