Santander Downgrades Two Important Financial Targets

September 30 2016 - 5:59AM

Dow Jones News

By Jeannette Neumann

MADRID--Banco Santander SA (SAN) downgraded two important

financial targets on Friday, as major European banks feel the

strain of a prolonged period of low interest rates and sluggish

demand for loans.

Santander executives told investors at a presentation in London

that the bank would step up cost-cutting efforts as well as focus

on increasing fees to counterbalance a tougher macroeconomic

outlook in Europe.

Santander lowered the target for its return on tangible equity,

a measure of profitability, to "more than 11%" by 2018 from a

previous target, set a year ago, of around 13% over the same

period.

The bank also raised the target range for its cost-to-income

ratio--a key measure of efficiency--to 45%-47% by 2018. The bank

said last year it aimed for a cost-to-income ratio of below 45%.

The lower the figure the better.

Citigroup analyst Stefan Nedialkov noted that the market

consensus for Santander's 2018 return on tangible equity is

10%--already below the bank's new target.

"We believe today's rebasing of targets is the right thing to

do," Mr. Nedialkov said in a research report. "The ROTE downgrade

seems to be driven by a higher cost-to-income ratio, and

potentially by slightly lower implied net interest income," which

measures lending profitability.

Santander reiterated its target of reaching a capital ratio by

the end of 2018 of more than 11% under international regulations

known as "fully loaded" Basel III criteria. That ratio was 10.36%

at the end of June.

Santander shares were down 3.9% around 11 a.m. local time in

Madrid.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

September 30, 2016 05:44 ET (09:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

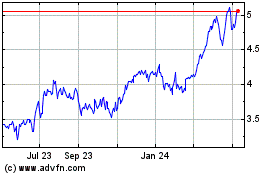

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

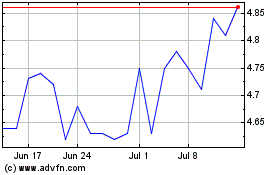

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024