CORRECT: Illinois Tool Agrees To Let Activist Shareholder On Board

January 13 2012 - 6:36PM

Dow Jones News

Illinois Tool Works Inc. (ITW) on Friday agreed to allow a

privately owned investment manager with a reputation for agitating

for the breakup of industrial conglomerates to have a seat on its

board of directors.

ITW has been facing increasing pressure from shareholders and

analysts alike to divest a significant portion of its business

portfolio to generate improved sales growth from the remaining

assets. ITW operates more than 800 businesses, generating more than

$18 billion a year in revenue.

The Glenview, Ill., company said its agreement with Relational

Investors LLC gives the fund the an option to appoint David

Batchelder, its principal and co-founder, to ITW's board any time

after ITW's 2012 annual shareholders meeting and 60 days prior to

the company's 2013 annual meeting.

Relational Investors, which has acquired 2.1% of ITW stock, was

the driving force behind the breakup of ITT Corp. (ITT) last year,

according to industry analysts and investors.

"We are pleased to have reached this agreement with Relational,"

said Chairman and Chief Executive David Speer in a wrttten

statement. "Our board and management team remain committed to

generating profitable growth and delivering strong returns and we

look forward to continuing to enhance value for all of our

shareholders."

-By Bob Tita, Dow Jones Newswires; 312 750 4129;

robert.tita@dowjones.com

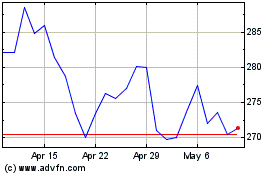

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Mar 2024 to Apr 2024

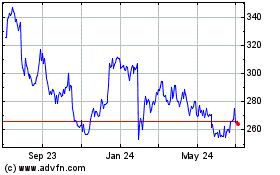

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Apr 2023 to Apr 2024