Transocean Ltd. (RIG) filed a Form 8K - Entry Into a Definitive

Agreement - with the U.S Securities and Exchange Commission on

November 21, 2016.

On November 21, 2016, Transocean Ltd., a Swiss corporation

("Transocean"), Transocean Partners LLC, a Marshall Islands limited

liability company ("Transocean Partners"), Transocean Partners

Holdings Limited, a Cayman Islands exempted company and an

indirect, wholly owned subsidiary of Transocean ("Transocean

Holdings") and TPHL Holdings LLC, a Marshall Islands limited

liability company and a direct, wholly owned subsidiary of

Transocean Holdings ("Merger Sub") entered into an Amendment (the

"Amendment") to the Agreement and Plan of Merger, dated as of July

31, 2016 (the "Merger Agreement"), among Transocean, Transocean

Partners, Transocean Holdings and Merger Sub, pursuant to which

Merger Sub will merge with and into Transocean Partners (the

"Merger"), with Transocean Partners surviving the Merger as an

indirect, wholly owned subsidiary of Transocean. The Amendment

increased the exchange ratio from 1.1427 Transocean shares for each

Transocean Partners common unit not owned by Transocean or its

subsidiaries to 1.2000 Transocean shares.

A copy of the Amendment is filed as Exhibit 2.1 hereto and is

incorporated herein by reference.

A copy of the press release announcing the Amendment is attached

as Exhibit 99.1 hereto and is incorporated herein by reference.

Forward-Looking Statements

This communication includes "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The statements regarding the proposed transaction,

including its effects, benefits and costs savings, opinions,

forecasts, projections, expected timetable for completion, expected

distribution and any other statements regarding Transocean's and

Transocean Partners' future expectations, beliefs, plans,

objectives, financial conditions, assumptions or future events or

performance that are not statements of historical fact, are

forward-looking statements within the meaning of the federal

securities laws. We can give no assurance that such expectations

will prove to have been correct. These statements are subject to

risks, uncertainties and assumptions including, among other things,

satisfaction of the closing conditions to the merger, the risk that

the contemplated merger does not occur, negative effects from the

pendency of the merger, the ability to realize expected cost

savings and benefits, failure to obtain the required vote of the

Transocean Partners' common unitholders, the timing to consummate

the proposed transaction, the adequacy of and access to sources of

liquidity, Transocean's and Transocean Partners' inability to

obtain drilling contracts for rigs that do not have contracts,

Transocean's and Transocean Partners' inability to renew drilling

contracts at comparable dayrates, operational performance, the

impact of regulatory changes, the cancellation of drilling

contracts currently included in each company's reported contract

backlog, and other risk factors that are discussed in Transocean

Partners' and Transocean's most recent Annual Report on Form 10-Ks,

as well as its other filings with the SEC available at the SEC's

Internet site (www.sec.gov). Actual results may differ materially

from those expected, estimated or projected. Forward-looking

statements speak only as of the date they are made, and we

undertake no obligation to publicly update or revise any of them in

light of new information, future events or otherwise.

Additional Information

This communication does not constitute an offer to buy or sell

or the solicitation of an offer to buy or sell any securities or a

solicitation of any vote or approval. INVESTORS ARE URGED TO READ

THE PROXY STATEMENT/PROSPECTUS, THE REGISTRATION STATEMENT, AND

OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC REGARDING THE

TRANSACTION CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY CONTAIN IMPORTANT INFORMATION. These documents

contain important information about the proposed transaction that

should be read carefully before any decision is made with respect

to the proposed transaction. Investors may obtain free copies of

these documents and other documents filed with the SEC by

Transocean Partners and Transocean through the website maintained

by the SEC at www.sec.gov. Copies of the documents filed with the

SEC by Transocean are available free of charge on Transocean's

internet website at: www.deepwater.com. Copies of the documents

filed with the SEC by Transocean Partners are available free of

charge on the Transocean Partners' internet website at:

www.transoceanpartners.com. You may also read and copy any reports,

statements and other information filed by Transocean and Transocean

Partners with the SEC at the SEC public reference room at 100 F

Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC

at (800) 732-0330 or visit the SEC's website for further

information on its public reference room.

Participants in Solicitation

Transocean, Transocean Partners, their respective directors and

certain of their respective executive officers may be considered,

under SEC rules, participants in the solicitation of proxies in

connection with the proposed transaction. Information about the

directors and executive officers of Transocean is set forth in its

Annual Report on Form 10-K for the year ended December 31, 2015,

which was filed with the SEC on February 25, 2016, its proxy

statement for its 2016 annual general meeting of shareholders,

which was filed with the SEC on March 18, 2016. Information about

the directors and executive officers of Transocean Partners is set

forth in its Annual Report on Form 10-K for the year ended December

31, 2015, which was filed with the SEC on February 25, 2016, and

its proxy statement for its 2016 annual meeting of unitholders,

which was filed with the SEC on March 17, 2016, and in the joint

proxy statement/prospectus, which was filed with the SEC on October

6, 2016. These documents can be obtained free of charge from the

sources indicated above. Additional information regarding the

participants in the proxy solicitation and a description of their

direct and indirect interests in the transaction, by security

holdings or otherwise, is contained in the proxy

statement/prospectus and other relevant materials that may be filed

with the SEC.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/1451505/000145150516000257/rig-20161121x8k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/1451505/000145150516000257/0001451505-16-000257-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

November 21, 2016 17:11 ET (22:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

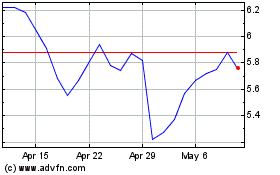

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

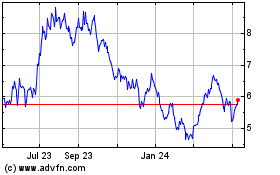

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024