Europe Stocks Fall After Two Days of Gains

June 30 2016 - 4:40AM

Dow Jones News

European stocks fell early Thursday, following a two-day

bounceback in risk assets around the world.

The Stoxx Europe 600 was down 0.9% in early trade after posting

its largest two-day gain since February.

The banking sector led losses, down 1.6%. The U.S. banking units

of Deutsche Bank AG and Banco Santander SA failed the Federal

Reserve's annual stress tests, while the International Monetary

Fund Wednesday named Deutsche Bank as the riskiest financial

institution in the world as the potential to be the source of

external shocks to the financial system.

Earlier, stocks in Japan and Shanghai closed little changed,

while Hong Kong's Hang Seng Index added 1.4%. Australia's S&P

ASX 200 rose 1.8%, led by energy and mining shares.

Thursday's moves followed two days of steep gains on Wall Street

and around the world, as stocks rebounded from major losses in the

aftermath of the U.K.'s surprise vote to exit the European

Union.

The pound was flat against the dollar at $1.3436.

In commodities, Brent crude oil fell 0.7% to $50.95 a barrel

after oil prices posted their biggest gain in over two months. Gold

was down 0.7% at $1,317 an ounce.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

June 30, 2016 04:25 ET (08:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

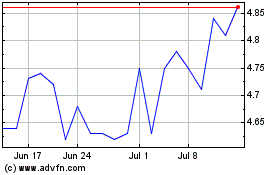

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

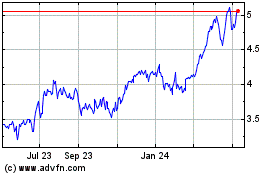

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024