Santander Consumer USA to Restate Financial Reports

September 23 2016 - 11:30AM

Dow Jones News

Santander Consumer USA Holdings Inc. said Friday it would

restate years of financial reports as they can no longer be relied

upon because of material weaknesses in internal control. The

company is restating its reports from the full-year 2013 until the

first quarter of 2016.

It says that the issues included its methodology for accreting

dealer discounts, its lack of consideration of net discounts when

estimating the allowance for credit losses and the discount rate

used in determining the impairment for loans accounted for as

troubled debt restructurings.

"Since the identification of errors in our financial reporting,

we have been completely focused on ensuring we correct everything

as quickly and transparently as possible," Chief Executive Jason

Kulas said.

The company expects the cumulative impact of the errors to

increase total equity of about 1%, as of March 31. The company also

said that the restatements will increase previously reported net

income for the quarter ended in March by about $9 million, or 2

cents a share.

The company said it is working to file its report for the

quarter ended in June as soon as possible and said it has received

waivers for some debt facilities that require timely filings.

Santander Consumer is a consumer finance company focused on

vehicle finance and third-party servicing.

Shares rose 11.7% in morning trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

September 23, 2016 11:15 ET (15:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

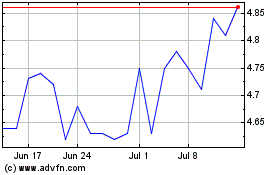

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

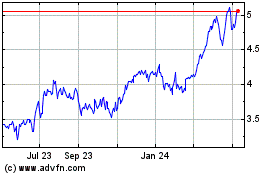

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024