Apple Shares' Best Streak in More Than 2 Years

September 16 2016 - 12:50PM

Dow Jones News

In a rough week for stocks, Apple Inc. has soared.

Shares in the Cupertino, Calif.-based company rose 12% this week

through Thursday, their best four-day streak in more than two

years. Apple was the top performer in the Dow Jones Industrial

Average on Thursday, and the only stock in the blue-chip index to

gain during a selloff Tuesday that sent the Dow industrials down

1.4%.

Apple was the most-active stock in both the Dow industrials and

S&P 500 on Thursday, gaining $3.80, or 3.4%, to $115.57. Shares

retreated 0.4% in early trading Friday.

Apple's strong week follows a recent stumble. Shares fell almost

5% in the two days after last Wednesday's iPhone 7 unveiling,

briefly sliding into negative territory for 2016. Some reviewers

said the phone offered only incremental improvements over previous

versions, such as better battery life and water resistance, instead

of dramatic new features. The removal of the phone's headphone jack

was also a polarizing decision.

Early adopters showed up as usual. Apple said it has already

sold out of some versions of the new phone since preorders started

last week. That came after T-Mobile and Sprint suggested strong

demand without giving numbers. Shoppers lined up to buy the new

phones Friday.

Several investors and analysts said hints of strong sales were

enough to demonstrate the the loyalty of Apple's customers, after

iPhone sales fell for two consecutive quarters. Meanwhile, Samsung

Electronics Co. is recalling its competing Galaxy Note 7 smartphone

because of battery fires.

"This shows that the user base is loyal and wants to upgrade

either when new tech comes along or when their new phones wear

out," said Jim Tierney, chief investment officer for concentrated

U.S. growth at AllianceBernstein Holding LP, who holds Apple

shares.

Apple didn't respond to a request for comment.

Technology shares have also been rallying broadly. Tech stocks

have soared 11% in the past three months through Thursday, almost

twice the gains of any other group. That is also a change from

earlier in the year, when a sharp dive in tech highlighted investor

concerns about slowing U.S. growth.

Apple has been big driver of those recent gains. Tech is the

only S&P 500 sector to rise this month, climbing 1.5% through

Thursday as the broader index fell 1.1%. Excluding Apple would cut

tech's gain to 0.2%, according to S&P Dow Jones Indices, noting

Apple remains the biggest company in the index by market cap.

Without Apple, the S&P 500 would be down 1.4% in that

period.

Some investors and analysts said Apple still has room to run.

The company traded at about 13 times its last 12 months of earnings

as of Wednesday's close, compared with almost 20 for the S&P

500, looking like a relative bargain at a time when many investors

are concerned about stretched valuations.

RBC Capital Markets analysts led by Amit Daryanani adjusted

their target price for the company upward to $120 from $117 a share

Thursday, maintaining a rating of "outperform" and saying the

current price still offers a good entry point for investors and the

company has been a relative oasis in recent market volatility.

RBC said worries remain that innovation is declining at Apple,

with new sales driven more by existing owners replacing phones than

new customers buying in. But it has attractive valuations, gross

margins that are at least stable and a consumer-friendly ecosystem

of hardware and software integrated across multiple devices that

would be difficult for competitors to replicate.

Write to Aaron Kuriloff at aaron.kuriloff@wsj.com

(END) Dow Jones Newswires

September 16, 2016 12:35 ET (16:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

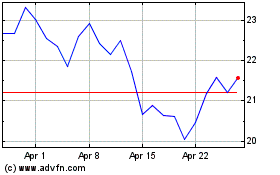

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

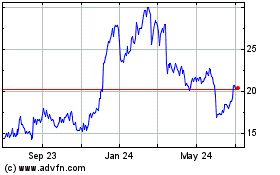

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024