Carriers Bring Back Subsidies With iPhone 7 Launch

September 09 2016 - 4:52PM

Dow Jones News

By Thomas Gryta

Wireless carriers have spent years nudging customers into paying

full price for their expensive smartphones, but a rash of

promotions around the coming iPhone 7 shows a willingness to still

subsidize the device.

Shortly after Apple Inc. unveiled its newest handset, T-Mobile

US Inc. and Sprint Corp. rolled out offers that promise a free

iPhone 7 with 32 gigabytes of storage to anyone who turns in an

Phone 6 or 6s. Sprint will also accept one of Samsung's latest S7

models.

The move was followed Friday by both Verizon Communications Inc.

and AT&T Inc., making the option available to most U.S.

wireless customers.

Encouraging customers to upgrade to the newest iPhone and

subsidizing the switch is a departure from what the industry has

done in recent years. Last year, Apple, Sprint and T-Mobile

introduced leases that let customers upgrade frequently for a

monthly fee. But the bigger carriers have mostly required customers

to pay $649 either up front or in monthly installments. That has

resulted in customers holding on to their devices longer and

switching between carriers less often.

"Subsidies are like crack," said Craig Moffett, a telecom

analyst with MoffettNathanson, noting the iPhone 7 launch opens a

window for carriers to get people to switch providers and grab

market share. "It is hard to resist the temptation of dangling a

free iPhone in front of the customers."

When the iPhone was rising in popularity and people were still

converting from flip phones, most people got the Apple device by

signing a two-year service contract and paying $200 for a base

model. That started to change in 2013, led by T-Mobile, as carriers

ditched the contract.

The majority of iPhones are now sold through installment plans.

AT&T, the once-exclusive carrier of the iPhone, doesn't even

offer the contract option. Many observers believe the industry had

successfully moved away from subsidies and conditioned customers to

the true cost of smartphones.

Service cancellations are at historical lows in the industry,

something that is good for the carriers. But it also means

potential switching events increase the urgency for smaller players

to capture customers when a new device is released. Customers tend

to re-evaluate their provider when buying a new device.

T-Mobile, which was the last major provider to carry the iPhone,

has a lot to gain by luring away customers from rivals. "We are the

net beneficiary of every major phone launch in recent years," a

T-Mobile spokesman said. "This is an opportunity to have more

customers switch."

Roger Solé, Sprint's chief marketing officer, said the carrier

was planning its offer before T-Mobile's announcement and it pairs

with its recent unlimited-data plan offer and network upgrades.

"The iPhone 7 is the last part of the value proposition that we

offer," Mr. Solé said. He conceded that others having a similar

limited-time offer makes Sprint's effort less effective.

T-Mobile and Sprint highlight that the free iPhone 7 promotion

isn't a step back to the old contract days, because customer bills

still reflect the cost of the device matched by a credit for that

cost. They will see that the device has a real cost but that it is

being covered by the carriers, spokespeople said.

For Apple, the promotions are positive because they encourage

upgrades as people are waiting longer and longer to replace their

devices. Apple sold 230 million iPhones world-wide in its past

fiscal year, but sales of the device have declined in each of the

past two quarters.

Under the old subsidized upgrades, U.S. carriers would charge

$200 upfront and recoup the balance with higher monthly fees. With

the newest offers, the carriers will cover some of their costs by

taking in used cellphones that they can resell or reuse. Used

prices for iPhone 6 models range from about $140 to $170, while

used iPhone 6s fetch between $200 and $250, according to

Gazelle.com.

Like the old service contract model, the iPhone 7 upgrades

require customers to stick around for two years to make it truly

free. In most cases, customers canceling their service early will

have to pay off the remainder of the device cost. The deals are

open to new and existing customers.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

September 09, 2016 16:37 ET (20:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

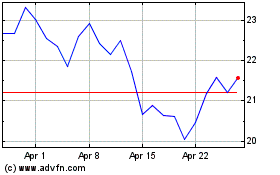

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

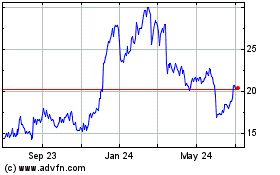

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024