Glencore Shares Hit New Low After Announcing Debt Rescue Plan

September 15 2015 - 9:00AM

Dow Jones News

By Alex MacDonald and Josie Cox

LONDON-- Glencore PLC shares hit a new low Tuesday, reversing

last week's gains after the commodities trader and producer

announced a debt rescue plan.

Shares in the Swiss commodities trader and producer fell 4.6% to

120.5 pence a share in mid afternoon European trade, cementing the

firm's ranking as the worst performer out of the U.K.'s blue chip

FTSE 100 index so far this year. The rest of the U.K. mining sector

also fell, with the FTSE 350 mining index down 1.6% and other large

miners such as Rio Tinto PLC and BHP Billiton PLC down 1.3% and

1.2% respectively.

The Swiss miner's shares have fallen nearly 60% since the

beginning of the year and by more than three quarters since its

London share listing in 2011.

The reason: a continued collapse in a basket of commodities

prices including copper and coal, two of its most important

earnings drivers. The company has also been hit by growing

uncertainty about the timing and structure of the proposed equity

issue of up to $2.5 billion as it seeks to pay down debt and stave

off a potential credit rating downgrade.

Glencore last week announced $10 billion worth of measures aimed

at cutting its net debt by a third to around $20 billion by the end

of 2016. This helped boost the company's shares.

But with Glencore's share price continuing to fall, some

analysts say the company may need to issue more shares to raise

funds.

"The more the share price drops, the more dilutive [issuing new

stock] becomes. They will have to issue more shares to achieve the

same level of funding," said Carole Ferguson, an equity analyst at

advisory firm SP Angel.

A Glencore spokesman declined to comment.

Glencore has also been troubled by its biggest bets not panning

out as prices fall for nearly every commodity, from copper to coal,

oil to zinc. The rout has raised new concerns about Chief Executive

Officer Ivan Glasenberg's decision to acquire Anglo-Swiss miner

Xstrata PLC for $29.5 billion, taking Glencore away from its

trading house roots.

The purchase catapulted Glencore into the mining big league,

making it the world's largest thermal coal exporter and largest

copper supplier. Since then prices for those two commodities, and

several others, have fallen to multiyear lows due to

weaker-than-expected demand from China, the world's largest

consumer of those commodities, and excess supply.

Copper dropped to a more than six-year low last month while the

benchmark price for thermal coal from South Africa fell to its

lowest level since 2007.

Write to Alex MacDonald at alex.macdonald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 15, 2015 08:45 ET (12:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

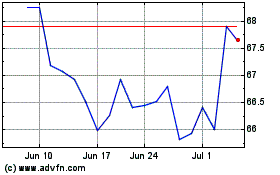

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

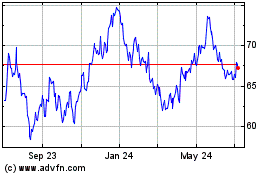

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024