Report of Foreign Issuer (6-k)

April 23 2015 - 4:06PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of April, 2015

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X

Form 40-F

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

No X

Banco Santander, S.A.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

Santander Asset Management and

Pioneer Investments to join forces to create a leading global asset manager in Europe and Latin America |

|

|

|

• Preliminary agreement reached to combine Pioneer Investments and Santander Asset Management

into a €353 billion global asset management firm in Europe and Latin America. |

|

|

|

• The new company will be called Pioneer Investments |

|

|

|

• The deal values Santander Asset Management at

€2.6 billion and Pioneer Investments at €2.75 billion. |

|

|

|

Madrid, April

23, 2015. Banco Santander and its partners Warburg Pincus and General Atlantic have reached a preliminary and exclusive agreement, subject to the signing of final terms, to merge Santander Asset Management and

Pioneer Investments to create a leading global asset manager in Europe and Latin America. The combined company, with approximately €353 billion in assets under management at the close of 2014,

will be called Pioneer Investments. |

|

|

|

This partnership will mean substantial scale enhancement for

the new asset manager in an industry where critical mass is a competitive advantage. The combined company will also have greater diversification, in both mature and high growth markets, in terms of products, client base and distribution

channels. |

|

|

|

The new company is expected to deliver enhanced growth and

profitability with an improved strategic focus and a solid growth trajectory. This will add to already strong performance for the combined company, with total net inflows in 2013 and 2014 of €43

billion. |

|

|

|

Furthermore, the long term distribution agreements with

Santander and UniCredit will mean unparalleled retail distribution capabilities in Europe and Latin America, to go in unison with the combined company’s powerful third party and institutional distribution capabilities. Added to this is the

potential for significant synergy generation through the cross selling of complementary products. |

|

|

|

|

Clients will benefit from the partnership between the two

managers which will improve and strengthen their product and service offering, while adding even greater focus and alignment for management. |

|

|

|

|

|

|

|

|

|

Comunicación Externa. Ciudad Grupo Santander Edificio

Arrecife Pl. 2 28660 Boadilla del Monte (Madrid) Telf.: 34 91 289 52 11

email:comunicacionbancosantander@gruposantander.com www.santander.com - Twitter: @bancosantander |

|

|

The agreement foresees the creation of a new company into which the local asset

managers of Santander Asset Management and Pioneer will be incorporated. Santander will have a direct 33.3% stake in the new company, UniCredit a 33.3% stake, and private equity fund managers Warburg Pincus and General Atlantic will share a 33.3%

stake. Pioneer´s operations in the United States will not be included in the new company but will be owned by UniCredit (50%) and Warburg Pincus and General Atlantic (50%).

Juan Alcaraz, current CEO of Santander Asset Management, will be the Chief Executive Officer of the new company and

Giordano Lombardo, current CEO and CIO of Pioneer Investment, will be the Chief Investment Officer of the new company.

The transaction values Santander Asset Management at €2.6

billion and Pioneer Investment at €2.75 billion. Warburg Pincus and General Atlantic will make an additional equity investment into the company as part of the transaction. This transaction will

not have any material impact in the Santander Group’s capital. Following the signing of the preliminary agreement, the parties will work towards signing a definitive and legally binding agreement which will be subject to the customary

regulatory and corporate approvals.

Santander Asset Management

Santander Asset Management is an independent and global asset manager with strong local roots in Europe and Latin

America. With a presence in 11 countries, it has assets of €172.5 billion across all types of investment vehicles, from investment funds and pension plans to institutional mandates. Santander

Asset Management’s investment solutions include specialised mandates in European and Latin American fixed and variable income.

Santander Asset Management has over 755 employees worldwide, of which around 220 are investment professionals with

over ten years of experience in asset management. Its investment process, the analytical capabilities of local teams and strict risk control facilitate an in-depth knowledge of market opportunities as well as the varying needs of its customers, and

are a distinguishing feature of Santander Asset Management.

Pioneer Investments

Pioneer is a leading independent global asset manager with a presence in 28 countries and an experienced team of over

2,000 employees, including more than 350 investment professionals. Pioneer is known internationally as one of the leading fixed income managers across all strategies, and offers strong capabilities in European, US and global equities, as well as

multi-asset and outcome-oriented, non-traditional products.

Pioneer manages €225 billion in assets, evenly split between proprietary distribution via UniCredit on one side, and intermediary and institutional clients globally on the other. In 2014, Pioneer had over €13 billion global net sales, and ranked among the top 5 highest selling asset managers in Europe and 10th worldwide.

|

|

|

|

|

|

|

|

|

Comunicación Externa. |

|

|

|

|

|

|

Ciudad Grupo Santander Edificio Arrecife Pl. 2 |

|

|

|

|

|

28660 Boadilla del Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com

www.santander.com - Twitter: @bancosantander |

|

2 |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Banco Santander, S.A. |

|

|

|

|

| Date: April 23, 2015 |

|

|

|

By: |

|

/s/ José García Cantera |

|

|

|

|

|

|

Name: José García Cantera |

|

|

|

|

|

|

Title: Chief Financial Officer |

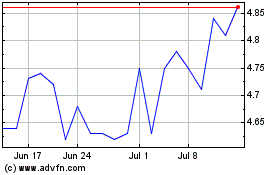

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

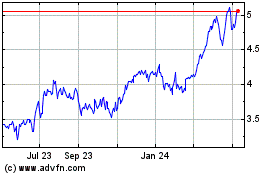

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024