High-Grade Bond Sales Reach $12 Billion For Second Day

March 09 2010 - 3:15PM

Dow Jones News

Highly rated companies offered about $12 billion in new bonds

Tuesday, after a $12 billion day Monday, as they take advantage of

low borrowing costs and investor appetite.

Indeed, a couple companies boosted the amount offered, and most

deals saw orders exceeding their size. Robust demand allowed some

companies to offer investors a smaller risk premium--less

compensation over risk-free Treasurys--than forecast when the deals

first came to market. Still, investors, as concerns over European

risk ebb, are eager for highly-rated bonds yielding more than

government securities.

"All in yields are extremely low, spreads are relatively

attractive and almost everyone expects rates to move higher

eventually," said Tom Murphy, portfolio manager at RiverSource

Investments in Minneapolis. "With corporate America seemingly more

sanguine about their business prospects, why not borrow to invest

for growth?"

New bond sales had slowed recently amid concerns over Greece's

fiscal position. But amid steps to address that situation, and as

reports continue to show economic recovery in the U.S., investors

are feeling more confident.

"There is a cautious perception that sovereign risk has been

somewhat reduced and this gives investors a chance to return to the

market," said Scott MacDonald, director of research at Aladdin

Capital Holdings in Stamford, Conn.

The largest deal Tuesday came from Swiss pharmaceutical giant

Novartis AG (NVS), which increased its three-part offering to $5

billion from $4 billion. Proceeds will finance its acquisition of a

52% stake in eye-care products maker Alcon from Nestle SA (NSRGY,

NESN.VX), according to the prospectus.

Other deals include Royal Bank of Scotland Group PLC's (RBS,

RBS.LN) $2 billion note, Amgen Inc.'s (AMGN) $1 billion bonds,

American Honda Finance's $1 billion issue, and Anadarko Petroleum

Corp.'s (APC) $750 million 30-year.

Real estate investment trust ProLogis (PLD) was also marketing

$1.1 billion in notes in order to pay down its debt. Denmark's

largest bank, Danske Bank AS (DNSKY, DANSKE.KO), was offering a

five-year note of at least $500 million. Smaller deals from Georgia

Power Co. and Transalta Corp. (TAC, TA.T) were also on tap

Tuesday.

Meanwhile, Citigroup Inc. (C) is offering about $2 billion in

$25 par 30-year trust preferred securities, or TRUPs, as part of

its agreement with regulators on repaying federal bailout

funds.

Guy LeBas, chief fixed-income strategist at Janney Capital

Markets in Philadelphia, said the tone in the corporate market is

"good" and pointed out that deals sold on Monday have also

performed well in the secondary market.

Brighter tone has extended to the high yield market, where

smaller deals have been in vogue for the past several days,

punctuated by an occasional larger issue, such as MGM Mirage's

(MGM) $845 million offering of senior secured 10-year notes,

announced on Monday.

Also on Monday, Building Materials came to market with $325

million in 10-year notes, and Sonic Automotive Inc. (SAH) said it

would sell $210 million of eight-year notes.

-By Romy Varghese, Dow Jones Newswires; 215-656-8263;

romy.varghese@dowjones.com

(Anusha Shrivastava, Prabha Natarajan and Michael Aneiro

contributed to this report.)

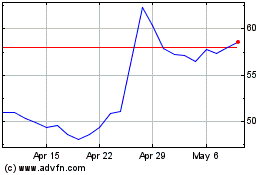

Sonic Automotive (NYSE:SAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sonic Automotive (NYSE:SAH)

Historical Stock Chart

From Apr 2023 to Apr 2024