Trump Victory Throws Doubt on AT&T-Time Warner Deal, Net Neutrality--Update

November 09 2016 - 5:11PM

Dow Jones News

By Ryan Knutson

Donald Trump's victory in the presidential campaign throws doubt

on AT&T Inc.'s proposed acquisition of Time Warner Inc. and

could undermine the government's net neutrality rules. But many of

his positions on the technology and telecommunications sectors are

largely unknown.

Mr. Trump said in October that he would block the AT&T-Time

Warner deal, and that he would try to break up the Comcast

Corp.-NBC Universal merger. In both cases, Mr. Trump said the media

is controlled by too few people.

Shares of AT&T rose 1.2% Wednesday, while Time Warner

shares, which were already trading at a wide discount to AT&T's

offer, fell 1.5%.

At an investor conference Wednesday, AT&T finance chief John

Stephens extended an olive branch. "We really look forward to

working with President-elect Trump," Mr. Stephens said. "His

policies and his discussions about infrastructure investment,

economic development, and American innovation all fit right in with

AT&T's goals."

Analysts say other industry consolidation is more likely.

Investors sent Sprint Corp. and T-Mobile US Inc. shares higher,

believing a merger between the two wireless carriers was more

likely under a Trump administration. Sprint shares rose 13%, while

T-Mobile gained 5%.

T-Mobile CEO John Legere said the election is positive in "many

ways" for T-Mobile and called for America to unite and move forward

together. "Let's see what an out of the box, nontypical,

nonpolitician can do for America," Mr. Legere said.

Richard Greenfield, an analyst at BTIG, said it is hard to

predict what Mr. Trump's stance against the AT&T-Time Warner

deal means for other sector consolidation. "Honestly, until we

understand the extent of Trump's views on the dangers of media

industry consolidation, it is impossible to know what deals could

get done," he wrote in a research note.

Independent telecom analyst Roger Entner predicted the Federal

Communications Commission would take a less activist role under Mr.

Trump. Beyond that, it isn't clear because neither candidate said

much about telecom during the campaign, he said. "It was basically

not a topic at all, which means to me that they haven't really

thought about it yet," Mr. Entner said during a conference call

held by the industry trade group CTIA.

In the past, Mr. Trump made statements against net neutrality,

saying it would "target conservative media" and comparing it

against the Fairness Doctrine, which required broadcasters on

government airwaves to provide balanced coverage of controversial

issues. Net neutrality requires all web traffic be treated equally,

and it doesn't allow certain content to get special treatment.

Analysts at New Street Research believe Mr. Trump will likely

align with traditional Republican thinking on telecom policy.

Particularly on complex, low-publicity items, "partisan gravity

will be sufficient to bring Trump's view into line with his party's

well-established path," researchers wrote in a note to clients

earlier this year.

It would be difficult, but not impossible, for Mr. Trump to

unwind the FCC's 2015 net neutrality rules. Those rules were upheld

by a Washington, D.C., appeals court, but the telecom industry has

appealed to the Supreme Court. If the court agrees to hear the

case, and Mr. Trump is able to appoint conservative judges, it is

plausible the rules could be overturned. The FCC could also simply

reclassify the internet again, and turn it back to the more lightly

regulated model used before, said Blair Levin, a former FCC

official who now serves as an adviser to New Street Research.

More than a year ago, after Mr. Trump began his presidential

campaign, the New Street Research analysts published a

tongue-in-cheek research note about the impact his presidency would

have on the U.S. telecom market. The note joked about how AT&T

and Verizon Communications Inc. would succeed under a Trump

presidency because "They are big. They are huge. They are

tremendous."

New Street Research sent out a revised note a few months later

after Mr. Trump began winning states in the Republican primary. We

"thought the prospect of a Trump presidency quite low," they

wrote.

Analysts at Citigroup say Mr. Trump's victory could affect some

media stocks as his embrace of social media boosts Twitter Inc. and

Facebook Inc., while his confrontational relationship with

traditional outlets hurts CBS, Disney, Time Warner and Fox.

Likewise, Mr. Trump's stance on net neutrality could help cable

companies like Comcast Corp. and Charter Communications Inc. but

hurt over-the-top players like Netflix Inc., Citigroup said.

Mr. Levin said a rewrite of the 1996 Telecom Act is more likely

given that Republicans now control both Congress and the White

House. A new bill would likely rein in the FCC's power, he said.

"The unpredictability of what happens now is so extreme," he said.

"When it comes to policy, we are coloring outside the lines."

Thomas Gryta contributed to this article.

Write to Ryan Knutson at ryan.knutson@wsj.com

(END) Dow Jones Newswires

November 09, 2016 16:56 ET (21:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

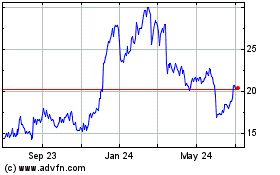

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

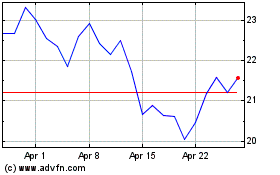

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024