Current Report Filing (8-k)

October 27 2016 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 27, 2016

(

September 30, 2016

)

Republic Services, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-14267

|

|

65-0716904

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18500 North Allied Way

|

|

|

|

Phoenix, Arizona

|

|

85054

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (480) 627-2700

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

Item 2.02 Results of Operations and Financial Condition

On

October 27, 2016

, Republic Services, Inc. (the Company) issued a press release containing information about the Company’s financial results for the

three

and

nine

months ended

September 30, 2016

. A copy of this press release is incorporated herein by reference as Exhibit 99.1. The attached earnings press release contains information about the Company's full-year 2016 guidance and preliminary outlook for 2017.

Updated Full-Year 2016 Guidance

Republic expects its full-year diluted earnings per share to be in a range of $1.75 to $1.76 and adjusted diluted earnings per share to be in a range of $2.19 to $2.20. Additionally, the Company expects full-year cash provided by operations to be in a range of $1,814 million to $1,824 million and adjusted free cash flow to be in a range of $840 million to $850 million.

Fiscal Year 2017 Preliminary Outlook

The preliminary outlook for 2017 does not represent full detailed guidance, but rather a point-in-time estimate based on current projections of 2016 performance, early reviews of the 2017 budget process and current economic conditions. Consistent with prior practice, the Company will provide formal guidance in February 2017 once the budget process is complete and full-year 2016 results are reported.

Diluted earnings per share is expected to be in a range of $2.29 to $2.34 and adjusted diluted earnings per share is expected to be in a range of $2.31 to $2.36, both of which assume an effective tax rate of 39.5 percent. Adjusted diluted earnings per share excludes the impact of restructuring charges.

Adjusted free cash flow for 2017 is expected to be in a range of $875 million to $900 million. Adjusted free cash flow consists of cash provided by operating activities, less property and equipment received, plus proceeds from the sale of property and equipment and is exclusive of cash paid for restructuring activities, net of tax.

With respect to the Company's preliminary outlook for adjusted free cash flow, a reconciliation to the closest corresponding GAAP financial measure is not available without unreasonable effort on a forward-looking basis due to low visibility that limits our ability to make accurate projections and estimates related to certain measures such as the purchase and sale of property and equipment, which could vary significantly, either individually or in the aggregate.

We believe that presenting an adjusted free cash flow preliminary outlook provides useful information regarding our recurring cash provided by operating activities after certain expenditures. It also demonstrates our ability to execute our financial strategy and is a key metric we use to determine compensation. The presentation of adjusted free cash flow has material limitations. Adjusted free cash flow does not represent our cash flow available for discretionary expenditures because it excludes certain expenditures that are required or to which we have committed such as debt service requirements and dividend payments. Our definition of adjusted free cash flow guidance may not be comparable to similarly titled measures presented by other companies.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release of Republic Services, Inc. issued October 27, 2016 to announce the financial results for the three and nine months ended September 30, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

REPUBLIC SERVICES, INC.

|

|

|

|

|

|

|

Date:

|

October 27, 2016

|

By:

|

/

S

/ C

HARLES

F. S

ERIANNI

|

|

|

|

|

Charles F. Serianni

|

|

|

|

|

Executive Vice President and

Chief Financial Officer

(Principal Financial Officer)

|

|

|

|

|

|

|

Date:

|

October 27, 2016

|

By:

|

/

S

/ B

RIAN

A. G

OEBEL

|

|

|

|

|

Brian A. Goebel

|

|

|

|

|

Vice President and

Chief Accounting Officer

(Principal Accounting Officer)

|

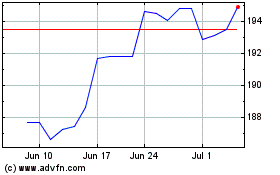

Republic Services (NYSE:RSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Republic Services (NYSE:RSG)

Historical Stock Chart

From Apr 2023 to Apr 2024