AB InBev Acquires SpikedSeltzer Creator Boathouse Beverage

September 09 2016 - 6:00PM

Dow Jones News

Anheuser-Busch InBev NV is bringing its alcohol expertise to the

carbonated-water category with the acquisition of SpikedSeltzer

creator Boathouse Beverage LLC.

Financial terms of the deal announced Friday weren't

available.

SpikedSeltzer is made from fermented sugar that creates a

carbonated-water beverage with 6% alcohol by volume. It comes in

flavors like Valencia Orange, Cape Cod Cranberry and Indian River

Grapefruit.

The acquisition highlights the pressure on AB InBev and other

brewers to expand beyond beer, which has been losing share of the

total U.S. alcohol market to liquor and wine over the past 15

years. The erosion has led market-leader AB InBev and MillerCoors,

the No. 2 brewer in the U.S. by volume, to create an array of

hybrid brews like Bud Light Lime-A-Rita and Redd's Apple Ale, which

are made like beer but flavored to taste like a cocktail.

The expansion has sparked the creation of alcoholic sodas and

spawned brands like Not Your Father's Root Beer and Henry's Hard

Soda, which comes in ginger-ale and orange-soda varieties.

Retail sales of flavored malt beverages last year topped $2.04

billion, up 21% from $1.68 billion in 2012, according to market

research firm IRI. The beer category had $33.34 billion in sales

last year.

Flavored malt beverages also appeal to brewers because they

command a higher price. A case of flavored malt beverages cost

$34.30 as of Aug. 7, 50% more than the $22.88 a case of beer

commanded, according to IRI.

Boathouse Beverage has helped expand the category. It began

making alcoholic, carbonated-water beverages in 2013 and has

increased sales to more than 36,000 barrels from 5 gallons.

Its success attracted other brewers. Mark Anthony Group Inc.,

which makes Mike's Hard Lemonade, this year launched White Claw

Hard Seltzer, and Boston Beer Co., which makes Samuel Adams Boston

Lager, launched Truly Spiked & Sparkling.

"Everyone looks at this as a new hot category," said Townsend

Ziebold, a managing partner at First Beverage Group, which advised

SpikedSeltzer on the deal. "It's gluten free, low in carbs, and

it's a versatile drink."

AB InBev plans to expand SpikedSeltzer sales by plugging the

brand into its national network of 500-plus distributors.

Currently, SpikedSeltzer is only available in 14 states, and

Northeastern states like Connecticut and Massachusetts account for

a significant portion of sales.

Boathouse and AB InBev said the deal allows SpikedSeltzer to

expand its capacity so that it can meet current demand. Production

will shift from Boathouse Beverage's current producers, North

American Breweries and Blues City Brewery, to AB InBev's

Baldwinsville, N.Y., brewery.

The deal is the first craft acquisition by AB InBev since it

reached an agreement with the Justice Department last month. Under

that agreement, AB InBev needs Justice Department approval for the

acquisition of any brewers that generate at least $7.5 million in

annual gross revenue, but a person familiar with the deal said that

SpikedSeltzer fell below that threshold.

AB InBev has acquired eight craft brewers since 2011 when it

bought Chicago-based Goose Island for $38.8 million.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

September 09, 2016 17:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

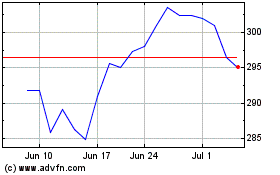

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

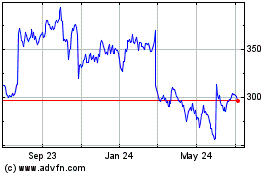

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Apr 2023 to Apr 2024