Finra Fines Santander Unit Over Puerto Rico Bond Sales -- Update

October 13 2015 - 1:28PM

Dow Jones News

By Anna Prior And Ezequiel Minaya

A unit of Spain's Banco Santander SA agreed to pay roughly $6.4

million in a settlement with Wall Street's self-regulator regarding

supervisory failings tied to the sale of Puerto Rican municipal

bonds, which have plunged in value in recent years.

The Financial Industry Regulatory Authority on Tuesday said

Santander Securities LLC would pay a $2 million fine for

supervisory failures related to sales of individual Puerto Rico

bonds and closed-end funds, and for failing to reasonably supervise

employee trading at the firm's Puerto Rico branch.

In addition, Santander agreed to pay about $4.3 million in

restitution to certain customers, as well as $121,000 in

restitution and an offer to buy back the securities sold to certain

customers who were affected by the firm's failure to supervise

employee trading, Finra said.

The securities industry's self-regulator found that for a

10-month period starting in December 2012, Santander didn't

accurately reflect the dangers associated with the Puerto Rican

paper in its risk-classification tool and failed to adequately

supervise its customers' use of margin and concentrated positions

in their accounts.

Finra added that Santander didn't revise the risk-tool

classifications following Moody's Investors Service's downgrade of

some of the island's municipal bonds to a notch above junk

territory in December 2012. The day after the move, Santander

allegedly stopped buying Puerto Rican municipal bonds being sold by

customers and accelerated efforts to dump its inventory.

As is customary, Santander neither admitted nor denied the

regulator's findings, according to the Finra disciplinary document,

posted on the regulator's website.

A Santander spokeswoman said the firm "is pleased to resolve

this matter and will comply with the terms of the Finra letter,"

adding that "the firm has taken steps to enhance its controls in

connection with the activities described in the Finra letter."

Tuesday's development comes as Puerto Rico's financial crisis

continues to draw scrutiny from U.S. lawmakers and regulators. Last

month, a measure to establish more robust federal oversight over

Puerto Rico's mutual-fund industry was introduced in Congress, and

a Senate committee held a hearing on Puerto Rico's financial

problems.

In addition, a unit of UBS Group AG in September agreed to pay

roughly $34 million in settlements with U.S. regulators for issues

tied to the sale of Puerto Rico bond funds. That included $15

million to settle charges from the Securities and Exchange

Commission, which said the unit failed to supervise a former broker

who had customers invest borrowed money in the bond funds, and

$18.5 million for a Finra fine and investor restitution.

The funds and municipal bonds sold by UBS and other brokerages

were popular among island residents in part due to generous tax

advantages.

But Puerto Rico has been facing a sluggish economy and high

unemployment for years, and officials have been seeking to

restructure the island's $72 billion debt load. Gov. Alejandro

García Padilla has called the island's debt unpayable, and many

Puerto Rico bonds are trading well below face value.

Write to Anna Prior at anna.prior@wsj.com and Ezequiel Minaya at

ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 13, 2015 13:13 ET (17:13 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

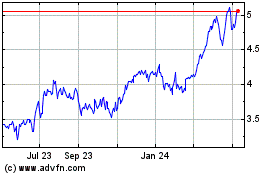

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

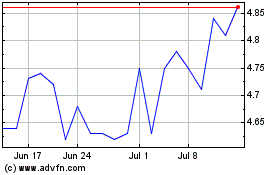

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024