UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2015

The Boston Beer Company, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Massachusetts |

|

001-14092 |

|

04-3284048 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| One Design Center Place, Suite 850, Boston, MA |

|

02210 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (617) 368-5000

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4c under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition |

On July 30, 2015,

The Boston Beer Company, Inc. disclosed financial information for the second quarter of 2015 in an earnings release, a copy of which is set forth in the attached Exhibit 99.

The information in this Form 8-K and the Exhibit 99 attached hereto is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the

Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

As noted in the accompanying Earnings Release, on

July 29, 2015, the Board of Directors of the Boston Beer Company, Inc. authorized an increase in the aggregate expenditure limit for the Company’s stock repurchase program by $75.0 million, from $400.0 million to $475.0 million.

| Item 9.01 |

Financial Statements and Exhibits |

Exhibit 99 – Earnings Release of

The Boston Beer Company, Inc. dated July 30, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

The Boston Beer Company, Inc.

(Registrant) |

|

|

|

| Date: July 30, 2015 |

|

|

|

/s/ William F.

Urich |

|

|

|

|

William F. Urich |

|

|

|

|

Chief Financial Officer |

Exhibit 99

|

|

|

|

|

| Investor Relations Contact: |

|

|

|

Media Contact: |

| Jennifer Larson |

|

|

|

Jessica Paar |

| (617) 368-5152 |

|

|

|

(617) 368-5060 |

BOSTON BEER REPORTS

SECOND QUARTER 2015 RESULTS

BOSTON, MA

(7/30/15) — The Boston Beer Company, Inc. (NYSE: SAM) reported second quarter 2015 net revenue of $252.2 million, an increase of $20.6 million or 9%, over the same period last year, mainly due to core shipment growth of 7%. Net income for

the second quarter increased 16% to $29.9 million, or $2.18 per diluted share, an increase of $4.5 million or $0.30 per diluted share, from the second quarter of 2014. This increase was primarily due to shipment increases, improved gross margins and

a slightly lower income tax rate, partially offset by increased investments in advertising, promotional and selling expenses.

Earnings per diluted share

for the 26-week period ended June 27, 2015 were $3.18, an increase of $0.69 from the comparable 26-week period in 2014. Net revenue for the 26-week period ended June 27, 2015 was $451.7 million, an increase of $36.3 million, or 9%, from

the comparable 26-week period in 2014.

Highlights of this release include:

| |

• |

|

Depletions grew 6% and 7% from the comparable 13 and 26 week periods in the prior year. |

| |

• |

|

Gross margin was 54% for the second quarter and 52% for first half of the year, with the Company maintaining its full year gross margin target of between 51% and 53%. |

| |

• |

|

Advertising, promotional and selling expenses increased by $5.4 million or 8% in the quarter, primarily due to planned increased investments behind the Company’s brands. |

| |

• |

|

Full year 2015 depletions growth is now estimated to be between 6% and 9%, a decrease from the previously communicated estimate of 8% to 12%. |

| |

• |

|

Full year 2015 estimated earnings per diluted share remain unchanged at $7.10 to $7.50. |

| |

• |

|

Full year 2015 capital spending is now estimated to be between $70 million to $100 million, a decrease from the previously communicated estimated range of $80 million to $110 million. |

Jim Koch, Chairman and Founder of the Company, commented, “Our total company depletion trends of 6% in the second quarter of 2015 have slowed in

comparison to prior quarters due to some developing weakness in our Samuel Adams brand. While our total growth is testament to our strategy of a diversified brand portfolio, our Samuel Adams trends appear to represent a very competitive category

where drinkers are facing greatly increased choices and established brands are being impacted. We believe that quality,

freshness, innovation and variety will be the basic requirements for success in this environment. We believe that craft beer will continue to grow and that we are positioned to share in that

growth through the quality of our brands and beers, our innovation and speed to market capability and our sales execution, along with our strong financial position and ability to invest in growing our brands. We were delighted to learn that, for the

seventh year in a row, our distributors ranked us the number one beer supplier in the industry, in the annual poll of beer distributors conducted by Tamarron Consulting, a consulting firm specializing in the alcohol beverage distribution

industry. This is a testament to the efforts of all Boston Beer employees to service and support our distributors’ businesses and to the relationships we have built with them.”

Martin Roper, the Company’s President and CEO stated, “In the second quarter, our depletions growth benefited from strength in our Angry Orchard,

Twisted Tea and Traveler brands that offset declines in some of our Samuel Adams styles. The decline in some of our Samuel Adams styles is due to increased competition, which particularly impacted Boston Lager and some of our seasonal beers.

Accordingly, we have decreased our expectations for full-year depletions growth to between 6% and 9% to reflect the most recent trends. We are working hard to improve the Sam Adams brand trends and in the second half of the year we expect to

introduce new packaging and advertising to support our planned promotional activity. The national rollout of our Traveler brand is currently in progress supported by national media and in mid-July we began our national rollout of Coney Island Hard

Root Beer. Both these rollouts are being well-supported by distributors, retailers and drinkers. We are pleased with Traveler’s progress this year, but it is too early to tell how successful the Coney Island Hard Root Beer introduction will be.

We are planning continued investments in advertising, promotional and selling expenses, as well as in innovation, commensurate with the opportunities and the increased competition that we see.”

Mr. Roper went on to say, “We continue to focus on our supply chain with ongoing investments in improved training, stable scheduling, and operating

efficiency and reliability improvements. While we have made progress, we believe we still have capacity and cost improvement opportunities. We also continue to make supply chain improvements intended to further increase the freshness of our beers

and enhance our customer service. This includes piloting one wholesaler on a pure replenishment service model within our Freshest Beer Program, which if successful would further reduce wholesaler inventories. Looking forward, we expect to maintain a

high level of brand investment, as we pursue sustainable growth and innovation. We remain prepared to forsake the earnings that may be lost as a result of these investments in the short term, as we pursue long term profitable growth.”

2nd Quarter 2015 Summary of Results

Depletions

grew 6% from the comparable 13-week period in the prior year, primarily due to depletion increases across our Angry Orchard®, Twisted Tea® and Traveler brands, partially offset by declines in Samuel Adams® brand.

Core shipment volume was approximately 1.1 million barrels, a 7% increase compared to the second quarter of

2014.

The Company believes distributor inventory levels at June 27, 2015 were appropriate. Inventory at distributors participating in the Freshest

Beer Program at June 27, 2015 was equal in terms of days of inventory on hand when compared to June 28, 2014. The Company has over 69% of its volume in the Freshest Beer Program and it believes participation in the Program could reach 75%

of its volume by the end of 2015.

Gross margin increased to 54% compared to 53% in the second quarter of 2014. The margin increase was a result of price

increases and lower ingredient costs partially offset by product mix effects.

Advertising, promotional and selling expenses were $5.4 million higher than

costs incurred in the second quarter of 2014. The increase was primarily a result of increased investments in media advertising, increased costs for additional sales personnel and commissions, point of sale, and increased freight to distributors due

to higher volumes.

General and administrative expenses increased $1.4 million compared to the second quarter of 2014, primarily due to increases in

salary and benefit costs and consulting costs.

The Company’s effective tax rate decreased to 36.2% from 37.5% in the second quarter of 2014. The

2015 rate was a result of the favorable impact of lower state tax rates.

Year-to-Date 2015 Summary of Results

Depletions grew by 7% from the comparable 26-week period in 2014, primarily due to depletion increases across our Angry Orchard, Twisted Tea and Traveler

brands, partially offset by declines in Samuel Adams brand.

Core shipment volume was approximately 2.0 million barrels, a 6% increase from the

comparable 26-week period in 2014.

Advertising, promotional and selling expenses were $4.4 million higher than costs incurred in the comparable 26-week

period in 2014. The increase was primarily a result of increased investments in media advertising, increased costs for additional sales personnel and commissions, and increased freight to distributors due to higher volumes.

General and administrative expenses increased by $2.7 million from the comparable 26-week period in 2014, due to increases in salary and benefit costs and

consulting costs.

The Company’s effective tax rate decreased to 36.4% from 37.4% in the first half of 2014. The 2015 rate was a result of the

favorable impact of lower state tax rates.

The Company expects that its June 27, 2015 cash balance of $147.0 million, together with its future

operating cash flows and its $150.0 million line of credit, will be sufficient to fund future cash requirements.

During the 26-week period ended

June 27, 2015 and the period from June 28, 2015 through July 24, 2015, the Company repurchased approximately 170,000 shares of its Class A Common Stock for an aggregate purchase price of approximately $41.4 million. As of

July 24, 2015 the Company had approximately $51.2 million remaining on the $400.0 million share buyback expenditure limit set by the Board of Directors. On July 29, 2015 the Board of Directors approved an increase of $75.0 million to the

previously approved $400.0 million share buyback expenditure limit, for a new limit of $475.0 million.

Depletion estimates

Year-to-date depletions through the 29-week period ended July 18, 2015 are estimated by the Company to be up approximately 6% from the comparable period

in 2014.

Outlook

The Company has left

unchanged its projected 2015 earnings per diluted share of between $7.10 and $7.50. The Company’s actual 2015 earnings per share could vary significantly from the current projection. Underlying the Company’s current projection are the

following estimates and targets:

| |

• |

|

Depletions and shipments growth of between 6% and 9%. |

| |

• |

|

National price increases of between 1% and 2%. |

| |

• |

|

Gross margins of between 51% and 53%. |

| |

• |

|

Increased investment in advertising, promotional and selling expenses of between $25 million and $35 million. This does not include any increases in freight costs for the shipment of products to the Company’s

distributors. |

| |

• |

|

Increased expenditures of between $10 million to $15 million for continued investment in Traveler and other existing brands developed by Alchemy & Science, which are included in the full year estimated

increases in advertising, promotional and selling expenses. These estimates could change significantly and 2015 volume from these brands is unlikely to cover these and other potential Alchemy & Science brand investments. |

| |

• |

|

Effective tax rate of approximately 37%, a decrease from the previously communicated estimate of 38% due to the favorable impact of lower state tax rates. |

| |

• |

|

Capital spending of between $70 million and $100 million, which could be significantly higher, dependent on capital required to meet future growth. These estimates include capital investments for existing

Alchemy & Science projects of between $3 million and $5 million. |

About the Company

The Boston Beer Company, Inc. (NYSE: SAM) began in 1984 and today brews more than 60 styles of Samuel Adams beer. Our portfolio of brands also includes Angry

Orchard Hard Cider and Twisted Tea, as well as several other craft beer brands brewed by Alchemy & Science, our craft beer incubator. For more information, please visit our investor relations website at www.bostonbeer.com, which includes

links to all of our respective brand websites.

Forward-Looking Statements

Statements made in this press release that state the Company’s or management’s intentions, hopes, beliefs, expectations or predictions of the future

are forward-looking statements. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Additional information concerning factors that could cause actual results

to differ materially from those in the forward-looking statements is contained from time to time in the Company’s SEC filings, including, but not limited to, the Company’s report on Form 10-K for the years ended December 27, 2014 and

December 28, 2013. Copies of these documents may be found on the Company’s website, www.bostonbeer.com, or obtained by contacting the Company or the SEC.

Thursday, July 30, 2015

THE BOSTON BEER COMPANY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen weeks ended |

|

|

Twenty-six weeks ended |

|

| |

|

June 27,

2015 |

|

|

June 28,

2014 |

|

|

June 27,

2015 |

|

|

June 28,

2014 |

|

|

|

|

|

|

| Barrels sold |

|

|

1,125 |

|

|

|

1,054 |

|

|

|

2,014 |

|

|

|

1,892 |

|

|

|

|

|

|

| Revenue |

|

$ |

268,721 |

|

|

$ |

247,365 |

|

|

$ |

481,555 |

|

|

$ |

444,735 |

|

| Less excise taxes |

|

|

16,517 |

|

|

|

15,754 |

|

|

|

29,848 |

|

|

|

29,279 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

|

252,204 |

|

|

|

231,611 |

|

|

|

451,707 |

|

|

|

415,456 |

|

| Cost of goods sold |

|

|

115,979 |

|

|

|

108,515 |

|

|

|

215,866 |

|

|

|

201,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

136,225 |

|

|

|

123,096 |

|

|

|

235,841 |

|

|

|

213,615 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Advertising, promotional and selling expenses |

|

|

71,370 |

|

|

|

65,922 |

|

|

|

131,618 |

|

|

|

127,179 |

|

| General and administrative expenses |

|

|

18,036 |

|

|

|

16,681 |

|

|

|

35,265 |

|

|

|

32,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

89,406 |

|

|

|

82,603 |

|

|

|

166,883 |

|

|

|

159,731 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

46,819 |

|

|

|

40,493 |

|

|

|

68,958 |

|

|

|

53,884 |

|

| Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income (expense), net |

|

|

11 |

|

|

|

(5 |

) |

|

|

7 |

|

|

|

(9 |

) |

| Other income (expense), net |

|

|

54 |

|

|

|

201 |

|

|

|

(271 |

) |

|

|

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income (expense), net |

|

|

65 |

|

|

|

196 |

|

|

|

(264 |

) |

|

|

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income tax provision |

|

|

46,884 |

|

|

|

40,689 |

|

|

|

68,694 |

|

|

|

53,940 |

|

| Provision for income taxes |

|

|

16,952 |

|

|

|

15,261 |

|

|

|

25,019 |

|

|

|

20,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

29,932 |

|

|

$ |

25,428 |

|

|

$ |

43,675 |

|

|

$ |

33,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share - basic |

|

$ |

2.24 |

|

|

$ |

1.95 |

|

|

$ |

3.28 |

|

|

$ |

2.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share - diluted |

|

$ |

2.18 |

|

|

$ |

1.88 |

|

|

$ |

3.18 |

|

|

$ |

2.49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of common shares - Class A basic |

|

|

9,748 |

|

|

|

9,196 |

|

|

|

9,673 |

|

|

|

9,097 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of common shares - Class B basic |

|

|

3,532 |

|

|

|

3,770 |

|

|

|

3,575 |

|

|

|

3,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of common shares - diluted |

|

|

13,667 |

|

|

|

13,486 |

|

|

|

13,650 |

|

|

|

13,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

|

|

(5 |

) |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Comprehensive income |

|

$ |

29,927 |

|

|

$ |

25,428 |

|

|

$ |

43,676 |

|

|

$ |

33,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE BOSTON BEER COMPANY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

June 27,

2015 |

|

|

December 27,

2014 |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

146,983 |

|

|

$ |

76,402 |

|

| Accounts receivable, net of allowance for doubtful accounts of $30 and $144 as of June 27, 2015 and December 27, 2014,

respectively |

|

|

52,575 |

|

|

|

36,860 |

|

| Inventories |

|

|

57,119 |

|

|

|

51,307 |

|

| Prepaid expenses and other current assets |

|

|

13,776 |

|

|

|

12,887 |

|

| Income tax receivable |

|

|

3,517 |

|

|

|

21,321 |

|

| Deferred income taxes |

|

|

7,288 |

|

|

|

8,685 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

281,258 |

|

|

|

207,462 |

|

|

|

|

| Property, plant and equipment, net |

|

|

397,853 |

|

|

|

381,569 |

|

| Other assets |

|

|

9,719 |

|

|

|

12,447 |

|

| Goodwill |

|

|

3,683 |

|

|

|

3,683 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

692,513 |

|

|

$ |

605,161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

46,012 |

|

|

$ |

35,576 |

|

| Accrued expenses and other current liabilities |

|

|

72,356 |

|

|

|

74,594 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

118,368 |

|

|

|

110,170 |

|

|

|

|

| Deferred income taxes |

|

|

51,182 |

|

|

|

50,717 |

|

| Debt and capital lease obligations, less current portion |

|

|

471 |

|

|

|

528 |

|

| Other liabilities |

|

|

7,810 |

|

|

|

7,606 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

177,831 |

|

|

|

169,021 |

|

|

|

|

| Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Class A Common Stock, $.01 par value; 22,700,000 shares authorized; 9,783,399 and 9,452,375 issued and outstanding as of

June 27, 2015 and December 27, 2014, respectively |

|

|

98 |

|

|

|

95 |

|

| Class B Common Stock, $.01 par value; 4,200,000 shares authorized; 3,467,355 and 3,617,355 issued and outstanding as of June 27,

2015 and December 27, 2014 |

|

|

35 |

|

|

|

36 |

|

| Additional paid-in capital |

|

|

282,554 |

|

|

|

224,909 |

|

| Accumulated other comprehensive loss, net of tax |

|

|

(1,132 |

) |

|

|

(1,133 |

) |

| Retained earnings |

|

|

233,127 |

|

|

|

212,233 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

514,682 |

|

|

|

436,140 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

692,513 |

|

|

$ |

605,161 |

|

|

|

|

|

|

|

|

|

|

THE BOSTON BEER COMPANY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASHFLOWS

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Twenty-six weeks ended |

|

| |

|

June 27,

2015 |

|

|

June 28,

2014 |

|

|

|

|

| Cash flows provided by operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

43,675 |

|

|

$ |

33,743 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

20,455 |

|

|

|

15,391 |

|

| Loss on disposal of property, plant and equipment |

|

|

339 |

|

|

|

71 |

|

| Bad debt (recovery) expense |

|

|

(49 |

) |

|

|

120 |

|

| Stock-based compensation expense |

|

|

3,632 |

|

|

|

3,937 |

|

| Excess tax benefit from stock-based compensation arrangements |

|

|

(12,847 |

) |

|

|

(8,131 |

) |

| Deferred income taxes |

|

|

1,862 |

|

|

|

(101 |

) |

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(15,666 |

) |

|

|

(15,881 |

) |

| Inventories |

|

|

(5,812 |

) |

|

|

(7,935 |

) |

| Prepaid expenses, income tax receivable and other assets |

|

|

33,201 |

|

|

|

(3,500 |

) |

| Accounts payable |

|

|

11,570 |

|

|

|

2,724 |

|

| Accrued expenses and other current liabilities |

|

|

(2,430 |

) |

|

|

17,766 |

|

| Other liabilities |

|

|

424 |

|

|

|

116 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

78,354 |

|

|

|

38,320 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows used in investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property, plant and equipment |

|

|

(38,880 |

) |

|

|

(88,451 |

) |

| Cash paid for other intangible assets |

|

|

(100 |

) |

|

|

— |

|

| Decrease in restricted cash |

|

|

57 |

|

|

|

55 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(38,923 |

) |

|

|

(88,396 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows provided by financing activities: |

|

|

|

|

|

|

|

|

| Repurchase of Class A Common Stock |

|

|

(22,782 |

) |

|

|

— |

|

| Proceeds from exercise of stock options |

|

|

40,332 |

|

|

|

23,126 |

|

| Cash paid on note payable |

|

|

(54 |

) |

|

|

(53 |

) |

| Excess tax benefit from stock-based compensation arrangements |

|

|

12,847 |

|

|

|

8,131 |

|

| Net proceeds from sale of investment shares |

|

|

807 |

|

|

|

630 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

|

31,150 |

|

|

|

31,834 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in cash and cash equivalents |

|

|

70,581 |

|

|

|

(18,242 |

) |

|

|

|

| Cash and cash equivalents at beginning of year |

|

|

76,402 |

|

|

|

49,524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

146,983 |

|

|

$ |

31,282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

| Income taxes paid |

|

$ |

9,738 |

|

|

$ |

7,605 |

|

|

|

|

|

|

|

|

|

|

| (Decrease) increase in accounts payable for purchase of property, plant and equipment |

|

$ |

(1,134 |

) |

|

$ |

7,950 |

|

|

|

|

|

|

|

|

|

|

Copies of The Boston Beer Company’s press releases, including quarterly financial results,

are available on the Internet at www.bostonbeer.com

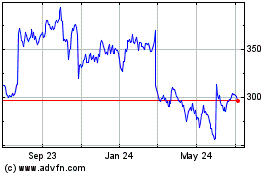

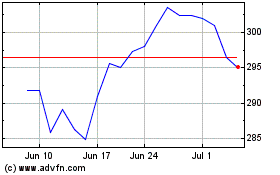

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Apr 2023 to Apr 2024