OneWeb, an affiliate of the Japanese group, to buy Intelsat in

bid for wider internet access

By Andy Pasztor and Mayumi Negishi

Japanese telecom company SoftBank Group Corp. is orchestrating a

deal between U.S. satellite startup OneWeb Ltd. and debt-laden

satellite operator Intelsat SA in an attempt to deliver faster and

cheaper internet connections world-wide.

OneWeb, which is 40%-owned by SoftBank, Tuesday said it would

buy Intelsat, combining two very different types of satellite

fleets that would offer low-cost, versatile connectivity spanning

the globe. As part of the deal, SoftBank will inject $1.7 billion

into the combined company, in which it will hold a 40% stake.

The deal, which is subject to approval by Intelsat bondholders,

would lower Intelsat's roughly $14.5 billion debt by about $3.6

billion, while allowing OneWeb to further expand its ambitious

satellite-production and deployment plans in the next decade.

The combination comes amid escalating efforts by other tech

giants to find the recipe for ubiquitous internet links in the sky.

Facebook Inc. is developing a high-altitude, solar-powered drone,

called Aquila, to provide web access to remote locations. Alphabet

Inc.'s Google is working on high-altitude balloons, dubbed Project

Loon, and specialized satellites. Even Boeing Co, which in the past

resisted the trend toward small satellites, is pursuing plans to

possibly launch its own downsized fleet.

SoftBank, which runs a major cellphone provider in Japan and

controls Sprint Corp. in the U.S., is chasing new deals as it seeks

to control technologies it sees as essential in an age of increased

connectivity, automation and artificial intelligence.

Last year, it closed a $32 billion deal to buy U.K. chip

designer ARM Holdings PLC, a key supplier of chip architecture for

cellphones. ARM aims to double the number of its engineers in five

years to accelerate research in areas such as chip security and

robotics.

SoftBank Chief Executive Masayoshi Son is preparing to open a

$100 billion fund, with the backing of Saudi Arabia's

sovereign-wealth fund and other partners, in an attempt to become

the world's biggest investor in technology over the next

decade.

The proposed deal between OneWeb and Intelsat would be a major

departure from the traditional way satellite-service providers have

operated. It would feature a hybrid fleet of large Intelsat craft

operating at high altitudes and eventually perhaps more than 2,500

smaller satellites circling much closer to the Earth.

The move is the latest marrying a startup space company with a

more established player at a time many incumbent satellite-services

companies are struggling with a capacity glut that is weighing on

earnings. Luxembourg's SES SA last year agreed to buy all of O3b

Networks Ltd. OneWeb's founder, Greg Wyler, also founded and serves

as executive chairman of O3b.

For Intelsat, which has been struggling under a heavy debt load

and sluggish growth, the proposed deal amounts to a lifeline to

reinvigorate its offerings by teaming up with a more-nimble

partner.

Intelsat has weathered a string of acquisitions and leveraged

buyouts stretching back more than a decade. Several private-equity

firms acquired the company in 2004 for $3.1 billion. Four years

later, a different set of private-equity partners closed a deal for

the company relying on only $5 billion of equity and the assumption

of more than $11 billion of debt. Recently, Intelsat's management

has been seeking strategies to manage its debt and boost sales.

Stephen Spengler, Intelsat's chief executive, described the move

as "an acceleration of the plans of both companies." He said

Softbank's agreement to inject $1.7 billion into the new entity

wasn't intended to underwrite the proposed fleet expansion.

But by paring debt and capitalizing on some of OneWeb's assets,

Mr. Spengler envisions offering customers more options as data

rates and user patterns shift around the world.

"We need to bring multiple solutions to the table" to persuade

customers the combined fleets offer long-term stability under

fast-changing conditions, he said during a call with analysts hours

after the announcement. With annual revenue projected to stay at

roughly $2.1 billion for 2017, Mr. Spengler said Intelsat also

would benefit from foregoing some capital expenditures, But company

officials said it was too early to release specifics.

Building, testing and launching large commercial-communications

satellites that hover over a specific spot on the Earth can cost

hundreds of millions of dollars and take several years from the

time designs are started.

By contrast, OneWeb projects initially assembling its satellites

over a matter of days -- and eventually in less than 24 hours -- at

a cost below $1 million apiece.

Pending approvals by bondholders and regulators, Mr. Spengler is

slated to be chief executive and Mr. Wyler executive chairman of

the combined company.

The deal's goal is to unlock new applications and markets,

including faster and less-expensive internet links for mobile

devices and homes and business in developing regions. By building

on OneWeb's technical advances and Intelsat's experience serving

mature and emerging areas, the transaction provides "an opportunity

to utilize" diverse assets and "create something that is larger

than the individual companies," Mr. Wyler said in an interview.

He also said OneWeb's existing partners, including Airbus SE,

unanimously back the deal. The announcement comes barely days

before a joint venture between OneWeb and Airbus is scheduled to

break ground to construct a cutting-edge automated factory in

Florida intended to assemble satellites faster than any other

facility in the world. The venture has projected building some 600

modular satellites and starting initial service by 2019.

The two satellite fleets won't be able to directly hand off

signals to each other. But the combination would mean tailoring

capacity from each system to most effectively serve different types

of markets.

Industry officials consider large, highflying systems better

able to satisfy extensive demand in urban areas, partly because

individual satellites have unmatched power and capacity.

Constellations of smaller spacecraft such as the OneWeb plans to

put up, however, cost less and typically have shorter lag times

between transmissions from space and reception of signals on the

ground. They often are preferred for serving dispersed demand over

less populated areas.

In a speech in London last week, Mr. Wyler told reporters that

OneWeb was leaning toward building and deploying a

second-generation fleet, potentially comprising another 2,000

additional, higher-capacity satellites by 2027, partly reflecting

SoftBank's vision of expanded capacity.

--Robert Wall contributed to this article.

Write to Andy Pasztor at andy.pasztor@wsj.com and Mayumi Negishi

at mayumi.negishi@wsj.com

(END) Dow Jones Newswires

March 01, 2017 02:49 ET (07:49 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

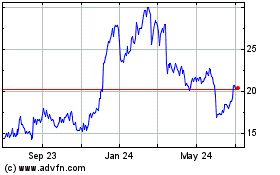

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

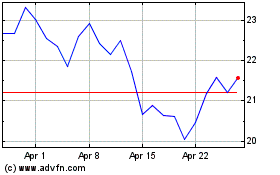

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024