By Ryan Tracy and Donna Borak

Big U.S. banks won permission from regulators Wednesday to boost

dividends and buybacks, offering investors some welcome news after

the sector got hammered when the U.K. voted last week to exit the

European Union.

All but two of 33 institutions passed the final round of the

Federal Reserve's annual "stress tests," conducted to gauge how

such firms would fare in a new financial crisis.

Big firms such as Bank of America Corp. and Citigroup Inc.,

which struggled on the tests in recent years, passed this time.

Morgan Stanley also passed but received a bit of a rebuke. The Fed

said it found "weaknesses" in internal risk- management processes

and required the bank to submit a revised capital plan by the end

of the year, though it will still be able to return capital in the

meantime.

Morgan Stanley Chairman and Chief Executive James Gorman said

that the firm is able to increase its capital return to

shareholders for the fourth consecutive year, adding "we are

committed to addressing the Fed's concerns about our capital

planning process and fully expect to meet their requirements within

the established time frame."

The U.S. banking units of two foreign firms, Deutsche Bank AG

and Banco Santander SA, were flunked, due to Fed concerns about

their ability to measure risks. It was the second year in a row the

German bank failed and the third consecutive failure for the

Spanish firm.

Overall, the 2016 stress tests reflect the Fed's view that the

banking sector is much stronger than it was leading up to the 2008

bailouts. Bank regulators have steadily raised capital requirements

for the largest banks since the crisis to make banks -- and the

financial system -- more resilient and better able to absorb

losses. The changes have forced banks to fund themselves with less

borrowed money and more investor funds, such as common equity that

can't flee when market turmoil strikes, and many analysts said

those changes helped contain the damage from the Brexit market

rout.

The stress-test result could prove a tonic for bank stocks,

which have been wilting of late. Falls in long-term bond yields

earlier this month promised to further pressure profits, and

additional declines following the Brexit vote made the outlook

worse. Fears of a hit to global growth after the U.K. vote, along

with the prospect of market turmoil, cast an even darker cloud over

banks.

Despite the firming of stocks generally in the past two days,

the KBW Nasdaq Bank Index remains down 7% from its level when the

Brexit vote was announced. Among S&P 500 sectors, financials

are the worst performer this year, down 5.6%. The stress-test

results were announced after U.S. markets closed, and Bank of

America, Citigroup and J.P. Morgan Chase & Co. all followed the

Fed report by announcing they would boost capital returns to

shareholders. In after-hours trading, shares of Citigroup were up

around 2.3%, Bank of America 1.7% and J.P. Morgan 1.4%. Despite its

conditional approval on the test, shares in Morgan Stanley rose

1.2%.

This is the second set of stress-test results released by the

Fed over the past week, assessing whether officials believe the

biggest banks could continue to lend even during a deep recession.

Last week, the largest U.S. banks breezed through the first round

of tests with capital ratios well in excess of the amount the

regulator views as a minimum, even when put through a hypothetical

recession.

Born of the financial meltdown in 2009, the stress tests have

become a defining moment each year for big banks and investors.

Bank executives manage their firms with one eye on how it will

affect test results and have had to spend billions of dollars to

develop systems to deal with them. They have become crucial for

investors ever since the Fed decided in 2011 that the banks would

have to submit capital-return plans as part of the tests and

dividends and buybacks became dependent on the outcome of these

hypothetical exercises. Some bankers have criticized the Fed's

process as overly opaque and stringent and have complained that the

higher capital required by them has choked lending and harmed the

economy. That said, both bank executives and regulators have said

the tests have made banks stronger and forced improvements in the

ways that banks measure and manage risks.

Banks that received approval for their capital plans will be

able to pay out as much as around two-thirds of projected net

income for the coming four quarters, a senior Fed official said.

That also means, though, that banks will continue to retain

capital, which could also reassure investors worried about their

ability to withstand any continuing Brexit-related market

tumult.

Nevertheless, a document issued by the Fed Wednesday outlined

areas where the regulator expects further improvement next year, a

reminder that future stress-test successes aren't guaranteed.

For Deutsche Bank and Santander, the Fed's rejection of those

firms' capital plans is a public embarrassment, but the practical

impact is more limited. The rejection effectively locks up some

U.S. profits, which can't be sent home to the parent firms at a

higher rate until they pass the tests, but the firms don't have

publicly announced plans to return capital home that would be

affected by that restriction, a Fed official said.

The official, on a conference call with reporters, didn't say

the firms would face harsher sanctions in the future and suggested

both firms are making progress. They have dedicated substantial

resources and manpower to addressing regulators' concerns, but the

Fed still believes the firms have substantial work to do, for

example, by ensuring they have reliable data about all of the risks

they face, the official said.

"We appreciate the Federal Reserve's recognition of our

progress, and we will implement the lessons learned this year in

order to strengthen our capital planning process," said Bill

Woodley, deputy CEO of Deutsche Bank Americas.

In a statement, Santander Holdings Chief Executive Officer Scott

Powell noted that the company has strong capital levels and would

work to address regulators' other concerns. "We have made progress,

but our internal capital planning, stress testing, internal

controls, governance and oversight require further improvement to

meet our regulators' expectations," Mr. Powell said. "We are

financially sound. These results do not affect our ability to serve

our customers," he added.

Santander executives have said during the past couple of years

that the regulatory troubles in the U.S. are partially the result

of growing pains as the lender builds up a holding company to

oversee its banking unit and consumer-lending subsidiary.

But U.S. regulators have also faulted Santander for

risk-management problems broadly, and investors and analysts say

they are growing impatient with Santander's mess in the U.S.

The Deutsche Bank unit in question, Deutsche Bank Trust Corp.,

represents about 3% of the German lender's total global assets. A

bigger test for Deutsche Bank will come in two years when its

bigger, newly consolidated U.S. business -- set up as what is known

as an intermediate holding company -- comes fully under stress-test

review.

Two new entrants to this year's test -- BancWest Corp., a

subsidiary of France's BNP Paribas SA, and TD Group U.S. Holdings

LLC, which is owned by Toronto-Dominion Bank -- passed the Fed's

yearly exercise.

M&T Bank Corp. gained the Fed's approval, but the Buffalo,

N.Y., firm passed only after scaling back its proposal to

distribute funds to shareholders, to ensure its capital buffers

stayed above the minimums required by the Fed.

It was the only bank to take the "mulligan" allowing banks to

adjust their payout plans. Had the bank not done so, it would have

failed the test by falling below two of the four required capital

ratios in a hypothetical recession, the Fed said.

The Fed changes the details of its recession scenario from year

to year, so the specifics can hit one type of bank harder than

another. This year, the Fed's hypothetical scenario envisioned the

U.S. unemployment rate more than doubling to 10%, the stock market

losing half of its value and financial markets becoming so

topsy-turvy that short-term U.S. Treasury rates turn negative as

investors pay the U.S. government to hold their money.

--Christina Rexrode, Jenny Strasburg and Jeannette Neumann

contributed to this article.

Write to Ryan Tracy at ryan.tracy@wsj.com and Donna Borak at

donna.borak@wsj.com

(END) Dow Jones Newswires

June 29, 2016 19:37 ET (23:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

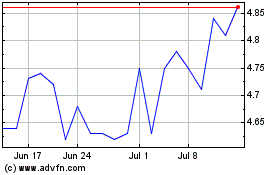

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

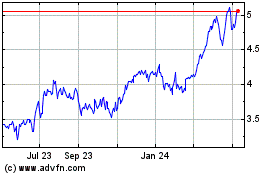

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024