Sprint to Sell, Lease Back Some Network Assets

April 06 2016 - 7:00PM

Dow Jones News

Sprint Corp. said Wednesday it would take another step to

address its cash crunch by selling some network assets and leasing

them back.

This is the latest move by Sprint, which has been losing

customers and money for years, to shore up its cash situation. The

company said it would get a $2.2 billion infusion by selling

network equipment to certain entities, known together as Network

LeaseCo.

The newly formed Network LeaseCo. would be backed by external

investors, including Sprint parent SoftBank Group Corp. Network

LeaseCo. would lease the equipment it purchased back to the

carrier.

The transaction essentially serves as a loan that will cost

Sprint less than tapping debt markets, freeing up much-needed

resources for network investment and operations.

"Sprint and SoftBank have worked together again to create a

unique structure that provides Sprint with an attractive source of

capital," said Sprint Chief Financial Officer Tarek Robbiati.

Sprint expects the $2.2 billion of cash proceeds generated by

this transaction to be repaid in staggered, unequal payments

through January 2018.

The network assets involved in the transaction have a net book

value of about $3 billion, according to Sprint, and consist

primarily of equipment located at cell towers.

In November, the company had made a more unconventional move to

boost its cash pile, saying it would get a $1.1 billion cash

infusion through a deal to sell certain handsets and other devices

it has leased to its customers.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

April 06, 2016 18:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

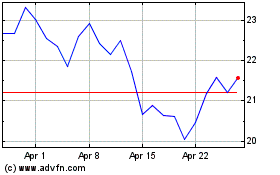

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

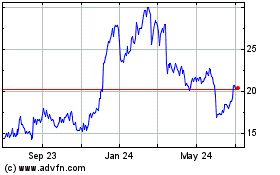

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024