Debt-Market Tumult Hits Corporate-Bond Sales

September 28 2015 - 7:24PM

Dow Jones News

By Mike Cherney

Bond-market turmoil mounted Monday, as three companies reduced

or put off planned bond sales in response to soft investor demand,

damped by concerns that a global economic slowdown is taking

shape.

Santander Holdings USA Inc., the U.S. arm of Spanish bank Banco

Santander SA, canceled a planned sale that had been expected at $1

billion or more, a person familiar with the deal said. Chattanooga,

Tenn.-based shopping-center company CBL & Associates Properties

Inc. pulled a $300 million bond sale. Westfield Corp., another

shopping-center firm, canceled the sale of 10-year bonds, though

the company was able to sell $1 billion in five-year debt at higher

yields than initially expected.

The market weakness is the latest sign of building worries about

the pace of global economic growth. The deals pulled Monday came

from companies carrying investment-grade ratings; bankers had

little trouble selling similar bonds earlier in the year.

"I have never seen the investment-grade primary markets this

schizophrenic before," said Ron Quigley, managing director and head

of fixed-income syndicate at Mischler Financial Group. "One day the

window is open, the next it's slammed shut."

U.S. corporate-bond issuance in 2015 is up 15% from the

comparable year-ago period, according to Securities Industry and

Financial Markets Association data, after setting records in each

of the past three years.

But the market action over the past month reflects anxiety among

some investors that slower growth in China and persistently low

commodity prices will push some companies into financial distress

and dim global economic prospects. Bond investors in recent months

have demanded higher yields relative to Treasurys to own U.S.

corporate debt, indicating some worry about companies' ability to

pay back their debt.

"We're starting to become a little more cautious in terms of our

views," said Christopher Coolidge, a portfolio manager at

Brandywine Global Investment Management, which oversees $65

billion. "We're OK heading into the end of the year, but next year

I think is going to be pretty tough for the U.S. economy."

Bonds backed by mining giant Glencore PLC dropped sharply after

an analyst report from Investec Securities renewed questions about

whether the Switzerland-based company will be able to reduce its

debt load amid soft commodity prices. The prices of some Glencore

bonds fell as much as 25%, a large drop for a company that still

commands investment-grade ratings.

"I've never seen bonds react so violently to a research report,"

said Tim Doubek, senior portfolio manager at Columbia Threadneedle

Investments, which oversees about $500 billion.

Hewlett-Packard Co. could represent another test. The company is

prepping a sizable bond sale that was expected to sell as early as

Monday, some investors and analysts said. H-P could still sell the

bonds later in the week.

An H-P spokeswoman declined to comment. Representatives for

Westfield and Santander didn't respond to requests for comment.

CBL pulled its bond sale "in light of today's capital-market

conditions, " the company said in a statement. "We decided to

postpone the offering until market conditions become more

favorable."

Corporate-debt markets had been consistently wide open in recent

years, as investors bet that slow but steady economic growth in the

U.S. would support corporate earnings.

Monday's events come after companies in the junk-bond market,

where companies have lower credit ratings, were forced last week to

increase yields on new debt sales. Altice NV paid higher yields on

a bond offering backing its purchase of Cablevision Systems Corp.

and had to reduce the size of its deal from $6.3 billion to $4.8

billion. Olin Corp. also reduced the size of its bond sale and

boosted interest payments to fund its acquisition of Dow Chemical

Co.'s chlorine-products unit.

Junk bonds, which are viewed as a more sensitive indicator of

economic conditions because the companies are more indebted and

have less cushion to withstand a downturn, logged a poor day

Monday. The SPDR Barclays High Yield Bond ETF was down about 1.4%

on the day, almost as bad as the 1.9% drop in the Dow Jones

Industrial Average stock benchmark.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 28, 2015 19:09 ET (23:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

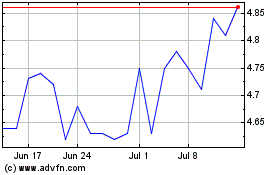

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

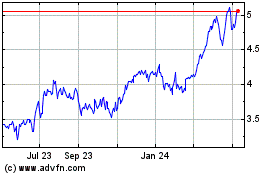

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024