FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of October, 2016

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

¨

No

x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes

¨

No

x

Banco Santander, S.A.

TABLE OF CONTENTS

Item 1

|

|

|

|

|

|

|

|

|

|

|

|

|

Banco Santander reaffirms its key

shareholder targets for 2018

Bank confirms plans to increase

Earnings Per Share (EPS) in 2016 and 2017, reaching double digits by 2018, and grow Dividend Per Share (DPS) and Tangible Net Asset Value (TNAV) Per Share every year

London, September 30th, 2016. Banco Santander confirmed today that it is on track to deliver the financial targets it set in last

year’s Strategic Plan 2016-2018, despite an increasingly challenging macroeconomic environment.

Speaking in London with analysts and investors at the Banco Santander Group Strategy Update 2016, Ana Botin, Group Executive Chairman,

said: “We have a clear and consistent strategy that is helping us earn the loyalty of customers across our 10 core markets. Our business model is continuing to generate predictable and sustainable returns and we are delivering on our financial

and commercial commitments, despite the challenging environment.”

Over the last year, macroeconomic expectations have deteriorated in some of the markets in which the Group operates, particularly in the

U.K. This has led to a depreciation of many currencies against the Euro and an expectation that interest rates will remain at record low levels for longer than expected. Moreover, regulatory uncertainty will continue in the coming years and tax

pressure is also increasing in some of Banco Santander’s core countries.

Despite this context, Santander confirmed today that it is maintaining the key 2018 targets within its 2016-2018 Strategic Plan, including

the commitment to increase dividend per share (DPS) and earnings per share (EPS) every year in the next three years.

Santander also confirmed today that it will deliver against its target to increase the number of loyal customers to 18.5 million by 2018.

Furthermore, the Bank aims is to increase the number of digitally active customers from 15 million in 2015 to 30 million in 2018.

In the last twelve months the number of loyal customers increased by 10% to 14.4 million, while digitally active customers increased by 23%

to 19.1 million. Moreover, the average market share in SMEs and Corporates across the Bank increased by almost a half percentage point.

José Antonio Álvarez, Group Chief Executive Officer, said: “While the environment in some of our markets has

deteriorated, our strategy and business model continues to deliver for our customers and shareholders. Our geographic diversification with strong market presence and best-in-class efficiency offers a clear competitive advantage that will allow us to

benefit further as the economic environment improves.”

|

Item 2

Ana Botín Group Executive Chairman Opening Presentation

Banco Santander, S.A. (“Santander”), Santander UK Group Holdings (“Santander UK”) and Banco Santander (Brasil) S.A. (“Santander Brasil”) all caution that this

presentation and other written or oral statements made from time to time by Santander, Santander UK and Santander Brasil contain forward-looking statements. These forward-looking statements are found in various places throughout this presentation

and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a

number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) general market, macro-economic, governmental,

political and regulatory trends; (2) movements in local and international securities markets, currency exchange rates and interest rates; (3) competitive pressures; (4) technological developments; (5) transaction, commercial and

operating factors; and (6) changes in the financial position or credit worthiness of our customers, obligors and counterparties. The risk factors that we have indicated in our past and future filings and reports, including those with the

Securities and Exchange Commission of the United States of America (the “SEC”) could adversely affect our business and financial performance and should be considered in evaluating any forward-looking statements contained herein. Other

unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak only as of the date on which they are made and are based on the knowledge, information

available and views taken on the date on which they are made; such knowledge, information and views may change at any time. These statements are only predictions and are not guarantees of future performance, results, actions or events. Santander,

Santander UK and Santander Brasil do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. The information contained in this presentation is subject to,

and must be read in conjunction with, all other publicly available information, including, where relevant, any fuller disclosure document published by Santander, Santander UK nor Santander Brasil. Any person at any time acquiring securities must do

so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice

as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in the presentation. In making this presentation available, Santander, Santander UK and Santander Brasil are not giving advice nor making

any recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of

an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is

intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Note: Statements as to historical performance, share

price or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior year. Nothing in this presentation should

be construed as a profit forecast. Note: The businesses included in each of our geographical segments and the accounting principles under which their results are presented here may differ from the businesses included in our public subsidiaries in

such geographies and the accounting principles applied locally. Accordingly, the results of operations and trends shown for our geographical segments may differ materially from those disclosed locally by such subsidiaries. Helping people and

businesses prosper 2

Content 1 Our delivery since the last Investor Day 2 Update on our commercial transformation 3 Looking forward and key takeaways Helping people and businesses prosper 3

|

1

|

|

Our delivery since the last Investor Day Helping people and businesses prosper 4

|

‘Helping people and Clear purpose businesses prosper’ Predictability of earnings through the cycle Strategic focus Simple, on people, Customer Digital Sustainable and Personal,

culture and loyalty excellence high RoTE to Fair customers enable us to capture the growth opportunity Geographic Clear focus Unique and Balance diversification on retail and Best-in-class Grow cash strong sheet with critical commercial efficiency

DPS foundations quality mass banking Helping people and businesses prosper 5

In our last Investor Day we shared our strategy and strategic priorities 1 People 2 Customers Earn the loyalty of our retail A strong internal culture: and corporate customers: Simple |

Personal | Fair improve our franchise The best bank to Operational and work for digital excellence To be the best retail and commercial bank, earning 4 ommunities the lasting loyalty of our… 3 areholders Reinforced capital Santander and risk

Universities management Support people in our local EPS, DPS and RoTE growth communities Helping people and businesses prosper 6

In a context significantly worse than the one expected Old Scenario during last year’s Investor Day… New Scenario Lower interest rates Low and lower than expected GDP growth

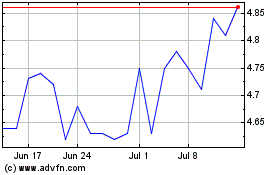

Euribor Yield Curve GDP Growth (Average of Santander Countries), % 0.2% 2.4 2.1 2.0 0.0% 1.5 -0.2% -0.4% 1W 1M 2M 3M 6M 9M 1Y 2015 2016 UK EU referendum Higher regulatory and tax pressure GBP / EUR Expected effective tax charge for 2016 as % of PBT

-17% 1.40 1.17 c.35% c.35% c.28% c.20% Aug-15 Aug-16 Source: Bloomberg Helping people and businesses prosper 7

…Santander is delivering strong financial and operating performance… 1H’16 vs. 1H’15 Total revenues +3.6% Total fees +6.6%1 Cost of risk -13bps Underlying profit +8.9%

Underlying RoTE2 11.1% ? Note: Currency neutral (1) +7.7% including perimeter: PSA and Banco Internacional do Funchal (2) 1H’16 figure Helping people and businesses prosper 8

…as it delivers for its people and communities, making progress on Cultural Change A strong internal culture Simple | Personal | Fair Supporting people in our local communities

Simple, More than 3/4 of our employees Personal & 6th position and 1st European Bank3 support the new culture1 Fair culture Supporting 1,195 universities supported and >7 pp vs. average of financial Employment 1 access to 31k students

awarded services employees Commitment education scholarships Leadership, +22 pp improvement in work-life 900k people supported talent & 1 balance in local communities2 performance (1) Internal survey 2015 to which 150,000+ Santander

employees responded. Work-life balance improvement is compared versus 2014. Employee commitment measured versus financial services standard. 2016 Global Engagement Survey in progress (2) In 1H’16 (3) Among the 198 banks included in

the Dow Jones Sustainability Indexes Helping people and businesses prosper 9

On track towards last year’s Investor Day commitments for 2016 at Group level… 1H’16 2016 (change vs. 1H’15) ID Commitment Loyal retail and commercial 14.4 15.0

customers (MM) (+10%) Average SME and Corp. +49bps +50bps market share growth (vs. 1H’15) 19.1 Digital customers (MM) 20.0 (+23%) 1.19 Cost of risk (%) Improving (-13bps) Helping people and businesses prosper 10

…and at country level 2016 1H’16 ID Commitment 1I2I3 customers 1.24 2.0 (MM) SMEs loan growth vs. market >5 >5 (Jaws, pp) Loyal SME and Corporates +4% +27% (% change vs.

1H’15) NPL ratio1 3.2% ~peers Digital customers 695 725 (k) Loan portfolio CAGR2 +20% +15% (% growth vs. 2014) (1) BR GAAP (2) All SCF countries (excluding SC UK). 1H’16 corresponds to 2015 FY figures Helping people and

businesses prosper 11

Our business model allows us to fund profitable growth, increase cash dividend per share and accumulate capital RoTE 1H’161 (%) (1H’16 vs. 1H’15) 14 +10% +4% cash DPS2

customer loans3 12 11 Increase Fund business 11 cash dividends c. 1/3 c. 1/3 growth 11 per share 10 9 Top tier profitability 9 allows us to… 8 8 8 c. 1/3 7 7 6 Accumulate capital 5 +53bps FL CET1 (1) Source: Based on public company

data—Bloomberg. Santander Underlying. RoTCE for US Banks (2) 1st interim dividend charged to 2015-16 earnings (3) Currency neutral Helping people and businesses prosper 12

Predictable and growing earnings through the cycle Santander has the lowest volatility in earnings among peers… Average volatility of quarterly reported EPS (%), 1999-1H’161 734

136 123 95 Profitability 80 68 49 47 has proven strong 45 25 10 and stable over time Best …with growing profits Statutory profit growth, CAGR (%), 1998 vs. 2015 +7 <0 +4 +11 +11 +13 +10 +7 +2 +16 +10 Source: Bloomberg Note: GAAP criteria

(1) The analysis takes the quarterly EPS to 1H’16, starting from the first available data since Jan’99 Helping people and businesses prosper 13

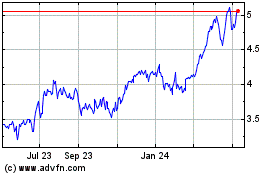

Growing shareholder’s value Tangible net asset value per share Euros per share 4.13 4.07 4.01 2014 2015 2Q’16 Helping people and businesses prosper 14

|

2

|

|

Update on our commercial transformation Helping people and businesses prosper 15

|

Our model has unique competitive advantages as it combines: Critical mass in retail+commercial Relevant exposure to markets banking in 9+1 with high interest rates countries Net Interest

Income, % of total1 Low rates markets 2% 121 million customer 6%2 relationships High rates 24% 10% markets 15% 8% Geographical 6% diversification 11% 3%3% SCF 13% Other Latam High margin in low SC USA rate markets (1) Does not include

Corporate Centre (2) USA ex- SC USA Helping people and businesses prosper 16

Customer relationships at scale is our core differentiator We are the bank with the highest number …delivering scale in each of them of top franchises in the world… Top 5 banks

in top 50 markets Average # of customers per country (MM) 8 9.3 6 5.5 6 0.9 4 0.8 4 1.3 3 0.8 3 3.9 3 2.5 2 7.5 2 3.4 Source: McKinsey & Company (citing annual reports, SNL, McKinsey CEE Banking database, Central Banks of Brazil, Spain and

Portugal. Average # of customers per country includes only countries where the Bank has relevant retail banking presence) Helping people and businesses prosper 17

Progress in our commercial transformation 1 Commercial and digital transformation around the customer 2 Op. Excellence: best-in-class customer service and cost-to-income 3 Deliver organic

capital generation whilst funding growth Helping people and businesses prosper 18

1 Transforming our commercial model around the customer Examples Loyal customers Total Group (MM) Spain Annual growth of loyal SMEs customers +1.3MM 3% 26% 18.5 Before After 14.4 13.1

Mexico +540k customers per year 1H’15 1H’16 2018 Helping people and businesses prosper 19

1 Developing digital relationships with our customers Digital customers1 1 out of 3 accounts 30MM opened in digital channels One 1|2|3 2016 target: account opened 20MM every minute on

19.1MM digital channels2 Mobile cash loan in 60 15.5MM seconds 1H’15 1H’16 2018 (1) Person or legal entity, that being a customer of a commercial bank, has logged into his personal area of internet banking, mobile banking or both in

the last 30 days (2) Applicable to Santander existing customers, opened every weekday minute on digital channels Helping people and businesses prosper 20

1 Unlocking organic profitable growth potential in our core markets through customer loyalty Retail loyal customers / Active customers (%) Fees / costs (average) c.50% 20% c. of Group

>40% underlying profit1 Leading 55% franchises >40% Total population: c.40% 110MM +7pp >25% c.80% of Group >20% 1 High upside underlying profit 20% 48% potential Total population2: >15% 525MM >15% 30% (1) Excluding Corporate

Centre, Spain Real State activities, SCF and GCB (2) USA includes only population of the Northeast and Florida Data as of 2015 Helping people and businesses prosper 21

1 Progress in our transformation: customer loyalty drives growth in revenues/fees 2.5 +9% Fee income1 2.3 (Bn EUR) 14.4 13.1 +10% Loyal customers (MM) 2Q’15 2Q’16

(1) Currency neutral Helping people and businesses prosper 22

1 Benefits to be reaped in fee income through our commercial transformation Fees/Assets SAN vs. peer average (%) +10bps c.0bps Opportunity -10bps • €1.3 bn p.a. reaching

peer average • >€5 bn p.a. reaching best-in-class -50bps Data as of 2015. Opportunity estimated for all countries of the Group Helping people and businesses prosper 23

2 Operational excellence means better cost efficiency… Best-in-class C/I: Top 2 among peers1 -16% Corporate Centre opex in 2016 Cost to income (%) Corporate Centre attributable

loss / Underlying attributable profit (%) 90 Eurozone 80 peer 70 average2 Global peer average 60 37 -14pp 29 50 22 40 30 20 10 0 1H’15 1H’16 (1) Source: Based on public company data—Bloomberg. (2) Societe Generale,

BBVA, BNP, Intesa, Unicredit, Credit Agricole Helping people and businesses prosper 24

2 …and improvement in customer experience leveraging technologies Geographies within Top 3 Digital process for customer satisfaction1 mortgage business 1 Time to complete 2

application reduced Online “3-click” from up to 3 hours to 6 <40 min (-75%) loan application: +4 93% of process is paper less = 200k 8 Biometrics 7 hours less required Faster and more secure by our sales force 3 Mexico: used by c.30% of

active customers Brazil: +4MM customers 1H’15 1H’16 2018 in 10 months Not in Top 3 Top 3 (1) Source: Corporate Customer Satisfaction Benchmark Helping people and businesses prosper 25

3 Recurrent and sustainable pre-provision profit while containing cost of risk… 3.3 3.3 3.3 3.0 3.1 3.0 2.9 2.9 2.8 PPP1 / loans (%) 2.4 1.7 1.7 1.4 1.4 1.4 1.3 1.2 1.0 Cost of

risk (%) 2008 2009 2010 2011 2012 2013 2014 2015 1H’16 (1) PPP: pre-provision profit Helping people and businesses prosper 26

3 …allows to fund profitable growth, increase cash dividend per share and accumulate capital organically FL CET1 (%) ? Committed to accumulate organically +53 bps >11 10bps

CET1 on average per quarter 10.36 9.83 ? RWA growth below profit and lending growth ? Plans to better manage regulatory capital at a bottom-up basis ? Capital and M&A discipline across the Group 1H’15 1H’16 2018 Helping people and

businesses prosper 27

|

3

|

|

Looking forward and key takeaways Helping people and businesses prosper 28

|

On track to meet all of our 2016/17 commitments 2016/17 2015 1H’2016 commitments Loyal customers (MM) 13.8 14.4 15 / 17 Digital customers (MM) 16.6 19.1 20 / 25 Fee income1 3.0% 6.6%

Increase Cost of risk 1.25% 1.19% Improve Cost to income 47.6% 47.9% Stable EPS (€) 0.40 0.19 (1st half) Increase DPS2 (€) 0.050 0.055 Increase TNAV / share (€) 4.07 4.13 Increase FL CET1 10.05% 10.36% +40bps per year

(1) Currency neutral YoY growth. As of 1H’16: +7.7% including perimeter: PSA and Banco Internacional do Funchal (2) 1st interim dividend charged to 2015-16 earnings Helping people and businesses prosper 29

Reaffirming our key shareholder metrics, increasing EPS in 16/17, reaching double digit by 2018, and growing DPS and TNAV per share ? Top 3 bank to work for in the majority of ? 17MM

retail Loyal Customers our geographies ? 1.6MM loyal SMEs and Corporates ? Customer loans growth above peers ? All geographies top 3 in customer service* ? 30MM digital customers (x2) People Customers ? c.10% CAGR of fee income 2015-18 “To be

the best retail and commercial bank, earning the lasting loyalty of our people, ? People supported in our customers, shareholders ? Cost to income ratio 45-47% communities: 4.5MM and communities” ? 2015-18 average cost of risk 1.2% 2016-18

Communities Shareholders 11% ? FL CET1 > ? c.130k scholarships 2016-18 ? Increasing EPS, reaching double digit growth by 2018 ? 30-40% cash dividend pay-out: Yearly DPS increase ? RoTE >11% * Except for the US – approaching peers Helping

people and businesses prosper 30

Our commercial transformation will increase profitability as improved customer experience drive loyal and digital customer growth Our team, and a culture of doing things in a way that is

Simple, Personal and Fair are the cornerstone of our strategy Our model offers best-in-class predictability of results through the cycle as well as leading efficiency and RoTE The strength of our balance sheet and returns allow us to fund our

growth, pay growing cash DPS and accumulate capital We are on plan to deliver our 2016-18 commitments Helping people and businesses prosper 31

Simple Personal Fair

Item 3

José Antonio Álvarez Group Chief Executive Officer

Banco Santander, S.A. (“Santander”), Santander UK Group Holdings (“Santander UK”) and Banco Santander (Brasil) S.A. (“Santander Brasil”) all caution that this

presentation and other written or oral statements made from time to time by Santander, Santander UK and Santander Brasil contain forward-looking statements. These forward-looking statements are found in various places throughout this presentation

and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a

number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) general market, macro-economic, governmental,

political and regulatory trends; (2) movements in local and international securities markets, currency exchange rates and interest rates; (3) competitive pressures; (4) technological developments; (5) transaction, commercial and

operating factors; and (6) changes in the financial position or credit worthiness of our customers, obligors and counterparties. The risk factors that we have indicated in our past and future filings and reports, including those with the

Securities and Exchange Commission of the United States of America (the “SEC”) could adversely affect our business and financial performance and should be considered in evaluating any forward-looking statements contained herein. Other

unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak only as of the date on which they are made and are based on the knowledge, information

available and views taken on the date on which they are made; such knowledge, information and views may change at any time. These statements are only predictions and are not guarantees of future performance, results, actions or events. Santander,

Santander UK and Santander Brasil do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. The information contained in this presentation is subject to,

and must be read in conjunction with, all other publicly available information, including, where relevant, any fuller disclosure document published by Santander, Santander UK nor Santander Brasil. Any person at any time acquiring securities must do

so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice

as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in the presentation. In making this presentation available, Santander, Santander UK and Santander Brasil are not giving advice nor making

any recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of

an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is

intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Note: Statements as to historical performance, share

price or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior year. Nothing in this presentation should

be construed as a profit forecast. Note: The businesses included in each of our geographical segments and the accounting principles under which their results are presented here may differ from the businesses included in our public subsidiaries in

such geographies and the accounting principles applied locally. Accordingly, the results of operations and trends shown for our geographical segments may differ materially from those disclosed locally by such subsidiaries. Helping people and

businesses prosper 1

Content 1 Delivering in a challenging environment 2 Focus on execution: placing customers at the centre of our model 3 Key priorities in our main markets: a profitable growth story 4

Looking forward and key takeaways Helping people and businesses prosper 2

|

1

|

|

Delivering in a challenging environment Helping people and businesses prosper 3

|

We are on plan to deliver our 2016 commitments… 2016 2015 1H’2016 commitments Fee income1 3.0% 6.6% 2 Increase Cost to income ratio 47.6% 47.9% Stable Cost of risk 1.25% 1.19%

Improve Underlying RoTE 11.0% 11.1% Improve TNAV / share (€) 4.07 4.13 Increase Cash dividend / share (€cents) 15.8 17.2 3 Increase FL CET1 10.05% 10.36% 10.45% (1) Currency neutral(2) +7.7% including perimeter: PSA and Banco

Internacional do Funchal(3) 2016(e), assuming an acceptance percentage of the scrip dividend equal to that in 2015 Helping people and businesses prosper 4

…within a sector facing 3 challenges • A low-economic growth Structurally higher Mature markets 1 profitability • Low and flat yield curve profitability headwinds in

Emerging Markets • New regulatory environment • More demanding customers… Need to redefine • .who require a better service at a lower cost 2 customer relationships • The industry needs to place the customer at the centre of

the business model • Banking disintermediation 3 New entrants • Shadow banking • Digital players Helping people and businesses prosper 5

1 Profitability headwinds in mature markets while structural higher profitability in emerging markets Mature markets Emerging markets • Lower nominal growth • Cyclical adjustment

(mostly) completed • Lower interest rates for longer Revenues • Stable political / regulatory environment • Asset pricing pressure • Structural growth remains intact • Lower credit demand • Higher regulatory /

compliance costs • Nominal growth but maintaining positive Costs • Tax increases jaws • Digital transformation needs investments Capital • Upwards pressure due to regulation • High capital levels required to finance growth

RoTE RoTE below cost of capital 15-20% (European banks) with sustainable high growth “g” Helping people and businesses prosper 6

2 Need to redesign customer’s relationships: a commercial transformation is required Anytime Open and Anywhere Multichannel Trust receptive access in their bank Anyhow What do our

customers want? One customer, Operational one value proposition Adapted Greater service, excellence proposals lower cost Customer’s experience & loyalty become a must Helping people and businesses prosper 7

3 New entrants compete in less capital intensive segments Financial competitors Technology competitors P2P lending Payment platforms New entrants attack Shadow banking segments where

digitalisation improves Mobile payments customer services or Capital markets / eliminates pricing disintermediation FX direct platforms inefficiencies Supply chain finance… Helping people and businesses prosper 8

Santander’s strategy tackles these 3 sector’s challenges Challenges Executing our strategy Outcome • Commercial transformation Mature markets Revenues • Operational

excellence 1 profitability • Capital optimisation RoTE headwinds Costs • Digitalisation • Commercial transformation Need to redesign More loyal and digital customers 2 customer • Operational excellence relationships Customer

experience • Processes re-engineering • Commercial transformation Entry barrier 3 New entrants • Digitalisation Value for money service Helping people and businesses prosper 9

|

2

|

|

Focus on execution: placing customers at the centre of our model Helping people and businesses prosper 10

|

Clear strategy, focused on execution 3 C A Commercial transformation to Revenues improve revenue growth Core to our customer Digitalisation oriented strategy to outperform in B Reduce the

“twin” costs of doing revenues and costs Costs business: expenses and risk management D Investing capital more selectively into Capital higher RoRWA business Improve RoTE Helping people and businesses prosper 11

A Revenues: commercial transformation to improve revenue growth More customers and + More digital + Improved customer + Focus on highly more loyal customers experience profitable segments

Increase fee Gain profitable business market share Revenues ROTE Helping people and businesses prosper 12

A Revenues: loyal customers growth consistent with our commercial transformation Since the launch1 On track to meet our targets Spain Loyal customers (MM) 100k SME customers 1.1MM retail

customers 10% 18.5 17.0 Brazil 14.4 15.0 13.1 650k new accounts Mexico 174k credit cards in only 4 months Portugal 130k customers 1H’15 1H’16 16(e) 17(e) 18(e) (1) Spain: 1I2I3 current account from May’15 to Jun’16, 1I2I3

SME from Nov’15 to Jun’16. Brazil: ContaSuper from 2012 to Aug’16. Mexico: Aeromexico from Feb’16 to Aug’16. Portugal: Mundo1I2I3 from Mar’15 to Aug’16 Helping people and businesses prosper 13

A Revenues: strong growth of digital banking customers On track to meet our targets Since the launch1 Digital customers (MM) NeoClick – loans in 3 clicks 23% 30.0 +40k loans, $200MM

25.0 19.1 20.0 15.5 Biometric authentication +4MM customers, 8MM by year end 1H’15 1H’16 2016(e) 2017(e) 2018(e) Digital bank awards % digital customers / total active customers +7pp Best digital bank in Argentina 50% 41% (Global Finance

magazine) 35% 36% 28% Banking app ranking 3rd best European banking app 1H’15 1H’16 2016(e) 2017(e) 2018(e) (Forrester research) (1) Chile: NeoClick from Apr’16 to Aug’16. Brazil: Biometric authentication from Jan’16 to

Aug’16 Helping people and businesses prosper 14

A Revenues: continuous improvement on customer experience Evolution in customer satisfaction rankings1 1st 3rd 4th 3rd 3rd 2nd 3rd 2nd 8th +1 +1 +2 +1 +2 -2 -1 +1 2018 target: all

geographies Top 3 in customer service2 (1) Corporate customer satisfaction benchmark. 1H’16 vs. 1H’15 (2) Except for the US – approaching peers Helping people and businesses prosper 15

A Revenues: our commercial transformation delivers fee business growth and profitable market share gains Our recurrence ratio (fees/costs) is improving 1H’16 vs. 1H’15

International business 2018 Target: Covering >50% of our operating Revenues +13% cost with fee income >50% Insurance 47.6% Premiums (open market) +10% 46.5% Cards Volumes (turnover) +11% 2015 1H’16 2018(e) Helping people and businesses

prosper 16

B Costs: reducing the ‘twin’ costs of doing business Targets • All geographies top 3 in customer service1 OPERATING COSTS • Customer loyalty 1 • Cost to income

ratio: 45-47% in 2018 Operational excellence • Flat costs in real terms • Leading Cost-to-income in the industry + COST OF RISK • Reducing CoR • 2015-2018 average cost of risk 1.2% 2 Excellence in risk management across the cycle

= Higher profitability (1) Except for the US – approaching peers. Helping people and businesses prosper 17

B Costs: committed to deliver flat cost growth in real terms One the most efficient international banks Initiatives to capture savings +14pp 62% HQ Re-sizing and optimisation Mid-single

48% digit cost Re-sizing (c.450 branches) and reduction optimisation Global peer average1 Fit-to-Grow program Our principles Headquarters optimisation • Cost-growth below / around inflation Footprint optimisation and digital transformation

• Positive jaws • IT investments financed by BAU savings Organisational and IT optimisation • Simplification of corporate centres Post merger integration (BANIF) • Branch network optimisation Process reengineering 2018 target =

C/I 45-47% Santander to continue to lead on efficiency (1) BBVA, BNP Paribas, HSBC, Intesa Sanpaolo, Lloyds, Société Générale, UBS, UniCredit, Barclays, Bank of America, Wells Fargo, Citi, JP Morgan, Itau and ING.

Source: Company data – Bloomberg Helping people and businesses prosper 18

B Costs: reducing the cost of risk across the cycle Comfortable asset quality trends… …and outperforming local peers1 1H’16 c.3% Peers 5.6% 5.2% 6.1% vs. 8.0% 4.5% 4.6% 4.4%

4.3% NPL 3.9% 1.5% vs. 2.1% 1.2% 2.4% Peers 1.6% 1.7% 1.4% Cost 1.3% 1.3% 1.2% of 3.4% vs. 5.1% risk 0.5% vs. 1.1% ‘11 ‘12 ‘13 ‘14 jun’15 ‘15 jun’16 ‘16(e) ‘17(e) ‘18(e) Avg. 2015-18 Note: Local

criteria (1) Spain: BBVA España, Popular, CaixaBank, Bankinter, Bankia and Sabadell; UK: Barclays, RBS, LBG, Nationwide and HSBC Bank plc; Brazil: Large private banks; SCF: Credit Agricole and BNP Helping people and businesses prosper 19

C Digitalisation creates a ‘virtuous circle’ on P&L dynamics 1H’16 vs. 1H’15 “Atendimento Digital” Service / Digitalisation Expense Cost of risk revenues

+20% savings savings loyal customers, +30% gross improvement margin and -25% service costs …of front “NeoClick” 93% of process is paper less = …of big data 200K sales force hours “Customer service centre”…of

processes -35% branch transactions and +20% sales …of architecture “Buy-by-click” (cloud) digital granting process 100% .of software “Risk data aggregation” development Big data infrastructure: -25% cost reduction Helping

people and businesses prosper 20

D Capital: A disciplined approach to use our capital …to allow us to accumulate capital after Our golden rules… growing cash DPS and the business Currency neutral. 1H’16 vs.

1H’15 FL CET1 (%) Loan growth > RWA growth 4% > 1% +53 bps >11 10.36 Profit growth > RWA growth 9.83 9% > 1% Capital selectively allocated into higher RoRWAs businesses Dec’15 Jun’16 RoRWA1 1.30% vs. 1.35%

1H’15 1H’16 2018(e) (1) Underlying consolidated profit / average risk-weighted assets Helping people and businesses prosper 21

Our strategy, business model and execution allow us to fund profitable growth, increase cash dividend per share and accumulate capital RoTE 1H’161 (%) (1H’16 vs. 1H’15)

14 +10% +4% cash DPS2 customer loans3 12 11 Increase Fund business 11 cash dividends c. 1/3 c. 1/3 growth 11 per share 10 9 Top tier profitability 9 allows us to… 8 8 8 c. 1/3 7 7 6 Accumulate capital 5 +53bps FL CET1 (1) Source:

Based on public company data—Bloomberg. Santander Underlying. RoTCE for US Banks(2) 1st interim dividend charged to 2015-16 earnings(3) Currency neutral Helping people and businesses prosper 22

|

3

|

|

Key priorities in our main markets: a profitable growth story Helping people and businesses prosper 23

|

As mature markets profitability headwinds remain, long-term presence in Latam is a strong competitive advantage Latam Europe & US Yield curves Steeper and higher Low / negative

Low levels of banking c.40% c.95% penetration Low leverage <100% >200% Debt/ GDP Credit demand Sustainable high Low single-digit (2015-2020) double-digit growth growth Nominal GDP growth +6-8% +2-3% (2015-2020) Growing population +2% +0.5%

(2015-2020) Middle class -4% +73% (2009-2030) Source: Eurostat, U.S. Census, Cepal, The Economist Intelligence Unit and IMF Helping people and businesses prosper 24

Two differentiated markets and approaches to sustain profits and dividends growth Underlying attributable profit (1H’16) Rest of Latam 1% Emerging markets: 6% 4% 15% Mature

markets: Growth Capital-generating 7% 5% Focus on maintaining Focus on recovering high growth and 19% 13% profitability profitability 1% 3% 6% 20% Helping people and businesses prosper 25

Spain and UK Key priorities Key priorities • Recovery of profitability to c.13% • We maintain our strategy • Loyal and digital customer growth and • Only scale

challenger in the UK market share gains • Customer loyalty and market share • Focus on fee businesses growth • Operational excellence improvements • Cost management remains a priority • Enhanced focus on risk management and

protecting current RoTE Helping people and businesses prosper 26

Brazil and Mexico Key priorities Key priorities • Focus on revenue growth: improving • Grow our franchise to become #2 / #3 risk adjusted margins and fee business operator in

most segments • Increasing market share: acquiring • Improve retail customers franchise (GetNet), consumer, SMEs… while maintaining our strengths • Digital transformation • Infrastructure and digitalisation • Continued

improvement in risk • Improve RoTE to c.17% management and collections Helping people and businesses prosper 27

SCF and US Key priorities Key priorities • Maintain high profitability and continue • Enhance elements to meet regulatory to gain market share requirements • Expand

agreements with pan-European • Improve customer experience and gain retailers brand awareness • Digitalise the business model • Maintain leadership in Auto Finance • Continue to be a mostly self-funded • Recover

profitability: above CoE for operation SBNA and maintain high levels at SC USA Helping people and businesses prosper 28

Portugal and Poland Key priorities Key priorities • Leading RoTE and top RoRWA • Maintain RoTE leadership • Focus on profitable market share gains • Achieve above

market growth in (corporates / SMEs) volumes and profits while growing our loyal customer base • Improve in customer loyalty and cost efficiency • Continue digitalisation • Active asset quality management: • Monitoring regulatory

cost and its reducing NPL ratio to below 6% impact on cost of risk Helping people and businesses prosper 29

Chile and Argentina Key priorities Key priorities • Keep high profitability, efficiency and • Establish Santander as the market capital discipline leader in a normalising economy

• Maintain market leadership / continue to • Focus on revenue / market share grow market share profitably growth • Work on productivity gains to achieve • Maintain RoTE in a falling CoE consistently positive jaws environment

• At least top 3 in customer experience Helping people and businesses prosper 30

|

4

|

|

Looking forward and key takeaways Helping people and businesses prosper 31

|

‘Helping people and Clear purpose businesses prosper’ Predictability of earnings through the cycle Strategic focus Simple, on people, Customer Digital Sustainable and Personal,

culture and loyalty excellence high RoTE to Fair customers enable us to capture the growth opportunity Geographic Clear focus Unique and Balance diversification on retail and Best-in-class Grow cash strong sheet with critical commercial efficiency

DPS foundations quality mass banking Helping people and businesses prosper 32

Santander is well placed to overcome current sector challenges due to its unique business model and commercial transformation and to continue to deliver profitable organic growth Strong

increase on loyal and digital banking customers while delivering operational excellence in a less capital intensive growth model As we work to progressively improve mature markets profitability despite current headwinds, long-term presence in LatAm

is a strong competitive advantage to offer quality and predictable shareholder value creation Helping people and businesses prosper 33

Simple Personal Fair

Item 4

Item 4

Nathan Bostock Country Head UK

Banco Santander, S.A. (“Santander”), Santander UK Group Holdings (“SantanderUK”) and Banco Santander (Brasil) S.A. (“SantanderBrasil”) all caution that this

presentation and other written or oral statements made from time to time by Santander, Santander UK and Santander Brasil contain forward-looking statements. These forward-looking statements are found in various places throughout this presentation

and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a

number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) general market, macro-economic, governmental,

political and regulatory trends; (2) movements in local and international securities markets, currency exchange rates and interest rates; (3) competitive pressures; (4) technological developments; (5) transaction, commercial and

operating factors; and (6) changes in the financial position or credit worthiness of our customers, obligors and counterparties. The risk factors that we have indicated in our past and future filings and reports, including those with the

Securities and Exchange Commission of the United States of America (the “SEC”) could adversely affect our business and financial performance and should be considered in evaluating any forward-looking statements contained herein. Other

unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak only as of the date on which they are made and are based on the knowledge, information

available and views taken on the date on which they are made; such knowledge, information and views may change at any time. These statements are only predictions and are not guarantees of future performance, results, actions or events. Santander,

Santander UK and Santander Brasil do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. The information contained in this presentation is subject to,

and must be read in conjunction with, all other publicly available information, including, where relevant, any fuller disclosure document published by Santander, Santander UK nor Santander Brasil. Any person at any time acquiring securities must do

so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice

as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in the presentation. In making this presentation available, Santander, Santander UK and Santander Brasil are not giving advice nor making

any recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of

an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is

intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Note: Statements as to historical performance, share

price or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior year. Nothing in this presentation should

be construed as a profit forecast. Note: The businesses included in each of our geographical segments and the accounting principles under which their results are presented here may differ from the businesses included in our public subsidiaries in

such geographies and the accounting principles applied locally. Accordingly, the results of operations and trends shown for our geographical segments may differ materially from those disclosed locally by such subsidiaries. Helping people and

businesses prosper 2

Content 1 Market and financial system 2 Delivering our 2015-18 strategy 3 Positioned to capture growth opportunities 4 Looking forward and key takeaways Helping people and businesses

prosper 3

|

1

|

|

Market and financial system Helping people and businesses prosper 4

|

The macroeconomic environment has deteriorated in the Old Scenario last 12 months… New Scenario Slower GDP growth Lower for longer interest rates GDP (annual average) Bank Rate (year

end) 2.00 2.4 2.5 1.50 2.3 1.00 2.2 1.6 1.6 0.50 0.25 0.25 0.25 0.7 2015 2016(e) 2017(e) 2018(e) 2015 2016(e) 2017(e) 2018(e) Labour market uncertainty House prices reducing in the short term Unemployment (year end) House Price Inflation (year end)

5.7 5.7 5.3 9.5 5.1 6.1 4.9 3.4 3.9 4.7 4.8 2.4 0.0 2.3 2015 2016(e) 2017(e) 2018(e) 2015 2016(e) 2017(e) 2018(e) Source: HM Treasury Comparison of External Economic Forecasts Aug’16 (unemployment, GDP, HPI) Santander Economic Forecast (Bank

Rate) Helping people and businesses prosper 5

…under a demanding regulatory agenda • PPI timebar and redress • Ring-fencing • FPC powers (e.g. BTL) • Competition (e.g. savings, cards) • Stress testing

• Capital position • Residential mortgage risk • Performance management for challengers weights • Reduction in • Basel proposals (operational countercyclical risk, credit risk, internal models) capital buffer • IFRS 9

(interaction with capital, • Term Funding stress tests) Scheme • Retail Banking Market • Payments access and Investigation infrastructure provision • Bank corporation tax surcharge Helping people and businesses prosper 6

|

2

|

|

Delivering our 2015-18 strategy Helping people and businesses prosper 7

|

Santander UK is uniquely positioned to succeed A full service retail and commercial bank with …successfully challenging the big banks meaningful scale and opportunity… 14MM

active customers 1 – in – 4 switchers are to Santander 4th 10MM current accounts largest Corporate and SMEs lending (%, YoY growth) Ł167 bn customer liabilities Santander Market1 3rd Ł153 bn mortgages largest 10 11 >Ł200

bn customer assets 8 4 1 Omni-channel distribution with leading -2 digital services and complementary 2014 2015 1H’16 optimised footprint Data as of Jun’16 (1) Source: Bank of England Bankstats (Aug’16) Helping people and

businesses prosper 8

Our strategy is clear and unchanged from 12 months ago Our strategic priorities Our To help people and businesses Customer loyalty and market share growth Customers purpose prosper

Operational and digital excellence Predictable and growing profitability and To be the best retail and commercial Shareholders a strong balance sheet Our bank, earning the lasting loyalty of aim our people, customers, shareholders and communities

Strong internal culture: Simple | Personal | Fair People Best employer Our Simple | Personal | Fair Supporting communities through skills, values Communities knowledge and innovation Helping people and businesses prosper 9

Our strategy is delivering for our customers… Retail Corporate and SMEs 1|2|3 World customers (MM) Loyal customers (k) 4.6 4.9 266 279 3.6 239 Dec’14 Dec’15 Jun’16

Dec’14 Dec’15 Jun’16 Retail banking deposits (Ł bn) Total assets (Ł bn) 130 137 141 Primary1 54% 62% 65% 26 28 24 Dec’14 Dec’15 Jun’16 Dec’14 Dec’15 Jun’16 Spread2 (0.76%) (0.63%) (0.59%)

(1) Banking and savings balances of customers with a primary 1|2|3 Current Account or other primary current account (2) Spreads against the relevant swap rate or LIBOR. Retail banking customer deposits include savings and bank accounts for

personal and business banking customers, Jersey and Cater Allen. YTD Helping people and businesses prosper 10

…increasing customer experience and operational efficiency More satisfied customers More efficient operations Retail customer experience (FRS1 %) Increasing digital relationships

(1H’16 vs 1H’15) 64 61 Average of 3 highest • +41% mobile customers 62 performing peers • +29% digital transactions2 54 Dec’12 Dec’13 Dec’14 Dec’15 Jun’16 Corporate customer experience More efficient

distribution (Charterhouse1 %) 58 • c.50% credit cards opened online Market average 52 • >30% bank accounts opened online 56 46 • >40% mortgages retained online Dec’12 Dec’13 Dec’14 Dec’15 Jun’16

(1) Refer to Appendix 1 in the 2Q’16 Quarterly Management Statement for a full definition (2) Digital transactions includes instant transfers and payments made via online, mobile and PayM Helping people and businesses prosper 11

People and communities continue to be key to our success People Communities 48k people 72% supported Colleague 1H’16 engagement1 +5pp +4pp vs. prior vs. GFS 2k year norm2 Students

supported 1H’16 (1) Survey conducted by Hay Group (Oct’15). % favourable responses (2) Global Financial Services norm Helping people and businesses prosper 12

Risk management supports our balance sheet strength and asset quality Non performing loans (ŁMM) (1H’16) Mortgage stock LTV2 44% 4,246 3,887 3,575 3 3,150 3,165 BTL

mortgages 4% CRE exposure4 5% Dec’12 Dec’13 Dec’14 Dec’15 Jun’16 NPL ratio1 2.05% 1.98% 1.79% 1.52% 1.47% (1) Non-performing loans as a percentage of loans and advances to customers (2) Unweighted average LTV

(3) Residential BTL stock as % of total residential mortgage stock (4) CRE as % of total customers loans Helping people and businesses prosper 13

As a result of this strategy and the strength of our balance sheet we deliver predictable and sustainable results Profit before tax (ŁMM) BoE 2015 stress test (CET1 drawdown, bps3)

1,860 1,589 1H 787 959 956 70 FY’14 FY’151 1H’162 210 Total revenues (ŁMM) 290 2,325 2,346 320 330 2,260 2,305 2,205 500 1H’14 2H’14 1H’15 2H’15 1H’16 (1) Excludes Ł450MM charge for PPI recorded

in the corporate centre under Group criteria(2) Excludes Ł119MM gain on sale of VISA Europe Ltd (3) Difference between actual CET1 ratio (Dec’14) and the minimum ratio (period 2015-2019) after applying stress scenario and assuming

strategic management actions (but before AT1 conversion). Peak stress scenario = GDP -3.2% (near-term peak to trough), unemployment 9.2%, inflation -0.9%, HPI -20% (near-term peak to trough), bank rate 0% Helping people and businesses prosper 14

|

3

|

|

Positioned to capture growth opportunities Helping people and businesses prosper 15

|

Our main opportunity is to continue increasing customer loyalty Retail Corporate Loyal customers (% of active) Loyal customers (% of active) x1.7 43 x2.3 35 26 15 UK Group leading UK Group

leading franchises Avg 1 franchises Avg1 • Deeper and more personal relationships • Leading service proposition enabling by meeting and anticipating more of our deeper relationships and driving primacy customer’s needs • 69

Corporate centres (+35 since 2012) • Differentiated proposition adapted to • Simple and efficient credit process each customer • Comprehensive product range and international reach helping UK customers to expand globally

(1) Argentina, Chile, Poland and Portugal Helping people and businesses prosper 16

In retail, 1|2|3 World will continue to transform our franchise Non 1|2|3 CA 1|2|3 CA Deeper 23% loyal1 68% relationships Improved select / 6% 34% customer profiles affluent More valuable

1.5 products 2.1 relationships Improved liquidity average x1.0 x5.5 stability balance More satisfied 64.9% 76.7% customers2 (1) Loyal customers are primary current account customers (credit turnover >= Ł500 per month and at least

two direct debits on the account) who hold an additional product (2) Source: Current Account, GfK FRS 12 months ending Jun’16. Refer to Appendix 1 in the 2Q’16 QMS for a full definition Helping people and businesses prosper 17

In corporate, our ring-fencing plans will support business growth and enhance loyalty Santander UK Group Holdings plc Differentiated “challenger” positioning Specialist,

dedicated and customer-centric corporate bank: Santander UK plc Santander Corporate Bank • Seamless service covering all customer needs • International: global reach and expertise of the Retail, Business Banking and SMEs, Mid/Large

Corporates Santander Group small SMEs and Global customers (Ł173 bn customer loans1) (Ł28 bn customer loans1) <1% 2H’18 Customers re-segmented Completion of Santander UK group’s target ring-fencing model outlined in

ring-fencing plans submitted to the PRA and FCA. Plans are subject to, among other things, regulatory and court approvals and res are indicative based on current information, are not a forecast and may differ materially upon implementation of the

final ring-fencing model. Santander Corporate Bank is expected to be easury Services plc (1) 1H’16 Helping people and businesses prosper 18

Creating digital solutions to meet all of our customer’s financial needs Examples New end-to-end online Mortgage New online Investment Hub • >40% of mortgages retained online

• Integrated within the Santander online banking experience • 75% reduction in time to complete application (from up to 3 hours to <40 min) • Full range of online transactions • >70% reduction in time from application to

• Santander investments plus further c.2k funds offer (from 11 days to 3 days)1 Digital touch points2 85% 88% 71% 2012 2015 1H’16 (1) Expected by 2016 year end (2) Digital touch points = (Digital: online and mobile logons) /

(Branch: financial transactions + Telephony: service calls + Digital: online and mobile logons) Helping people and businesses prosper 19

Efficiency improvements to continue Simplifying our organisation and 55.8 Cost to processes, and digitalising across our income businesses ratio (%) 52.5 Excluding 51.2 banking

Omni-channel platform with optimised reform1 physical distribution, leading digital tools and remote service / advice 1,220 1,231 Costs 1,127 1,158 Leveraging Group scale (ŁMM) through shared capabilities across 1H’13 1H’14 1H’15

1H’16 countries > Ł100MM reduction in our cost base by 2018 while continuing to grow the business (1) Ł30MM Helping people and businesses prosper 20

|

4

|

|

Looking forward and key takeaways Helping people and businesses prosper 21

|

We are on plan to deliver our 2016 commitments 2016 1H’15 1H’16 commitments Fee income CAGR +4% +6%1 +5-10% Digital customers (MM) 3.6 4.3 4.3 Corporate customer loans2 >5pp

+7pp >5pp growth vs. market (1) Annualised YTD rate (2) Commercial Banking and GCB Helping people and businesses prosper 22

2018 Santander UK targets 1H’16 2018 Top 3 People Colleague engagement UK Bank Retail loyal customers (MM) 3.7 4.7 SME and Corporate loyal customers (k) 279 308 Customers Digital

customers (MM) 4.3 6.5 Retail customer experience (‘FRS’)1 63.5% Top 3 Fee income CAGR 6%2 5-10% Return on Tangible Equity (RoTE) 10% 8-10% Cost to income ratio 53% 50-52% Shareholders CET1 capital ratio 11.2% c.12% Non performing loan

ratio 1.5% <2% Dividend pay-out ratio (yearly) 50% 50% Communities Number of scholarships 2016-2018 (vol) 1,900 24,100 People supported 2016-2018 (vol) 47,600 600,000 Note: after incorporating new macroeconomic scenario, the following 2018

targets have been revised: RoTE (previously 12-14%), cost to income ratio (previously <50%), non performing loan ratio (previously <1.5%) . Group criteria except CET1 (1) Source GfK FRS 12 months rolling data. Refer to appendix 1 in the

2Q’16 QMS Santander UK for a full definition (2) Annualised YTD rate Helping people and businesses prosper 23

We have a clear strategy of building deeper relationships that allow us to capture growth opportunities Our commercial and digital transformation delivers value to our customers and

shareholders The quality of our balance sheet and best-in-class risk management drives predictability despite challenges in the market Helping people and businesses prosper 24

Simple Personal Fair

Item 5

Rami Aboukhair Country Head Spain

Banco Santander, S.A. (“Santander”), Santander UK Group Holdings (“Santander UK”) and Banco Santander (Brasil) S.A. (“Santander Brasil”) all caution that this

presentation and other written or oral statements made from time to time by Santander, Santander UK and Santander Brasil contain forward-looking statements. These forward-looking statements are found in various places throughout this presentation

and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a

number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) general market, macro-economic, governmental,

political and regulatory trends; (2) movements in local and international securities markets, currency exchange rates and interest rates; (3) competitive pressures; (4) technological developments; (5) transaction, commercial and

operating factors; and (6) changes in the financial position or credit worthiness of our customers, obligors and counterparties. The risk factors that we have indicated in our past and future filings and reports, including those with the

Securities and Exchange Commission of the United States of America (the “SEC”) could adversely affect our business and financial performance and should be considered in evaluating any forward-looking statements contained herein. Other

unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak only as of the date on which they are made and are based on the knowledge, information

available and views taken on the date on which they are made; such knowledge, information and views may change at any time. These statements are only predictions and are not guarantees of future performance, results, actions or events. Santander,

Santander UK and Santander Brasil do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. The information contained in this presentation is subject to,

and must be read in conjunction with, all other publicly available information, including, where relevant, any fuller disclosure document published by Santander, Santander UK nor Santander Brasil. Any person at any time acquiring securities must do

so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice

as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in the presentation. In making this presentation available, Santander, Santander UK and Santander Brasil are not giving advice nor making

any recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of

an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is

intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Note: Statements as to historical performance, share

price or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior year. Nothing in this presentation should

be construed as a profit forecast. Note: The businesses included in each of our geographical segments and the accounting principles under which their results are presented here may differ from the businesses included in our public subsidiaries in

such geographies and the accounting principles applied locally. Accordingly, the results of operations and trends shown for our geographical segments may differ materially from those disclosed locally by such subsidiaries. Helping people and

businesses prosper 2

Content 1 Market and financial system 2 Strengths and opportunities 3 Update on our 2015-18 strategy 4 Looking forward and key takeaways Helping people and businesses prosper 3

|

1

|

|

Market and financial system Helping people and businesses prosper 4

|

Solid macroeconomic perspectives GDP (annual growth, %) Unemployment (%) 24.4 22.1 19.6 18.0 16.5 3.2 2.9 2.1 2.0 1.4 2014 2015 2016(e) 2017(e) 2018(e) 2014 2015 2016(e) 2017(e)

2018(e) CPI (annual growth, %) Goods and services exports (annual growth, %) 1.5 0.7 6.5 6.7 -0.2 5.1 -0.5 3.9 3.5 -0.6 2014 2015 2016(e) 2017(e) 2018(e) 2014 2015 2016(e) 2017(e) 2018(e) Source: INE and Santander Research Department. Estimated as

of Jul’16 Helping people and businesses prosper 5

Opportunity for growth in a low rates context Loans to private sector (annual growth, %) Interest rate (Euribor 12 Months, %) 0.44 0.7 2.6 -2.3 -4.7 -3.9 0.14 2014 2015 2016(e) 2017(e)

2018(e) -0.02 Customer deposits (annual growth, %) -0.07 -0.10 2.0 2014 2015 2016(e) 2017(e) 2018(e) 3.7 0.2 2.3 -0.7 2014 2015 2016(e) 2017(e) 2018(e) Source: INE, Thomsom Reuters and Santander Research Department. Estimated as of Jul’16

Helping people and businesses prosper 6

|

2

|

|

Strengths and opportunities Helping people and businesses prosper 7

|

Santander Spain is a leading player in the market Market Share vs June 2016 Market share1 branch market share1 Loans €157.3 bn 13.4% +3.0pp Deposits €171.8 bn 13.0% +2.6pp Funds

€46.9 bn 15.6% +5.2pp Total Savings €218.7 bn 13.4% +3.0pp Branches 3.1k 10.4% 2 (1) Data as of Jun’16 obtained from Bank of Spain’s Statistical Bulletin (chapters 4, 8 and 19) related to total Credit Institutions and Credit

Financial Intermediaries and confidential reports M-21, UME-1 and UME-2 (2) EDIBAN Helping people and businesses prosper 8

Strong foundations for profitable growth Strong brand awareness # 1 choice for customers considering switching1 Best-in-class for high Leaders in high income payroll acquisitions,

Affluent, Private Banking value segments and Corporates segments Strong NPL ratio below sector average and positive recovery rates risk profile branches, +5.1k ATMs and growing digital customers balanced business mix serving individuals and

businesses Part of Unique global connectivity value proposition with capacity to leverage Santander Group on Group’s investments, resources and brand (1) With 27%, for customers interested in dealing with a new bank (FRS Survey for

Financial Behavior of mass market clients in 2014) Helping people and businesses prosper 9

Opportunities to increase profitability and market share Potential to continue increasing customer loyalty Strengthen our position in SMEs 6.4MM • +18% in loyal customers as •

1|2|3 SME account 70% a result of 1|2|3 strategy • +54k loyal SMEs (+26%) • 27% Increase insurance and • High value-added asset management market products Loyal Active share Loyal Work with customers customers Santander Efficient

and customer oriented Digital and innovation for value generation Margin per branch • Boost omni-channel • Data driven company +17% transformation • Distribution network • Improved customer optimisation journeys Dec’15

Dec’16(e) Note: 1H’16 vs. 1H’15 Helping people and businesses prosper 10

|

3

|

|

Update on our 2015-18 strategy Helping people and businesses prosper 11

|

Consistent and well established goals and priorities Strategic goals Priorities Build deep, long lasting relationships with Increase market share based on 1 our customers organic growth

with a customer loyalty strategy 2 Be the “bank of choice” in Spain for SMEs and Corporates Culture Improve our efficiency while Excellence in customer service & innovation enhancing our customer 3 Simple to generate value

experience Personal Fair 4 Advanced Risk Management Be the best bank to work for strengthening our Simple | Personal | Fair culture 5 Sustainable profitability Helping people and businesses prosper 12

1 1|2|3 strategy is paying off Better customer • 425k switchers with better customer profile acquisition • +54k loyal SMEs (+26%) • +18% loyal customers, x2.4 more

products and services Deepening customer • +64bps payroll market share loyalty • 9.4 direct debits per account and +72% higher card spending than other customers • Representing 50% of new volume production Strong commercial •

SMEs volumes starting to grow results • Retail fee income +7% YoY Increased customer • From 5th (2015) position to TOP 3 (2016) experience Improving • x2 pre-approved credit limits risk profile • Improved average credit

score Helping people and businesses prosper 13

2 To grow in SMEs is key for our future profitability 1|2|3 SMEs account SMEs and Corporate strategy Increase customer • c.2.5k business Relationship Managers Relationship acquisition

model • 150 business branches • +100K SMEs current accounts in just 10 months • New private web and mobile app Digital ? Digital and active business customers +84% transformation • Contact center: from customer support to Boost

loyalty and customer management transactionality • x9 annual growth rate of Value added • International business, Factoring and loyal SMEs products Confirming, Leasing and Renting customers Helping people and businesses prosper 14

1-2 Customer loyalty driving growth in lending. Credit Cards spend International business UPLs new volumes Mortgages new volumes market share lending +128% +88bps +10%1 +38% 1H’15

1H’16 1H’15 1H’16 1Q’15 1Q’16 1H’15 1H’16 • +300bps market share • New production pricing > stock • >65% cards from 1|2|3 • +25% in international customers business approved limits

(1) Data as of May ‘16 Helping people and businesses prosper 15

1-2 .while supporting higher fee income and capital efficiency Our “pay for value” delivers high …and moves us towards a more …outperforming our peers… fee income

growth… capital light model Retail banking fee income YoY Fee income evolution YoY (1H’16) RORWA +7% +18bps 2% -6% 1H’15 1H’16 Peers average Dec’15 Dec’16 (e) Helping people and businesses prosper 16

3 Our omni-channel model improves customer experience efficiently New branch model Mobile customer +2.8k new ATMs with new experience Customer centric functionalities approach Call centre

Omni-channel 1st position in quality1 relationship manager Digital customers growth Online transactions growth # digital transactions in personal segment +20% +13% 4.2MM 2.3MM 2.7MM Jun’15 Jun’16 2018 target 2Q’15 2Q’16

(1) EQUOS quality research December 2015 Helping people and businesses prosper 17

3 We have developed our commercial network to improve efficiency and customer experience Despite closures, our commercial Transformation of our branches to Improving customer referrals

activity has not suffered provide a better customer experience Santander Branch evolution % of 1|2|3 accounts openings through referrals Branch average headcount +11% 25% -37% -33% x4 market avg 17% 4.7 k 14% 3.5k 11% 3.1k 11% Dec’15

Dec’16(e) 7% Business volume per branch (MM€) 6% +17% 2010 2015 2016 +29% credit Jun’15 Sep’15 Dec’15 Mar’16 Jun’16 Aug’16 production per branch2 Dec’15 Dec’16(e) (1) Santander Branches in 2010,

2015 and Jun’16 (2) 1H’16 vs.1H’15. After the last efficiency plan Helping people and businesses prosper 18

|

4

|

|

Looking forward and key takeaways Helping people and businesses prosper 19

|

We are on track to deliver our 2016 commitments 2016 1H’15 1H’16 commitments 1I2I3 customers (k) 290 1,240 2,000 Customer experience (position) 5th 3rd 3rd Cost of risk

0.84% 0.45% 0.60% SMEs market share 20% 20% 20% Helping people and businesses prosper 20

2018 Santander Spain targets 1H’16 2018 Best bank to work 2nd 1st People Individual career plans 13,200 15,400 Evaluation 180º for commercial positions 6,500 7,000 Total retail

loyal customers (MM) 1.2 2.5 1I2I3 customers (k) 1,240 4,000 Customers Digital customers (MM) 2.7 4.2 Best-in-class banks in customer experience 3rd 1st Fee income CAGR 2% 5-10% NPL ratio 6.1% <4% Shareholders1 RoTE 12% c.13% Cost to income

ratio 53% c.55% Communities Number of scholarships 2016-2018 (k) 12.2 2 39.2 (1) Management perimeter(2) Total scholarships for 2016 Helping people and businesses prosper 21

We are uniquely positioned to grow further by challenging the retail and SMEs market with our 1|2|3 strategy, and continue leading in Affluent, Private Banking and Corporate Banking A

commercial transformation in place to favour customer loyalty and customer service and efficiency improvement Our model ensures predictable, sustainable and profitable organic growth with less capital consumption and a best-in-class risk profile

Helping people and businesses prosper 22

Simple Personal Fair

Item 6

Sérgio Rial Country Head Brazil

Banco Santander, S.A. (“Santander”), Santander UK Group Holdings (“Santander UK”) and Banco Santander (Brasil) S.A. (“Santander Brasil”) all caution that this

presentation and other written or oral statements made from time to time by Santander, Santander UK and Santander Brasil contain forward-looking statements. These forward-looking statements are found in various places throughout this presentation

and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a

number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) general market, macro-economic, governmental,

political and regulatory trends; (2) movements in local and international securities markets, currency exchange rates and interest rates; (3) competitive pressures; (4) technological developments; (5) transaction, commercial and

operating factors; and (6) changes in the financial position or credit worthiness of our customers, obligors and counterparties. The risk factors that we have indicated in our past and future filings and reports, including those with the

Securities and Exchange Commission of the United States of America (the “SEC”) could adversely affect our business and financial performance and should be considered in evaluating any forward-looking statements contained herein. Other

unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak only as of the date on which they are made and are based on the knowledge, information

available and views taken on the date on which they are made; such knowledge, information and views may change at any time. These statements are only predictions and are not guarantees of future performance, results, actions or events. Santander,

Santander UK and Santander Brasil do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. The information contained in this presentation is subject to,

and must be read in conjunction with, all other publicly available information, including, where relevant, any fuller disclosure document published by Santander, Santander UK nor Santander Brasil. Any person at any time acquiring securities must do

so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice

as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in the presentation. In making this presentation available, Santander, Santander UK and Santander Brasil are not giving advice nor making

any recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of

an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is

intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Note: Statements as to historical performance, share

price or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior year. Nothing in this presentation should

be construed as a profit forecast. Note: The businesses included in each of our geographical segments and the accounting principles under which their results are presented here may differ from the businesses included in our public subsidiaries in

such geographies and the accounting principles applied locally. Accordingly, the results of operations and trends shown for our geographical segments may differ materially from those disclosed locally by such subsidiaries. Helping people and

businesses prosper 2

Content 1 Market and financial system 2 Strengths and opportunities 3 Update on our 2015-18 strategy 4 Looking forward and key takeaways Helping people and businesses prosper 3

|

1

|

|

Market and financial system Helping people and businesses prosper 4

|

Brazil’s improving macroeconomic outlook Current …in a country with solid Achievement Adjustment process… starting point fundamentals of sustainable growth • Lower

inflation • Public debt stabilisation • Large external reserves • Closing the gap between • Room for lower rates • Less government intervention • Demographic bonus consumption vs. investments • Export sector

recovery • Public banks focused on • Top 10 country in household • Infrastructure investments development and infrastructure consumption and FDI¹• Higher productivity • Pension system reform • Solid financial

system • Fiscal austerity GDP Inflation Int. Rate Exch. Rate (YoY %) (IPCA %) (Selic %) (R$ / US$) 2016 F -3.2% 7.3% 13.8% 3.30 2017 F 1.4% 5.1% 11.0% 3.45 2018 F 2.2% 4.5% 10.5% 3.58 (1) Foreign Direct Investment Source: Central Bank of

Brazil, September 2016 Helping people and businesses prosper 5

Santander is in a strong position in a consolidated sector Main highlights (5 largest banks) 1. Market share 2. Well capitalised 3. Well funded • Deposits: c.76% • BIS ratio:

16.5% • Loans / deposits: 102% • Loans: c.70% Resilient figures in a challenging scenario Capital Ratio NPL ratio – Over 90 Cost of risk CET 1 5.2% 5.2% 4.7% 15.3% 14.3% 4.6% 3.8% 4.1% 3.5% 3.7% 4.2% 3.2% 3.6% 3.3% 3.1% 3.0% 3.6% 3.2%

2Q’13 2Q’14 2Q’15 2Q’16 2Q’13 2Q’14 2Q’15 2Q’16 Large private Santander banks Brasil Large private banks Santander Brasil Source: Central Bank of Brazil. Data as of 2Q’16, in BR GAAP criteria Helping

people and businesses prosper 6

|

2

|

|

Strengths and opportunities Helping people and businesses prosper 7

|

Santander is the 3rd largest private bank in Brazilą… The only international bank with significant scale in Brazil • Leadership in the Auto market2 • 1st in Advisor for