Brazilian Banks to Form Credit Registry

January 21 2016 - 6:50PM

Dow Jones News

RIO DE JANEIRO—Brazil's five largest banks announced Thursday

that they have joined forces to create a credit intelligence bureau

aimed at reducing bad loans and boosting credit for good

borrowers.

Government-run banks Banco do Brasil SA and Caixa Econô mica

Federal and private-sector institutions Banco Bradesco SA, Itaú

Unibanco Holding SA and Banco Santander SA have signed a nonbinding

agreement to form the new credit registry, which will compile data

on individuals and companies.

The new firm will track loan payment information from borrowers

who agree to take part in the registry. The aim, banks say, is

reduce lenders' risks and lower interest rates for borrowers with

solid credit scores.

"It will improve credit conditions, lower default rates and

avoid over-indebtedness," said Murilo Portugal, the president of

Brazil's Federation of Banks, known as Febraban.

At least two local firms already gather credit information to

sell to banks, retailers and other businesses. But the information

they provide is focused largely on identifying borrowers who have

missed payments and are bad risks.

Creating robust credit profiles of good borrowers is more

challenging because Brazilian law requires these consumers to give

their consent to be tracked. The five banks contend that their

customers will be more likely to sign up for the registry because

the institutions have an existing relationship with them.

After several years of economic growth and expanding credit

availability, Brazilians are now being squeezed by a stagnant

economy, sticky inflation and soaring unemployment.

Default rates for Brazilian consumers jumped to 5.8% last

November, and among companies to 4.5%, excluding certain loans that

may be controlled or subsidized, according to Miguel José Ribeiro

de Oliveira, a research director at Anefac, a Brazilian association

of executives in the financial sector. Those rates, he said, are

based on payments which are more than 90 days late.

Meanwhile, the average interest rates on loans to firms and

consumers have skyrocketed over the last 12 months, reaching 30.2%

and 64.8% a year, respectively, last November, Mr. Oliveira

said.

The new credit intelligence firm will operate separately from

the commercial banks, who will each own a 20% stake. The new entity

will provide credit data for its controlling shareholders as well

as sell the data to other financial institutions, according Mr.

Portugal.

The executives involved in the project will likely spend the

next year working on legal and regulatory issues to implement the

new credit registry, which should only be fully operational in the

next four years or so, Mr. Portugal said.

Write to Luciana Magalhaes at Luciana.Magalhaes@dowjones.com

(END) Dow Jones Newswires

January 21, 2016 18:35 ET (23:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

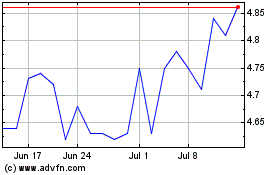

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

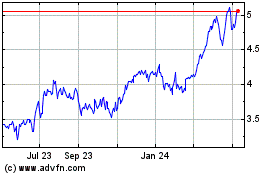

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024