Transocean Files 8K - Regulation FD

July 05 2016 - 8:16AM

Dow Jones News

Transocean Ltd. (RIG) filed a Form 8K - Regulation FD Disclosure

- with the U.S Securities and Exchange Commission on July 05,

2016.

On July 5, 2016, Transocean Ltd. announced that Transocean Inc.,

its wholly-owned subsidiary, commenced an offering (the "Offering")

of US$1.5 billion aggregate principal amount of senior unsecured

notes due 2023 to eligible purchasers under Rule 144A/Regulation S

of the Securities Act of 1933, as amended. The notes will be

guaranteed by Transocean Ltd. and certain of Transocean Inc.'s

subsidiaries.

Simultaneously with the Offering, Transocean Inc. is conducting

a tender offer (the "Tender Offer") to purchase for cash US$1

billion principal amount of its 6.500% Senior Notes due 2020,

6.375% Senior Notes due 2021 and 3.800% Senior Notes due 2022 (the

"Existing Notes"), subject to the terms and conditions specified in

the related offer to purchase (the "Offer to Purchase"). The Tender

Offer will expire at 11:59 P.M., New York City time, on August 1,

2016, subject to any extension.

The Tender Offer is subject to, and conditioned upon, the

satisfaction or waiver of certain conditions described in the Offer

to Purchase, including, among others, Transocean Inc. having raised

net proceeds through the Offering or other issuances of debt in the

public or private capital markets, on reasonably satisfactory

terms, sufficient to purchase all of the Existing Notes validly

tendered (and not validly withdrawn) and accepted for purchase in

the Tender Offer and to pay accrued interest and all fees and

expenses in connection with the Tender Offer. The Offering is not

conditioned upon the consummation of the Tender Offer.

Transocean Inc. intends to use US$1 billion of the proceeds from

the Offering to repurchase the Existing Notes, as described in the

Offer to Purchase. The remaining proceeds of Offering not applied

to the Tender Offer are intended to be used to refinance existing

indebtedness and for general corporate purposes.

A copy of the press releases announcing the Offering and the

Tender Offer are furnished herewith as Exhibits 99.1 and 99.2,

respectively, and are incorporated herein by reference.

Since March 31, 2016, Transocean Ltd. or one or more of its

subsidiaries has repurchased in the open market an aggregate

principal amount of US$228 million of Transocean Inc.'s debt

securities for an aggregate cash payment of US$189 million. As a

result of the repurchases, the aggregate principal amounts of the

following Transocean Inc. notes has been retired: US$36 million of

the 5.05% Senior Notes due 2016, US$38 million of the 2.5% Senior

Notes due 2017, US$20 million of the 6.0% Senior Notes due 2018,

US$26 million of the 7.375% Senior Notes due 2018, US$13 million of

the 6.5% Senior Notes due 2020, US$44 million of the 6.375% Senior

Notes due 2021, US$38 million of the 3.8% Senior Notes due 2022,

US$8 million of the 7.45% Senior Notes due 2027 and US$5 million of

the 7.5% Senior Notes due 2031.

The information in this Current Report on Form 8-K, including

Exhibits 99.1 and 99.1, is being "furnished" pursuant to Item 7.01

and shall not be deemed to be "filed" for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of that section, and is not incorporated

by reference into any Transocean Ltd. filing, whether made before

or after the date hereof, regardless of any general incorporation

language in such filing.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/1451505/000155837016006560/rig-20160705x8k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/1451505/000155837016006560/0001558370-16-006560-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

July 05, 2016 08:01 ET (12:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

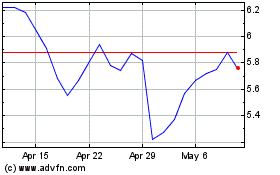

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

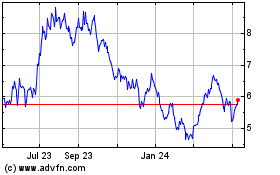

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024