Transocean Seeks to Cancel Two Dividend Payments

August 25 2015 - 5:47PM

Dow Jones News

By Josh Beckerman

Transocean Ltd. is seeking to cancel the third and fourth

installments of its dollar-denominated dividend this year, which

the company had already approved in May.

Shares dropped 12% to $10.75 in after-hours trading. Through

Tuesday's close, they had fallen 67% in the past 12 months.

The offshore driller said in February that it planned four

installments of 15 cents each, which represented an 80% reduction

from the previous payout rate, citing its "cyclical and

capital-intensive industry."

Transocean said Tuesday that it will seek shareholder approval

of the cancellation at an Oct. 29 meeting. The company is also

seeking a par value reduction of its shares to address expected

capital losses. It expects to record impairment charges for

investments in affiliates "in light of the deterioration of the

offshore drilling market and concerns regarding the timing of the

market's recovery."

In August, Transocean said its second-quarter revenue fell 19%

to $1.88 billion.

On Monday, Moody's Investors Service placed the ratings of 11

offshore drillers including Transocean under review for downgrade.

The rating firm said contractors "will face an extremely

challenging operating environment through at least 2017."

In May, BP PLC agreed to settle its remaining claims with

Transocean and Halliburton Co. over the 2010 Deepwater Horizon oil

spill, with which all three companies had involvement.

Write to Josh Beckerman at josh.beckerman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 25, 2015 17:32 ET (21:32 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

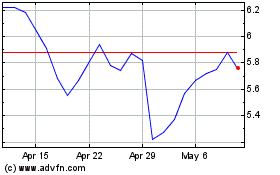

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

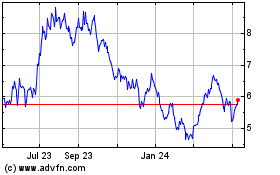

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024