Santander Consumer USA Chairwoman Resigns for Broader Role at Spanish Lender -- Update

July 12 2016 - 1:40PM

Dow Jones News

By Tess Stynes

Former J.P. Morgan Chase & Co. executive Blythe Masters

resigned as nonexecutive chairwoman of Santander Consumer USA

Holdings Inc., the subprime auto-lending unit of the Spanish

banking giant, after less than a year.

Ms. Masters, who was appointed to the position in July 2015,

will move into a broader role with parent company Banco Santander

SA with a focus on its global digital banking efforts.

Among her new duties, Ms. Masters will be senior adviser on

technology and blockchain, the record-keeping technology behind the

bitcoin currency.

While alternative currency bitcoin itself has been embroiled in

legal battles and volatility, the underlying blockchain technology

-- or distributed ledger technology -- has drawn heavy interest

from mainstream finance as a potential way to help reduce

costs.

Ms. Masters also will join Santander's international advisory

board, as well as the board of Santander's online bank,

Openbank.

Ms. Masters is chief executive of financial technology startup

Digital Asset Holdings LLC -- a startup developing mainstream uses

for blockchain technology. Her previous experience includes senior

executive roles at J.P. Morgan Chase, including serving as head of

its global commodities business from 2007 to 2014, and serving as

finance chief of its investment bank from 2004 to 2007.

William Rainer, a former chairman of the U.S. Commodity Futures

Trading Commission, will take over as head of Santander Consumer's

board.

Ms. Masters's resignation comes after the U.S. Federal Reserve

recently rejected the capital plan of Banco Santander SA's U.S.

holding company in its annual stress test -- the third year the Fed

has faulted the unit, citing deficiencies across a range of

business operations. The rejected capital plan marked the latest in

a string of setbacks for Santander in the U.S.

Regulators also have faulted risk management at the U.S.

consumer-lending subsidiary, whose previous chief executive, Tom

Dundon, stepped down in July of 2015.

Santander executives have said during the past couple of years

that the regulatory troubles in the U.S. are partially the result

of growing pains as the lender builds up from scratch a holding

company to oversee its banking unit and consumer-lending

subsidiary.

Santander Consumer, one of the largest U.S. auto lenders, also

has faced a number of federal inquiries into its auto-lending

practices.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

July 12, 2016 13:25 ET (17:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

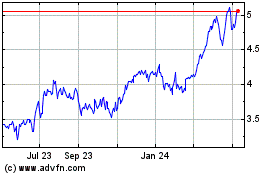

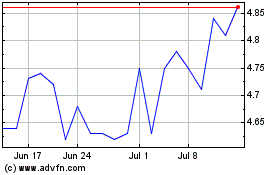

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024