UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| Check

the appropriate box: |

|

Preliminary

Proxy Statement |

|

CONFIDENTIAL,

FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(E)(2)) |

|

Definitive

Proxy Statement |

|

Definitive

Additional Materials |

|

Soliciting

Material Pursuant to ss.240.14a-12 |

THE BOSTON BEER COMPANY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4)

and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| |

|

(set

forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

(5) |

Total

fee paid: |

|

Fee paid previously with preliminary materials. |

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount

Previously Paid: |

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

(3) |

Filing

Party: |

| |

(4) |

Date

Filed: |

April 15, 2015

Dear Fellow Stockholder:

It is my pleasure to invite you to attend

our 2015 Annual Meeting of Stockholders on May 27, 2015 at 9:00 a.m., Eastern Time, at our Samuel Adams Brewery, located at 30

Germania Street, Boston, Massachusetts.

At the Annual Meeting you will be asked

to elect three Class A Directors and cast an advisory vote on executive compensation. As the sole holder of Class B Common Stock,

I will elect five Class B Directors and cast a vote to ratify the selection of our independent registered public accounting firm.

At the Annual Meeting each year, it is always

a joy for me to share with you news about our company and samples of the beers that will support our long-term growth. More importantly,

the meeting is an opportunity for you to ask questions and express opinions about the company, regardless of the number of shares

that you own.

The Proxy Statement and Boston Beer’s

Annual Report for the fiscal year ended December 27, 2014 are available at www.bostonbeer.com.

On behalf of the Board of Directors and

Boston Beer’s management team, I thank you for your continued confidence and support of Boston Beer and our beers.

Cheers!

Jim Koch

Founder, Brewer, and

Chairman of the Board of Directors

Notice

of the 2015

Annual Meeting of Stockholders

May 27, 2015

9:00 A.M., Eastern Time

Samuel Adams Brewery, 30 Germania Street, Boston, Massachusetts

To our Stockholders:

The 2015 Annual Meeting of the Stockholders

of The Boston Beer Company, Inc. (“Boston Beer”, the “Company”, “we”, or “us”)

will be held on Wednesday, May 27, 2015, at 9:00 a.m. at the Samuel Adams Brewery located at 30 Germania Street, Boston, Massachusetts.

The Class A Stockholders will meet for the following

purposes:

| |

1. |

For the election of three (3) Class A Directors, each to serve for

a term of one (1) year; |

|

| |

2. |

To conduct an advisory vote to approve the compensation of our Named

Executive Officers; and |

|

| |

3. |

To consider and act upon any other business that may properly come

before the meeting. |

|

The sole holder of Class B Stock will attend for the

following purposes:

| |

1. |

For the election of five (5) Class B Directors, each to serve for

a term of one (1) year; |

|

| |

2. |

To ratify the selection of Deloitte Touche

Tohmatsu Limited (“Deloitte”) as our independent registered public accounting firm for the 2015 fiscal year; and |

|

| |

3. |

To consider and act upon any other business that may properly come

before the meeting. |

|

| |

These items of business are more fully

described in the Proxy Statement accompanying this Notice. The Board of Directors has fixed the close of business on March 30,

2015 as the Record Date for the meeting. Only stockholders of record on that date are entitled to notice of and to vote at the

meeting. |

|

| |

|

|

|

|

| |

YOUR VOTE IS VERY IMPORTANT. WHETHER

OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE. You may submit

your proxy: (1) by mail using a traditional proxy card; (2) by calling the toll-free number listed on your proxy card; or (3)

through the internet, as described in the enclosed materials. If you receive more than one proxy because you own shares registered

in different names or addresses, each proxy should be voted. This Proxy Statement and accompanying proxy are being distributed

on or about April 15, 2015. |

|

| |

|

|

|

|

| |

|

|

|

|

| |

April 15, 2015 |

|

Kathleen H. Wade |

|

| |

|

|

Corporate Secretary |

|

| |

|

|

|

|

| |

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 27, 2015 |

|

| |

|

|

|

|

| |

The Notice of Annual Meeting, Proxy Statement,

and the Annual Report to Stockholders (the “Proxy Materials”) are available on the internet. You may access the Proxy

Materials at http://www.bostonbeer.com. |

|

YOUR VOTE IS IMPORTANT!

Whether or not you plan to attend our Annual

Meeting, please vote as soon as possible. Under New York Stock Exchange rules, your broker will NOT be able to vote your shares

unless they receive specific instructions from you. We strongly encourage you to vote.

We have been advised that many states

are strictly enforcing escheatment laws and requiring shares held in “inactive” accounts to be escheated to the state

in which the shareholder was last known to reside. One way you can ensure that your account remains active is to vote your shares.

We encourage you to vote by the internet

or telephone. It is convenient for you and saves us significant postage and processing costs. To vote by the internet, go to http://www.envisionreports/sam

and follow the steps outlined on the secured website. To vote by telephone, call toll free at 1-800-652-8683. Internet and

telephone voting for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. ET on May 26, 2015.

Table of Contents

Proxy Summary

This summary highlights information contained

elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider regarding the proposals

being presented at the Annual Meeting. We recommend that you read the entire Proxy Statement before casting your vote.

Online Availability of Proxy Materials

Your proxy is being solicited for the Annual

Meeting. A Notice of the Online Availability of Proxy Materials has been mailed to all stockholders of record advising that they

can: (1) view all Proxy Materials online; or (2) request a paper or email copy of the Proxy Materials free of charge. We encourage

stockholders to access their Proxy Materials online to reduce the environmental impact and cost of our proxy solicitation.

Eligibility to Vote

Only stockholders of record are eligible

to vote at the Annual Meeting. You can vote if you held shares of Class A or Class B Common Stock as of the close of business

on March 30, 2015. Each outstanding share of Boston Beer’s Class A and Class B Common Stock entitles the stockholder to

one (1) vote on each matter properly brought before the Class.

2014 Business Highlights

Boston Beer’s business goal is to

become the leading supplier in the “Better Beer” and Hard Cider categories by creating and offering high quality full-flavored

beers and hard ciders. With the support of a large, well-trained sales organization and world-class brewers, we strive to achieve

this goal by offering great beers and hard ciders and increasing brand availability and awareness through distribution, advertising,

point-of-sale, promotional programs, and drinker education.

In late 2013, our Board of Directors and

Executive Officers established several strategic and financial goals designed to increase sales and profitability, aggressively

manage price and costs to achieve delivered gross margin and earnings goals, invest in our supply chain to meet demand and deliver

great beers and hard ciders at competitive economics, and build an organization capable of driving growth and operating our breweries

safely, while improving operational efficiencies, optimizing costs, and reducing risk. To that end, in 2014 our significant accomplishments

included:

| • |

Net revenue of $903.0 million, an increase of $163.9

million, or 22%, from 2013 |

| |

|

| • |

Earnings per diluted share of $6.69, an increase

of $1.51, or 29%, compared to 2013 earnings per diluted share |

| |

|

| • |

Depletions (sales by our wholesalers to retailers)

growth of slightly below 22% |

| |

|

| • |

Shipments (our sales to our wholesalers) growth of

20% |

| |

|

| • |

Cash and cash equivalents on hand as of the end of

the 2014 fiscal year of $76.4 million |

| |

|

| •

|

Capital expenditures of approximately $151.8 million

to expand our capacity, strengthen our organizational capability, and support the growth and increasing complexity of our

business |

Voting Matters and Board Recommendations

| Item

# |

|

Voting Matters |

|

Board Recommendation |

| Item 1 |

|

The election of each of the nominees for Class A Director, to be decided by

plurality vote of the holders of Class A Common Stock present in person or represented by proxy. |

|

FOR each

Director Nominee |

| Item 2 |

|

The non-binding advisory vote to approve the compensation of our Named Executive Officers, to be voted on by the holders

of Class A Common Stock present in person or by proxy. |

|

FOR |

| Item 3 |

|

The election of each of the nominees for Class B Director, to be decided by

the affirmative vote of the sole holder of the outstanding shares of Class B Common Stock. |

|

FOR each

Director Nominee |

| Item 4 |

|

The ratification of Deloitte as our independent registered public accounting firm,

to be decided by the affirmative vote of the Class B Stockholder. |

|

FOR |

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 7

2015 Proxy Statement 7

Board Nominees

Class A Director Nominees

| Name |

|

Age |

|

Director

Since |

|

Principal

Occupation |

|

Committees |

| David A. Burwick |

|

53 |

|

2005 |

|

President and CEO of Peet’s Coffee & Tea, Inc. |

|

Nom/Gov (Chair), Comp |

| Pearson C. Cummin, III |

|

72 |

|

1995 |

|

Managing Member of Grey Fox Associates, LLC |

|

Comp (Chair), Audit |

| Jean-Michel

Valette* |

|

54 |

|

2003 |

|

Chairman, Select Comfort Corporation |

|

Audit, Nom/Gov |

| |

|

|

|

|

|

|

|

|

| Class B Director

Nominees |

| |

|

|

|

|

|

|

|

|

| Name |

|

Age |

|

Director

Since |

|

Principal

Occupation |

|

Committees |

| Cynthia A. Fisher |

|

54 |

|

2012 |

|

Founder, Managing Director of WaterRev, LLC |

|

- |

| C. James Koch |

|

65 |

|

1995 |

|

Founder and Chairman of Boston Beer |

|

- |

| Jay Margolis |

|

66 |

|

2006 |

|

Chairman of Intuit Consulting LLC |

|

Audit, Comp, Nom/Gov |

| Martin F. Roper |

|

52 |

|

1999 |

|

President/CEO of Boston Beer |

|

- |

| Gregg

A. Tanner |

|

58 |

|

2007 |

|

CEO of Dean Foods Company |

|

Audit (Chair) |

Abbreviations: Audit=Audit Committee; Comp=Compensation Committee;

Nom/Gov=Nominating/Governance Committee

* Lead Director

Named Executive Officers

For the fiscal year ended December 27, 2014,

Boston Beer’s “Named Executive Officers” consisted of President and Chief Executive Officer Martin F. Roper,

Treasurer and Chief Financial Officer William F. Urich, and the next four most-highly compensated Executive Officers, namely Founder

and Chairman C. James Koch, Vice President of Operations Thomas W. Lance, Vice President of Sales John C. Geist, and Vice President

of Brand Development Robert P. Pagano.

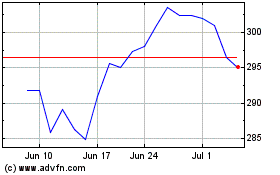

Executive Compensation

Boston Beer’s executive compensation

program is designed to attract, motivate, reward, and retain highly competent executives, with a focus on pay for performance

through bonuses linked to company and individual performance targets and equity awards with performance-based vesting linked to

depletions growth. Overall, Boston Beer believes it should provide competitive pay to its executives and align compensation with

achieving its strategic goals and delivering strong company performance, both in terms of depletions growth and long-term stockholder

value. Our compensation philosophy is to provide employees with an overall compensation package that provides strong performers

with the opportunity to earn competitive compensation over the long term through a combination of base salary, cash incentives,

and equity awards. As shown in the charts below, the pay mix of our CEO and of our other Named Executive Officers in 2014 is consistent

with these goals. For example, in 2014, cash incentives and equity awards provided approximately 59% of the total potential compensation

of our CEO and approximately 49% of the potential compensation, in the aggregate, of our other Named Executive Officers.

* Of the total potential compensation

of our other Named Executive Officers, salary constituted 38% to 67%, bonuses earned (paid in 2015 based on 2014 performance)

constituted 16% to 32%, and equity compensation, all of which was in the form of stock options, constituted 0% to 32%.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 8

2015 Proxy Statement 8

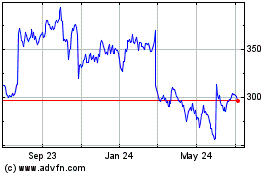

Further, the chart below shows the correlation

of Company performance and the compensation of our CEO over the last three fiscal years:

While the CEO’s salary increased 3.2%

from 2013 to 2014, his total compensation decreased year-over-year because he earned 40.3% of his bonus potential in 2014, as

compared to 72.2% of his bonus potential in 2013. Overall, the Company’s anticipated growth was higher in 2014 than in 2013,

which ultimately resulted in more aggressive bonus goals for 2014. As a result, Company performance and change in CEO compensation

were not directly aligned from 2013 to 2014.

Note: 2012 EPS growth shown above is calculated

based on adjusted EPS of $3.73 for 2011, which excludes the favorable impact of settlements of $1.08 per diluted share in 2011,

compared to reported unadjusted EPS of $4.81 for 2011.

The actual compensation paid to each of

our Named Executive Officers is discussed in the Compensation Discussion and Analysis, or CD&A, section of this Proxy Statement.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 9

2015 Proxy Statement 9

FREQUENTLY ASKED QUESTIONS

This Proxy Statement is provided in connection

with the solicitation of proxies by the Board of Directors of Boston Beer for use at the 2015 Annual Meeting of Stockholders and

at any adjournments thereof.

| 1. |

When

and where is the Annual Meeting and who may attend? |

The Annual Meeting will be held on Wednesday,

May 27, 2015, at 9:00 a.m. ET at the Samuel Adams Brewery located at 30 Germania Street, Boston, Massachusetts. The Brewery will

be open at approximately 8:30 a.m. ET. Stockholders who are entitled to vote may attend the meeting, as well as our invited guests.

Each stockholder is permitted to bring one guest.

DIRECTIONS TO THE BREWERY

FROM THE SOUTH OF BOSTON

Take 93N to exit 18 (Mass Ave and Roxbury

Exit). Go straight down Melnea Cass Blvd toward Roxbury. Once on Melnea Cass Blvd you will go through seven lights. At the eighth

light take a left on Tremont St (Landmark: Northeastern University and Ruggles T Station will be on your right when you turn

onto Tremont St. Note: Tremont St eventually becomes Columbus Ave). Follow Tremont St through seven lights. Take a right on

Amory St (Landmark: look for a big, powder blue Muffler Mart shop on the right – directly after Centre Street). Follow

Amory St through 2 lights. After the 2nd light take a left on Porter St (Landmark: Directly after Boylston St).

Go to the end of Porter St and the Brewery is on the right.

FROM THE NORTH OF BOSTON

Take 93S to exit 18 (Mass Ave and Roxbury

exit) and follow the above directions.

FROM THE SUBWAY

Take the Orange Line outbound toward Forest

Hills. Exit at the Stony Brook stop. Above ground take a left onto Boylston St. Take your first right onto Amory St. Then take

your first left onto Porter St to Brewery gate (the Brewery will be at the end of Porter St on your right).

| 2. |

Who

is eligible to vote? |

You can vote if you held shares of Class

A or Class B Common Stock as of the close of business on March 30, 2015 (the “Record Date”). Each outstanding share

of Boston Beer’s Class A and Class B Common Stock entitles the stockholder to one (1) vote on each matter properly brought

before the Class. On the Record Date, we had outstanding and entitled to vote 9,745,880 shares of Class A Common Stock, $.01 par

value per share, and 3,617,355 shares of Class B Common Stock, $.01 par value per share.

| 3. |

What

is the difference between holding shares as a “Stockholder of Record” and as a “Beneficial Owner”? |

If your shares are registered in your name

on the books and records of Computershare, our registrar and transfer agent, you are a “Stockholder of Record” (also

sometimes referred to as a “Registered Stockholder”). If you are a Stockholder of Record, we sent the Notice directly

to you.

If your shares are held by your broker or

bank on your behalf, your shares are held in “Street Name” and you are considered a “Beneficial Owner.”

If this is the case, the Notice has been forwarded to you by your broker, bank, or other holder of record.

| 4. |

I

am eligible to vote and want to attend the Annual Meeting. What do I need to bring? Do I need to contact Boston Beer in advance

of the Annual Meeting? |

Stockholders of Record. If you are

a Stockholder of Record and plan to attend the meeting, please bring your Admission Ticket, Notice, other evidence of ownership

if you voted by mail, or the Notice and photo identification if you voted by phone or internet. Stockholders of Record who do

not present a Notice at the meeting will be admitted only upon verification of ownership at the admission counter.

Beneficial Owners. If you are a Beneficial

Owner and plan to attend the meeting, you must present proof of ownership of Boston Beer shares as of March 30, 2015, such as

the Notice you received from your broker or a brokerage account statement, and photo identification.

In either case, you do not

need to contact us in advance to inform us that you will be attending.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 10

2015 Proxy Statement 10

| 5. |

I

am a Stockholder of Record. How do I vote? |

By Internet or Telephone: You may

vote your proxy by the internet or by telephone by following the instructions provided in the Notice. To vote by the internet,

go to http://www.envisionreports/sam and follow the steps outlined on the secured website. To vote by telephone, call toll

free at 1-800-652-8683. Internet and telephone voting for Stockholders of Record will be available 24 hours a day and will close

at 11:59 p.m. ET on May 26, 2015.

By Mail: If you received the Notice

of Annual Meeting, Proxy Statement, Proxy Card, and the Annual Report to Stockholders (the “Proxy Materials”), or

if you requested that the Proxy Materials be sent to you by mail, you may vote by completing, signing, and dating the Proxy Card

and returning it in the prepaid envelope.

In Person at the Annual Meeting:

You may vote in person at the Annual Meeting. If you voted via proxy before the meeting, you must revoke it in order to vote in

person. If you need to revoke your proxy, please consult with a Boston Beer representative upon admission to the Annual Meeting.

| 6. |

I

am a Beneficial Owner. How do I vote? |

As the Beneficial Owner, you have the right

to direct your broker, bank, or other holder of record on how to vote your shares by mail using the voting instruction card included

in the mailing. You will receive instructions from your broker, bank, or other holder of record regarding how to provide direction

on the voting of your shares. If you are a Beneficial Owner and wish to vote your shares in person at the Annual Meeting, you

must bring a Legal Proxy provided by your bank, broker, or other holder of record.

| 7. |

Why

did I receive a Notice of Internet Availability of Proxy Materials instead of printed Proxy Materials? |

As permitted by the rules of the Securities

and Exchange Commission (“SEC”) and as a way to reduce printing and mailing costs, we make the Proxy Materials available

to our stockholders electronically via the internet. Unless you previously asked to receive the printed Proxy Materials, we mailed

you a Notice containing instructions on how to access the Proxy Materials online, as well as how you may submit your proxy over

the internet or by telephone. If you would like a printed copy of our Proxy Materials, please follow the instructions contained

in the Notice.

| 8. |

What

is a “proxy” and what is a “proxy statement”? |

A “proxy” is the legal designation

of another person to vote the shares you own. That other person is called your proxy. If you designate someone as your proxy in

a written document, that document is also called a proxy or a proxy card. A “proxy statement” is a document that SEC

regulations require us to give you when we ask you to sign a proxy card designating individuals to vote on your behalf.

| 9. |

As

a Class A Stockholder, what are my voting choices for each of the proposals to be voted on at the Annual Meeting? |

Item 1: Election of Three Class A Director Nominees

Voting Choices

| • |

Vote in favor of all nominees; |

| |

|

| • |

Vote in favor of specific nominees and withhold a favorable vote

for specific nominees; or |

| |

|

| • |

Withhold authority to vote for all nominees. |

The Board Recommends a Vote FOR Each of

the Nominees.

Item 2: Non-binding Advisory Vote to Approve Boston Beer’s

Named Executive Officer Compensation

Voting Choices

| • |

Vote in favor of the proposal; |

| |

|

| • |

Vote against the proposal; or |

| |

|

| • |

Abstain from voting for the proposal. |

The Board Recommends a Vote,

in an Advisory Manner, FOR Approval of the 2014 Compensation of Boston Beer’s Named Executive Officers and the Compensation

Policies and Procedures as Described in this Proxy Statement.

| 10. | How many Class A votes must

be present to hold the Annual Meeting? |

The holders of a majority of the issued

and outstanding shares of each class of Common Stock are required to be present in person or to be represented by proxy at the

Annual Meeting in order to constitute a “quorum” to vote on the matters coming before their respective Class.

Abstentions and “withheld” votes

will be counted as present in determining whether the quorum requirement is satisfied. Votes withheld with respect to the election

of Class A Directors will have the same effect as negative votes. Similarly, abstentions will have the same effect as negative

votes on the advisory vote of Class A stockholders regarding the compensation of our Named Executive Officers.

| 11. | What if I do not specify a

choice for a matter when returning a proxy? |

If you sign and return the proxy card without

indicating your instructions, your shares will be voted FOR each of the agenda items for which you are entitled to vote and have

not clearly indicated votes. In addition, if other matters come before the meeting, your proxy will have discretion to vote on

these matters in accordance with their best judgment.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 11

2015 Proxy Statement 11

| 12. |

What

does it mean if I receive more than one Notice? |

If you received multiple Notices, it means

that you hold your shares in different ways (for example, some shares held directly, some beneficially or in a trust, in custodial

accounts, or by joint tenancy) or in multiple accounts. Each Notice you receive should be voted separately by internet, telephone,

or mail.

| 13. |

May

stockholders ask questions at the Annual Meeting? |

Yes. There will be a question and answer

period after the formal business of the meeting has concluded. In order to provide an opportunity for everyone who wishes to ask

a question, stockholders may be limited to two minutes each to present their question. When speaking, stockholders must direct

questions to the Chairman and confine their questions to matters that relate directly to the business of the meeting.

| 14. |

When

will Boston Beer announce the voting results? |

We will announce the preliminary voting

results at the Annual Meeting. We will report the final results in a Current Report on Form 8-K filed with the SEC within four

business days after the meeting.

| 15. |

I

lost my Notice or Proxy Materials. How am I able to vote? |

You will need the control number found on

the bottom of your Notice to be able to vote your shares. If you are a Stockholder of Record and you have not received your Notice

or Proxy Materials by May 4, 2015, or have lost or misplaced your Notice or Proxy Materials, please contact Computershare, at

800-652-8683 or www.computershare.com, to get your control number. If you are a Beneficial Owner, please contact your bank,

broker, or other holder of record.

| 16. |

Can

I revoke or change my proxy? |

You may revoke or change your proxy at any

time before it is exercised by: (1) delivering to Boston Beer a signed proxy card with a date later than your previously delivered

proxy; (2) voting in person at the Annual Meeting after revoking your proxy; (3) granting a subsequent proxy through the internet

or telephone; or (4) sending a written revocation to our Corporate Secretary, Kathleen H. Wade. Your most current proxy is the

one that will be counted.

| 17. |

Who

incurs the expenses of the proxy solicitation? |

All reasonable proxy soliciting expenses

incurred in connection with the solicitation of proxies for the Annual Meeting will be borne by Boston Beer. Our officers and

employees may solicit proxies by mail, telephone, fax, or personal contact, without being additionally compensated. In addition,

Boston Beer has retained Georgeson Inc., a professional proxy solicitation firm, to assist in the solicitation of proxies for

a fee of approximately $7,500, plus reimbursement of reasonable out-of-pocket expenses.

| 18. |

How

can I contact Boston Beer? |

Our corporate headquarters are located at

One Design Center Place, Suite 850, Boston, Massachusetts 02210. Our main telephone number is (617) 368-5000. Our investor website

is www.bostonbeer.com.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 12

2015 Proxy Statement 12

SECURITY

OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information

regarding beneficial ownership of our Class A Common Stock and Class B Common Stock as of March 30, 2015, by:

| • |

Each person (or group of affiliated persons) known by us to be the beneficial owner(s) of

more than 5% of our outstanding Class A Common Stock and Class B Common Stock; |

| |

|

| • |

Our current Directors, all of whom are nominees for reelection as Directors; |

| |

|

| • |

Our Named Executive Officers; and |

| |

|

| • |

All our current Directors and Executive Officers as a group. |

The address of all our Directors and Executive

Officers is c/o The Boston Beer Company, Inc., One Design Center Place, Suite 850, Boston, Massachusetts 02210. The information

provided in the table is based on our records, information on file with the SEC, and information provided to us, except as otherwise

noted.

Beneficial ownership is determined under

the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under those

rules, beneficial ownership includes any shares as to which an individual has sole or shared voting power or investment power

and also any shares that the individual has the right or option to acquire under certain circumstances. Unless otherwise indicated,

each person named below held sole voting and investment power over the shares listed. All shares are Class A Common Stock, except

for shares of Class B Common Stock, all of which are held by C. James Koch. Ownership percentages shown below are percentages

of all outstanding Class A Common Stock, except in the case of C. James Koch, which shows the percentage of all outstanding Class

A and Class B Common Stock.

| | |

Shares Beneficially Owned |

| Name of Beneficial Owner | |

Number | | |

Percent | |

| Directors and Named Executive Officers: | |

| | | |

| | |

| C. James Koch(1) | |

| 3,832,535 | | |

| 28.7 | % |

| Martin F. Roper(2) | |

| 181,030 | | |

| 1.9 | % |

| Cynthia A. Fisher(3) | |

| 109,081 | | |

| 1.1 | % |

| David A. Burwick(4) | |

| 35,646 | | |

| * | |

| Jean-Michel Valette(5) | |

| 35,625 | | |

| * | |

| Gregg A. Tanner(6) | |

| 33,241 | | |

| * | |

| Jay Margolis(7) | |

| 25,241 | | |

| * | |

| Pearson C. Cummin, III(8) | |

| 24,664 | | |

| * | |

| William F. Urich(9) | |

| 18,029 | | |

| * | |

| Robert P. Pagano(10) | |

| 4,928 | | |

| * | |

| Thomas W. Lance(11) | |

| 3,840 | | |

| * | |

| John C. Geist(12) | |

| 496 | | |

| * | |

| All Directors and Executive Officers | |

| 4,258,427 | | |

| 31.9 | % |

| as a group (15 people) | |

| | | |

| | |

| Owners of 5% or More | |

| | | |

| | |

| of the Company’s Outstanding Shares: | |

| | | |

| | |

| FMR LLC(13) | |

| 1,080,073 | | |

| 11.6 | % |

| 82 Devonshire Street, Boston, MA 02109 | |

| | | |

| | |

| Black Rock, Inc.(14) | |

| 724,179 | | |

| 7.8 | % |

| 40 E. 52nd Street | |

| | | |

| | |

| New York, NY 10022 | |

| | | |

| | |

| The Vanguard Group, Inc.(15) | |

| 601,006 | | |

| 6.4 | % |

| 100 Vanguard Blvd., Malvern, PA 19355 | |

| | | |

| | |

| Neuberger Berman Group LLC(16) | |

| 590,835 | | |

| 6.3 | % |

| Neuberger Berman

LLC | |

| | | |

| | |

| Neuberger Berman

Management LLC | |

| | | |

| | |

| Neuberger Berman

Equity Funds | |

| | | |

| | |

| 605 Third Avenue, New

York, NY 10158 | |

| | | |

| | |

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 13

2015 Proxy Statement 13

| * |

Represents holdings of less than one percent (1%). |

| |

|

| (1) |

Includes 92,132 shares of Class A Common Stock directly held by

Mr. Koch; 3,617,355 shares of Class B Common Stock, constituting all of the outstanding shares of Class B Common Stock; options

to acquire 44,126 shares of Class A Common Stock exercisable currently or within sixty (60) days; 23,486 shares of Class A

Common Stock held by Mr. Koch as custodian for the benefit of his minor children, and 5,000 shares of Class A Common Stock

held as trustee in a trust of which Mr. Koch is the sole beneficiary. Also includes 50,436 shares of Class A Common Stock

reported as beneficially owned by Cynthia A. Fisher, Mr. Koch’s spouse, consisting of 3,656 shares of Class A Common

Stock held as custodian for the benefit of her minor children, 2,532 shares of Class A Common Stock held as trustee of irrevocable

trusts for the benefit of her minor children, and 44,248 shares of Class A Common Stock held in a collection of generation

skipping trusts, as to which Ms. Fisher has sole voting and investment power and as to which Mr. Koch disclaims beneficial

ownership. |

| |

|

| (2) |

Includes options to acquire 180,000 shares of Class A Common Stock exercisable currently

or within sixty (60) days. |

| |

|

| (3) |

Includes options to acquire 7,722 shares of Class A Common Stock

exercisable currently or within sixty (60) days. Also includes 3,656 shares of Class A Common Stock held by Ms. Fisher as

custodian for the benefit of her minor children; 2,532 shares of Class A Common Stock held by Ms. Fisher as trustee of irrevocable

trusts for the benefit of her minor children; 44,248 shares of Class A Common Stock held by Ms. Fisher as trustee of a collection

of generation-skipping trusts; and 27,437 shares of Class A Common Stock held in trust by a limited liability company of which

Ms. Fisher is the manager and to which Ms. Fisher disclaims beneficial ownership. Also includes 23,486 shares of Class A Common

Stock reported as beneficially owned by C. James Koch, Ms. Fisher’s spouse, as custodian for the benefit of their minor

children, for which Mr. Koch has sole voting and investment power and as to which Ms. Fisher disclaims beneficial ownership. |

| |

|

| (4) |

Includes options to acquire 35,241 shares of Class A Common Stock exercisable currently

or within sixty (60) days. |

| |

|

| (5) |

Includes options to acquire 19,125 shares of Class A Common Stock exercisable currently

or within sixty (60) days. |

| |

|

| (6) |

Consists of options to acquire 33,241 shares of Class A Common Stock exercisable currently

or within sixty (60) days. |

| |

|

| (7) |

Includes options to acquire 22,741 shares of Class A Common Stock exercisable currently

or within sixty (60) days. |

| |

|

| (8) |

Includes options to acquire 17,741 shares of Class A Common Stock exercisable currently

or within sixty (60) days. |

| |

|

| (9) |

Includes options to acquire 14,000 shares of Class A Common Stock

exercisable currently or within sixty (60) days and 396 shares of Class A Common Stock purchased under the Company’s

Investment Share Program which are not yet vested. |

| |

|

| (10) |

Consists of options to acquire 4,928 shares of Class A Common Stock exercisable currently

or within sixty (60) days. |

| |

|

| (11) |

Includes options to acquire 498 shares of Class A Common Stock

exercisable currently or within sixty (60) days and 487 shares of Class A Common Stock purchased under the Company’s

Investment Share Program which are not yet vested. |

| |

|

| (12) |

Consists of 496 shares of Class A Common Stock purchased under the Company’s Investment

Share Program which are not yet vested. |

| |

|

| (13) |

Information is based on a Schedule 13G filed with the SEC on February

13, 2015 by FMR LLC, which reported sole voting power with respect to 30,651 shares and sole dispositive power with respect

to 1,080,073 shares. |

| |

|

| (14) |

Information is based on a Schedule 13G filed with the SEC on January

26, 2015 by BlackRock, Inc., which reported sole voting power with respect to 705,869 shares and sole dispositive power with

respect to 724,179 shares. |

| |

|

| (15) |

Information is based on a Schedule 13G filed with the SEC on February

9, 2015 by The Vanguard Group, Inc., which reported sole voting power with respect to 11,428 shares, shared dispositive power

with respect to 10,728 shares, and sole dispositive power with respect to 590,278 shares. |

| |

|

| (16) |

Information is based on a Schedule 13G filed with the SEC on February

12, 2015 by Neuberger Berman Group LLC, Neuberger Berman LLC, Neuberger Berman Management LLC and Neuberger Berman Equity

Funds, which reported that these entities may be deemed to beneficially own all of the shares reported in the table. Neuberger

Berman Group LLC and Neuberger Berman LLC each reported shared voting power with respect to 589,235 shares and shared dispositive

power with respect to 590,835 shares. Neuberger Berman Management LLC reported shared voting power and shared dispositive

power with respect to 537,591 shares. Neuberger Berman Equity Funds reported shared voting power and shared dispositive power

with respect to 479,519 shares. These entities also reported that the holdings of Neuberger Berman Trust Co N.A., Neuberger

Berman Trust Co of Delaware N.A., NB Alternatives Advisers LLC, Neuberger Berman Fixed Income LLC and NB Alternative Investment

Management LLC, affiliates of Neuberger Berman LLC, are also aggregated to comprise the shares reported. |

Section

16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange

Act of 1934 requires our Directors and Executive Officers and persons who own more than 10% of our outstanding Class A Common

Stock to file reports regarding their beneficial ownership of our stock with the SEC. Based solely upon a review of those filings

furnished to us and written representations in the case of our Directors and Executive Officers, we believe all reports required

to be filed under Section 16(a) with the SEC were timely filed in 2014.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 14

2015 Proxy Statement 14

NOMINEES FOR

BOARD OF DIRECTORS

The Nominees for our Board of Directors

have been proposed in accordance with our Articles of Organization, By-Laws, and Corporate Governance Guidelines. Below are

the nominees for election as Class A and Class B Directors, respectively, for a one-year term ending at the close of the 2016

Annual Meeting. As outlined in more detail below, each nominee has extensive business and senior management experience, and together

they represent a diverse group of individuals with particular skills and experience in the areas that we consider to be the most

critical to our business and prospects, including knowledge of and experience in the alcohol beverage industry, marketing and

brand development, operations and supply chain management, finance, sales, corporate governance, entrepreneurship, and general

enterprise management.

Nominees for Class A Director

We recommend that

holders of Class A Common Stock vote “FOR” each nominee listed.

David

A. Burwick

Independent Class A Director Nominee

Age: 53

Director Since: 2005

Committees: Nominating/Governance

Committee (Chair), Compensation Committee

Other Public Company Directorships:

None

In December 2012, Mr. Burwick was appointed

President and Chief Executive Officer of Peet’s Coffee & Tea, Inc., a specialty coffee and tea company based in California.

Prior to this role, starting in April 2010, Mr. Burwick served as President, North America of Weight Watchers International, Inc.,

a publicly-held company based in New York City and a leading provider of weight management services. Mr. Burwick previously had

been Senior Vice President and Chief Marketing Officer of PepsiCo North American Beverages, headquartered in Purchase, New York,

until September 2009. Before assuming that position in April 2008, he had been Executive Vice President, Commercial, of PepsiCo

International and President of Pepsi-QTG Canada, headquartered in Toronto, a position he held from November 2005 to March 2008.

Mr. Burwick held several positions with Pepsi-Cola North America, including serving as Senior Vice President and Chief Marketing

Officer from June 2002 until immediately prior to his move to Pepsi-QTG Canada.

Specific qualifications and experience

of particular relevance to Boston Beer

Mr. Burwick has extensive experience in

marketing consumer products. His significant experience in the beverage industry has also been integral in helping shape our overall

brand development strategies. Mr. Burwick’s broad senior management experience is also an asset to our Compensation Committee,

on which he has served since May 2005, including as Chair from May 2006 to May 2013, and our Nominating/Governance Committee,

on which he has served since May 2005. Mr. Burwick holds an MBA from Harvard Business School.

Pearson

C. Cummin, III

Independent Class A Director Nominee

Age: 72

Director Since: 1995

Committees: Compensation Committee

(Chair), Audit Committee

Other Public Company Directorships: None

Mr. Cummin has been active as a private

investor for many years and is currently the Managing Member of Grey Fox Associates, LLC, a private investment company headquartered

in Greenwich, Connecticut. He served as a Director of Pacific Sunwear of California, Inc., a California-based specialty apparel

retailer, from 1988 through March 2010, where he also had served as chair of its Compensation Committee and a member of its Audit

and Nominating/Governance Committees. Mr. Cummin also served as the Secretary/Treasurer of the American Diabetes Association in

2012.

Specific qualifications and experience

of particular relevance to Boston Beer

Mr. Cummin is an experienced investor and

venture capitalist with extensive experience in finance, public company corporate governance, and executive compensation matters.

He has served on our Audit Committee since 1995, having served as its Chair from May 1996 to May 2013, and on our Compensation

Committee since May 1997. He qualifies as a financial expert, having an MBA from Harvard Business School, as the former general

partner of a venture capital firm, and as a former member of the Audit Committee of Pacific Sunwear, a publicly-traded company.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 15

2015 Proxy Statement 15

Jean-Michel

Valette

Independent Class A Director Nominee

Age: 54

Director Since: 2003

Committees: Nominating/Governance

Committee, Audit Committee

Other Public Company Directorships:

Select Comfort Corporation

Mr. Valette currently serves as an independent

advisor to select branded consumer companies. Until November 2012 he was Chairman of the Board and a member of the Audit and Nominating/Governance

Committees of Peet’s Coffee & Tea Inc., a California-based specialty coffee company; since then he is a Director and

Chairman of its Audit and Valuation Committees. He is also Chairman of the Board and a member of the Audit Committee of Select

Comfort Corporation (NASDAQ: SCSS), a Minneapolis-based bedding company. Until October 2006, he was also Chairman of Robert Mondavi

Winery, a California wine company. Prior to assuming that position, he had served as President and Managing Director of Robert

Mondavi Winery from October 2004 to January 2005. From May 2003 through May 2006, Mr. Valette served as a Class B Director of

Boston Beer.

Specific qualifications and experience

of particular relevance to Boston Beer

Mr. Valette has over twenty-five years of

experience in management, public company corporate governance, strategic planning, and finance, with extensive experience in the

alcohol beverage industry. He holds an MBA from Harvard Business School. He also serves as a director of several private companies.

Mr. Valette served as the Chair of our Nominating/ Governance Committee from May 2004 until May 2013 and has served as a member

of our Audit Committee since May 2003. He was named Boston Beer’s Lead Director in May 2013.

Nominees for Class B Director

Cynthia

A. Fisher

Class B Director Nominee

Age: 54

Director Since: 2012

Committees: None

Other Public Company Directorships:

Easterly Government Properties, Inc.

In 2011, Ms. Fisher founded WaterRev, LLC,

an investment company located in Newton, Massachusetts, focused on innovative technology companies that enable sustainable practices

of water use. She is an independent investor and consults to corporate boards and executive management teams. She also serves

on the Board of Directors of Easterly Government Properties, Inc. (NYSE: DEA), a publicly-held real estate investment trust. In

1992, Ms. Fisher founded ViaCord, Inc., a cord blood stem cell banking company, and served as CEO of Viacord, Inc. from 1993 to

2000. In 2000, she co-founded ViaCell, Inc., a cellular medicines company and successor to ViaCord, which went public in 2005.

Ms. Fisher served as ViaCell’s President from 2000 to 2001 and as a member of its Board of Directors until 2002. Ms. Fisher

is the spouse of C. James Koch, Boston Beer’s Founder and Chairman of the Board of Directors.

Specific qualifications and experience

of particular relevance to Boston Beer

Ms. Fisher serves on the Board of Directors

of a public company and on the Board of Directors of several not-for-profit businesses, including Water. org and Ursinus College,

the Advisory Board of Harvard Medical School for Systems Biology, and the Board of Advisors for the Micheli Center for Sports

Injury Prevention. Ms. Fisher holds an MBA from Harvard Business School and an Honorary Doctorate of Science from Ursinus College.

She brings significant entrepreneurial experience, as well as insight in business strategy, operations, and consumer marketing

to the Board’s overall business perspective.

C.

James Koch

Class B Director Nominee

Age: 65

Director Since: 1995

Committees: None

Other Public Company Directorships:

None

Mr. Koch founded Boston Beer in 1984 and

currently serves as its Chairman. Until January 2001, Mr. Koch also served as the Company’s Chief Executive Officer. He

also served as the Company’s Secretary/Clerk until May 2010. Prior to starting Boston Beer, he had worked as a consultant

for an international consulting firm, with a focus on manufacturing.

Specific qualifications and experience

of particular relevance to Boston Beer

His thirty-one years at the helm of Boston

Beer, during which it has grown from a small start-up company to its current position as a leading craft brewer, is a testament

to his skill in brewing, strategy, brand development, and industry leadership.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 16

2015 Proxy Statement 16

Jay

Margolis

Independent Class B Director Nominee

Age: 66

Director Since: 2006

Committees: Audit Committee, Compensation

Committee, Nominating/ Governance Committee

Other Public Company Directorships: None

Mr. Margolis is Chairman of Intuit Consulting

LLC, a consulting firm specializing in retail, fashion, and consumer products located in Watermill, New York. From February 2013

to March 2015, Mr. Margolis was Chairman and CEO of Caché, Inc., a publicly-held specialty chain of women’s apparel

stores headquartered in New York. From August 2008 to April 2014, he served on the Board of Directors of Godiva Chocolatier Inc.,

a privately-held, high-end specialty chocolate manufacturer and retailer, with its North American headquarters located in New

York, New York. From October 2005 through July 2007, Mr. Margolis served as the President and CEO of the Apparel Group of Limited

Brands located in Ohio. Before assuming that position, he had been President and Chief Operating Officer of Massachusetts-based

Reebok, Inc. since 2001, where he also served as a Director.

Specific qualifications and experience

of particular relevance to Boston Beer

Mr. Margolis has significant knowledge in

consumer products retailing, merchandising, consumer insights, strategic planning, and public company corporate governance. His

extensive senior management experience has been an asset to the Board since he became a Director in 2006. Mr. Margolis has served

on our Compensation and Nominating/Governance Committees since May 2006 and re-joined the Audit Committee in May 2013, after having

previously served on the Audit Committee from May 2006 to December 2007.

Martin

F. Roper

Class B Director Nominee

Age: 52

Director Since: 1999

Committees: None

Other Public Company Directorships:

Lumber Liquidators, Inc.

Mr. Roper is Boston Beer’s President

and Chief Executive Officer, a position he has held since January 2001. Mr. Roper joined Boston Beer as Vice President of Manufacturing

and Business Development in September 1994, became the Chief Operating Officer in April 1997, and became President and Chief Operating

Officer in December 1999. In April 2006, Mr. Roper joined the Board of Directors of Lumber Liquidators, Inc. (NYSE: LL), a Virginia-based

hardwood flooring retailer, where he serves as Chair of its Compensation Committee and a member of its Audit Committee. Mr. Roper

holds a master’s degree in manufacturing from Cambridge University, as well as an MBA from Harvard Business School. Prior

to joining Boston Beer, he worked as a strategy consultant and led small manufacturing companies in turn-around situations.

Specific qualifications and experience

of particular relevance to Boston Beer

Mr. Roper’s experience, both prior

to and since joining Boston Beer, provides strength in operations, strategy, finance, public company corporate governance, and

general management.

Gregg

A. Tanner

Independent Class B Director Nominee

Age: 58

Director Since: 2007

Committees: Audit Committee (Chair)

Other Public Company Directorships:

Dean Foods Company

Mr. Tanner is currently Chief Executive

Officer of Dean Foods Company (NYSE: DF), a leading food and beverage company and the largest processor and direct-to-store distributor

of fluid milk and other dairy and dairy case products in the United States, located in Dallas, Texas, a position he has held since

November 2012. Prior to serving as CEO, Mr. Tanner served as the Chief Supply Chain Officer and President of its Fresh Dairy Direct

division since November 2007. From July 2006 through October 2007, Mr. Tanner was Senior Vice President of Global Operations for

The Hershey Company of Hershey, Pennsylvania. He was with ConAgra Foods of Omaha, Nebraska from September 2001 through July 2005,

holding the position of Senior Vice President, Retail Supply Chain from June 2002 through July 2005. Prior to that, Mr. Tanner

held positions of increasing responsibility at the Quaker Oats Company and Ralston Purina Company.

Specific qualifications and experience

of particular relevance to Boston Beer

Mr. Tanner has over thirty years of operations,

supply chain management, and general management experience in the food and beverage industry, with significant experience in risk

management. He also qualifies as a financial expert in that he has overseen profits, losses, and balance sheets in senior executive

roles for S&P 500 companies. Mr. Tanner has been a member of our Audit Committee since he joined the Board in December 2007.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 17

2015 Proxy Statement 17

CORPORATE

GOVERNANCE

We are committed to having effective corporate

governance and high ethical standards because we believe that these values support our long-term performance. Our Articles of

Organization, By-Laws, Corporate Governance Guidelines, the charters of the Board’s committees, and our Code of Business

Conduct and Ethics provide the framework of our corporate governance standards. These documents are available on our investor

website, www.bostonbeer.com, and are also available in print by request. Requests should be directed to our Investor Relations

Department, The Boston Beer Company, Inc., One Design Center Place, Suite 850, Boston, Massachusetts 02210.

Director Independence

The Board currently consists of eight Directors,

comprised of three Directors who were elected by the Class A Stockholders and five Directors who were elected by the sole Class

B Stockholder. All three of the individuals standing for reelection as Class A Directors – David A. Burwick, Pearson C.

Cummin III, and Jean-Michel Valette – and two of the five individuals standing for reelection as Class B Directors –

Jay Margolis and Gregg A. Tanner – constituting a majority of the Board of Directors, have no material relationship with

Boston Beer (either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company)

and are independent, as determined in accordance with the director independence standards of the New York Stock Exchange (“NYSE”)

and the SEC. Only independent Directors serve as members of the Audit, Compensation, and Nominating/Governance Committees.

Board Leadership Structure

Since 2001, Boston Beer has separated the

roles of CEO and Chairman. We believe that this strengthens the Company by allowing the CEO to focus on the day-to-day management

of the business and the Chairman to focus on leadership of the Board of Directors, issues of beer quality and innovation, and

overall brand strategy and awareness. The Chairman continues to be active in our business, but with more focus in critical areas

of the business and outreach, including participation in industry trade associations. Both the Chairman and the CEO participate

fully in deliberations of the Board of Directors.

On May 29, 2013, upon the recommendation

of the Nominating/Governance Committee, the non-management members of the Board of Directors voted to establish a position of

Lead Director and adopted a charter for the position. The non-management members of the Board of Directors then appointed Jean-Michel

Valette as the Lead Director. The role of the Lead Director is to serve in a lead capacity to coordinate the activities of the

other non-management Directors, including but not limited to: (i) presiding at meetings of the Board in the absence of, or upon

the request of, the Chairman; (ii) presiding over all executive meetings of non-management Directors and reporting to the Board

concerning such meetings; (iii) reviewing Board agendas in collaboration with the Chairman and CEO and recommending matters for

the Board to consider; (iv) serving as a liaison between Directors and the Chairman and CEO without inhibiting direct communications

between the Chairman, CEO, and other Directors; (v) serving as the principal liaison for consultation and communication between

Directors and stockholders; and (vi) advising the Chairman concerning the retention of advisors and consultants who report directly

to the Board.

Executive Sessions of the Board

The independent Directors regularly meet

in scheduled executive sessions without management. A portion of each executive session includes the Chairman and the one non-management

Director who is not independent, and another portion includes only the independent Directors. The Lead Director leads these sessions,

and at the conclusion of each executive session reports back to the Chairman and the CEO on the executive session discussions.

The independent Directors met formally in executive sessions four times during the Company’s 2014 fiscal year.

Board Risk Oversight

The Board as a whole has ultimate responsibility

for risk oversight. It exercises this oversight function through its standing committees, each of which has primary risk oversight

responsibility with respect to all matters within the scope of its responsibilities set forth in its charter. As further described

below under the headings “Audit Committee” and “Compensation Committee,” the Audit Committee and management

discuss policies regarding Boston Beer’s risk assessment and risk management programs and processes and the Compensation

Committee reviews the risks associated with Boston Beer’s compensation practices.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 18

2015 Proxy Statement 18

Review of Related Party Transactions

Under our Code of Business Conduct and Ethics,

our Officers, Directors, and employees are required to report any proposed related-party transactions to our Compliance Officer,

who will bring them to the attention of the Audit Committee. Since the beginning of the last fiscal year, we have had no transactions

with our Officers, Directors, their immediate family members, or any stockholder owning 5% or more of our outstanding stock, nor

do we currently have any proposed transactions, in which Boston Beer is or was a participant and in which any such related person

had or will have a direct or indirect material interest.

Board Meetings and Attendance

We believe that all members of the Board

of Directors should attend and actively participate in meetings of the Board and of its committees. Directors are also strongly

encouraged to attend meetings of stockholders.

During the Company’s 2014 fiscal year,

there were four regular meetings of the Board of Directors. Three regular meetings were held at our headquarters in Boston, Massachusetts,

and one regular meeting was held in Los Angeles, California.

All Directors attended the 2014 Annual Meeting

of Stockholders, which was held at our brewery in Boston, Massachusetts. At this meeting, the Directors had the opportunity to

meet directly with several of our individual stockholders, many of whom have held stock since our initial public offering in 1995.

During the 2014 fiscal year, each of our

Directors attended all of the meetings of the Board of Directors in person or by telephone. Additionally, each of our Directors

attended all of the meetings of the committees on which the Director served, either in person or by telephone.

Board Committee Structure

There are three standing committees of the

Board of Directors: the Audit Committee, the Compensation Committee, and the Nominating/Governance Committee. Membership on these

committees is limited to independent Directors. Membership on the Committees of the Board of Directors currently is:

| Director |

|

Audit |

|

Compensation |

|

Nom/Gov |

| David A. Burwick* |

|

|

|

X |

|

Chair |

| Pearson C. Cummin, III* |

|

X |

|

Chair |

|

|

| Cynthia A. Fisher |

|

|

|

|

|

|

| C. James Koch |

|

|

|

|

|

|

| Jay Margolis* |

|

X |

|

X |

|

X |

| Martin F. Roper |

|

|

|

|

|

|

| Gregg A. Tanner* |

|

Chair |

|

|

|

|

| Jean-Michel Valette* |

|

X |

|

|

|

X |

Ms. Fisher, Mr. Koch, and Mr. Roper are

not independent Directors.

Each of the committees operates under a

written charter adopted by the Board and reviews these charters annually and makes recommendations for revisions to the Board.

On February 12, 2014, the Board voted to amend the Corporate Governance Guidelines and the Charters for the Audit, Compensation,

and Nominating/Governance Committees. Effective as of October 8, 2014, the Board again amended the Compensation Committee Charter.

Copies of the respective charters, as amended, are available on Boston Beer’s investor website, www.bostonbeer.com. The

function of each committee and attendance during 2014 are described below.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 19

2015 Proxy Statement 19

Audit Committee

In accordance with its charter, the Audit

Committee assists the Board in fulfilling its responsibility to oversee management’s conduct of Boston Beer’s financial

reporting process, including overseeing the financial reports and other financial information provided by the Company’s

internal accounting and financial control systems and the annual independent audit of the Company’s financial statements.

The Audit Committee appoints, evaluates, and determines the compensation of the Company’s independent auditors; reviews

and approves the scope of the annual audit of the Company’s financial statements and the fees for such audit; pre-approves

all other audit and non-audit services provided to the Company by the independent auditors; reviews the Company’s disclosure

controls and procedures, internal controls, and corporate policies relating to financial information and earnings guidance; and

reviews other risks that may have a significant impact on the Company’s financial statements. Each year, the Audit Committee

reviews its charter and its performance and prepares the Audit Committee Report for inclusion in the annual proxy statement.

The Audit Committee is also responsible

for the oversight of operational, governance, and other risks that could adversely affect Boston Beer’s business. To fulfill

these oversight responsibilities, at each of its regular meetings, the Audit Committee meets with Boston Beer’s Director

of Risk Management and Review, who is also responsible for the internal audit function, and with representatives of the Company’s

independent registered public accounting firm. At its regular meetings, the Audit Committee also reviews and discusses potential

material risks to the Company, and asks for and receives regular updates on steps taken by management to address those risks.

Areas of focus in 2014 included safety, product quality, regulatory and legal compliance, scalability for growth and complexity,

and brand image. The Audit Committee reports any risks that it believes could have a material adverse impact on the Company to

the full Board of Directors.

The Board has determined that each member

of the Audit Committee is an “audit committee financial expert” as defined under SEC rules. The Audit Committee met

six times in 2014, with all members being in attendance and participating at all of those meetings. Except for a special meeting

held on December 9, 2014, the Chairman, CEO, and CFO attended each of the meetings, but recused themselves when the Audit Committee

met in executive sessions with the Director of Risk Management and Review or with the Company’s independent registered public

accountants. Neither the Chairman nor the CEO attended the December 9, 2014 special meeting.

The Audit Committee Report is included in

the Audit Information section of this Proxy Statement.

Compensation Committee

The Compensation Committee handles the Board’s

responsibilities relating to compensation of Boston Beer’s Officers and Directors, exercising overall responsibility for

evaluating and approving the Company’s compensation programs and policies relating to Officers and Directors. The Committee

provides general oversight of Boston Beer’s compensation structure, including the Company’s equity compensation plans;

reviews and makes recommendations to the Board concerning policies or guidelines with respect to employment arrangements involving

Executive Officers and Directors of the Company; reviews and approves corporate goals and objectives relevant to the compensation

of the Chairman and CEO and other executives; evaluates the performance of the Chairman and the CEO and other executives in light

of those goals and objectives; and sets the compensation level for the Chairman, the CEO, and the other Executive Officers.

Members of the Compensation Committee perform

an annual evaluation of the performance of the Chairman and the CEO, including obtaining feedback from other Executive Officers

and a select group of senior managers. The Compensation Committee also considers areas of risk that may arise from Boston Beer’s

compensation practices, not only relating to executives, but with respect to the Company as a whole. In carrying out its responsibilities,

the Compensation Committee reports to the Board of Directors on a regular basis; reviews its own performance; reviews and reassesses

the adequacy of its charter and recommends any proposed changes to the Board of Directors for its approval; and issues an annual

report, including a discussion and analysis of executive compensation, for inclusion in the Proxy Statement.

In February 2013, the Compensation Committee

considered and recommended to the Board the adoption of equity ownership guidelines for Directors and Executive Officers of the

Company, which guidelines are more specifically discussed in the CD&A section of this Proxy Statement. It also reviewed and

supported the recommendation of the Nominating/ Governance Committee regarding the adoption of a new, formal policy that bans

hedging or pledging of Boston Beer stock by all Directors, Executive Officers, and other employees who are privy to material non-public

information. Both policies were unanimously adopted by the Board in February 2013 and later incorporated into the Corporate Governance

Guidelines and the Compensation Committee Charter. The Compensation Committee has subsequently reviewed the progress made on the

equity ownership guidelines on two separate occasions, which progress is discussed in more detail under the heading “Additional

Compensation Policies and Practices” in this Proxy Statement.

The Compensation Committee amended the Employee

Equity Incentive Plan, or our “EEIP”, effective January 1, 2014, to clarify the vesting of “Investment Shares”

(as defined under the heading “Investment Shares” below) owned by employees who are age 64 or older. Under the amended

plan, Investment Shares issued on or after January 1, 2014 to an employee who is age 64 or older will vest on the first anniversary

of issuance if the plan participant is still employed by the Company on that date. Investment Shares issued prior to January 1,

2014 that have not otherwise vested under the standard five-year vesting schedule will fully vest when the participant turns 65

if the participant is still then employed by the Company on that date.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 20

2015 Proxy Statement 20

On February 12, 2014, the Compensation Committee

approved certain changes to the cash component of the non-management Director compensation schedule, effective as of the 2014

Annual Meeting, as described under the heading “Director Compensation – Compensation Summary” in this Proxy

Statement. Following the appointment of the Lead Director in May 2013, the Compensation Committee established the compensation

for that position.

On October 8, 2014, the Compensation Committee

restated the EEIP to formally clarify certain procedures and practices followed with respect to restricted stock grants and discretionary

options and to set a limit on the number of shares that may be issued annually under the EEIP. More specifically, the amendment

set forth performance measures to be used for restricted stock grants or discretionary options granted to certain Executive Officers

and senior managers that are designed to qualify for the performance-based compensation exception under Section 162(m) of the

Internal Revenue Code. A copy of the currently effective EEIP was included as an exhibit to our Annual Report on Form 10-K filed

with the SEC on February 24, 2015.

The Compensation Committee met three times

in 2014. All members of the Compensation Committee attended and participated in all of the meetings. The CEO also attended each

of the meetings.

The Compensation Discussion and Analysis

and the Report of the Compensation Committee are included in this Proxy Statement.

Nominating/Governance Committee

The Nominating/Governance Committee assists

the Board by recommending to the Board nominees for election as Directors and nominees for each Board committee, evaluating the

Board’s leadership structure, developing and recommending to the Board a set of corporate governance principles, and overseeing

an annual evaluation of the Board.

The Nominating/Governance Committee, acting

independently and with the sole Class B Stockholder, who elects the majority of the Board under Boston Beer’s Articles of

Organization, periodically assesses the size and composition of the Board, including the existing experience, qualifications,

attributes, and skills represented by the current Board members and those that could enhance the overall breadth and strength

of the Board. The Committee also reviews director independence and any potential conflicts of interest; examines and discusses

the analyses of Boston Beer’s corporate governance standards by proxy advisory firms; considers votes cast by stockholders;

reviews communications with stockholders in order to ensure the adequacy of our corporate governance practices and policies; and

makes recommendations to management and/or the Board of Directors for improvements.

Each year, the Nominating/Governance Committee

formally reviews its charter and its performance as well as the adequacy of Boston Beer’s Corporate Governance Guidelines,

recommending any necessary changes to the full Board for approval.

The Nominating/Governance Committee met

two times in 2014, with all members attending and participating in each of the meetings.

In February 2015, the Nominating/Governance

Committee reviewed and approved a revised Insider Trading Policy for the Company, applicable to all Directors, Officers, and employees.

The revised policy clarifies: (1) the permissibility of trading during certain open trading windows for Company insiders; and

(2) the use of approved Rule 10b5-1 Plans for permissible trading outside those windows.

Consideration of Nominees for Director

Identifying

and Evaluating Nominees for the Board of Directors

The Nominating/Governance Committee employs

a variety of methods for identifying and evaluating nominees for Director. The Committee identifies those attributes, qualifications,

skills, and experience that Committee members believe should be reflected on the Board as a whole. Then, the Committee reviews

the characteristics of the then-current Board and seeks to identify any particular perceived weakness or imbalance. In doing so,

the Nominating/Governance Committee takes into consideration the results of the annual self-assessments performed by the Board

and each of the standing committees and seeks input from the Board. The Committee also meets with the sole Class B Stockholder,

who elects a majority of the Board pursuant to Boston Beer’s Articles of Organization.

The Nominating/Governance Committee has

discussed the issue of term limits and concluded that establishing formal Director term limits is not in the best interests of

the Company. The Committee has weighed the potential advantage of bringing “new blood” to the Board versus the disadvantage

of losing valuable contributions by Directors who have developed expansive knowledge concerning the Company and its operations,

which has historically resulted in increased contributions as a whole. The Committee believes that the Board’s annual self-evaluation

serves as an appropriate alternative to term limits.

While the Board does not have a formal policy

on diversity, the Nominating/ Governance Committee’s assessment of Board development takes experience, judgment, and diversity

in all aspects of our business into account, all in the context of the perceived needs of the Board at the relevant time. Most

recently, the Nominating/Governance Committee worked with the sole Class B Stockholder to assess the candidacy of Cynthia A. Fisher.

As the Nominating/ Governance Committee anticipated, Ms. Fisher’s significant entrepreneurial experience has broadened the

Board’s overall business perspective and diversity.

Candidates may come to the attention of

the Nominating/Governance Committee through a number of sources, including current Board members, professional search firms, stockholders,

or other persons. Candidates are evaluated at regular or special meetings of the Nominating/Governance Committee and may be considered

at any point during the year. In making their evaluation, members of the Nominating/Governance Committee include a review of a

candidate’s directorships in other public companies, as well as involvement in any regulatory or legal proceedings, or any

sanctions or orders imposed by any self-regulatory organization.

THE BOSTON BEER COMPANY, INC.  2015 Proxy Statement 21

2015 Proxy Statement 21

Stockholder

Nominees

The policy of the Nominating/Governance

Committee is to consider properly submitted stockholder nominations for candidates for membership on the Board as described in

the above section. The same process is used for evaluating a director candidate submitted by a stockholder as is used in the case

of any other potential nominee. Any stockholder nominations proposed for consideration by the Nominating/Governance Committee

should include the nominee’s name and qualifications for Board membership and should be addressed to:

Chair, Nominating/Governance Committee

The Boston Beer Company, Inc.

One Design Center Place, Suite 850

Boston, Massachusetts 02210

If Boston Beer receives a communication

from a stockholder nominating a candidate that is not submitted as described above, it will forward such communication to the

Chair of the Nominating/Governance Committee.

Response to 2014 Annual Meeting and Stockholder

Feedback