AutoNation to Expand Operations; Profit Falls

October 28 2016 - 8:40AM

Dow Jones News

AutoNation Inc. plans to spend as much as $500 million to expand

its footprint in the U.S., as the nation's largest dealership group

by sales confronts softening light-vehicle demand and increased

earnings pressure.

The Fort Lauderdale, Fla.,-based retailer said Friday that

income from continuing operations fell 9% in the third quarter.

AutoNation's expansion plan includes the creation of a line of

stand-alone used-car stores dubbed "AutoNation USA" that will

compete with CarMax Inc. and a crop of internet startups in the

hotly contested segment when outlets begin opening next year.

AutoNation also will expand its lucrative parts, service and

collision operations in the coming years.

In the third quarter, AutoNation recorded earnings from

continuing operations of $108 million, or $1.05 a share, compared

with $119 million, or $1.05 a share, a year ago. Revenue rose 4% to

$5.6 billion amid continued strength in truck and sport-utility

segments.

Analysts expected earnings of $1.15 a share on $5.6 billion in

revenue. The company said the continuing Takata Corp. air-bag

recall hurt results because about 14% of its used inventory can't

be sold until fixed, leading to a $6 million charge.

AutoNation Chief Executive Mike Jackson has been working to

offset several headwinds in recent months, including a decline in

demand for sedans and small cars because of lower gasoline prices

and changing consumer tastes. While U.S. light-vehicle volumes are

up for the market as a whole, retail sales to individual customers

at dealerships are struggling to keep pace with year-ago levels,

forcing auto makers to rely more heavily on fleet sales and leading

their dealers to look for other pockets of growth with potential

for higher margins.

The company added or acquired four new-car stores and a

collision center in the third quarter, representing a potential for

nearly $500 million in new revenue.

Used vehicles typically deliver higher margins than new units,

however, so the capstone of Mr. Jackson's expansion plan is opening

five AutoNation USA pre-owned vehicle sales and service centers in

the U.S. next year. The retailer has identified an additional 20

sites in its existing markets in coming years.

Mr. Jackson has complained about certain auto makers employing

irrational sales techniques, including offering deep sales

incentives that erode brand cache and deplete margins. By opening

new businesses not dependent on the sale of new vehicles,

AutoNation could lessen its exposure to the cyclical nature of the

car business by operating units that do well even when the economy

softens.

While CarMax is the best-known company in the used-car

dealership business, other major dealer groups, including Sonic

Automotive Inc., have expanded with stand-alone used-car stores.

Many startups, meanwhile, have abandoned the brick-and-mortar

approach and sell only via mobile apps or the internet.

AutoNation's new effort will feature no-haggle pricing by

employing salespeople who don't work on commission, a strategy that

follows the company's drive to create a timesaving and hassle-free

experience for buyers increasingly interested in buying cars

online.

Used vehicles sell for about $19,000 on average in the U.S.,

compared with $33,400 for new vehicles, according to the National

Automobile Dealers Association. In the best years, new

light-vehicle volumes equal about 17 million, while used volumes

exceed 40 million. The supply of good-condition used cars is

expected to grow in coming years as new-vehicle leases expire,

potentially pressuring margins but also offering more revenue

potential for sellers.

AutoNation also plans to open or acquire at least 18 new

AutoNation-branded collision centers and open four additional

AutoNation-branded auctions over the next two years. In addition,

it will offer a line of branded precision parts and automotive

accessories.

(END) Dow Jones Newswires

October 28, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

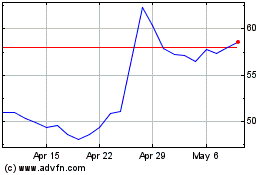

Sonic Automotive (NYSE:SAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sonic Automotive (NYSE:SAH)

Historical Stock Chart

From Apr 2023 to Apr 2024