Transocean to Buy Rest of Transocean Partners in $514 Million Deal

August 01 2016 - 9:00AM

Dow Jones News

Swiss offshore drilling company Transocean Ltd. agreed to buy

back the master limited partnership that it formed two years ago,

under pressure from Carl Icahn, in a deal that values Transocean

Partners LLC at about $514 million.

Transocean, which owned nearly 52% of Transocean Partners common

stock, agreed to swap 1.1427 of its shares for each unit of the

master limited partnership. Based on the closing prices Friday, the

offer values Transocean Partners at $12.56 a share, a 15% premium

to stock's closing price of $10.92.

Transocean Partners's initial public offering was priced at $22

in the summer of 2014. At the time, forming master limited

partnerships had become a popular strategy for energy companies as

the structure enabled companies to forgo paying corporate income

tax. When Transocean first announced plans for the IPO, it made

other moves to placate activist investor Mr. Icahn, including a

dividend and a smaller board of directors.

However, the subsequent slump in oil prices caused energy

producers to dial back investment and exploration plans, prompting

two years of spending cuts, canceled projects and tens of thousands

of layoffs.

Transocean Partners, which traded as high as $29.43 in the weeks

following the IPO, hit a low of $5.89 in January. Transocean has

lost about 73% of its market value since the IPO. In premarket

trading, Transocean shares fell 1.2% to $10.86, while Transocean

Partners shares added 0.7% to $11.

Transocean Chief Executive Jeremy Thigpen said the deal

announced Monday would give Transocean the benefit of a "simplified

administration and governance" and cost savings. Under the deal,

Transocean expects to issue about 22.7 million shares.

The deal is subject to the customary approvals and conditions,

including the approval of more than half of the Transocean Partners

units not held by Transocean.

After the deal is completed—expected in this year's fourth

quarter—Transocean also would acquire 51% of ownership interests in

drillships Discoverer Inspiration, Discoverer Clear Leader and

Development Driller III, currently owned by Transocean

Partners.

Write to Brittney Laryea at brittney.laryea@wsj.com

(END) Dow Jones Newswires

August 01, 2016 08:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

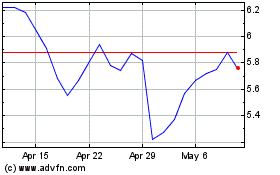

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

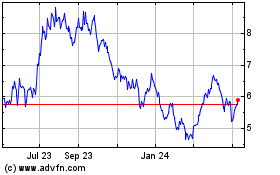

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024