UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 18, 2017

Sprint Corporation

(Exact Name of Registrant as Specified in its Charter

)

|

|

|

|

|

|

|

Delaware

|

001-04721

|

46-1170005

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

6200 Sprint Parkway

Overland Park, Kansas 66251

(Address of Principal Executive Offices, Including Zip Code)

(855) 848-3280

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

Item 5.02

|

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Chief Operating Officer Appointment

On January 24, 2017, Sprint Corporation (“Sprint”) announced that Nestor Cano, 52, has agreed to become Chief Operating Officer of Sprint effective on February 2, 2017 (the “Effective Date”). The press release is filed as Exhibit 99.1 to this Form 8-K and is incorporated by reference herein.

Mr. Cano has been the President, Europe of Tech Data Corporation since June 2007. Tech Data Corporation (“TDC”) is listed on NASDAQ and is one of the world’s largest wholesale distributors of technology products. Mr. Cano joined TDC in July 1989 as a Software Product Manager and served in various management positions within TDC’s operations in Spain and Portugal from 1990 to 1995, after which time he was promoted to Regional Managing Director. In March 1999, he was appointed Executive Vice President of U.S. Sales and Marketing, and in January 2000 was promoted to President, the Americas. Mr. Cano was promoted to President, Worldwide Operations in August 2000 and was appointed to President, Europe in June 2007.

On January 19, 2017, Sprint entered into an employment agreement with Mr. Cano (the “Agreement”) with an initial term of four years from the Effective Date. The Agreement provides for the following annual compensation:

|

|

|

|

|

|

|

|

|

Ÿ

|

|

an annual base salary of $1,300,000;

|

|

|

|

|

|

|

|

|

|

Ÿ

|

|

participation in Sprint's short-term incentive compensation plan with a targeted annual opportunity equal to 100% of his annual base salary; and

|

|

|

|

|

|

|

|

|

|

Ÿ

|

|

participation in Sprint's long-term incentive compensation plan with a targeted annual opportunity equal to $1,625,000.

|

The Agreement states that Sprint will provide Mr. Cano with the following sign-on compensation:

|

|

|

|

|

|

|

|

|

Ÿ

|

|

a $300,000 cash sign-on bonus payable as soon as administratively practicable after the Effective Date, subject to repayment if Mr. Cano resigns within two years after his Effective Date; and

|

|

|

|

|

|

|

|

Ÿ

|

|

an award of restricted stock units (the “Make-Whole RSUs”) in consideration for certain forfeited restricted stock units from his former employer, subject to Sprint’s Omnibus Incentive Plan and governed by the Evidence Award substantially in the form attached to the Agreement as Exhibit B, and the value of which will be $2,397,468, with the number of restricted stock units to be determined using Sprint’s grant methodology and practices for other Sprint senior executives.

|

The Agreement provides for an award of 1.75 million shares of restricted stock units which can be earned upon the achievement of specified volume-weighted average prices of Sprint’s common stock during any 150-calendar day period during the period from February 2, 2017 through May 31, 2019, with vesting of earned shares occurring 50 percent on February 1, 2020, and 50 percent occurring on February 1, 2021 (the “Turnaround RSU Award”).

The Agreement provides that Mr. Cano’s job location will be in Overland Park, Kansas and that he will relocate his primary residence to the area under the standard officer relocation program.

The Agreement also provides that if (1) Sprint provides notice of non-renewal of the employment term and Mr. Cano’s employment terminates upon the resulting expiration of the employment term, and (2) Mr. Cano has no earned shares under his Turnaround RSU Award, Sprint will pay Mr. Cano $1,563,347 cash in a lump sum as soon as practicable after such termination. If Mr. Cano has earned shares under his Turnaround RSU Award, however, he will not receive this lump sum and will receive no severance.

Under the Agreement, in the event that Mr. Cano’s employment is terminated by Sprint without cause (as defined in the Agreement), or Mr. Cano terminates his employment for good reason (as defined in the Agreement), other than in connection with a change in control of Sprint and subject to a release of claims:

|

|

|

|

|

|

|

|

|

Ÿ

|

|

he will continue to receive his base salary for 24 months following his termination date (the “Payment Period”);

|

|

|

|

|

|

|

|

|

|

Ÿ

|

|

he will receive a payment under the then-applicable short-term incentive plan during the Payment Period equal to the lesser of his targeted opportunity as of his termination date and the payout determined by Sprint's Compensation Committee based on actual performance of Sprint compared to the targeted objectives under the plan;

|

|

|

|

|

|

|

|

|

|

|

|

Ÿ

|

|

he will be entitled to participate in certain benefit plans during the Payment Period; and

|

|

|

|

|

|

|

|

Ÿ

|

|

the restrictions with respect to any unvested portions of the Make-Whole RSUs will lapse as of his termination date.

|

In addition, in the event that Mr. Cano’s employment is terminated by Sprint without cause (as defined in the Agreement) after the second anniversary of his Effective Date, the restrictions with respect to the Turnaround RSU Award will lapse for a pro-rata number of the shares earned upon achievement of the price targets that would have otherwise been received without such termination on the vesting date, based on the number of days Mr. Cano was employed during the performance period over the entire performance period.

Upon Mr. Cano’s death, the restrictions with respect to any unvested portions of the Make-Whole RSUs would lapse and a pro rata portion of any earned shares under the Turnaround RSU Award would lapse as described above.

In the event of Mr. Cano’s termination of employment due to disability, he will continue to receive his base salary for 12 months (reduced by any amounts paid under Sprint’s long-term disability plan), he will be entitled to continue to participate in certain benefit plans for such period, and the restrictions with respect to any unvested portion of the Make-Whole RSUs will lapse as of his termination date. In addition, a pro rata portion of any earned shares under the Turnaround RSU Award would lapse as described above.

If, in connection with a change in control of Sprint, Mr. Cano’s employment is terminated without cause or Mr. Cano terminates his employment for good reason during the 18-month period following a change in control (subject to certain exceptions), subject to a release of claims, he is entitled to severance compensation in the form of a lump sum payment of two times his base salary and two times his annual short-term target opportunity as of the date of his termination of employment, to participate in certain benefit plans during the Restricted Period (as defined below) and to the lapse as of his termination date of the restrictions with respect to any unvested portion of the Make-Whole RSUs. With respect to the Turnaround RSU Award, earned shares (if any) will be the greater of the achievement based on (1) volume-weighted average prices of Sprint’s common stock over any 150-calendar day period as of the date of the change in control as compared to the price targets, or (2) the consideration per share of Sprint stock in connection with the change in control as compared to the price targets. Any earned shares under the previous sentence will vest on the vesting date as specified, unless the continuing entity fails to assume the RSUs, in which case vesting will accelerate without proration as of the date of the change in control. In addition, if during the 18-month period, Mr. Cano’s employment is terminated by Sprint without cause, or Mr. Cano terminates his employment for good reason, any earned shares will immediately vest and become payable without proration. Change in Control for this award is as defined in the equity plan in effect, except that acquisition by SoftBank Group Corp. or its subsidiaries of 100% of Sprint’s shares (such that Sprint ceases to have any class of equity securities listed on a national securities exchange) will not be governed by the acceleration provisions upon a change in control.

Throughout his employment and through the 24-month period following Mr. Cano’s date of termination (the “Restricted Period”), Mr. Cano has agreed not to compete with Sprint or solicit employees or customers of Sprint. If Mr. Cano breaches any of these obligations, he would forfeit his right to any future severance payments and benefits to which he otherwise would be entitled.

The Agreement is filed as Exhibit 10.1 to this Form 8-K and is incorporated by reference herein.

Roger Solé Retention Award

On January 18, 2017, Sprint Corporation’s Compensation Committee approved a cash retention payment to Roger Solé, Chief Marketing Officer, in the amount of $200,000. The cash retention payment must be repaid by Mr. Solé if he voluntarily leaves the Company within one year from the payment date.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

The following exhibits are filed with this report:

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Employment Agreement, executed as of January 19, 2017, between Nestor Cano and Sprint Corporation

|

|

99.1

|

|

Press Release

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: January 24, 2017

|

Sprint Corporation

|

|

|

By:

/s/ Stefan K. Schnopp

Stefan K. Schnopp

Vice President and Corporate Secretary

|

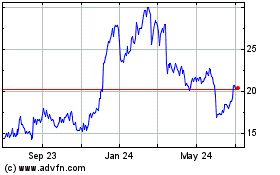

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

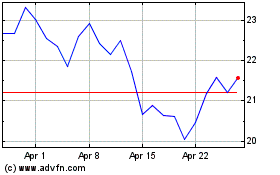

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024