UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 7, 2015

RPM INTERNATIONAL INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-14187 |

|

02-0642224 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 2628 Pearl Road, P.O. Box 777, Medina, Ohio |

|

44258 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (330) 273-5090

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On January 7, 2015, the Company issued a press release announcing its second quarter results, which provided detail not included in previously issued

reports. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits.

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press release of the Company, dated January 7, 2015, announcing the Company’s second quarter results. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

RPM International Inc. |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date January 7, 2015 |

|

|

|

|

|

/s/ Edward W. Moore |

|

|

|

|

|

|

Edward W. Moore |

|

|

|

|

|

|

Senior Vice President, General Counsel and

Chief Compliance Officer |

Exhibit Index

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press release of the Company, dated January 7, 2015, announcing the Company’s second quarter results. |

Exhibit 99.1

RPM Reports Fiscal 2015 Second-Quarter Results

| |

• |

|

Second-quarter net income improves 10% on flat sales |

| |

• |

|

Reconsolidation of SPHC subsidiaries will add $400 million to annualized sales, and will be reflected in subsequent quarterly results |

| |

• |

|

EPS guidance for FY 2015 reduced to a range of $2.25 to $2.30 |

MEDINA, OH – January 7, 2015 –

RPM International Inc. (NYSE: RPM) today reported a 10% increase in net income and an 8% increase in earnings per diluted share on flat sales for its fiscal 2015 second quarter ended November 30, 2014.

Second-Quarter Results

Net sales of $1.07 billion were

flat compared to last year. Consolidated EBIT (earnings before interest and taxes) increased 3.2%, to $120.1 million from $116.4 million in the fiscal 2014 second quarter. Fiscal 2015 second-quarter net income was up 9.8% to $69.8 million from $63.6

million in the fiscal 2014 second quarter. Earnings per diluted share increased 8.3% to $0.52 from $0.48 a year ago.

“Second-quarter operating

performance was mixed, with stronger sales in our businesses serving the U.S. commercial construction market offset by weaker results in Europe, a continued unfavorable year-over-year trend from our Kirker nail enamels business and the negative

impact of foreign currency,” stated Frank C. Sullivan, chairman and chief executive officer.

Second-Quarter Segment Sales and Earnings

During the fiscal 2015 second quarter, industrial segment sales grew 1.4% to $718.3 million from $708.7 million in the fiscal 2014 second quarter. Organic

sales improved 0.7%, including 3.3% in foreign exchange translation losses, while acquisition growth added 0.7%. Industrial segment EBIT declined 5.9% to $79.0 million from $83.9 million in the same period a year ago.

“Most of our European businesses are experiencing a challenging economic climate, negatively impacting our results. Additionally, the strong dollar has

negatively impacted all of our international results upon translation. However, we had strong positive performance by our concrete admixture and commercial sealants companies, which serve the U.S. commercial construction market, and our line of

remediation equipment for water and smoke damage. Additionally, our South American businesses are generating good results in their local currencies,” Sullivan stated.

RPM’s fiscal 2015 second-quarter consumer segment sales declined 2.8% to $352.8 million from $362.8 million a year ago. Organic sales declined 4.2%,

including foreign exchange losses of 1.3%, while acquisition growth added 1.4%. Consumer segment EBIT improved 19.1%, to $61.6 million from $51.7 million a year ago. The improvement in EBIT for RPM’s consumer segment is primarily due to

the reversal of a $17 million ‘earn-out’ accrual relating to the Kirker acquisition.

“As stated in the first quarter, Kirker continues to

be challenged by a comparison to extremely strong prior-year performance. In anticipation of potential volatility in Kirker’s earnings, our acquisition deal structure allows for performance-related payments to offset any shortfall in earnings.

As a result, we

RPM Reports Fiscal 2015 Second-Quarter Results

January 7, 2015

Page

2

of 4

reversed the $17 million earn-out accrual into income when it became clear that Kirker would not be able to meet its performance objectives this year,” stated Sullivan. “Additionally,

our large retail customers made aggressive inventory adjustments due to the harsh weather faced in early November. This was in reaction to last year’s severe winter when they were caught off-guard and held excess inventory. We expect to benefit

from a return to more normal inventory levels by our retail customers in the second half of the fiscal year.”

Unusual non-operating costs in this

year’s second quarter totaled $2.8 million pre-tax, and were related primarily to legal expenses incurred in conjunction with a Securities and Exchange Commission investigation of timing of expense accruals in the 2013 fiscal year, which did

not affect full-year earnings, along with the Specialty Products Holding Corp. (SPHC) settlement, and a voluntary self-disclosure agreement with the state of Delaware for unclaimed property.

Cash Flow and Financial Position

For the first half of

fiscal 2015, cash from operations was $55.3 million compared to $21.8 million a year ago. During last year’s first quarter, the company made a contingent payment to the General Services Administration of approximately $45 million

after-tax. Capital expenditures of $26.5 million compare to $34.6 million during the first half of last year. Total debt at November 30, 2014 was $1.43 billion, compared to $1.37 billion at November 30, 2013 and $1.35

billion at May 31, 2014. RPM’s net (of cash) debt-to-total capitalization ratio was 44.8%, compared to 46.4% at November 30, 2013. At November 30, 2014, liquidity stood at $1.01 billion, including cash of $297 million and

$718 million in long-term committed available credit.

First-Half Sales and Earnings

Fiscal 2015 first-half net sales improved 1.7% to $2.28 billion from $2.24 billion during the first six months of fiscal 2014. Consolidated EBIT increased 1.2%

to $283.7 million from $280.4 million during the first six months of fiscal 2014. Net income was up 1.3% to $168.8 million from $166.7 million in the fiscal 2014 first half. Diluted earnings per share were $1.24, compared to $1.25 a year

ago.

First-Half Segment Sales and Earnings

RPM’s industrial segment fiscal 2015 first-half sales improved 3.6%, to $1.49 billion from $1.44 billion in the fiscal 2014 first half. Organic sales

increased 2.6%, including net foreign exchange translation losses of 1.6%, while acquisition growth added 1.0%. Industrial segment EBIT was flat to last year at $184.1 million.

First-half sales for the consumer segment declined 1.7% to $782.8 million from $796.2 million a year ago. Organic sales decreased 3.0%, including net foreign

exchange losses of 0.5%, and acquisition growth added 1.3%. Consumer segment EBIT increased 2.9% to $138.2 million from $134.4 million in the first half of fiscal 2014.

RPM Reports Fiscal 2015 Second-Quarter Results

January 7, 2015

Page

3

of 4

SPHC Reconsolidation

The financial results of the company’s SPHC subsidiary and its business units will be reconsolidated with RPM’s results starting in the third quarter

of fiscal 2015. The reconsolidation occurred as a result of the consummation of a plan of reorganization, which resulted in the formation of a trust under Section 524(g) of the United States Bankruptcy Code for the benefit of current and future

asbestos personal injury claimants, as previously disclosed. The trust assumes all liability and responsibility for current and future asbestos claims against the entities emerging from bankruptcy.

SPHC originally filed for bankruptcy protection on May 31, 2010 to permanently resolve asbestos claims against its Bondex International Inc. subsidiary.

While RPM has continued to own SPHC and its subsidiaries during the bankruptcy process, their financial results were not consolidated with RPM’s during that time.

The trust was funded with an initial contribution of $450.0 million in cash from the Company’s revolving line of credit. Payments to the trust, including

this initial $450.0 million, will total $797.5 million in pre-tax contributions over the next four years and have a present value, after tax, of $485.0 million.

The reconsolidated SPHC operating subsidiaries include:

| |

• |

|

Chemical Specialties Manufacturing Corp., a producer of commercial cleaning products; |

| |

• |

|

Day-Glo Color Corp., a leading manufacturer of fluorescent colorants and pigments; |

| |

• |

|

Dryvit Systems, Inc., a leading manufacturer of exterior insulation finish systems; |

| |

• |

|

Kop-Coat, Inc., a leading producer of wood treatments for lumber and coatings for the marine market; |

| |

• |

|

RPM Wood Finishes Group (Mohawk Finishing Products, CCI and Guardian Protection Products, Inc.), a primary supplier of wood coatings to the furniture industry; |

| |

• |

|

TCI, Inc., a leading producer of powdered metal coatings; and |

| |

• |

|

ValvTect Petroleum Products, a producer of fuel additives. |

Business Outlook

“For the second half of our fiscal year, we expect our consumer segment to benefit from a return to more normal inventory levels at our retail customers

with continued growth in consumer DIY spending, and anticipate that the decline in nail polish enamel sales will be much less severe. In our industrial segment, we do not see a near-term turnaround in the European economies and expect continued

strengthening of the U.S. dollar to continue negatively impacting results on translation,” stated Sullivan.

“Based on these factors, for the

second half of fiscal 2015, we expect to generate 6% sales growth in our consumer segment, driving an EBIT increase of 10% to 12%, and 2% to 3% sales growth in our industrial segment, driving an EBIT increase of 4% to 5%. Additionally, we will

benefit from the reconsolidation of our SPHC businesses, which should add approximately $170 million in sales and $0.05 per diluted share to our fiscal 2015 second-half results.”

“Taking all of these elements into consideration, we have reduced our diluted EPS guidance for the year to $2.25 to $2.30. From a longer-term

perspective, we are optimistic given the return of our SPHC businesses and the elimination of their asbestos liability. We can now accelerate growth investments in our businesses and more aggressively return capital to shareholders when

appropriate,” stated Sullivan. “Looking forward to fiscal 2016, our consolidated EPS guidance is a range of $2.70 to $2.80 per share.”

RPM Reports Fiscal 2015 Second-Quarter Results

January 7, 2015

Page

4

of 4

Webcast and Conference Call Information

Management will host a conference call to further discuss these results beginning at 10:00 a.m. EST today. The call can be accessed by dialing

888-771-4371 or 847-585-4405 for international callers. Participants are asked to call the assigned number approximately 10 minutes before the conference call begins. The call, which will last approximately one hour, will be open to the public, but

only financial analysts will be permitted to ask questions. The media and all other participants will be in a listen-only mode.

For those unable to

listen to the live call, a replay will be available from approximately 1 p.m. EST today until 11:59 p.m. EST on January 14, 2015. The replay can be accessed by dialing 888-843-7419 or 630-652-3042 for international callers. The access code is

38349283. The call also will be available both live and for replay, and as a written transcript, via the RPM web site at www.RPMinc.com.

About RPM

RPM International Inc., a holding company, owns subsidiaries that are world leaders in specialty coatings, sealants, building materials and related

services serving both industrial and consumer markets. RPM’s industrial products include roofing systems, sealants, corrosion control coatings, flooring coatings and specialty chemicals. Industrial brands include Stonhard, Tremco, illbruck,

Carboline, Flowcrete, Day-Glo, Dryvit and Euco. RPM’s consumer products are used by professionals and do-it-yourselfers for home maintenance and improvement and by hobbyists. Consumer brands include Rust-Oleum, DAP, Zinsser, Varathane and

Testors. Additional details can be found at www.RPMinc.com and by following RPM on Twitter at www.twitter.com/RPMintl.

For more information, contact

Barry M. Slifstein, vice president – investor relations and planning, at 330-273-5090 or bslifstein@rpminc.com.

This press release contains

“forward-looking statements” relating to our business. These forward-looking statements, or other statements made by us, are made based on our expectations and beliefs concerning future events impacting us, and are subject to uncertainties

and factors (including those specified below) which are difficult to predict and, in many instances, are beyond our control. As a result, our actual results could differ materially from those expressed in or implied by any such forward-looking

statements. These uncertainties and factors include (a) global markets and general economic conditions, including uncertainties surrounding the volatility in financial markets, the availability of capital and the effect of changes in interest

rates, and the viability of banks and other financial institutions; (b) the prices, supply and capacity of raw materials, including assorted pigments, resins, solvents and other natural gas- and oil-based materials; packaging, including plastic

containers; and transportation services, including fuel surcharges; (c) continued growth in demand for our products; (d) legal, environmental and litigation risks inherent in our construction and chemicals businesses and risks related to

the adequacy of our insurance coverage for such matters; (e) the effect of changes in interest rates; (f) the effect of fluctuations in currency exchange rates upon our foreign operations; (g) the effect of non-currency risks of

investing in and conducting operations in foreign countries, including those relating to domestic and international political, social, economic and regulatory factors; (h) risks and uncertainties associated with our ongoing acquisition and

divestiture activities; (i) risks related to the adequacy of our contingent liability reserves; and (j) other risks detailed in our filings with the Securities and Exchange Commission, including the risk factors set forth in our Annual

Report on Form 10-K for the year ended May 31, 2014, as the same may be updated from time to time. We do not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events, information or

circumstances that arise after the date of this release.

# # #

CONSOLIDATED STATEMENTS OF INCOME

IN THOUSANDS, EXCEPT PER SHARE DATA

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

November 30, |

|

|

November 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Net Sales |

|

$ |

1,071,128 |

|

|

$ |

1,071,487 |

|

|

$ |

2,275,024 |

|

|

$ |

2,236,161 |

|

| Cost of sales |

|

|

617,185 |

|

|

|

613,542 |

|

|

|

1,312,688 |

|

|

|

1,279,144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

453,943 |

|

|

|

457,945 |

|

|

|

962,336 |

|

|

|

957,017 |

|

| Selling, general & administrative expenses |

|

|

334,889 |

|

|

|

343,048 |

|

|

|

681,414 |

|

|

|

678,507 |

|

| Interest expense |

|

|

19,404 |

|

|

|

20,809 |

|

|

|

38,819 |

|

|

|

41,534 |

|

| Investment (income), net |

|

|

(5,058 |

) |

|

|

(2,005 |

) |

|

|

(8,861 |

) |

|

|

(5,899 |

) |

| Other (income), net |

|

|

(1,042 |

) |

|

|

(1,491 |

) |

|

|

(2,864 |

) |

|

|

(1,925 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

105,750 |

|

|

|

97,584 |

|

|

|

253,828 |

|

|

|

244,800 |

|

| Provision for income taxes |

|

|

31,894 |

|

|

|

29,170 |

|

|

|

75,133 |

|

|

|

69,497 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

73,856 |

|

|

|

68,414 |

|

|

|

178,695 |

|

|

|

175,303 |

|

| Less: Net income attributable to noncontrolling interests |

|

|

4,090 |

|

|

|

4,852 |

|

|

|

9,850 |

|

|

|

8,643 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to RPM International Inc. Stockholders |

|

$ |

69,766 |

|

|

$ |

63,562 |

|

|

$ |

168,845 |

|

|

$ |

166,660 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share of common stock attributable to RPM International Inc. Stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.52 |

|

|

$ |

0.48 |

|

|

$ |

1.27 |

|

|

$ |

1.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.52 |

|

|

$ |

0.48 |

|

|

$ |

1.24 |

|

|

$ |

1.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average shares of common stock outstanding—basic |

|

|

130,028 |

|

|

|

129,426 |

|

|

|

130,061 |

|

|

|

129,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average shares of common stock outstanding—diluted |

|

|

134,966 |

|

|

|

130,418 |

|

|

|

135,000 |

|

|

|

130,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL SEGMENT INFORMATION

IN THOUSANDS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

November 30, |

|

|

Six Months Ended

November 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Net Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Industrial Segment |

|

$ |

718,347 |

|

|

$ |

708,713 |

|

|

$ |

1,492,233 |

|

|

$ |

1,439,939 |

|

| Consumer Segment |

|

|

352,781 |

|

|

|

362,774 |

|

|

|

782,791 |

|

|

|

796,222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

1,071,128 |

|

|

$ |

1,071,487 |

|

|

$ |

2,275,024 |

|

|

$ |

2,236,161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes (a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Industrial Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes (a) |

|

$ |

77,109 |

|

|

$ |

81,394 |

|

|

$ |

179,573 |

|

|

$ |

178,975 |

|

| Interest (Expense), Net (b) |

|

|

(1,898 |

) |

|

|

(2,528 |

) |

|

|

(4,531 |

) |

|

|

(5,062 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT (c) |

|

$ |

79,007 |

|

|

$ |

83,922 |

|

|

$ |

184,104 |

|

|

$ |

184,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes (a) |

|

$ |

61,562 |

|

|

$ |

51,720 |

|

|

$ |

138,231 |

|

|

$ |

134,437 |

|

| Interest (Expense), Net (b) |

|

|

(4 |

) |

|

|

26 |

|

|

|

(12 |

) |

|

|

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT (c) |

|

$ |

61,566 |

|

|

$ |

51,694 |

|

|

$ |

138,243 |

|

|

$ |

134,372 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate/Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Expense) Before Income Taxes (a) |

|

$ |

(32,921 |

) |

|

$ |

(35,530 |

) |

|

$ |

(63,976 |

) |

|

$ |

(68,612 |

) |

| Interest (Expense), Net (b) |

|

|

(12,444 |

) |

|

|

(16,302 |

) |

|

|

(25,415 |

) |

|

|

(30,638 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT (c) |

|

$ |

(20,477 |

) |

|

$ |

(19,228 |

) |

|

$ |

(38,561 |

) |

|

$ |

(37,974 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes (a) |

|

$ |

105,750 |

|

|

$ |

97,584 |

|

|

$ |

253,828 |

|

|

$ |

244,800 |

|

| Interest (Expense), Net (b) |

|

|

(14,346 |

) |

|

|

(18,804 |

) |

|

|

(29,958 |

) |

|

|

(35,635 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT (c) |

|

$ |

120,096 |

|

|

$ |

116,388 |

|

|

$ |

283,786 |

|

|

$ |

280,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

The presentation includes a reconciliation of Income (Loss) Before Income Taxes, a measure defined by Generally Accepted Accounting Principles in the United States (GAAP), to EBIT. |

| (b) |

Interest (expense), net includes the combination of interest (expense) and investment income/(expense), net. |

| (c) |

EBIT is defined as earnings (loss) before interest and taxes. We evaluate the profit performance of our segments based on income before income taxes, but also look to EBIT as a performance evaluation measure because

interest expense is essentially related to corporate acquisitions, as opposed to segment operations. For that reason, we believe EBIT is also useful to investors as a metric in their investment decisions. EBIT should not be considered an alternative

to, or more meaningful than, operating income as determined in accordance with GAAP, since EBIT omits the impact of interest and taxes in determining operating performance, which represent items necessary to our continued operations, given our level

of indebtedness and ongoing tax obligations. Nonetheless, EBIT is a key measure expected by and useful to our fixed income investors, rating agencies and the banking community all of whom believe, and we concur, that this measure is critical to the

capital markets’ analysis of our segments’ core operating performance. We also evaluate EBIT because it is clear that movements in EBIT impact our ability to attract financing. Our underwriters and bankers consistently require inclusion of

this measure in offering memoranda in conjunction with any debt underwriting or bank financing. EBIT may not be indicative of our historical operating results, nor is it meant to be predictive of potential future results. |

CONSOLIDATED BALANCE SHEETS

IN THOUSANDS

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

November 30, 2014 |

|

|

November 30, 2013 |

|

|

May 31, 2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

296,527 |

|

|

$ |

224,172 |

|

|

$ |

332,868 |

|

| Trade accounts receivable |

|

|

833,378 |

|

|

|

802,453 |

|

|

|

901,587 |

|

| Allowance for doubtful accounts |

|

|

(26,605 |

) |

|

|

(30,024 |

) |

|

|

(27,641 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net trade accounts receivable |

|

|

806,773 |

|

|

|

772,429 |

|

|

|

873,946 |

|

| Inventories |

|

|

637,932 |

|

|

|

597,660 |

|

|

|

613,644 |

|

| Deferred income taxes |

|

|

20,280 |

|

|

|

38,146 |

|

|

|

22,281 |

|

| Prepaid expenses and other current assets |

|

|

198,301 |

|

|

|

181,220 |

|

|

|

219,556 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,959,813 |

|

|

|

1,813,627 |

|

|

|

2,062,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property, Plant and Equipment, at Cost |

|

|

1,172,307 |

|

|

|

1,144,947 |

|

|

|

1,191,676 |

|

| Allowance for depreciation and amortization |

|

|

(662,329 |

) |

|

|

(645,594 |

) |

|

|

(658,871 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

|

509,978 |

|

|

|

499,353 |

|

|

|

532,805 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

|

1,118,444 |

|

|

|

1,125,460 |

|

|

|

1,147,374 |

|

| Other intangible assets, net of amortization |

|

|

441,556 |

|

|

|

461,555 |

|

|

|

459,536 |

|

| Deferred income taxes, non-current |

|

|

7,582 |

|

|

|

5,623 |

|

|

|

7,943 |

|

| Other |

|

|

159,880 |

|

|

|

170,526 |

|

|

|

168,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other assets |

|

|

1,727,462 |

|

|

|

1,763,164 |

|

|

|

1,783,265 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

4,197,253 |

|

|

$ |

4,076,144 |

|

|

$ |

4,378,365 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

379,874 |

|

|

$ |

370,993 |

|

|

$ |

525,680 |

|

| Current portion of long-term debt |

|

|

151,358 |

|

|

|

4,835 |

|

|

|

5,662 |

|

| Accrued compensation and benefits |

|

|

111,032 |

|

|

|

127,150 |

|

|

|

173,846 |

|

| Accrued loss reserves |

|

|

18,537 |

|

|

|

22,120 |

|

|

|

27,487 |

|

| Other accrued liabilities |

|

|

208,701 |

|

|

|

208,983 |

|

|

|

204,411 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

869,502 |

|

|

|

734,081 |

|

|

|

937,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-Term Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term debt, less current maturities |

|

|

1,275,875 |

|

|

|

1,365,115 |

|

|

|

1,345,965 |

|

| Other long-term liabilities |

|

|

411,922 |

|

|

|

436,335 |

|

|

|

466,659 |

|

| Deferred income taxes |

|

|

48,476 |

|

|

|

46,753 |

|

|

|

50,061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total long-term liabilities |

|

|

1,736,273 |

|

|

|

1,848,203 |

|

|

|

1,862,685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

2,605,775 |

|

|

|

2,582,284 |

|

|

|

2,799,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock; none issued |

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock (outstanding 133,748; 133,174; 133,273) |

|

|

1,337 |

|

|

|

1,332 |

|

|

|

1,333 |

|

| Paid-in capital |

|

|

806,898 |

|

|

|

776,363 |

|

|

|

790,102 |

|

| Treasury stock, at cost |

|

|

(94,354 |

) |

|

|

(80,370 |

) |

|

|

(85,400 |

) |

| Accumulated other comprehensive (loss) |

|

|

(259,267 |

) |

|

|

(147,740 |

) |

|

|

(156,882 |

) |

| Retained earnings |

|

|

935,773 |

|

|

|

772,637 |

|

|

|

833,691 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total RPM International Inc. stockholders’ equity |

|

|

1,390,387 |

|

|

|

1,322,222 |

|

|

|

1,382,844 |

|

| Noncontrolling interest |

|

|

201,091 |

|

|

|

171,638 |

|

|

|

195,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

1,591,478 |

|

|

|

1,493,860 |

|

|

|

1,578,594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity |

|

$ |

4,197,253 |

|

|

$ |

4,076,144 |

|

|

$ |

4,378,365 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

IN THOUSANDS

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

|

| |

|

November 30, |

|

|

November 30, |

|

| |

|

2014 |

|

|

2013 |

|

| Cash Flows From Operating Activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

178,695 |

|

|

$ |

175,303 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

30,132 |

|

|

|

29,128 |

|

| Amortization |

|

|

16,015 |

|

|

|

15,776 |

|

| Reversal of contingent consideration obligations |

|

|

(18,080 |

) |

|

|

|

|

| Deferred income taxes |

|

|

2,170 |

|

|

|

(8,500 |

) |

| Stock-based compensation expense |

|

|

15,706 |

|

|

|

9,622 |

|

| Other |

|

|

(1,222 |

) |

|

|

(1,229 |

) |

| Changes in assets and liabilities, net of effect from purchases and sales of businesses: |

|

|

|

|

|

|

|

|

| Decrease in receivables |

|

|

44,564 |

|

|

|

21,971 |

|

| (Increase) in inventory |

|

|

(41,392 |

) |

|

|

(44,020 |

) |

| Decrease (increase) in prepaid expenses and other current and long-term assets |

|

|

1,306 |

|

|

|

(750 |

) |

| (Decrease) in accounts payable |

|

|

(133,960 |

) |

|

|

(111,598 |

) |

| (Decrease) in accrued compensation and benefits |

|

|

(57,837 |

) |

|

|

(28,152 |

) |

| (Decrease) in accrued loss reserves |

|

|

(8,471 |

) |

|

|

(5,488 |

) |

| (Decrease) in contingent payment |

|

|

|

|

|

|

(61,894 |

) |

| Increase in other accrued liabilities |

|

|

37,229 |

|

|

|

38,304 |

|

| Other |

|

|

(9,599 |

) |

|

|

(6,641 |

) |

|

|

|

|

|

|

|

|

|

| Cash Provided By Operating Activities |

|

|

55,256 |

|

|

|

21,832 |

|

|

|

|

|

|

|

|

|

|

| Cash Flows From Investing Activities: |

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

(26,498 |

) |

|

|

(34,603 |

) |

| Acquisition of businesses, net of cash acquired |

|

|

(33,355 |

) |

|

|

(20,827 |

) |

| Purchase of marketable securities |

|

|

(14,308 |

) |

|

|

(33,770 |

) |

| Proceeds from sales of marketable securities |

|

|

19,205 |

|

|

|

19,672 |

|

| Other |

|

|

6,515 |

|

|

|

1,546 |

|

|

|

|

|

|

|

|

|

|

| Cash (Used For) Investing Activities |

|

|

(48,441 |

) |

|

|

(67,982 |

) |

|

|

|

|

|

|

|

|

|

| Cash Flows From Financing Activities: |

|

|

|

|

|

|

|

|

| Additions to long-term and short-term debt |

|

|

83,312 |

|

|

|

2,776 |

|

| Reductions of long-term and short-term debt |

|

|

(6,501 |

) |

|

|

(6,071 |

) |

| Cash dividends |

|

|

(66,763 |

) |

|

|

(61,796 |

) |

| Repurchase of stock |

|

|

(8,954 |

) |

|

|

(7,877 |

) |

| Payments of acquisition related contingent consideration |

|

|

(24,750 |

) |

|

|

(5,000 |

) |

| Other |

|

|

1,048 |

|

|

|

3,670 |

|

|

|

|

|

|

|

|

|

|

| Cash (Used For) Financing Activities |

|

|

(22,608 |

) |

|

|

(74,298 |

) |

|

|

|

|

|

|

|

|

|

| Effect of Exchange Rate Changes on Cash and Cash Equivalents |

|

|

(20,548 |

) |

|

|

1,066 |

|

|

|

|

|

|

|

|

|

|

| Net Change in Cash and Cash Equivalents |

|

|

(36,341 |

) |

|

|

(119,382 |

) |

| Cash and Cash Equivalents at Beginning of Period |

|

|

332,868 |

|

|

|

343,554 |

|

|

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents at End of Period |

|

$ |

296,527 |

|

|

$ |

224,172 |

|

|

|

|

|

|

|

|

|

|

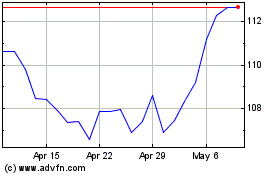

RPM (NYSE:RPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

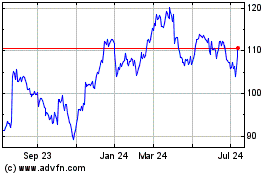

RPM (NYSE:RPM)

Historical Stock Chart

From Apr 2023 to Apr 2024