Santander Posts Higher Third-Quarter Profit -- 2nd Update

October 29 2015 - 3:49AM

Dow Jones News

By Jeannette Neumann

MADRID-- Banco Santander SA on Thursday reported a 5% rise in

third-quarter profit on stronger lending income and slightly lower

loan-loss provisions.

The bank said net profit for the quarter was EUR1.68 billion

($1.86 billion), roughly in line with analysts' expectations of

EUR1.7 billion, according to a poll by data provider FactSet.

Profit increased in Santander's U.K., Brazilian and Spanish

businesses.

"We view the economic situation as improving in the majority of

our core markets," said Santander's executive chairman Ana

Botín.

Santander, the eurozone's largest bank by market value, said net

interest income was EUR7.98 billion, up from EUR7.5 billion in the

same period last year, roughly in line with analysts' forecasts of

EUR7.9 billion. Net interest income, a key driver of revenue for

retail banks, is the difference between what lenders pay clients

for deposits and charge for loans.

Santander reported a "fully loaded" capital ratio of 9.85%, a

sliver higher than in the second quarter. Investors and analysts

are closely watching the pace at which Santander is able to

generate capital. Despite a hefty capital increase in January, the

lender's financial cushion remains below its European banking

peers.

Net profit in Santander's U.K. unit was up 18% at EUR480 million

in the third quarter on stronger lending income and lower loan loss

provisions. Loans to clients were up in the first nine months of

this year compared with a year ago.

Profit at Santander's Brazil unit rose to EUR385 million from

EUR376 million on lower loan loss provisions. Net interest income

fell to EUR1.98 billion from EUR2.25 billion.

Accounted for in the Brazilian real, net profit and net interest

income both rose strongly during the third quarter.

Santander's Spanish business reported third-quarter net profit

of EUR311 million, up from EUR252 million a year earlier on sharply

lower loan loss provisions. But net interest income fell nearly 8%

during that period. Net interest income also fell 2.2% in the third

quarter from the second quarter.

Investors and analysts had expected a decline in that key

profitability figure. Its Spain unit, like other Spanish banks,

faces sluggish borrowing demand and falling yields on the loans

they are issuing.

Investors and analysts also had expected Santander's net

interest income in its Spain unit to take a slight hit from the

expense of funding a new, higher interest checking account.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 03:34 ET (07:34 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

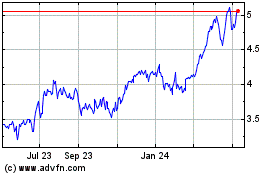

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

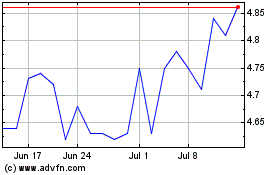

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024