OneWeb in Talks With Japan's SoftBank About Potential Linkup

October 25 2016 - 1:30PM

Dow Jones News

OneWeb Ltd., a satellite-internet startup whose backers include

Airbus Group SE and entrepreneur Richard Branson, is in talks with

Japan's SoftBank Group Corp. about a potential strategic linkup,

according to people familiar with the matter.

No deal has been finalized, these people said, and OneWeb

representatives also have engaged in discussions with other

possible suitors. It isn't clear whether SoftBank, a global

internet and telecommunications company with an interest in

satellite technology, is seeking to become a minority funder or to

acquire a significant stake in OneWeb. The talks haven't been

reported before.

They were initiated as part of OneWeb's effort to raise roughly

$500 million this fall to support its previously announced

constellation of some 640 small, low-Earth orbit satellites

designed to deliver fast broadband connections in rural and

emerging markets. But as discussions with SoftBank progressed,

according to one person familiar with the matter, the focus shifted

to the possibility of a broader transaction.

It isn't clear which other companies may be involved in separate

discussions with OneWeb and Chairman Greg Wyler, the founder and

the chief architect of its proposed constellation.

Mr. Wyler has said OneWeb Satellites, a joint venture with

Airbus, aims is to reshape the industry by setting up a proposed

high-volume manufacturing facility in Florida. The goal is to turn

out satellites on an automated assembly line akin to those now used

for medical devices or airplane equipment. Airbus has set an

aggressive price target of less than $1 million per satellite,

versus traditional price tags amounting to hundreds of millions of

dollars for larger and more capable spacecraft dependent on

customized, hands-on assembly procedures.

The activity comes amid a world-wide resurgence of interest in

small satellites, with dozens of fledgling manufacturers, service

providers and launch companies scrambling to grab market share.

With its prominent backers and high-profile chairman, OneWeb has

been in the forefront of this trend and captured the imagination of

well-known experts. Silicon Valley financier Steve Jurvetson, for

example, told a conference in Long Beach, Calif., last month that

the company's global dream of connecting schoolhouses to the

internet is "one of the most enthralling and exciting things" in

the digital arena.

Taking a stake in OneWeb would fit SoftBank Group founder and

Chief Executive Masayoshi Son's long-term strategy of investing in

technologies for a more connected world, and could create synergies

with SoftBank's mobile operations.

Established in 1981 by Mr. Son, SoftBank was an early financial

backer of Yahoo Inc., as well as Alibaba Group Holding Ltd., which

has grown to become China's biggest internet shopping outlet.

Mr. Son's company bought U.S. mobile carrier Sprint Corp. in

2013 for $22 billion and operates Japan's third-largest mobile

carrier. One of the markets OneWeb is looking at is supporting

mobile-phone services.

SoftBank also has made some inroads into satellite technology.

In February it announced that it intends to provide high speed LTE

services in Japan partly by relying on Israel's Gilat Satellite

Networks Ltd.'s technology. In 2014 SoftBank established a

satellite research company called SoftBank Satellite Planning Corp.

aimed at developing new satellite communications networks. Boeing

Co. took an equity stake in the company in 2015.

SoftBank has been stepping up its pace of transactions, pouring

more than $45 billion into technology investments alongside

co-investors over the past two years, including a $32-billion deal

to buy U.K.-based chip designer ARM Holdings PLC, whose chips power

more than 95% of the world's smartphones.

SoftBank also has garnered additional investment firepower with

a recently announced $100 billion technology-investment fund it is

creating with Saudi Arabia's Public Investment Fund. SoftBank plans

to invest at least $25 billion in the fund over the next five

years. The Saudi fund could invest up to $45 billion during the

same period, and more could come from other investors.

Write to Andy Pasztor at andy.pasztor@wsj.com and Alexander

Martin at alexander.martin@wsj.com

(END) Dow Jones Newswires

October 25, 2016 13:15 ET (17:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

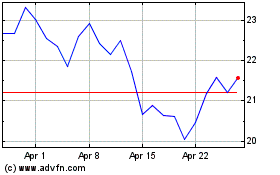

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

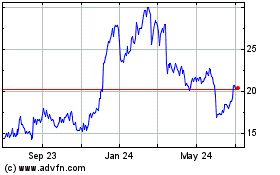

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024