Additional Proxy Soliciting Materials (definitive) (defa14a)

April 21 2016 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

Filed by the Registrant

☒

|

|

Filed by a Party other than the Registrant

☐

|

|

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a

‑6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a

‑12

|

|

|

|

|

|

Transocean Ltd.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a

‑6(i)(1) and 0

‑11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0

‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0

‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

Additional Information Concerning the 2016 Annual General Meeting of

Shareholders of Transocean Ltd.

to be held on May 12, 2016

The proxy statement for our 2016 annual general meeting sets forth target values for the 2015 performance unit grants to our named executive officers and identifies the target award percentage for maximum performance with respect to total shareholder return (“TSR”).

Although the previous six cycles in our performance unit program have yielded zero payout due to performance below established thresholds, the Compensation Committee of our Board of Directors continues to be sensitive to shareholder concerns over declining shareholder value.

Reflecting

these concerns, in February 2016, the Compensation Committee introduced a cap on

the

performance award

payouts

if TSR is negative. Specifically,

if at the completion of the

2016-2018

performance cycle

,

the Company’s absolute

TSR

declines by an amount greater than

15%, then the number of earned

p

erformance

u

nits will

not exceed

100% of target, regardless of

the Company’s relative ranking

in

its performance peer group

. Without this limitation, the metric could

otherwis

e result in a number of earned performance u

nits greater than 100% of target.

The Compensation Committee will continue to evaluate this cap for future performance cycles

to ensure

that

it reflects the relevant

market conditions

,

thus maintaining

our compensation philosophy to align pay with performance and to ensure maximum alignment with our shareholders.

The proxy statement also identifies operating costs

as

one of the performance measures within the c

ontext

of our 2015 Annual Bonus Plan

.

This financial measure is designed to motivate management

to

optimiz

e

an efficient cost structure

in both expanding and contracting markets

,

including operating and maintenance expenses and general and administrative expenses.

As explained in the proxy statement, the established 2015 cost budget target was adjusted downward during the year to normalize for reduced rig activity.

The downward adjustment was necessary because i

nternal operating cost budgets are developed

at the beginning of the year

based

up

on assumed rig activity

for the year

and the associated cost of

operating

each rig.

When

market conditions

decline

and

fewer

rigs

are

utilized,

the

rig-

related

budgeted

costs

should be

– and were –

reduced

and

the related

targets adjusted

accordingly

. If

these

adjustments were not made to

both

measures,

actual

spending against established targets

would

have

appear

ed artificially low, which

could

potentially

lead

to

the

unintended consequence of higher incentive awards du

e to

lower rig activity

. S

uch an outcome would not be consistent with our desire to maintain rigorous standards with respect to our executive compensation program

.

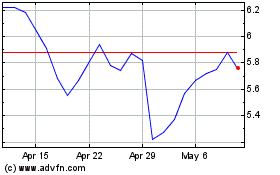

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

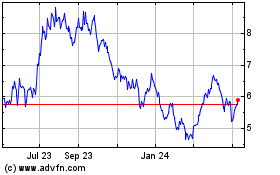

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024