Santander Profit Up Slightly

January 27 2016 - 2:30AM

Dow Jones News

MADRID—Banco Santander SA said Wednesday that fourth-quarter net

profit rose 0.3% from a year earlier.

Net profit for the three months to the end of December, was

€1.46 billion ($1.59 billion). Analysts had forecast €1.29 billion,

according to a poll by data provider FactSet.

The Spanish bank reported net interest income of €7.89 billion

against €7.71 billion a year earlier and forecasts of €7.88

billion.

Net interest income, a key driver of profit for retail banks

such as Santander, is the difference between what lenders pay

clients for deposits and charge for loans.

Investors and analysts are closely watching the pace at which

Santander is able to generate capital given concerns that the bank

is one of the most weakly capitalized European lenders.

Santander Executive Chairman Ana Botí n had tried to quell those

concerns by issuing â,¬7.5 billion in shares in January 2015. But

she hasn't made as much progress boosting capital since then and

that weakness continues to vex investors and analysts.

"Capital is the biggest risk to Santander's share price," Exane

BNP Analyst Santiago Ló pez Dí az wrote in a research report ahead

of the results. "While capital ratios are not fully comparable

across the board in Europe (due, among other things, to differences

in balance sheet compositions), Santander's level stands well below

the ratio we expect for the European sector as a whole at the end

of 2015."

Capital concerns have heightened as the recession deepens in

Brazil, which generates around one-fifth of Santander's net

profit.

Brazil's currency had fallen 26% against the euro as of December

2015 from a year earlier, which will chip away at Santander's

revenue in the South American country when it is converted into

euros on the lender's financial statements.

More individuals and businesses will struggle to pay their debts

on time amid Brazil's recession.

Francisco Riquel, an analyst with Madrid-based

financial-services firm N+1 Group, estimates that Santander's

nonperforming loans in Brazil will more than double by 2017 from

2014.

A weak capital ratio, currency problems in the bank's Latin

American units and an overall bleak, low-interest rate outlook for

European banks, have combined to slash Santander's market value to

around €59 billion from around €86 billion before the bank raised

capital in early January 2014.

Despite the plummet, Santander remains the eurozone's largest

bank by market value.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

January 27, 2016 02:15 ET (07:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

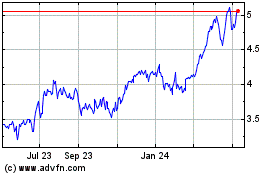

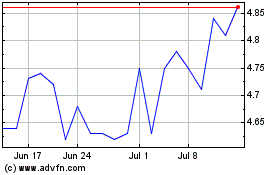

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024