UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 5, 2016 (December 30, 2015)

RANGE RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-12209 |

|

34-1312571 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 100 Throckmorton, Suite 1200

Ft. Worth, Texas |

|

76102 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (817) 870-2601

(Former name or former address, if changed since last report): Not

applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Range Resources Corporation

ITEM 2.01 Completion of Acquisition or Disposition of Assets

As previously announced, a subsidiary of Range Resources Corporation (the “Company”) entered into a definitive sales agreement on

November 3, 2015 to sell its Virginia and West Virginia producing properties and other assets. We closed on the sale of these assets on December 30, 2015. Unaudited pro forma consolidated financial information of the Company to give effect

to the disposition of these assets pursuant to such agreement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

ITEM 9.01. Financial Statements and Exhibits

| (b) |

Pro Forma Financial information: |

Unaudited pro forma information of the Company to give effect

to the disposition of our Virginia and West Virginia assets is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference:

| |

- |

Unaudited Pro Forma Consolidated Balance Sheet as of September 30, 2015 |

| |

- |

Unaudited Pro Forma Consolidated Statements of Operations for the year ended December 31, 2014 and for the nine months ended September 30, 2015 |

99.1 Unaudited Pro Forma Consolidated Financial Statements.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

RANGE RESOURCES CORPORATION |

|

|

| By: |

|

/s/ ROGER S. MANNY |

|

|

Roger S. Manny |

|

|

Executive Vice President and Chief Financial Officer |

Date: January 5, 2016

3

Exhibit index

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 99.1 |

|

Unaudited Pro Forma Consolidated Financial Statements. |

4

Exhibit 99.1

Range Resources Corporation

Unaudited Pro Forma Consolidated Financial Statements

The following unaudited pro forma consolidated financial information is presented to illustrate the effect of Range Resources

Corporation’s (“Range”, “our”, “we”) sale of certain assets in Virginia and West Virginia on our historical financial position and operating results. The sale closed on December 30, 2015. The accompanying

unaudited pro forma consolidated balance sheet and unaudited pro forma consolidated statements of operations have been prepared to assist in the analysis of the financial effects of the divestiture. This divestiture does not qualify as a

discontinued operation under ASC 205 after our 2014 adoption of Accounting Standards Update 2014-08. This pro forma information is based on the historical consolidated financial statements of Range and should be read in conjunction with the

accompanying footnotes and the financial statements included in the Range Resources Corporation Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on February 24, 2015 and Quarterly Report on Form 10-Q for

the three and the nine months ended September 30, 2015, filed with the SEC on October 28, 2015.

The accompanying unaudited pro

forma consolidated balance sheet as of September 30, 2015 has been prepared to give effect to the divestiture as if it had occurred on September 30, 2015. The unaudited pro forma consolidated statements of operations for the year ended

December 31, 2014 and the nine months ended September 30, 2015 have been prepared to give effect to the divestiture as if it had occurred on January 1, 2014.

The unaudited pro forma consolidated balance sheet and statements of operations included herein are for information purposes only and are not

necessarily indicative of the results that might have occurred had the divestiture taken place on the respective dates assumed. Actual results may differ significantly from those reflected here in the unaudited consolidated pro forma financial

statements for various reasons, including but not limited to, the differences between the assumptions used to prepare the unaudited pro forma consolidated financial statements and actual results. The pro forma adjustments in the unaudited pro forma

consolidated balance sheet and the statements of operations included herein include the use of estimates and assumptions as described in the accompanying notes. The pro forma adjustments are based on information available to management at the time

these unaudited pro forma consolidated financial statements were prepared. We believe our current estimates provide a reasonable basis of presenting the significant effects of the transaction. However, the estimates and assumptions are subject to

change as additional information becomes available. The unaudited pro forma consolidated financial statements only include adjustments related to the disposition of the Virginia and West Virginia assets.

RANGE RESOURCES CORPORATION

UNAUDITED PRO FORMA CONSOLIDATED BALANCE SHEET

(Unaudited, in thousands, except per share data)

September 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As Reported |

|

|

Pro Forma

Adjustments |

|

|

As Adjusted |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

490 |

|

|

$ |

865,331 |

(a) |

|

$ |

865,821 |

|

| Accounts receivable less allowance for doubtful accounts of $3,306 |

|

|

110,792 |

|

|

|

— |

|

|

|

110,792 |

|

| Derivative asset |

|

|

289,108 |

|

|

|

— |

|

|

|

289,108 |

|

| Inventory and other |

|

|

23,038 |

|

|

|

(102 |

) (b) |

|

|

22,936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

423,428 |

|

|

|

865,229 |

|

|

|

1,288,657 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative asset |

|

|

44,067 |

|

|

|

— |

|

|

|

44,067 |

|

| Natural gas and oil properties, successful efforts method |

|

|

10,656,621 |

|

|

|

(1,671,500 |

) (b) |

|

|

8,985,121 |

|

| Accumulated depletion and depreciation |

|

|

(2,871,827 |

) |

|

|

351,848 |

(b) |

|

|

(2,519,979 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,784,794 |

|

|

|

(1,319,652 |

) |

|

|

6,465,142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other property and equipment |

|

|

128,535 |

|

|

|

(19,236 |

) (b) |

|

|

109,299 |

|

| Accumulated depreciation and amortization |

|

|

(98,700 |

) |

|

|

10,238 |

(b) |

|

|

(88,462 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29,835 |

|

|

|

(8,998 |

) |

|

|

20,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

|

115,780 |

|

|

|

(74 |

) (b) |

|

|

115,706 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

8,397,904 |

|

|

$ |

(463,495 |

) |

|

$ |

7,934,409 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

147,870 |

|

|

$ |

— |

|

|

$ |

147,870 |

|

| Asset retirement obligations |

|

|

17,689 |

|

|

|

(375 |

) (b) |

|

|

17,314 |

|

| Accrued liabilities |

|

|

172,702 |

|

|

|

(2,022 |

) (b) |

|

|

170,680 |

|

| Derivative liabilities |

|

|

293 |

|

|

|

— |

|

|

|

293 |

|

| Accrued interest |

|

|

31,756 |

|

|

|

— |

|

|

|

31,756 |

|

| Deferred tax liabilities |

|

|

95,502 |

|

|

|

— |

|

|

|

95,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

465,812 |

|

|

|

(2,397 |

) |

|

|

463,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank debt |

|

|

987,000 |

|

|

|

— |

|

|

|

987,000 |

|

| Senior notes |

|

|

750,000 |

|

|

|

— |

|

|

|

750,000 |

|

| Subordinated notes |

|

|

1,850,000 |

|

|

|

— |

|

|

|

1,850,000 |

|

| Deferred tax liabilities |

|

|

843,189 |

|

|

|

(161,235 |

) (b) |

|

|

681,954 |

|

| Derivative liabilities |

|

|

111 |

|

|

|

— |

|

|

|

111 |

|

| Deferred compensation liabilities |

|

|

117,137 |

|

|

|

— |

|

|

|

117,137 |

|

| Asset retirement obligations and other liabilities |

|

|

299,973 |

|

|

|

(47,676 |

) (b) |

|

|

252,297 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

5,313,222 |

|

|

|

(211,308 |

) |

|

|

5,101,914 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock, $1 par, 10,000,000 shares authorized, none issued and outstanding |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Common stock, $0.01 par, 475,000,000 shares authorized, 169,369,535 issued at September 30, 2015 |

|

|

1,693 |

|

|

|

— |

|

|

|

1,693 |

|

| Common stock held in treasury, 60,015 shares at September 30, 2015 |

|

|

(2,275 |

) |

|

|

— |

|

|

|

(2,275 |

) |

| Additional paid-in capital |

|

|

2,439,075 |

|

|

|

— |

|

|

|

2,439,075 |

|

| Retained earnings |

|

|

646,189 |

|

|

|

(252,187 |

) (b) |

|

|

394,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

3,084,682 |

|

|

|

(252,187 |

) |

|

|

2,832,495 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

8,397,904 |

|

|

$ |

(463,495 |

) |

|

$ |

7,934,409 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

2

RANGE RESOURCES CORPORATION

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2015

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As Reported |

|

|

Pro Forma

Adjustments (c) |

|

|

As Adjusted |

|

| Revenues and other income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Natural gas, NGL and oil sales |

|

$ |

835,601 |

|

|

$ |

(90,902 |

) |

|

$ |

744,699 |

|

| Derivative fair value income |

|

|

290,052 |

|

|

|

— |

|

|

|

290,052 |

|

| Gain on the sale of assets |

|

|

2,053 |

|

|

|

— |

|

|

|

2,053 |

|

| Brokered natural gas, marketing and other |

|

|

61,688 |

|

|

|

(9,617 |

) |

|

|

52,071 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues and other income |

|

|

1,189,394 |

|

|

|

(100,519 |

) |

|

|

1,088,875 |

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Direct operating |

|

|

106,975 |

|

|

|

(15,283 |

) |

|

|

91,692 |

|

| Transportation, gathering and compression |

|

|

284,258 |

|

|

|

(6,008 |

) |

|

|

278,250 |

|

| Production and ad valorem taxes |

|

|

26,506 |

|

|

|

(5,160 |

) |

|

|

21,346 |

|

| Brokered natural gas and marketing |

|

|

80,924 |

|

|

|

(22,796 |

) |

|

|

58,128 |

|

| Exploration |

|

|

17,146 |

|

|

|

(759 |

) |

|

|

16,387 |

|

| Abandonment and impairment of unproved properties |

|

|

36,187 |

|

|

|

— |

|

|

|

36,187 |

|

| General and administrative |

|

|

150,471 |

|

|

|

(7,548 |

) |

|

|

142,923 |

|

| Termination costs |

|

|

6,290 |

|

|

|

— |

|

|

|

6,290 |

|

| Deferred compensation plan |

|

|

(56,611 |

) |

|

|

— |

|

|

|

(56,611 |

) |

| Interest expense |

|

|

125,590 |

|

|

|

(34,190 |

) |

|

|

91,400 |

|

| Loss on early extinguishment of debt |

|

|

22,495 |

|

|

|

— |

|

|

|

22,495 |

|

| Depletion, depreciation and amortization |

|

|

453,178 |

|

|

|

(47,962 |

) |

|

|

405,216 |

|

| Impairment of proved properties and other assets |

|

|

502,233 |

|

|

|

— |

|

|

|

502,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

1,755,642 |

|

|

|

(139,706 |

) |

|

|

1,615,936 |

|

|

|

|

|

| (Loss) income before income taxes |

|

|

(566,248 |

) |

|

|

39,187 |

|

|

|

(527,061 |

) |

| Income tax (benefit) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Current |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Deferred |

|

|

(174,390 |

) |

|

|

15,283 |

|

|

|

(159,107 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(174,390 |

) |

|

|

15,283 |

|

|

|

(159,107 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(391,858 |

) |

|

$ |

23,904 |

|

|

$ |

(367,954 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(2.36 |

) |

|

|

|

|

|

$ |

(2.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

(2.36 |

) |

|

|

|

|

|

$ |

(2.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid per common share |

|

$ |

0.12 |

|

|

|

|

|

|

$ |

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Shares– basic |

|

|

166,327 |

|

|

|

|

|

|

|

166,327 |

|

| Shares– diluted |

|

|

166,327 |

|

|

|

|

|

|

|

166,327 |

|

See accompanying notes.

3

RANGE RESOURCES CORPORATION

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2014

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As Reported |

|

|

Pro Forma

Adjustments (c) |

|

|

As Adjusted |

|

| Revenues and other income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Natural gas, NGL and oil sales |

|

$ |

1,911,989 |

|

|

$ |

(147,889 |

) |

|

$ |

1,764,100 |

|

| Derivative fair value income |

|

|

383,520 |

|

|

|

— |

|

|

|

383,520 |

|

| Gain on the sale of assets |

|

|

285,638 |

|

|

|

— |

|

|

|

285,638 |

|

| Brokered natural gas, marketing and other |

|

|

130,548 |

|

|

|

(5,046 |

) |

|

|

125,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues and other income |

|

|

2,711,695 |

|

|

|

(152,935 |

) |

|

|

2,558,760 |

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Direct operating |

|

|

150,483 |

|

|

|

(18,198 |

) |

|

|

132,285 |

|

| Transportation, gathering and compression |

|

|

325,289 |

|

|

|

(5,298 |

) |

|

|

319,991 |

|

| Production and ad valorem taxes |

|

|

44,555 |

|

|

|

(7,223 |

) |

|

|

37,332 |

|

| Brokered natural gas and marketing |

|

|

129,980 |

|

|

|

(14,240 |

) |

|

|

115,740 |

|

| Exploration |

|

|

63,548 |

|

|

|

(999 |

) |

|

|

62,549 |

|

| Abandonment and impairment of unproved properties |

|

|

47,079 |

|

|

|

(100 |

) |

|

|

46,979 |

|

| General and administrative |

|

|

213,426 |

|

|

|

(8,647 |

) |

|

|

204,779 |

|

| Termination costs |

|

|

8,371 |

|

|

|

— |

|

|

|

8,371 |

|

| Deferred compensation plan |

|

|

(74,550 |

) |

|

|

— |

|

|

|

(74,550 |

) |

| Interest expense |

|

|

168,977 |

|

|

|

(33,900 |

) |

|

|

135,077 |

|

| Loss on early extinguishment of debt |

|

|

24,596 |

|

|

|

— |

|

|

|

24,596 |

|

| Depletion, depreciation and amortization |

|

|

551,032 |

|

|

|

(53,192 |

) |

|

|

497,840 |

|

| Impairment of proved properties and other assets |

|

|

28,024 |

|

|

|

— |

|

|

|

28,024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

1,680,810 |

|

|

|

(141,797 |

) |

|

|

1,539,013 |

|

|

|

|

|

| Income (loss) before income taxes |

|

|

1,030,885 |

|

|

|

(11,138 |

) |

|

|

1,019,747 |

|

| Income tax (benefit) expense |

|

|

|

|

|

|

|

|

|

|

|

|

| Current |

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

| Deferred |

|

|

396,502 |

|

|

|

(4,344 |

) |

|

|

392,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

396,503 |

|

|

|

(4,344 |

) |

|

|

392,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

634,382 |

|

|

$ |

(6,794 |

) |

|

$ |

627,588 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

3.81 |

|

|

|

|

|

|

$ |

3.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

3.79 |

|

|

|

|

|

|

$ |

3.75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid per common share |

|

$ |

0.16 |

|

|

|

|

|

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Shares– basic |

|

|

163,625 |

|

|

|

|

|

|

|

163,625 |

|

| Shares– diluted |

|

|

164,403 |

|

|

|

|

|

|

|

164,403 |

|

See accompanying notes.

4

RANGE RESOURCES CORPORATION

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

(1) BASIS OF PRESENTATION

On December

30, 2015, we completed the sale of our certain assets in Virginia and West Virginia for a purchase price of $876.0 million subject to the terms of the purchase and sale agreement dated November 3, 2015. The sale has an effective date of November 1,

2015 and consequently operating net revenues after that date is a downward adjustment to the selling price through the normal post-closing provisions of the agreement.

The accompanying unaudited pro forma consolidated balance sheet and unaudited pro forma consolidated statements of operations have been

prepared to give effect to the divestiture as if it had occurred on September 30, 2015 for the unaudited pro forma consolidated balance sheet and on January 1, 2014 for the unaudited pro forma consolidated statements of operations.

The following are descriptions of the individual columns included in the accompanying unaudited pro forma consolidated balance sheet and the

accompanying unaudited pro forma consolidated statements of operations.

(2) PRO FORMA ADJUSTMENTS

The unaudited pro forma consolidated financial statements reflect the following adjustments:

Balance Sheet

“As

reported” – represents the historical consolidated balance sheet of Range Resources Corporation as of September 30, 2015.

| |

a) |

To adjust for the proceeds and other estimated closing and post-closing adjustments associated with the divestiture. The following is a table of the estimated cash proceeds (in thousands): |

|

|

|

|

|

| Gross cash proceeds |

|

$ |

876,000 |

|

| Less estimated closing and post-closing adjustments |

|

|

(10,669 |

) |

|

|

|

|

|

| Estimated net cash proceeds |

|

$ |

865,331 |

|

|

|

|

|

|

| |

b) |

To remove the Virginia and West Virginia assets sold as a part of the purchase and sale agreement dated November 3, 2015. The following is a summarization of the application of net proceeds and estimated loss on the

divestiture (in thousands): |

|

|

|

|

|

| Net proceeds |

|

$ |

865,331 |

|

| Net investment in inventory and other assets |

|

|

(176 |

) |

| Net investment in natural gas and oil properties |

|

|

(1,319,652 |

) |

| Net investment in other property and equipment |

|

|

(8,998 |

) |

| Other liabilities – firm transportation contract |

|

|

9,743 |

|

| Asset retirement obligation |

|

|

40,330 |

|

|

|

|

|

|

| Loss on disposition of assets |

|

|

(413,422 |

) |

| Tax benefit |

|

|

161,235 |

) |

|

|

|

|

|

| Net loss on disposition of assets |

|

$ |

(252,187 |

) |

|

|

|

|

|

Statements of Operations

“As reported” – represents the historical consolidated statements of operations of Range Resources for the year ended December

31, 2014 and the nine months ended September 30, 2015.

| |

c) |

All adjustments are to eliminate revenues and costs and expenses (including the income tax effect) of our Virginia and West Virginia assets from our consolidated operations. Interest expense is allocated based on the

ratio of net assets of Virginia and West Virginia to our consolidated net assets plus long term debt. |

5

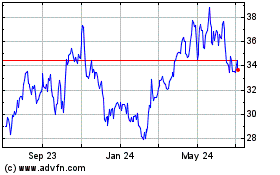

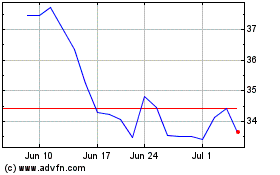

Range Resources (NYSE:RRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Range Resources (NYSE:RRC)

Historical Stock Chart

From Apr 2023 to Apr 2024