UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Sonic

Automotive, Inc.

(Name of Issuer)

Class A Common Stock, par value $0.01 per share

(Title of Class of Securities)

83545G 10 2

(CUSIP

Number)

James R. Wyche, Esq.

Moore & Van Allen PLLC

100 North Tryon Street, Suite 4700

Charlotte, North Carolina 28202-4003

(704) 331-1000

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 16, 2015

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule,

including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter the disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 1 of 9 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON: Sonic Financial Corporation |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS):

(a) x (b) ¨ |

| 3 |

|

SEC USE ONLY:

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS): WC and OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: North Carolina |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER:

8,881,2501 |

|

8 |

|

SHARED VOTING POWER:

0 |

|

9 |

|

SOLE DISPOSITIVE POWER:

8,881,2501 |

|

10 |

|

SHARED DISPOSITIVE POWER:

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

8,881,250 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 17.5% |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS): CO |

| 1 |

Includes 8,881,250 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be acquired, upon the election of the reporting person, through the conversion of 8,881,250 shares of Sonic Automotive,

Inc.’s Class B Common Stock owned directly by the reporting person. |

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 2 of 9 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON: O. Bruton Smith |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS):

(a) x (b) ¨ |

| 3 |

|

SEC USE ONLY:

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS): PF and OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER:

2,685,3752 |

|

8 |

|

SHARED VOTING POWER:

8,881,2503 |

|

9 |

|

SOLE DISPOSITIVE POWER:

2,685,3752 |

|

10 |

|

SHARED DISPOSITIVE POWER:

8,881,2503 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

11,566,625 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 22.7% |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS): IN |

| 2 |

Includes (i) 195,792 shares of Sonic Automotive, Inc.’s Class A Common Stock owned directly by the reporting person, (ii) 318,333 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be acquired by

the reporting person upon the exercise of stock options or the vesting of restricted stock units within the next 60 days and (iii) 2,171,250 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be acquired, upon the election of the

reporting person, through the conversion of 2,171,250 shares of Sonic Automotive, Inc.’s Class B Common Stock owned directly by the reporting person. |

| 3 |

Includes 8,881,250 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be acquired, upon the election of the reporting person, through the conversion of 8,881,250 shares of Sonic Automotive,

Inc.’s Class B Common Stock owned indirectly by the reporting person. |

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 3 of 9 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON: B. Scott Smith |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS):

(a) x (b) ¨ |

| 3 |

|

SEC USE ONLY:

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS): PF and OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER:

410,7934 |

|

8 |

|

SHARED VOTING POWER:

9,851,7015 |

|

9 |

|

SOLE DISPOSITIVE POWER:

410,7934 |

|

10 |

|

SHARED DISPOSITIVE POWER:

9,851,7015 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

10,262,494 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 20.2% |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS): IN |

| 4 |

Includes (i) 173,905 shares of Sonic Automotive, Inc.’s Class A Common Stock owned directly by the reporting person, (ii) 160,778 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be acquired by

the reporting person upon the exercise of stock options or the vesting of restricted stock units within the next 60 days and (iii) 76,110 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be acquired, upon the election of the

reporting person, through the conversion of 76,110 shares of Sonic Automotive, Inc.’s Class B Common Stock owned directly by the reporting person. |

| 5 |

Includes (i) 69,686 shares of Sonic Automotive, Inc.’s Class A Common Stock owned indirectly by the reporting person and (ii) 9,782,015 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be

acquired, upon the election of the reporting person, through the conversion of 9,782,015 shares of Sonic Automotive, Inc.’s Class B Common Stock owned indirectly by the reporting person. |

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 4 of 9 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON: David Bruton Smith |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS):

(a) x (b) ¨ |

| 3 |

|

SEC USE ONLY:

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS): PF and OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER:

113,6696 |

|

8 |

|

SHARED VOTING POWER:

8,950,9367 |

|

9 |

|

SOLE DISPOSITIVE POWER:

113,6696 |

|

10 |

|

SHARED DISPOSITIVE POWER:

8,950,9367 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

9,064,605 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 17.8% |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS): IN |

| 6 |

Includes (i) 92,061 shares of Sonic Automotive, Inc.’s Class A Common Stock owned directly by the reporting person and (ii) 21,608 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be acquired

by the reporting person upon the exercise of stock options or the vesting of restricted stock units within the next 60 days. |

| 7 |

Includes (i) 69,686 shares of Sonic Automotive, Inc.’s Class A Common Stock owned indirectly by the reporting person and (ii) 8,881,250 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be

acquired, upon the election of the reporting person, through the conversion of 8,881,250 shares of Sonic Automotive, Inc.’s Class B Common Stock owned indirectly by the reporting person. |

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 5 of 9 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSON: Marcus G. Smith |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS):

(a) x (b) ¨ |

| 3 |

|

SEC USE ONLY:

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS): PF and OO |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e): ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION: United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER:

0 |

|

8 |

|

SHARED VOTING POWER:

8,950,9368 |

|

9 |

|

SOLE DISPOSITIVE POWER:

0 |

|

10 |

|

SHARED DISPOSITIVE POWER:

8,950,9368 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

8,950,936 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11): 17.6% |

| 14 |

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS): IN |

| 8 |

Includes (i) 69,686 shares of Sonic Automotive, Inc.’s Class A Common Stock owned indirectly by the reporting person and (ii) 8,881,250 shares of Sonic Automotive, Inc.’s Class A Common Stock that can be

acquired, upon the election of the reporting person, through the conversion of 8,881,250 shares of Sonic Automotive, Inc.’s Class B Common Stock owned indirectly by the reporting person. |

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 6 of 9 Pages |

Explanatory Note. This Amendment No. 2 (this “Amendment”) amends and supplements

the Schedule 13D originally filed jointly by Sonic Financial Corporation (“SFC”) and Mr. O. Bruton Smith (“Bruton Smith”) with the Securities and Exchange Commission (the “SEC”) on

November 19, 1997, as amended by Amendment No. 1 to the Schedule 13D filed jointly by SFC and Bruton Smith with the SEC on January 10, 2013 (as amended, the “Schedule 13D”). Except as provided herein, this Amendment

does not modify any of the information previously reported on the Schedule 13D. Capitalized terms used but not otherwise defined in this Amendment shall have the meanings ascribed to such terms in the Schedule 13D.

This Amendment is being filed to report that on June 16, 2015, (i) SFC was recapitalized for business succession purposes and, immediately

thereafter, Bruton Smith sold voting shares of SFC, a holder of Sonic Automotive, Inc.’s Class B Common Stock, to certain of his lineal descendants, resulting in Mr. Smith no longer holding a majority of the voting power of SFC (but

remaining the majority holder of the nonvoting SFC shares), and (ii) B. Scott Smith (“Scott Smith”), David Bruton Smith (“David Smith”) and Marcus G. Smith (“Marcus Smith”) were appointed as

executive officers of SFC, while Bruton Smith remains its Chief Executive Officer and President. SFC, Bruton Smith, Scott Smith, David Smith and Marcus Smith are referred to herein collectively as the “Reporting Persons.”

| Item 1. |

Security and Issuer. |

This Amendment relates to the Class A Common

Stock, par value $0.01 per share (the “Class A Common Stock”), of Sonic Automotive, Inc., a Delaware corporation (the “Issuer”). The address of the Issuer’s principal executive offices is 4401 Colwick Road,

Charlotte, North Carolina 28211.

| Item 2. |

Identity and Background. |

This Amendment is being filed jointly by:

(i) SFC, a North Carolina corporation, (ii) Bruton Smith, a United States citizen, (iii) Scott Smith, a United States citizen, (iv) David Smith, a United States citizen, and (v) Marcus Smith, a United States citizen. SFC

holds securities of the Issuer and Speedway Motorsports, Inc., a Delaware corporation (“SMI”), and conducts certain other activities. The directors of SFC are listed on Attachment A. The executive officers of SFC are Bruton

Smith, Chief Executive Officer and President; Scott Smith, Executive Vice President; David Smith, Executive Vice President; and Marcus Smith, Executive Vice President. Each of the executive officers of SFC is a shareholder of, but does not have

voting control over, SFC. The principal office and business address of SFC and its directors and Bruton Smith, Scott Smith, David Smith and Marcus Smith is 5401 East Independence Boulevard, Charlotte, North Carolina 28212. Bruton Smith is the

Chairman of the Board and Chief Executive Officer of the Issuer and is the Executive Chairman of SMI. The Issuer is one of the largest automotive retailers in the United States, as measured by total revenues, and its principal office address is 4401

Colwick Road, Charlotte, North Carolina 28211. SMI is a leading promoter, marketer and sponsor of motorsports activities in the United States, and its principal office address is 5555 Concord Parkway South, Concord, North Carolina 28027. Scott Smith

is the President and Chief Strategic Officer of the Issuer. David Smith is the Vice Chairman of the Issuer. Marcus Smith is the Chief Executive Officer and President of SMI.

During the last five years, neither SFC and its directors nor Bruton Smith, Scott Smith, David Smith or Marcus Smith has been convicted in a

criminal proceeding (excluding traffic violations or similar misdemeanors) or was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree

or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

The 8,881,250 shares

of Class A Common Stock beneficially owned by the Reporting Persons were acquired by SFC as part of the Issuer’s reorganization and capital restructuring involving the issuance of shares of Class B Common Stock by the Issuer just prior to

its initial public offering in 1997. The Class B Common Stock is convertible into an equal number of shares of Class A Common Stock upon the holder’s election or under other limited circumstances. Bruton Smith has acquired 2,685,375

additional shares of Class A Common Stock upon the exercise of stock options and restricted stock unit awards under the Issuer’s stock issuance plans or in open-market and other purchases using personal funds and resources, as well as

acquisition in his individual capacity as part of the Issuer’s reorganization and capital restructuring involving the issuance of shares of Class B Common Stock by the Issuer just prior to its initial public offering in 1997. Scott Smith has

acquired 1,381,244 additional shares of Class A Common Stock upon the exercise of stock options and restricted stock unit awards under the Issuer’s stock issuance plans or in open-market and other purchases using personal funds and

resources, as well as acquisition in his individual capacity as part of the Issuer’s reorganization

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 7 of 9 Pages |

and capital restructuring involving the issuance of shares of Class B Common Stock by the Issuer just prior to its initial public offering in 1997. David Smith has acquired 183,355 additional

shares of Class A Common Stock upon the exercise of stock options and restricted stock unit awards under the Issuer’s stock issuance plans or in open-market and other purchases using personal funds and resources. Marcus Smith has acquired

69,686 additional shares of Class A Common Stock in open-market and other purchases using personal funds and resources.

| Item 4. |

Purpose of Transaction. |

The Reporting Persons initially acquired shares of Class A

Common Stock as part of the Issuer’s reorganization and capital restructuring in connection with its initial public offering in 1997. Their purpose in acquiring these and subsequent shares was to maintain voting control over the Issuer by the

Smith family. The Reporting Persons may, from time to time, depending on market conditions and other factors deemed relevant by them, acquire additional shares of Class A Common Stock, and they reserve the right to, and may in the future choose

to, change this purpose with respect to this investment and take such actions as they deem appropriate in light of the circumstances including, without limitation, to dispose of, in the open market, in a private transaction or by gift, all or a

portion of the shares of Class A Common Stock which they now beneficially own or may hereafter acquire.

Except as described herein,

the Reporting Persons do not have any present plans or proposals which relate to, or would result in, (i) the acquisition of additional securities of the Issuer; (ii) the disposition of securities of the Issuer; (iii) an extraordinary

corporate transaction involving the Issuer or any of its subsidiaries; (iv) a sale or transfer of a material amount of the Issuer’s or any of its subsidiaries’ assets; (v) a change in the present board of directors or management

of the Issuer; (vi) a material change in the present capitalization or dividend policy of the Issuer; (vii) any other material change in the Issuer’s business or corporate structure; (viii) a change in the Issuer’s charter

or bylaws or other actions which may impede the acquisition of control of the Issuer by any person; (ix) the delisting or deregistration of any of the Issuer’s securities; or (x) any action similar to any of the actions listed in

(i) through (ix) above.

| Item 5. |

Interest in Securities of the Issuer. |

(a) As of the date of this report, (i) SFC

beneficially owned 8,881,250 shares of Class A Common Stock, including 8,881,250 shares of Class A Common Stock that can be acquired, upon the election of SFC, through the conversion of 8,881,250 shares of the Issuer’s Class B Common

Stock owned directly by SFC; (ii) Bruton Smith beneficially owned an aggregate of 11,566,625 shares of Class A Common Stock, including 195,792 shares of Class A Common Stock owned directly by Bruton Smith, 318,333 shares of

Class A Common Stock that can be acquired by Bruton Smith upon the exercise of stock options or the vesting of restricted stock units within the next 60 days, and 11,052,500 shares of Class A Common Stock that can be acquired, upon the

election of Bruton Smith, through the conversion of 11,052,500 shares of the Issuer’s Class B Common Stock owned directly or indirectly by Bruton Smith; (iii) Scott Smith beneficially owned an aggregate of 10,262,494 shares of Class A

Common Stock, including 173,905 shares of Class A Common Stock owned directly by Scott Smith, 160,778 shares of Class A Common Stock that can be acquired by Scott Smith upon the exercise of stock options or the vesting of restricted stock

units within the next 60 days, 69,686 shares of Class A Common Stock owned indirectly by Scott Smith, and 9,858,125 shares of Class A Common Stock that can be acquired, upon the election of Scott Smith, through the conversion of 9,858,125

shares of the Issuer’s Class B Common Stock owned directly or indirectly by Scott Smith; (iv) David Smith beneficially owned an aggregate of 9,064,605 shares of Class A Common Stock, including 92,061 shares of Class A Common

Stock owned directly by David Smith, 21,608 shares of Class A Common Stock that can be acquired by David Smith upon the exercise of stock options or the vesting of restricted stock units within the next 60 days, 69,686 shares of Class A

Common Stock owned indirectly by David Smith, and 8,881,250 shares of Class A Common Stock that can be acquired, upon the election of David Smith, through the conversion of 8,881,250 shares of the Issuer’s Class B Common Stock owned

indirectly by David Smith; (v) Marcus Smith beneficially owned an aggregate of 8,950,936 shares of Class A Common Stock, including 69,686 shares of Class A Common Stock owned indirectly by Marcus Smith, and 8,881,250 shares of

Class A Common Stock that can be acquired, upon the election of Marcus Smith, through the conversion of 8,881,250 shares of the Issuer’s Class B Common Stock owned indirectly by Marcus Smith; (vi) William R. Brooks (“William

Brooks”), a director of SFC, beneficially owned an aggregate of 58,607 shares of Class A Common Stock, consisting of the 58,607 shares of Class A Common Stock owned directly by William Brooks; and (vii) Randall Storey, a

director of SFC, did not beneficially own, directly or indirectly, any shares of Class A Common Stock. All such share numbers are adjusted for a two-for-one stock split effected in the form of a dividend in 1999.

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 8 of 9 Pages |

Bruton Smith’s, Scott Smith’s, David Smith’s, Marcus Smith’s and William

Brooks’ holdings represent approximately 22.7%, 20.2%, 17.8%, 17.6% and 0.1%, respectively, of the Issuer’s common shares outstanding as of March 31, 2015, including SFC’s holdings that represent approximately 17.5% (based upon

50,871,115 shares of Class A Common Stock deemed outstanding, assuming issuance of the 12,029,375 shares of Class A Common Stock upon conversion of the outstanding shares of Class B Common Stock). Shares beneficially owned by Bruton Smith,

Scott Smith, David Smith, Marcus Smith and William Brooks represent approximately 69.8%, 62.2%, 55.9%, 55.9% and 0.04%, respectively, of the total voting power of the combined voting classes of the capital stock of the Issuer, with the SFC holdings

representing approximately 55.8%.

(b) As of the date of this report, (i) SFC had (A) sole power to vote or direct the voting of, and sole

power to dispose or direct the disposition of, 8,881,250 shares of Class A Common Stock beneficially owned by it, consisting of the 8,881,250 shares of Class A Common Stock that can be acquired upon the conversion of the 8,881,250 shares of the

Issuer’s Class B Common Stock owned directly by it; and (B) shared power to vote or direct the voting of, and shared power to dispose or direct the disposition of, no shares of Class A Common Stock beneficially owned by it; (ii) Bruton

Smith had (A) sole power to vote or direct the voting of, and sole power to dispose or direct the disposition of, 2,685,375 shares of Class A Common Stock beneficially owned by him, including the 2,171,250 shares of Class A Common

Stock that can be acquired upon the conversion of the 2,171,250 shares of the Issuer’s Class B Common Stock owned directly by him, 195,792 shares of Class A Common Stock owned directly by him, and 318,333 shares of Class A Common

Stock that can be acquired by him upon the exercise of stock options or the vesting of restricted stock units within the next 60 days; and (B) shared power to vote or direct the voting of, and shared power to dispose or direct the disposition

of, 8,881,250 shares of Class A Common Stock beneficially owned by him, consisting of the 8,881,250 shares of Class A Common Stock that can be acquired upon the conversion of the 8,881,250 shares of the Issuer’s Class B Common Stock

held by SFC; (iii) Scott Smith had (A) sole power to vote or direct the voting of, and sole power to dispose or direct the disposition of, 410,793 shares of Class A Common Stock beneficially owned by him, including the 76,110 shares

of Class A Common Stock that can be acquired upon the conversion of the 76,110 shares of the Issuer’s Class B Common Stock owned directly by him, 173,905 shares of Class A Common Stock owned directly by him, and 160,778 shares of

Class A Common Stock that can be acquired by him upon the exercise of stock options or the vesting of restricted stock units within the next 60 days; and (B) shared power to vote or direct the voting of, and shared power to dispose or

direct the disposition of, 9,851,701 shares of Class A Common Stock beneficially owned by him, including the 8,881,250 shares of Class A Common Stock that can be acquired upon the conversion of the 8,881,250 shares of the Issuer’s

Class B Common Stock held by SFC, the 900,765 shares of Class A Common Stock that can be acquired upon the conversion of the 900,765 shares of the Issuer’s Class B Common held by BWI Financial, LLC, an entity in which he is the sole

manager and a member, and the 69,686 shares of Class A Common Stock held directly by SMDA Development 1, LLC, an entity in which he is a manager and a member; (iv) David Smith had (A) sole power to vote or direct the voting of, and

sole power to dispose or direct the disposition of, 113,669 shares of Class A Common Stock beneficially owned by him, including the 92,061 shares of Class A Common Stock owned directly by him and the 21,608 shares of Class A Common

Stock that can be acquired by him upon the exercise of stock options or the vesting of restricted stock units within the next 60 days; and (B) shared power to vote or direct the voting of, and shared power to dispose or direct the disposition

of, 8,950,936 shares of Class A Common Stock beneficially owned by him, including the 8,881,250 shares of Class A Common Stock that can be acquired upon the conversion of the 8,881,250 shares of the Issuer’s Class B Common Stock held

by SFC, and the 69,686 shares of Class A Common Stock held directly by SMDA Development 1, LLC, an entity in which he is a manager and a member; (v) Marcus Smith had (A) sole power to vote or direct the voting of, and sole power to

dispose or direct the disposition of, no shares of Class A Common Stock beneficially owned by him; and (B) shared power to vote or direct the voting of, and shared power to dispose or direct the disposition of, 8,950,936 shares of

Class A Common Stock beneficially owned by him, including the 8,881,250 shares of Class A Common Stock that can be acquired upon the conversion of the 8,881,250 shares of the Issuer’s Class B Common Stock held by SFC, and the 69,686

shares of Class A Common Stock held directly by SMDA Development 1, LLC, an entity in which he is a manager and a member; and (vi) William Brooks had (A) sole power to vote or direct the voting of, and sole power to dispose or direct

the disposition of, 58,607 shares of Class A Common Stock beneficially owned by him; and (B) shared power to vote or direct the voting of, and shared power to dispose or direct the disposition of, no shares of Class A Common Stock

beneficially owned by him.

(c) SFC and its directors and Bruton Smith, Scott Smith, David Smith and Marcus Smith have not effected any

transactions in the Class A Common Stock during the past 60 days.

(d) Not applicable.

(e) Not applicable.

Schedule 13D/A

|

|

|

| CUSIP No. 83545G 10 2 |

|

Page 9 of 9 Pages |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Scott Smith has pledged 976,875 shares of the Issuer’s Class B Common Stock owned directly or indirectly by him to a financial institution

as security for certain loans.

| Item 7. |

Material to be Filed as Exhibits. |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Joint Filing Agreement, dated June 24, 2015. |

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth

in this Amendment is true, complete and correct.

Date: June 24, 2015

|

|

|

| SONIC FINANCIAL CORPORATION |

|

|

| By: |

|

/s/ William R. Brooks |

| Name: |

|

William R. Brooks |

| Title: |

|

Vice President |

|

| /s/ O. Bruton Smith |

| O. BRUTON SMITH |

|

| /s/ B. Scott Smith |

| B. SCOTT SMITH |

|

| /s/ David Bruton Smith |

| DAVID BRUTON SMITH |

|

| /s/ Marcus G. Smith |

| MARCUS G. SMITH |

Attachment A

SFC Directors

|

|

|

|

|

| Name |

|

Principal Occupation or Employment |

|

Citizenship |

| O. Bruton Smith |

|

Chairman and Chief Executive Officer of Sonic Automotive, Inc. and Executive Chairman of Speedway Motorsports, Inc. |

|

U.S. |

|

|

|

| William R. Brooks |

|

Vice Chairman, Chief Financial Officer and Treasurer of Speedway Motorsports, Inc. |

|

U.S. |

|

|

|

| Randall Storey |

|

Senior Vice President and Tax Director of Speedway Motorsports, Inc. |

|

U.S. |

Exhibit 99.1

JOINT FILING AGREEMENT

This Joint Filing Agreement is made pursuant to Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, by and among the parties

listed below, each referred to herein as a “Joint Filer.” The Joint Filers agree that the foregoing Statement on Schedule 13D/A with respect to the Class A Common Stock of Sonic Automotive, Inc., a Delaware corporation, is filed on

behalf of each of the undersigned and that all subsequent amendments to such statement shall be filed on behalf of each of the undersigned without necessity of filing an additional joint filing agreement. This Joint Filing Agreement may be included

as an exhibit to such joint filing.

The undersigned further agree that each party hereto is responsible for the timely filing of such

Statement on Schedule 13D/A and any subsequent amendments, and for the accuracy and completeness of the information concerning such party contained therein; provided, however, that no party is responsible for the accuracy or completeness of the

information concerning any other party, unless such party knows or has reason to believe that such information is inaccurate. This Joint Filing Agreement may be signed in counterparts with the same effect as if the signature on each counterpart were

upon the same instrument.

IN WITNESS WHEREOF, each of the undersigned hereby executes this Joint Filing Agreement as of this 24th day of

June 2015.

|

|

|

| SONIC FINANCIAL CORPORATION |

|

|

| By: |

|

/s/ William R. Brooks |

| Name: |

|

William R. Brooks |

| Title: |

|

Vice President |

|

| /s/ O. Bruton Smith |

| O. BRUTON SMITH |

|

| /s/ B. Scott Smith |

| B. SCOTT SMITH |

|

| /s/ David Bruton Smith |

| DAVID BRUTON SMITH |

|

| /s/ Marcus G. Smith |

| MARCUS G. SMITH |

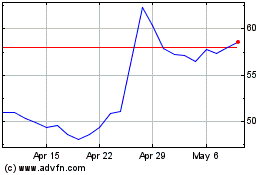

Sonic Automotive (NYSE:SAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sonic Automotive (NYSE:SAH)

Historical Stock Chart

From Apr 2023 to Apr 2024