Americans Keep Their Cellphones Longer

April 18 2016 - 3:52PM

Dow Jones News

By Thomas Gryta

The death of the two-year cellphone contract has broken many

Americans from a habit of routinely upgrading their

smartphones.

Since the early days of Apple Inc.'s iPhone, most customers have

avoided paying for the full price for the latest model. But the

success of AT&T Inc. and Verizon Communications Inc. since 2013

in shifting customers into plans that force them to pay the full

price for devices -- and separate that cost from monthly service

fees -- has consumers holding on to their devices longer.

Citigroup estimates the phone-replacement cycle will stretch to

29 months for the first half of 2016, up from 28 months in the

fourth quarter of 2015 and the typical range of 24 to 26 months

seen during the two prior years.

"It's never good to be in a market where subsidy hides the real

cost of doing something," John Stankey, chief executive of

AT&T's entertainment group, said during an investor conference

last month. The technological advances that come in new models are

narrowing, he said, and many wireless customers "are no longer

thinking that they want to upgrade it every 12 months or 18

months."

Matt Szatkowski is planning to keep his phone -- potentially

until it no longer works. The 24 year-old who lives in Orange,

Conn., bought his iPhone 6 from AT&T in September using an

installment plan and paid it off in 18 months. Now that the $37.50

monthly payments are finished, he plans to wait as long as possible

to upgrade.

"I don't need one," he said, noting that while he may be curious

about the new phones' features, so far he doesn't feel a need to

upgrade. "This one works perfectly fine."

Previously, Mr. Szatkowski traded in his phones every two years

because the structure of his contract plan encouraged it. He called

the upgrade cycle a "marketing trap" and believes the features on

his phone will hold up for years.

Last year, Apple tried to combat that shift by introducing a

leasing program allowing customers to get a new device as often as

every 12 months. Fewer Americans, however, are buying their phones

directly from Apple, with three-fourths opting to purchase from

their wireless carriers in 2015, according to a study by Consumer

Intelligence Research Partners.

"In terms of the upgrade program itself, I think over time, it

will be meaningful as customers get into a different pattern,"

Apple CEO Tim Cook said during a January conference call with

analysts. "This has to do with wanting to provide customers a very

simple way to upgrade."

Smaller carriers Sprint Corp. and T-Mobile US Inc. also offer

phone leases with frequent upgrades. AT&T and Verizon -- the

two biggest players, with about three-quarters of the country's 246

million mainstream cellular subscribers, according to UBS, don't

offer such a leasing option. Most AT&T or Verizon customers

must either buy their new phones upfront or pay in monthly

installments.

Sprint said 55% of its customers buying a phone choose leasing.

T-Mobile said it hasn't seen a drop in upgrade rates in recent

quarters. At the end of the lease, a customer has to either return

the phone or make a one-time payment to buy the device.

Analysts see the longer device life as positive for the carriers

because it could lead to fewer service cancellations or defections

in the competitive industry. "Handset sales are the main trigger

for customer activity and movement among the carriers," UBS analyst

John Hodulik said in a recent note to clients.

In 2015, about 30% of the U.S. postpaid phone base upgraded

their device, according to UBS, down from 32.5% in 2014 and a high

of 35% in 2011. The firm expects an all-time low 6.2% of the base

to upgrade in the first quarter, down from 7.2% a year ago.

The longer upgrade cycle lowers equipment revenue for the

telecom companies, but Verizon's Chief Financial Officer Fran

Shammo argued last month that the top-line shift is painless.

"In this world where the customer is paying full price for the

phone, it has less of an impact regardless of where volume is," he

said. "I record $1 dollar of revenue, I record $1 of cost, it is

zero profit because everybody is selling them at cost."

The shift isn't as benign for Apple.

BTIG analyst Walter Piecyk recently cut 10 million units out of

his fiscal 2016 and 2017 iPhone estimates because of shifting

upgrade rates in the U.S. "We have broader concerns that there is a

structural change under way in the pace of upgrades," he told

clients.

Apple declined to comment.

Mr. Piecyk warned it may take more quarters and the launch of

the next model of iPhone -- likely in the fall -- to confirm the

trend. While some contend that being in the tail end of the

two-year iPhone model cycle hurts upgrades, he said the decline

this year has been "more steep than prior cycles."

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

April 18, 2016 15:37 ET (19:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

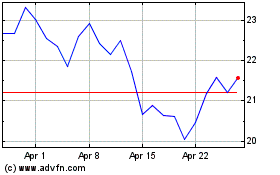

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

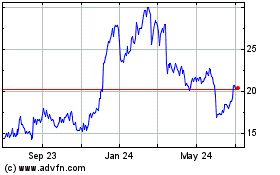

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024