FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March, 2015

Commission File Number: 001-12518

Banco

Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨

No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(7):

Yes ¨

No x

Banco Santander, S.A.

TABLE OF CONTENTS

|

|

|

| Item |

|

|

|

|

| 1 |

|

Press Release dated March 27, 2015 regarding General Shareholders Meeting |

PRESS RELEASE

GENERAL SHAREHOLDERS MEETING

Ana Botín:

“Santander is well positioned to face the challenges. We will lead change”

“Banco Santander has room for growth within our customer

base and in our ten core markets. We do not need to make acquisitions”.

“Our goal is that the dividend should follow the same trend as

profits generated by the Group, distributing between 30% and 40% of recurring profit”.

“As we did in 2014, we are confident our lending

in Spain will grow more than the market average”.

|

|

|

|

|

| Comunicación Externa.

Ciudad Grupo Santander Edificio Arrecife Pl. 2 28660 Boadilla del

Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com |

|

1 |

|

|

| |

• |

|

“During the 2014 year, total shareholder return was 17.2%, compared with an average of 2% for our competitors. The attention to and relationship with our shareholders has always been one of Santander’s

priorities, and will continue to be”. |

| |

• |

|

“It is just as important to offer a total return to our shareholders which is better than our competitors, as it is to obtain growth in earnings per share and dividends” |

| |

• |

|

“The financial sector today faces major challenges: developed markets are experiencing a period of very low interest rates; the new regulatory framework, which has more demanding standards; and the technological

revolution, which is changing consumer behaviour. Santander is well prepared to take on these challenges”. |

| |

• |

|

“Banco Santander’s business model sets us apart in the banking sector. We are a bank that is easy to understand and focused on retail banking. This model offers us a unique opportunity”.

|

| |

• |

|

“In the first two months of 2015, we increased credit facilities to SMEs and companies 3.9%, mortgages 26% and consumer credit 35%”. |

| |

• |

|

“Unemployment in Spain is the most important problem we need to solve as a country. As long as there are so many unemployed people, they should be our priority”. |

| |

• |

|

Our board is diverse and balanced. The changes made in the bank’s Board and the management team aim to provide the best prepared and most qualified team, and endow the group with the best international practices in

corporate governance”. |

|

|

|

|

|

| Comunicación Externa.

Ciudad Grupo Santander Edificio Arrecife Pl. 2 28660 Boadilla del

Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com |

|

2 |

|

|

Santander, March 27, 2015 –

Santander group executive chairman Ana Botín led the bank’s Annual General Meeting, which approved the 2014 accounts. Botín highlighted “the quality of last year’s profits (EUR 5,816 million, a 39.3% year-on-year

increase), which reflect an increase in gross operating profit in all the Group’s units and net improvement in results”. She also pointed out “the decrease in the NPL ratio to 5.2%, and in the cost of credit, which we are sure will

continue to improve, and the containment of costs, which increased below the inflation rate, placing our cost to income ratio at 47%, one of the best in the sector in Europe”.

Santander today

Ana Botín explained that

during the 2014 year, total shareholder return was 17.2%, 10% of which corresponds to the dividend and the rest to the increase in share price, versus our competitors’ average shareholder return of 2%. “Since the bank was founded, the

attention to and relationship with our shareholders has always been one of Santander’s priorities, and it will continue to be”.

“Today,

Banco Santander is at an excellent starting point”, she said, and praised “the work, strategic vision and leadership” of the former chairman, Emilio Botín. “Today, thanks to his aim, Santander is not only a larger

bank, but more diversified and sound, as evidenced by its resilience throughout the financial crisis”.

During her speech to shareholders, the

Santander group executive chairman went over the decisions that have been taken since her appointment to head the bank in four areas: corporate governance and board composition; the management team; the capital and dividend policy; and the strategic

review of our businesses and priorities. She explained that “the changes made to the bank’s board and management teams were intended to provide it with the best prepared and most qualified people and endow the group with the best

international practices in corporate governance. Banco Santander meets all recommendations as well as the highest standards of corporate governance. Our board is diverse and balanced: five of the 15 board members are executive and the 10

non-executive members have broad financial, regulatory and corporate expertise and knowledge of the markets where the Group operates. Of the ten non-executive members, eight are independent – representing 53% of the board. One third of the

board are women.

She also addressed the changes in the management team. She stressed the long track record of the group CEO, José Antonio

Álvarez. “He is the ideal person for this new stage. The rest of the appointments made are a natural part of this renewal process. They aim to strengthen those areas where the group wants to place special emphasis”, and pointed out

that the bank has strengthened its management teams in the United Kingdom, the United States, Brazil and Spain, among other changes.

Our operating

environment: opportunities and challenges

Regarding the economic environment, she said “the markets in which we operate have, in general, a

positive growth outlook. Spain is a clear example of this, as is the United Kingdom, the United States, Poland, Germany, Mexico and Chile. Brazil is going through a year of transition but the new Government is taking the necessary adjustment

measures so that the economy realises growth nearer its potential as soon as possible. The policy of the European Central Bank to promote greater liquidity will support Eurozone growth. The fall in oil prices and the depreciation of the euro will

also contribute to foment this progress”.

|

|

|

|

|

| Comunicación Externa.

Ciudad Grupo Santander Edificio Arrecife Pl. 2 28660 Boadilla del

Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com |

|

3 |

|

|

However, she said that the financial sector is faced

with “major challenges”, as the period of very low interest rates of mature markets and the new regulatory framework, with standards that are more demanding. “The important thing now is to resolve all the issues that are pending

definition as soon as possible and concentrate on implementing the measures needed. Furthermore, a continuous and global evaluation of the impact of the new regulatory framework will be needed to guarantee that an adequate balance is reached between

financial stability and economic growth.” Ana Botín added a third challenge: the technological revolution and new consumer behaviour, and added: “Our competitors are not only the traditional financial institutions or large shadow

banking funds, but also the major tech giants”.

Looking ahead

Ana Botín highlighted that “Santander is well prepared to take on these challenges” and emphasised that “Santander’s business model

sets us apart”. “We have a business model that stands out for geographic diversification; focus on retail banking; our independent subsidiaries model; the same culture and global brand; our balance sheet strength, prudent risk management

and global control frameworks; and our investment in innovation, digital transformation and our ability to share best practices between our different local units”. She added “we are not complicated to manage, nor difficult to understand,

nor do we operate a wide range of business lines scattered throughout a large number of markets. We are a bank that is easy to understand, and focused on retail banking. This model offers us a unique opportunity”.

Santander’s purpose and strategy

Santander

Group executive chairman said that “Santander’s purpose is to help people and businesses prosper. Our aim is to be the best retail bank, earning the lasting loyalty of our teams, customers, shareholders and communities”,

generating a virtuous cycle: “if our team feels motivated, committed and rewarded, they will do everything they can to help customers. If our customers receive excellent service and feel that we fulfil their needs, their loyalty towards the

bank will increase. When this happens, our profits and profitability grow, increasing the return for our shareholders. This will enable us to help society even more, increasing the sense of pride at belonging to our team”.

She explained how to build the best bank, and set out the priorities.

Teams

Santander group executive chairman said

that “our teams are first. One of our most important targets for 2017 is for Santander to be one of the top three banks for employees in most of our core countries”. Botín said that Santander Spain has announced a new policy to

promote a better work environment for its team, which includes issues as important as improving the organization and planning of work or the use of technology to work more flexibly.

Customers

Ana Botín reiterated that Banco

Santander has more than 100 million customers, 53 million of them are active, but only 13 million are loyal, in other words, customers that consider Santander their primary bank. “Our target is for the number of loyal customers,

both individuals and companies, to increase by around 40% by 2017, reaching 18 million.

|

|

|

|

|

| Comunicación Externa.

Ciudad Grupo Santander Edificio Arrecife Pl. 2 28660 Boadilla del

Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com |

|

4 |

|

|

Furthermore, she indicated that “we want to

continue consolidating our operational excellence model, improving our customer satisfaction levels. Offering digital services will be an essential part of this process”. She set a target for 2017 to reach 25 million digital customers, compared

with the present figure of 14 million and stressed that “the bank is investing heavily in developing a multi-channel distribution model where the customer is the focal point of our strategy”. She used as an example the success

achieved in the United Kingdom, where the number of mobile telephone customers surpassed one million in 2014 and more than a third of sales are carried out via digital channels, or Poland, which has a mobile bank considered one of the best in the

market. In Mexico, where the bank has developed a voice recognition system to identify customers.

“Banco Santander has room for growth within our

customer base and in our ten core markets. Hence, we do not need to make acquisitions”. “This doesn’t rule out looking at certain one-off investments, provided we add value for our shareholders”, she added.

Shareholders

During her speech, the chairman

referred to the capital increase carried out last January and to the dividend policy. “A strong capital base is key to take advantage of the opportunities for organic growth. For this reason, and after a detailed analysis of the different

options, at the beginning of this year the Board decided to raise 7.5 billion euros of capital. We went to the markets using an accelerated bookbuilding offer. The Board decided to use this option because it is less dilutive for shareholders.

Against a background of market uncertainty and high market volatility, any other alternative would have meant a greater discount and more dilution”. She pointed out the strong interest of investors (demand surpassed 50% of shares offered) and

that, after this transaction, CET1 fully loaded ratio is at 9.7%.

With respect to the dividend policy, Botín indicated that “keeping with the

Bank’s tradition, the goal was to continue to emphasize a cash dividend, in a way which is not dilutive and is sustainable and which grows along with the Group’s earnings”. As a result, the bank will pay a 0.20 euros per share

dividend charged against 2015 results with just one payment, corresponding to November, made via scrip for 0.05 euros while the rest be in cash. In 2015, shareholders will receive a total of 0.40 euros per share, of which 0.30 are charged against

fiscal year 2014 and 0.10 euros against the results of the current year, which means dividend yield per share of around 6%.

“Our goal is that the

dividend follow the same trend as the profits generated by the Group, with a pay-out ratio of between 30%-40%. This new policy is positive both for shareholders and for the bank. For the Board, it is just as important to offer a total return to

our shareholders which is better than our competitors, as it is to obtain growth in earnings per share and dividends” she said. The chairman also reiterated that the bank’s goals for 2017 are to reach ROTE of between 12% and 14% and

obtain a higher earnings per share than competitors.

Communities

Ana Botín also spoke about the bank’s support of communities. “The most important way in which we help communities is through investing in

education Banco Santander is today the world’s number one corporate contributor to education”, according to the report of the Varkey Foundation, in collaboration with Unesco. She pointed out that in 2014, the bank spent 146 million

euros on supporting research and education and helped 28,443 students with grants. She highlighted the commitment to spend another 700 million euros on universities over the next four years.

|

|

|

|

|

| Comunicación Externa.

Ciudad Grupo Santander Edificio Arrecife Pl. 2 28660 Boadilla del

Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com |

|

5 |

|

|

“Many elections will be taking place this year,

against a background of incipient recovery in Europe. It is the responsibility of political parties to make proposals to forge ahead with building a more prosperous Europe, of citizens to evaluate the options, and of the private sector and

companies to make further commitments to society and to continue investing with a long-term outlook”. “We need to work together to support entrepreneurs, companies, and to give them the tools, the confidence and the support they need

to help them be more competitive, and to grow and create more jobs. At Santander, this is what we are doing” she said. She announced that in the case of Spain, during the first two months of the year, new credit and loans to companies grew 3.9%

compared with 2014, mortgages 26% and consumer credit, 35%. “As we did in 2014, we are confident again this year that our lending in Spain will grow more than the market average”.

Ana Botín referred to the problem of unemployment, “the most important problem that we need to solve as a country”. “As long as there

are so many unemployed people, they should be our priority. We need to generate more jobs. And I think that for that to happen, economic growth is needed, along with social progress and always looking at the medium and long term. As Group Executive

Chairman of Santander, I want to stress that we will continue to work hard to contribute to the progress of the families and companies in Spain and other countries where we operate”.

To conclude, the chairman pointed out: “We have a clear strategy, and we have set ambitious targets. To achieve these targets, we have to change the way

we do things. Everything we do must be Simple, Personal and Fair. If we do things in a way which is simple, personal and fair, then we will manage to be the best retail and commercial bank, and earn the trust and loyalty of our employees,

customers, shareholders and communities”. And she concluded: “we have made Banco Santander one of the biggest success stories in Spain. We achieved this by overcoming uncertainty, prudently managing risk and energetically confronting

change. We are going to lead change. We are confident we can do so because we start from a solid foundation and, above all else, because we have a strategy designed for the future”.

José Antonio Álvarez: “ The profitability of the business will improve, and with it, returns for our shareholders”

During his speech, the chief executive officer of Banco Santander, José Antonio Álvarez, highlighted that the positive trends that marked the

start of the year, “will allow us to have confidence that the profitability of the business will continue and, with it, our shareholders’ profit”. Álvarez summarized the outlook and priorities for the coming years:

| |

• |

|

We have a good dynamic of volume growth and results. |

| |

• |

|

We have ample liquidity and capital to grow against a background of greater activity in our core markets. |

| |

• |

|

We know what to do to succeed commercially: place the customer at the centre of everything we do. |

|

|

|

|

|

| Comunicación Externa.

Ciudad Grupo Santander Edificio Arrecife Pl. 2 28660 Boadilla del

Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com |

|

6 |

|

|

| |

• |

|

We will maintain our focus on operational excellence to simplify internal processes, transform the bank digitally and improve efficiency and customer service. |

| |

• |

|

We are strengthening risk management, which as has always been a priority for Santander. |

| |

• |

|

We will use capital more efficiently, focusing on growth areas. |

| |

• |

|

We will simplify structures throughout the group. |

| |

• |

|

Our main goal is to improve return on equity. |

“These aspirations become ambitious goals for the medium

term whose ultimate aim is to create value for our teams, customers, shareholders and communities”, he said. The CEO reiterated the bank´s financial targets for 2017 and that “they should be reflected positively in shareholder

profit:

| |

• |

|

Our activity will increase at a greater rate than our main competitors, allowing gains in market share. |

| |

• |

|

Our operating efficiency will improve, positioning our costs over income below 45%. |

| |

• |

|

Permanently maintain NPLs below 5%. |

| |

• |

|

Maintain core capital ratios under Basel III of between 10% and 11%. |

| |

• |

|

Increase profit per share above our competitors and reach return on tangible equity of between 12% and 14%, with dividends distributed mainly in cash and in line with growth in profit”. |

|

|

|

|

|

| Comunicación Externa.

Ciudad Grupo Santander Edificio Arrecife Pl. 2 28660 Boadilla del

Monte (Madrid) Telf.: 34 91 289 52 11 email:comunicacionbancosantander@gruposantander.com |

|

7 |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Banco Santander, S.A. |

|

|

|

|

| Date: March 27, 2015 |

|

|

|

By: |

|

/s/ José García Cantera |

|

|

|

|

Name: |

|

José García Cantera |

|

|

|

|

Title: |

|

Chief Financial Officer |

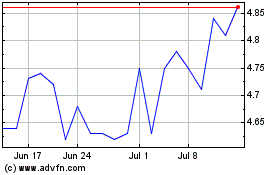

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

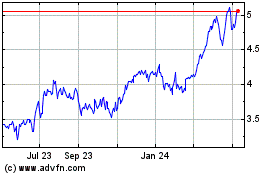

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024