Klayman & Toskes, PA and Carlo Law Offices Comment on S&P Credit Downgrade in Puerto Rico General Obligation Debt

April 27 2015 - 2:33PM

The Securities Arbitration Law Firm of Klayman & Toskes, P.A.

("K&T") and Carlo Law Offices comment on Standard & Poor's

("S&P") decision Friday to lower Puerto Rico's General

Obligation bond rating further into junk territory from B to CCC+,

four notches above default status. According to S&P statements,

"We base our downgrade...on our view that the commonwealth's market

access prospects have further weakened and Puerto Rico's ability to

meet its financial commitments is increasingly tied to the

business, financial and economic conditions on the island. Absent

improvement in those conditions, we believe debt and other

financial commitments will be unsustainable."

According to securities attorney, Steven D. Toskes, Esq., "The

recent downgrade may be followed by more ratings agencies

downgrades for bonds issued in Puerto Rico, which may result in

further selling pressures from municipal bond portfolios including

large mutual funds that hold Puerto Rico municipal bonds." Mr.

Toskes warns, "Investments in closed-end funds that are leveraged

against portfolios concentrated in Puerto Rico municipal bonds has

been disastrous for investors."

Investors who suffered losses in Puerto Rico municipal bonds

that are the result of Financial Industry Regulatory Authority

(FINRA) sales practice violations may recover losses through a

securities arbitration claim. FINRA sales practices violations

includes unsuitable investment advice that results in concentrated

investments in Puerto Rico municipal bonds, which is due to

brokerage firms' failure to supervise its financial advisors.

Klayman & Toskes, P.A. is currently investigating sales

practice violations of UBS Financial Services of Puerto Rico

(NYSE:UBS), Santander Securities (NYSE:SAN), Popular Securities

(Nasdaq:BPOP) and Oriental Financial (NYSE:OFG) related to

recommended investments in Puerto Rico municipal bonds and Puerto

Rico closed-end bond funds.

The securities arbitration law firms of Klayman & Toskes,

P.A., and Carlo Law Offices, P.S.C., are committed to the

protection of Puerto Rico investor rights. The FINRA dispute

resolution process and the legitimacy of Puerto Rico investor

rights direct our current investigations. The sole purpose of this

release is to investigate, on behalf of our clients, the sales

practices of Puerto Rico brokerage firms in connection with

investment recommendations provided to their customers. Current and

former customers of Puerto Rico brokerage firms who have

information concerning sales practices related to investments in

Puerto Rico closed-end bond funds and Puerto Rico municipal bonds

are encouraged to contact Steven D. Toskes of Klayman & Toskes,

P.A. or Lcdo. Osvaldo Carlo of Carlo Law Offices, at (787)

919-7325, or visit our websites at www.sueubspuertorico.com and

www.perdidasenbonospr.com/en/.

About Klayman & Toskes

Klayman & Toskes, a leading securities and litigation law

firm, practices exclusively in the field of securities arbitration

and litigation, on behalf of retail and institutional investors.

The firm represents investors throughout the world in securities

arbitration and litigation matters against major Wall Street

brokerage firms.

Destination:

http://www.perdidasenbonospr.com/en/klayman-toskes-pa-and-carlo-law-offices-comments-on-sp-credit-downgrade-in-puerto-rico-general-obligation-debt/

CONTACT: Klayman & Toskes, P.A.

Steven D. Toskes, 787-919-7325

stoskes@nasd-law.com

www.nasd-law.com

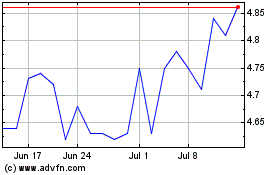

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

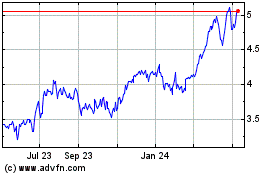

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024