UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 23, 2015

TRANSOCEAN LTD.

(Exact name of registrant as specified in its charter)

|

Switzerland |

|

000-53533 |

|

98-0599916 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

10 Chemin de Blandonnet

1214 Vernier, Geneva

Switzerland |

|

CH-1214 |

|

(Address of principal executive offices) |

|

(zip code) |

Registrant’s telephone number, including area code: +41 (22) 930-9000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

Transocean Ltd.’s (NYSE: RIG) (SIX: RIGN) (the “Company”) Compensation Report which is required under the Swiss Federal Counsel Ordinance Against Excessive Compensation at Public Companies is filed herewith as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Transocean Ltd. Compensation Report |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: March 23, 2015 |

TRANSOCEAN LTD. |

|

|

|

|

|

|

|

|

By: |

/s/ Jill S. Greene |

|

|

|

Authorized Person |

3

INDEX TO EXHIBITS

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Transocean Ltd. Compensation Report |

4

Exhibit 99.1

TRANSOCEAN LTD.

COMPENSATION REPORT

For the years ended December 31, 2014 and 2013

THIS PAGE INTENTIONALLY LEFT BLANK

|

|

Ernst & Young Ltd |

Phone |

+41 58 286 86 86 |

|

|

Maagplatz 1 |

Fax |

+41 58 286 86 00 |

|

|

P.O. Box |

www.ey.com/ch |

|

|

CH-8010 Zurich |

|

To the General Meeting of

Transocean Ltd., Steinhausen

Zurich, March 20, 2015

Report of the statutory auditor on the compensation report

We have audited the compensation report (pages CR-2 to CR-7) dated March 20, 2015 of Transocean Ltd. for the year ended December 31, 2014.

Board of Directors’ responsibility

The Board of Directors is responsible for the preparation and overall fair presentation of the compensation report in accordance with Swiss law and the Ordinance against Excessive Compensation in Stock Exchange Listed Companies (Ordinance). The Board of Directors is also responsible for designing the compensation system and defining individual compensation packages.

Auditor’s responsibility

Our responsibility is to express an opinion on the accompanying compensation report. We conducted our audit in accordance with Swiss Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the compensation report complies with Swiss law and articles 14-16 of the Ordinance.

An audit involves performing procedures to obtain audit evidence on the disclosures made in the compensation report with regard to compensation, loans and credits in accordance with articles 14-16 of the Ordinance. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatements in the compensation report, whether due to fraud or error. This audit also includes evaluating the reasonableness of the methods applied to value components of compensation, as well as assessing the overall presentation of the compensation report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Opinion

In our opinion, the compensation report for the year ended December 31, 2014 of Transocean Ltd. complies with Swiss law and articles 14-16 of the Ordinance.

Ernst & Young Ltd

|

/s/ Robin Errico |

|

/s/ Jolanda Dolente |

|

Licensed audit expert |

|

Licensed audit expert |

|

(Auditor in charge) |

|

|

CR-1

TRANSOCEAN LTD.

COMPENSATION REPORT

General

Transocean Ltd. (the “Company”, the “Group”, “we”, “us”, or “our”) is the parent company of Transocean Inc., Transocean Management Ltd., and Transocean Services AS, our wholly-owned subsidiaries. Transocean Ltd. is registered with the commercial register in the canton of Zug, and its stock is listed on the New York Stock Exchange and on the SIX Swiss Exchange. We are thus bound by the legal and regulatory requirements of both the United States of America and Switzerland. This Compensation Report reflects the requirements of Articles 13-16 of the Swiss Federal Ordinance Against Excessive Compensation in Public Corporations, and discloses any compensation paid to our members of the Board of Directors and the Executive Management Team for the fiscal years ended December 31, 2014 and 2013, respectively.

For a description of our governance framework relating to executive and director compensation, please refer to page P-37 et seq. of the 2015 Proxy Statement under the caption “Executive and Director Compensation Process.” For a description of our directors’ compensation principles, please refer to page P-40 et seq. of the 2015 Proxy Statement under the captions “Director Compensation Strategy” and “2014 Director Compensation.” For a description of our Executive Management Team compensation principles, please refer to page P-47 et seq. of the 2015 Proxy Statement under the caption “Compensation Discussion and Analysis.”

All 2014 compensation amounts are presented in CHF and USD and have been translated at the 2014 average annual currency exchange rate of USD 1.00 to CHF 0.915.

We have presented the comparative amounts for the year ended December 31, 2013 in the same manner that we presented such amounts in our statutory financial statements for the year ended December 31, 2013.

Board of Directors’ Compensation

Our non-employee directors were eligible to receive compensation as follows:

|

|

|

Year ended December 31, 2014 |

|

Year ended December 31, 2013 |

|

|

|

|

Payment |

|

Swiss franc |

|

Payment |

|

Swiss franc |

|

|

|

|

currency |

|

equivalent |

|

currency |

|

equivalent |

|

|

Annual retainer for non-executive chairman (a) (b) |

|

USD |

265,000 |

|

CHF |

242,475 |

|

USD |

265,000 |

|

CHF |

246,450 |

|

|

Annual retainer for non-executive vice-chairman (a) (b) |

|

250,000 |

|

228,750 |

|

— |

|

— |

|

|

Annual retainer for non-employee directors (b) |

|

100,000 |

|

91,500 |

|

90,000 |

|

83,700 |

|

|

Annual award of deferred units for non-executive chairman |

|

260,000 |

|

237,900 |

|

260,000 |

|

252,200 |

|

|

Annual award of deferred units for non-executive vice-chairman |

|

210,000 |

|

192,150 |

|

— |

|

— |

|

|

Annual award of deferred units for non-employee directors |

|

210,000 |

|

192,150 |

|

260,000 |

|

252,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional annual retainer for committee chairmen: |

|

|

|

|

|

|

|

|

|

|

Audit committee |

|

35,000 |

|

32,025 |

|

35,000 |

|

32,550 |

|

|

Compensation committee |

|

20,000 |

|

18,300 |

|

20,000 |

|

18,600 |

|

|

Corporate governance committee, finance and benefits committee, and health, safety and environment committee |

|

10,000 |

|

9,150 |

|

10,000 |

|

9,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Board meeting attendance fee (c) |

|

— |

|

— |

|

2,500 |

|

2,325 |

|

|

Committee meeting attendance fee (d) |

|

— |

|

— |

|

2,500 |

|

2,325 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) The annual retainer for our non-executive chairman and our non-executive vice-chairman are paid in lieu of the annual retainer paid to other non-employee directors and are prorated for a year in which the non-executive chairman or the non-executive vice-chairman serves as such for a partial year.

(b) We pay our non-executive chairman, non-executive vice-chairman and non-employee directors in U.S. dollars in quarterly installments in quarters for which the director has served. The Swiss franc equivalent amounts presented above reflect changes that resulted from translation of the U.S. dollar amounts for presentation in the statutory financial statements.

(c) Prior to May, 2014, the board meeting attendance fee was only paid for board member attendance at meetings in excess of the four regularly scheduled board meetings. Meeting fees are no longer paid.

(d) Prior to May, 2014, the committee meeting attendance fee was only paid for committee member attendance at meetings in excess of four regularly scheduled committee meetings. Meeting fees are no longer paid.

In addition to the directors’ compensation, we pay or reimburse our directors for travel and incidental expenses incurred for attending board, committee and shareholder meetings and for other company-related business purposes. Directors who are our employees do not receive compensation for board service. With the exception of Steven L. Newman, all of the directors on our board of directors are non-employees and receive compensation.

Deferred units are granted to each non-employee director, the non-executive vice-chairman, and the non-executive chairman annually and have an aggregate value equal to USD 210,000, USD 210,000 and USD 260,000 respectively, based upon the average of the high and low sales prices of our shares for each of the 10 trading days immediately prior to the date of grant. The deferred units vest on the date first to occur of (i) the first anniversary of the date of grant or (ii) the Annual General Meeting next following the date of grant,

CR-2

TRANSOCEAN LTD.

COMPENSATION REPORT - continued

subject to continued service through the vesting date. Vesting of the deferred units is not subject to any performance measures. Each director may elect to receive the vested units, or the shares attributable to such vested units, upon vesting or to have the company hold such vested units, or shares attributable to such vested units, until the director no longer serves on the board.

We paid our non-employee directors total compensation as follows:

|

|

|

Year ended December 31, 2014 |

|

Year ended December 31, 2013 |

|

|

|

|

Total |

|

Fees |

|

Deferred units |

|

Deferred |

|

Total |

|

Fees |

|

Deferred units |

|

Deferred |

|

|

|

|

compensation |

|

earned |

|

(value) |

|

units |

|

compensation |

|

earned |

|

(value) |

|

units |

|

|

Name and function |

|

(a) |

|

(b) |

|

(c) |

|

(units) |

|

(a) |

|

(b) |

|

(c) |

|

(units) |

|

|

Ian C. Strachan (d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman of the board since May 17, 2013; chairman of the finance committee and member of the corporate governance committee until May 17, 2013 |

|

CHF |

560,975 |

|

CHF |

328,023 |

|

CHF |

232,952 |

|

6,120 |

|

CHF |

496,849 |

|

CHF |

244,649 |

|

CHF |

252,200 |

|

4,760 |

|

|

|

|

USD |

613,087 |

|

USD |

358,495 |

|

USD |

254,592 |

|

6,120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Glyn Barker (e) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board; chairman of the audit committee since May 16, 2014 and a prior member of such committee: member of the finance committee |

|

|

329,410 |

|

|

141,260 |

|

|

188,150 |

|

4,943 |

|

|

367,918 |

|

|

115,718 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

360,010 |

|

|

154,382 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Jagjeet Bindra (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board until May 16, 2014; member of the corporate governance and health safety and environment committees until May 16, 2014 |

|

|

48,487 |

|

|

48,487 |

|

|

— |

|

— |

|

|

367,496 |

|

|

115,296 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

52,991 |

|

|

52,991 |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas W. Cason (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board until May 16, 2014; member of the audit committee and the finance committee until May 16, 2014 |

|

|

57,658 |

|

|

57,658 |

|

|

— |

|

— |

|

|

390,809 |

|

|

138,609 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

63,014 |

|

|

63,014 |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanessa C.L. Chang (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board; member of the audit committee and finance committee |

|

|

318,212 |

|

|

130,062 |

|

|

188,150 |

|

4,943 |

|

|

370,908 |

|

|

118,708 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

347,772 |

|

|

142,143 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Frederico F. Curado (f) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board; member of the compensation committee since May 17, 2013 and member of the audit committee since May 16, 2014; member of the health safety and environment committee from May 17, 2013 to May 16, 2014 |

|

|

298,873 |

|

|

110,723 |

|

|

188,150 |

|

4,943 |

|

|

316,484 |

|

|

64,284 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

326,637 |

|

|

121,008 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Chad Deaton (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board; chairman of the health safety and environment committee since May 16, 2014 and member of such committee since May 17, 2013, member of the corporate governance committee since May 17, 2013; member of the audit committee until May 16, 2014 |

|

|

323,943 |

|

|

135,793 |

|

|

188,150 |

|

4,943 |

|

|

368,583 |

|

|

116,383 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

354,036 |

|

|

148,407 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tan Ek Kia (g) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board; chairman of the compensation committee since May 17, 2013 and a prior member of such committee; member of the health safety and environment committee |

|

|

341,675 |

|

|

153,525 |

|

|

188,150 |

|

4,943 |

|

|

383,745 |

|

|

131,545 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

373,415 |

|

|

167,786 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Vincent J. Intrieri (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board since May 16, 2014; member of the corporate governance committee and compensation committee since May 16, 2014 |

|

|

255,640 |

|

|

67,490 |

|

|

188,150 |

|

4,943 |

|

|

— |

|

|

— |

|

|

— |

|

— |

|

|

|

|

|

279,388 |

|

|

73,759 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Steve Lucas (h) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board until May 16, 2014; chairman of the audit committee and member of the finance committee until May 16, 2014 |

|

|

69,074 |

|

|

69,074 |

|

|

— |

|

— |

|

|

407,021 |

|

|

154,821 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

75,491 |

|

|

75,491 |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin B. McNamara (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board; chairman of the corporate governance committee and member of the compensation committee |

|

|

368,758 |

|

|

180,608 |

|

|

188,150 |

|

4,943 |

|

|

405,803 |

|

|

153,603 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

403,014 |

|

|

197,386 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Samuel Merksamer (i) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board since May 17, 2013; member of the finance and health, safety and environment committees since May 17, 2013 |

|

|

298,873 |

|

|

110,723 |

|

|

188,150 |

|

4,943 |

|

|

314,159 |

|

|

61,959 |

|

|

252,200 |

|

4,760 |

|

|

|

|

|

326,637 |

|

|

121,008 |

|

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

|

|

CR-3

TRANSOCEAN LTD.

COMPENSATION REPORT– continued

|

|

|

Year ended December 31, 2014 |

|

Year ended December 31, 2013 |

|

|

|

|

Total |

|

Fees |

|

Deferred units |

|

Deferred |

|

Total |

|

Fees |

|

Deferred units |

|

Deferred |

|

|

|

|

compensation |

|

earned |

|

(value) |

|

units |

|

compensation |

|

earned |

|

(value) |

|

units |

|

|

Name and function |

|

(a) |

|

(b) |

|

(c) |

|

(units) |

|

(a) |

|

(b) |

|

(c) |

|

(units) |

|

|

Merrill A. “Pete” Miller, Jr. (j) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board since September 22, 2014; vice-chairman of the board since November 14, 2014 |

|

180,359 |

|

63,755 |

|

116,604 |

|

4,892 |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

197,115 |

|

69,678 |

|

127,437 |

|

4,892 |

|

|

|

|

|

|

|

|

|

|

Edward R. Muller (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board; chairman of the finance committee since May 17, 2013; member of the health safety and environment committee since May 16, 2014; member of the corporate governance committee until May 16, 2014; chairman of the compensation committee until May 17, 2013 |

|

355,560 |

|

167,410 |

|

188,150 |

|

4,943 |

|

400,109 |

|

147,909 |

|

252,200 |

|

4,760 |

|

|

|

|

388,591 |

|

182,962 |

|

205,629 |

|

4,943 |

|

|

|

|

|

|

|

|

|

|

Robert M. Sprague (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member of the board until May 16, 2014; chairman of the health safety and environment committee until May 16, 2014; member of the compensation committee until May 16, 2014 |

|

60,288 |

|

60,288 |

|

— |

|

— |

|

403,478 |

|

151,278 |

|

252,200 |

|

4,760 |

|

|

|

|

65,888 |

|

65,888 |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

J. Michael Talbert (k) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman of the board until May 17, 2013 |

|

— |

|

— |

|

— |

|

— |

|

127,875 |

|

127,875 |

|

— |

|

— |

|

|

|

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (CHF) |

|

CHF |

3,867,785 |

|

CHF |

1,824,879 |

|

CHF |

2,042,906 |

|

55,499 |

|

CHF |

5,121,237 |

|

CHF |

1,842,637 |

|

CHF |

3,278,600 |

|

61,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (USD) |

|

USD |

4,227,087 |

|

USD |

1,994,398 |

|

USD |

2,232,690 |

|

55,499 |

|

|

|

|

|

|

|

|

|

|

|

|

(a) Total compensation for board membership.

(b) Fees earned, including retainer fees, meeting fees, and dividend equivalents earned on vested and unvested deferred units.

(c) The fair value of deferred units was based on the market price of our shares on the grant date.

(d) In addition to the CHF 560,975 / USD 613,087 in 2014 Total compensation disclosed above, Mr. Strachan received compensation representing UK social tax contributions paid for his benefit, in the amount of CHF 44,607 / USD 48,751. 2013 Total compensation was subject to UK employer-paid social tax contributions in the amounts of CHF 32,556 / USD 35,007.

(e) In addition to the CHF 329,410 / USD 360,010 in 2014 Total compensation disclosed above, Mr. Barker received 2014 compensation of CHF 110,827 / USD 121,122, comprising CHF 28,848 / USD 31,527 in UK employer-paid social tax contributions on Transocean Ltd compensation; CHF 72,038 / USD 78,730 in fees for service on the board of directors of Transocean Partners LLC, and CHF 9,941 / USD 10,865 in UK employer-paid social tax contributions on Transocean Partners LLC fees. 2013 Total compensation was subject to UK employer-paid social tax contributions in the amounts of CHF 16,026 / USD 17,232.

(f) In addition to the CHF 298,873 / USD 326,637 in 2014 Total compensation disclosed above, Mr. Curado received compensation representing Swiss social tax contributions paid for his benefit, in the amount of CHF 8,775 / USD 9,591. In 2013, Swiss employer-paid social tax contributions in the amounts of CHF 5,233 / USD 5,627 were paid.

(g) In addition to the CHF 341,675 / USD 373,415 in 2014 Total compensation disclosed above, Mr. Tan received compensation representing Swiss social tax contributions paid for his benefit, in the amount of CHF 12,192 / USD 13,325. In 2013 Swiss employer-paid social tax contributions in the amounts of CHF 10,634 / USD 11,434 were paid.

(h) In addition to the CHF 69,074 / USD 75,491 in 2014 Total compensation disclosed above, Mr. Lucas received compensation representing UK social tax contributions paid for his benefit, in the amount of CHF 81,645 / USD 89,229. 2013 Total compensation was subject to UK employer-paid social tax contributions in the amounts of CHF 21,457 / USD 23,072.

(i) In addition to the CHF 298,873 / USD 326,637 in 2014 Total compensation disclosed above, Mr. Merksamer received 2014 compensation of CHF 26,385 / USD 28,836, for fees for service on the board of directors of Transocean Partners LLC.

(j) Mr. Miller received a grant of deferred units with an aggregate value of CHF 128,100 / USD 140,000, representing the proportionate amount of the USD 210,000 annual grant for the partial annual term extending from the date of his election in September 2014 to the date of our annual general meeting in May 2015.

(k) Total compensation was not subject to employer-paid social tax contributions in 2014 or 2013.

CR-4

TRANSOCEAN LTD.

COMPENSATION REPORT - continued

Executive Management Team Compensation

We paid the members of our Executive Management Team total compensation as follows:

|

|

|

Year ended December 31, 2014 |

|

Year ended December 31, 2013 |

|

|

|

|

Total salary and |

|

|

|

|

|

Total salary and |

|

|

|

|

|

|

|

|

other non |

|

Total |

|

|

|

other non |

|

Total |

|

|

|

|

|

|

share-based |

|

share-based |

|

Total |

|

share-based |

|

share-based |

|

Total |

|

|

Name and function |

|

compensation |

|

compensation |

|

compensation |

|

compensation |

|

compensation |

|

compensation |

|

|

Steven L. Newman |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President and Chief Executive Officer since March 1, 2010; member of the board since May 14, 2010 |

|

CHF |

3,413,606 |

|

CHF |

6,218,248 |

|

CHF |

9,631,854 |

|

CHF |

4,851,722 |

|

CHF |

7,702,418 |

|

CHF |

12,554,140 |

|

|

|

|

USD |

3,730,716 |

|

USD |

6,795,900 |

|

USD |

10,526,616 |

|

|

|

|

|

|

|

|

Esa Ikäheimonen |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer since November 15, 2012 |

|

2’125’671 |

|

2,144,475 |

|

4,270,194 |

|

2,289,252 |

|

2,674,429 |

|

4,963,681 |

|

|

|

|

2,290,335 |

|

2,343,689 |

|

4,634,024 |

|

|

|

|

|

|

|

|

John Stobart |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President and Chief Operating Officer since October 1, 2012 |

|

1,884,778 |

|

1,973,063 |

|

3,857,841 |

|

2,152,551 |

|

2,406,967 |

|

4,559,518 |

|

|

|

|

2,059,867 |

|

2,156,353 |

|

4,216,219 |

|

|

|

|

|

|

|

|

Allen Katz (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior Vice President and Interim General Counsel from November 17, 2012 to February 28, 2014 |

|

— |

|

— |

|

— |

|

1,100,117 |

|

— |

|

1,100,117 |

|

|

|

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

David Tonnel (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior Vice President, Finance and Controller since March 1, 2012 |

|

— |

|

— |

|

— |

|

884,291 |

|

1,283,731 |

|

2,168,022 |

|

|

|

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

Ihab Toma (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President and Chief of Staff from October 1, 2012 to December 31, 2013; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President, Operations from August 17, 2011 to October 1, 2012; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President, Global Business from August 16, 2010 to August 16, 2011 |

|

— |

|

— |

|

— |

|

1,948,365 |

|

2,139,521 |

|

4,087,886 |

|

|

|

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

Total (CHF) |

|

CHF |

7’424’055 |

|

CHF |

10,335,786 |

|

CHF |

17,759,889 |

|

CHF |

13,226,298 |

|

CHF |

16,207,066 |

|

CHF |

29,433,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (USD) |

|

USD |

8,080,918 |

|

USD |

11,295,941 |

|

USD |

19,376,859 |

|

|

|

|

|

|

|

(a) Effective December 3, 2013, Mr. Katz, Mr. Tonnel and Mr. Toma were no longer designated as members of the executive management team. For the year ended December 31, 2013, total compensation for Mr. Katz, Mr. Tonnel and Mr. Toma, for practical purposes, includes amounts for the full year.

We paid members of our Executive Management Team total salary and other non-share-based compensation, before deductions for employee social insurance and pension contributions, as follows:

|

|

|

Year ended December 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total salary and |

|

|

|

|

|

|

|

|

Additional |

|

Employer’s |

|

Employer’s social |

|

other non |

|

|

|

|

Base |

|

Bonus |

|

compensation |

|

pension |

|

security payments |

|

share-based |

|

|

Name |

|

salary |

|

(a) |

|

(b) |

|

contributions |

|

(c) |

|

compensation |

|

|

Steven L. Newman |

|

CHF |

1,136,125 |

|

CHF |

1,408,245 |

|

CHF |

764,692 |

|

CHF |

14,274 |

|

CHF |

90,270 |

|

CHF |

3,413,606 |

|

|

|

|

USD |

1,241,667 |

|

USD |

1,539,065 |

|

USD |

835,729 |

|

USD |

15,600 |

|

USD |

98,655 |

|

USD |

3,730,716 |

|

|

Esa Ikäheimonen |

|

701,223 |

|

591,005 |

|

502,461 |

|

147,994 |

|

182,988 |

|

2,125,671 |

|

|

|

|

766,364 |

|

613,107 |

|

549,136 |

|

161,742 |

|

199,986 |

|

2,290,335 |

|

|

John Stobart |

|

607,713 |

|

602,652 |

|

604,542 |

|

14,274 |

|

55,597 |

|

1,884,778 |

|

|

|

|

664,167 |

|

658,636 |

|

660,702 |

|

15,600 |

|

60,762 |

|

2,059,867 |

|

|

Total (CHF) |

|

CHF |

2,445,061 |

|

CHF |

2,601,902 |

|

CHF |

1,871,695 |

|

CHF |

176,542 |

|

CHF |

328,855 |

|

CHF |

7,424,055 |

|

|

Total (USD) |

|

USD |

2,672,198 |

|

USD |

2,810,808 |

|

USD |

2,045,567 |

|

USD |

192,942 |

|

USD |

359,403 |

|

USD |

8,080,918 |

|

(a) Bonus represents the amount earned in the year ended December 31, 2014, but not paid as of December 31, 2014.

(b) Additional compensation includes relocation pay and moving expenses; housing, automobile, home leave and cost of living allowances; dividend equivalents; club membership dues; and other company-reimbursed expenses and benefits provided to expatriate employees.

(c) Employer’s social security payments include costs of health benefits, such as medical and dental insurance, and unemployment and social security taxes.

CR-5

TRANSOCEAN LTD.

COMPENSATION REPORT - continued

|

|

|

Year ended December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total salary and |

|

|

|

|

|

|

|

|

Additional |

|

Swiss tax on |

|

Employer’s |

|

Employer’s social |

|

other non |

|

|

|

|

Base |

|

Bonus |

|

compensation |

|

global earnings |

|

pension |

|

security payments |

|

share-based |

|

|

Name |

|

salary |

|

(a) |

|

(b) |

|

and benefits |

|

contributions |

|

(c) |

|

compensation |

|

|

Steven L. Newman |

|

CHF |

1,108,250 |

|

CHF |

1,285,841 |

|

CHF |

2,204,900 |

|

CHF |

127,928 |

|

CHF |

14,229 |

|

CHF |

110,574 |

|

CHF |

4,851,722 |

|

|

Esa Ikäheimonen |

|

680,283 |

|

506,777 |

|

608,955 |

|

211,842 |

|

143,089 |

|

138,306 |

|

2,289,252 |

|

|

John Stobart |

|

587,450 |

|

545,240 |

|

725,750 |

|

231,040 |

|

7,115 |

|

55,956 |

|

2,152,551 |

|

|

Allen Katz (d) |

|

558,000 |

|

446,400 |

|

44,897 |

|

— |

|

5,720 |

|

45,100 |

|

1,100,117 |

|

|

David Tonnel (d) |

|

391,375 |

|

217,983 |

|

216,147 |

|

— |

|

14,229 |

|

44,557 |

|

884,291 |

|

|

Ihab Toma (d) |

|

587,071 |

|

482,700 |

|

352,864 |

|

172,741 |

|

103,585 |

|

249,404 |

|

1,948,365 |

|

|

Total |

|

CHF |

3,912,429 |

|

CHF |

3,484,941 |

|

CHF |

4,153,513 |

|

CHF |

743,551 |

|

CHF |

287,967 |

|

CHF |

643,897 |

|

CHF |

13,226,298 |

|

(a) Bonus represents the amount earned in the year ended December 31, 2013, but not paid as of December 31, 2013.

(b) Additional compensation includes tax reimbursements; relocation pay and moving expenses; housing, automobile, home leave and cost of living allowances; unused vacation payout; dividend equivalents; club membership dues; and other company-reimbursed expenses and benefits provided to expatriate employees.

(c) Employer’s social security payments include costs of health benefits, such as medical and dental insurance, and unemployment and social security taxes.

(d) Effective December 3, 2013, Mr. Katz, Mr. Tonnel and Mr. Toma were no longer designated as members of the executive management team. For the year ended December 31, 2013, total compensation for Mr. Katz, Mr. Tonnel and Mr. Toma, for practical purposes, includes amounts for the full year.

We granted to the members of our executive management team share-based compensation awards under our long-term incentive plans, as follows:

|

|

|

December 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

Deferred units |

|

Contingent deferred units |

|

share-based |

|

|

Name |

|

Units (a) |

|

Fair value (b) |

|

Units (c) |

|

Fair value (d) |

|

compensation (e) |

|

|

Steven L. Newman |

|

90,365 |

|

CHF |

3,585,177 |

|

90,365 |

|

CHF |

2,633,071 |

|

CHF |

6,218,248 |

|

|

|

|

90,365 |

|

USD |

3,918,226 |

|

90,365 |

|

USD |

2,877,673 |

|

USD |

6,795,900 |

|

|

Esa Ikäheimonen |

|

31,164 |

|

1,236,413 |

|

31,164 |

|

908,062 |

|

2,144,475 |

|

|

|

|

31,164 |

|

1,351,271 |

|

31,164 |

|

992,418 |

|

2,343,689 |

|

|

John Stobart |

|

28,673 |

|

1,137,584 |

|

28,673 |

|

835,479 |

|

1,973,063 |

|

|

|

|

28,673 |

|

1,243,261 |

|

28,673 |

|

913,092 |

|

2,156,353 |

|

|

Total |

|

150,202 |

|

CHF |

5,959,174 |

|

150,202 |

|

CHF |

4,376,612 |

|

CHF |

10,335,786 |

|

|

|

|

150,202 |

|

USD |

6,512,758 |

|

150,202 |

|

USD |

4,783,183 |

|

USD |

11,295,941 |

|

(a) We granted the time-based deferred units to the members of our executive management team on February 13, 2014.

(b) We estimate the fair value of time-based deferred units using the market price for our shares on the grant date.

(c) We granted the contingent deferred units to the members of our executive management team on February 13, 2014. The actual number of deferred units earned will be determined in the first 60 days of 2017, contingent upon our total shareholder return relative to our performance peer group and our performance against established targets for return on capital employed. The three-year performance period ends on December 31, 2016. The number of contingent deferred units reflects the target number of shares for the award. Actual shares earned and allocated will be determined based on performance thresholds and may range between 0 and 2 shares per contingent deferred unit.

(d) We estimate the grant date fair value of contingent deferred units using a Monte Carlo simulation model.

(e) Total share-based compensation in 2014 represents the fair value of grants made to the members of our executive management team and does not represent actual income earned. Any income earned from subsequent vesting of the awards will be subject to employer-paid social tax contributions at the statutory rate prevailing at the time income is earned.

CR-6

TRANSOCEAN LTD.

COMPENSATION REPORT — continued

|

|

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

Deferred units |

|

Contingent deferred units |

|

Stock options |

|

share-based |

|

|

Name |

|

Units (a) |

|

Fair value (b) |

|

Units (c) |

|

Fair value (d) |

|

Options (e) |

|

Fair value (f) |

|

compensation (h) |

|

|

Steven L. Newman |

|

46,020 |

|

CHF |

2,537,957 |

|

46,020 |

|

CHF |

3,169,236 |

|

123,512 |

|

CHF |

1,995,225 |

|

CHF |

7,702,418 |

|

|

Esa Ikäheimonen |

|

15,979 |

|

881,226 |

|

15,979 |

|

1,100,418 |

|

42,886 |

|

692,785 |

|

2,674,429 |

|

|

John Stobart |

|

14,381 |

|

793,098 |

|

14,381 |

|

990,369 |

|

38,597 |

|

623,500 |

|

2,406,967 |

|

|

David Tonnel (g) |

|

7,670 |

|

422,993 |

|

7,670 |

|

528,206 |

|

20,585 |

|

332,532 |

|

1,283,731 |

|

|

Ihab Toma (g) |

|

12,783 |

|

704,970 |

|

12,783 |

|

880,320 |

|

34,309 |

|

554,231 |

|

2,139,521 |

|

|

Total |

|

96,833 |

|

CHF |

5,340,244 |

|

96,833 |

|

CHF |

6,668,549 |

|

259,889 |

|

CHF |

4,198,273 |

|

CHF |

16,207,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) We granted the time-based deferred units to the members of our Executive Management Team on February 14, 2013.

(b) We estimate the fair value of time-based deferred units using the market price for our shares on the grant date.

(c) We granted the contingent deferred units to the members of our Executive Management Team on February 14, 2013. The actual number of deferred units to be granted will be determined in the first sixty days of 2016, contingent upon our total shareholder return relative to our performance peer group. The performance measurement is evaluated over the three-year performance period ending on December 31, 2015. The number of contingent deferred units reflects the target number of shares for the award. Actual shares earned and allocated will be determined based on performance thresholds and may range between 0 and 2 shares per contingent deferred unit

(d) We estimate the grant date fair value of contingent deferred units using a Monte Carlo simulation model.

(e) We granted stock options to the members of our executive management team on February 14, 2013. The stock options vest in one-third increments over a three-year period on the anniversary of the grant date.

(f) We estimate the fair value of stock options using option pricing models for non-qualified stock option grants.

(g) Effective December 3, 2013, Mr. Tonnel and Mr. Toma were no longer designated as members of the Executive Management Team.

(h) Total share-based compensation represents the fair value of grants made to the members of our executive management team and does not represent actual income earned. Any income earned from subsequent vesting of the awards will be subject to employer-paid social tax contributions at the statutory rate prevailing at the time income is earned

Credits and Loans Granted to Governing Bodies

In compliance with Article 29f paragraph 1 of our Articles of Association, which was adopted at the annual general meeting held in May 2014, we did not grant credits or loans to active or former members of our Board of Directors, members of our Executive Management Team or to any other related persons during the years ended December 31, 2014 and 2013. At December 31, 2014 and 2013, we had no outstanding credits or loans to active or former members of our Board of Directors, members of our Executive Management Team or to any other related persons.

Compensation to Former Members of our Board of Directors or our Executive Management Team or to Related Persons

During the years ended December 31, 2014 and 2013, we did not pay or grant any compensation to former members of our Board of Directors or our Executive Management Team or to related persons of active or former members of our Board of Directors or our Executive Management Team.

Subsequent event

Chief Executive Officer—Effective February 15, 2015, Steven L. Newman and our board of directors mutually agreed that he would step down as Chief Executive Officer. Effective February 16, 2015, Ian C. Strachan, the chairman of our board of directors, assumed the role on an interim basis.

CR-7

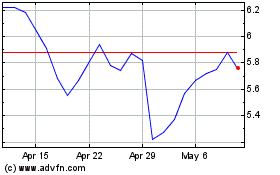

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

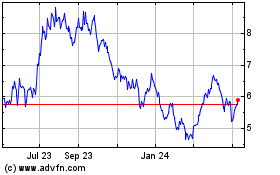

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024