- Earnings per diluted share: $2.92 from

net income, $2.63 from operating income*

- ROE 10 percent and Operating ROE* 11

percent for the full year

- Reported net premiums increased 7

percent in the fourth quarter

Reinsurance Group of America, Incorporated (NYSE: RGA), a

leading global provider of life reinsurance, reported

fourth-quarter net income of $190.1 million, or $2.92 per diluted

share, compared with $163.1 million, or $2.46 per diluted

share, in the prior-year quarter. Operating income* totaled

$171.3 million, or $2.63 per diluted share, compared with

$188.0 million, or $2.84 per diluted share, the year before. Net

foreign currency fluctuations had an adverse effect of $0.10 per

diluted share on net income, and $0.08 per diluted share on

operating income.

Quarterly Results

Year-to-Date Results ($ in thousands, except per share

data) 2016 2015 2016

2015 Net premiums $ 2,493,163 $ 2,328,501 $ 9,248,871

$ 8,570,741 Net income 190,149 163,127 701,443 502,166 Net income

per diluted share 2.92 2.46 10.79 7.46 Operating income* 171,259

187,950 632,598 567,084 Operating income per diluted share* 2.63

2.84 9.73 8.43 Book value per share 110.31 94.09 Book value per

share, excluding accumulated other comprehensive income (AOCI)*

92.59 83.23 Total assets 53,097,879 50,383,152 * See ‘Use of

Non-GAAP Financial Measures’ below

Full-year 2016 net income totaled $701.4 million, or $10.79 per

diluted share, versus $502.2 million, or $7.46 per diluted share,

in 2015. Operating income for the full year increased to $632.6

million, or $9.73 per diluted share, from $567.1 million, or $8.43

per diluted share, the year before. Net adverse foreign currency

fluctuations reduced 2016 net income by $0.29 per diluted share,

and operating income by $0.25 per diluted share. Net premiums

increased 8 percent in 2016. Full-year premiums reflected net

adverse foreign currency effects of approximately $172.2

million.

For the fourth quarter, consolidated net premiums totaled $2.5

billion, up 7 percent from last year’s fourth quarter.

Current-period premiums reflected net adverse foreign currency

effects of approximately $35.2 million. Excluding spread-based

businesses and the value of associated derivatives, investment

income rose 8 percent over year-ago levels, attributable to an

increase in average invested assets of approximately 14 percent and

strong variable investment income, offset in part by the impact of

lower yield on new money and reinvested assets. The average

investment yield, excluding spread businesses, was down 27 basis

points to 4.69 percent from the fourth quarter of 2015, mainly

attributable to a 2015 fourth-quarter transaction with investment

income retroactive to January 1. The average investment yield was

26 basis points higher than the third-quarter yield due to stronger

variable investment income.

The effective tax rate was approximately 36 percent on both

pre-tax GAAP income and operating income this quarter, above an

expected range of 34 to 35 percent, due to a greater balance of

income from jurisdictions with higher tax rates. For the full year,

the effective tax rate on pre-tax GAAP income and operating income

was approximately 33 percent.

Anna Manning, president and chief executive officer, commented,

“This was another good quarter for RGA, and it closed out a very

successful year. The fourth-quarter results continued a pattern of

good overall momentum and favorable diversification of earnings by

geography and product. Most key business segments posted good

results, with a notably strong performance for the U.S. Traditional

segment. EMEA, Asia Traditional and Canada also performed well,

while Australia underperformed. Overall top-line premium growth was

fairly strong again up 7 percent, or 9 percent in constant

currencies, based primarily upon solid organic growth and modest

contributions from in-force transactions.

“For the year, net income per share of $10.79 and operating

earnings per share of $9.73 also reflected strong results across

most key segments. Our overall strategy and global operating model

continued to produce solid returns as we serve our clients with

solutions spanning across geographies and product areas. We

achieved these strong results despite ongoing macroeconomic

headwinds including lower interest rates and weak foreign

currencies. In 2016, our return on equity was 10 percent and

operating return on equity was 11 percent. Importantly, RGA's

balance sheet remains strong.

“We executed a number of in-force and other transactions during

the year, but the size of the deals on average was smaller than in

recent years. We ended the year with an excess capital position of

$1.1 billion and our board approved a new share repurchase

authorization of $400 million, replacing the previous

authorization. We are well positioned to continue to pursue a

balanced approach to capital management in terms of deployment into

in-force and other attractive transactions, share repurchases and

shareholder dividend increases. Book value per share at year-end

2016 was $110.31 including AOCI, and $92.59 excluding AOCI.

“Looking forward, we remain optimistic about our ability to

serve clients, execute on our strategies and deliver attractive

financial returns.”

SEGMENT RESULTS

In the fourth quarter, RGA changed the name of its

Non-Traditional segments to Financial Solutions. The name change

better aligns our external reports with internally used

terminology. This name change does not affect any previously

reported results for the Financial Solutions segments.

U.S. and Latin America

Traditional

The U.S. and Latin America Traditional segment reported pre-tax

net income of $131.5 million, compared with $79.5 million

in the fourth quarter of 2015. Pre-tax operating income totaled

$129.3 million for the quarter, compared with

$79.0 million in last year’s fourth quarter. Results for the

current quarter benefited from higher variable investment income

and modestly favorable claims results in the Individual Mortality

business. Results in the year-ago quarter reflected poor experience

in the Group business, and unfavorable claims in the Individual

Mortality business. For the full year, pre-tax net income increased

to $371.1 million from $235.8 million and pre-tax operating income

increased to $375.3 million versus $233.5 million in 2015.

Traditional net premiums increased 4 percent from last year’s

fourth quarter to $1,430.3 million and 9 percent to $5,249.6

million for the full year.

Financial Solutions

The Asset-Intensive business reported pre-tax net income of

$72.3 million compared with $30.9 million last year.

Fourth-quarter pre-tax operating income totaled $46.7 million

compared with $47.6 million last year. Both periods' operating

income reflected favorable investment spreads. Full-year pre-tax

net income totaled $224.1 million versus $152.9 million in 2015.

Pre-tax operating income totaled $205.0 million for the full year

versus $199.6 million in 2015, with both periods benefiting from

favorable interest rate spreads.

The Financial Reinsurance business reported pre-tax net income

and pre-tax operating income of $14.4 million for the fourth

quarter compared with $15.9 million the year before, performing in

line with expectations. For the year, pre-tax net income and

pre-tax operating income rose to $59.2 million from $55.0 million

in the prior year.

Canada

Traditional

The Canada Traditional segment reported pre-tax net income of

$37.0 million compared with $44.6 million the year before. Pre-tax

operating income totaled $34.8 million compared with

$45.1 million in the fourth quarter of 2015. The year-ago

quarter was driven by particularly favorable individual mortality

claims experience, while the 2016 quarter reflected modestly

favorable individual mortality claims. The effect of net foreign

currency fluctuations was immaterial to pre-tax net income and

pre-tax operating income in the quarter. For the full year, pre-tax

net income increased to $134.7 million from $124.2 million in 2015.

Pre-tax operating income for the year rose to $125.6 million from

$123.8 million the year before. Foreign currency exchange rates

adversely affected pre-tax net income by $5.8 million and pre-tax

operating income by $6.2 million for the full year.

Reported net premiums increased 20 percent to $241.9 million for

the quarter, attributable to solid growth in individual mortality

and a one-time amendment in 2016 on a creditor treaty. Net premiums

for the full year increased to $928.6 million compared with $838.9

million in 2015. Net foreign currency fluctuations adversely

affected net premiums by $33.0 million for the full year.

Financial Solutions

The Canada Financial Solutions business segment, which consists

of longevity and fee-based transactions, reported fourth-quarter

pre-tax net income and pre-tax operating income of $4.1 million

compared with $3.4 million a year ago, reflecting favorable

longevity experience. The effect of net foreign currency

fluctuations was immaterial to pre-tax net income and pre-tax

operating income in the quarter. Pre-tax net income and pre-tax

operating income totaled $7.9 million for the full year compared

with $13.9 million in 2015, as 2015 experience was particularly

good. For the full year, foreign currency exchange rates adversely

affected pre-tax net income and pre-tax operating income by $0.7

million.

Europe, Middle East and Africa (EMEA)

Traditional

The EMEA Traditional segment reported pre-tax net income and

pre-tax operating income of $15.8 million, up from $12.9 million in

last year’s fourth quarter. Current-period results included higher

premiums and a favorable adjustment associated with improved client

reporting, somewhat offset by modestly unfavorable mortality and

morbidity experience in the U.K. Last year’s fourth quarter was

generally in line with expectations. Net foreign currency

fluctuations adversely affected pre-tax net income and pre-tax

operating income by $1.0 million. For the full year, pre-tax net

income decreased to $30.1 million from $48.4 million in 2015, and

pre-tax operating income decreased to $30.1 million from $48.1

million in the prior year. Full-year net foreign currency

fluctuations adversely affected pre-tax net income and pre-tax

operating income by $1.0 million.

Reported net premiums increased to $301.3 million from $299.9

million in the prior-year period primarily due to the impact of new

treaties. Foreign currency exchange rates adversely affected net

premiums by $37.4 million. For the full year, net premiums totaled

$1,140.1 million, with an adverse effect of $113.1 million

from foreign currency fluctuations.

Financial Solutions

The EMEA Financial Solutions business segment includes

longevity, asset-intensive and fee-based transactions. Pre-tax net

income totaled $41.3 million compared with $28.1 million in the

year-ago period. Pre-tax operating income increased to $36.7

million compared with $18.8 million the year before. Current-period

results reflected continued favorable experience in both the

asset-intensive and longevity businesses, along with the impact of

new business. Net foreign currency fluctuations adversely affected

pre-tax net income by $9.3 million and pre-tax operating income by

$8.2 million. For the full year, pre-tax net income totaled $138.0

million compared with $108.4 million in 2015. Pre-tax operating

income for the year was $122.4 million, up from $98.1 million the

year before. Net foreign currency fluctuations adversely affected

full-year pre-tax net income by $19.4 million and pre-tax operating

income by $16.7 million.

Asia Pacific

Traditional

The Asia Pacific Traditional segment reported pre-tax net income

of $18.5 million, down from $37.4 million in the prior-year

period. Pre-tax operating income totaled $18.5 million compared

with a very strong $35.7 million a year ago. Underwriting

experience was favorable across Asia with particularly strong

results in Hong Kong and Japan, but was offset by high claims on

individual disability business in Australia. Net foreign currency

fluctuations had a favorable effect of $1.1 million on pre-tax net

income and pre-tax operating income. For the full year, pre-tax net

income and pre-tax operating income totaled $113.9 million compared

with $105.7 million in 2015. The effect of net foreign currency

fluctuations was immaterial to pre-tax net income and pre-tax

operating income for the full year.

Reported net premiums rose to $448.3 million from $388.7

million in the prior-year period, reflecting solid growth in Asia.

Foreign currency exchange rates had a favorable effect of $12.6

million on net premiums. For the year, net premiums totaled

$1,681.5 million, up 8 percent over the prior year. Net foreign

currency fluctuations had a favorable effect of $3.3 million on net

premiums for the full year.

Financial Solutions

The Asia Pacific Financial Solutions business segment includes

asset-intensive and fee-based transactions. Pre-tax net losses

totaled $12.0 million compared with pre-tax net income of

$5.5 million last year. Pre-tax operating losses totaled $6.1

million compared with a pre-tax operating income of $5.4 million in

the prior-year quarter. The losses in the current period are

primarily due to unfavorable results on one treaty that continues

to run off. The effect of net foreign currency fluctuations was

immaterial to pre-tax net income and pre-tax operating income in

the quarter. For the full year, pre-tax net income totaled $4.1

million compared with $19.6 million in 2015. Pre-tax operating

losses were $2.4 million for the year, down from pre-tax operating

income of $22.5 million a year ago. Foreign currency exchange rates

had a favorable effect of $1.5 million on pre-tax net income and

$0.8 million on pre-tax operating income for the full year.

Corporate and Other

The Corporate and Other segment’s pre-tax net losses totaled

$27.4 million compared with a pre-tax net loss of $51.5 million the

year before. Pre-tax operating losses were $26.3 million, versus

the year-ago pre-tax loss of $16.7 million. Current-period results

reflected higher compensation, including annual incentive accrual

adjustments. For the full year, pre-tax net losses totaled $39.2

million compared with $119.1 million in 2015. Pre-tax operating

losses were $88.4 million versus $52.0 million in the prior

year.

Company Guidance

On an annual basis, the Company provides financial guidance

based upon the intermediate term rather than giving a range of

annual earnings per share for an upcoming year. This better

reflects the long-term nature of the business and the difficulty in

predicting the timing of shorter-term or periodic events such as

block transactions. The Company accepts risks over very long

periods of time, up to 30 years or longer in some cases. While more

predictable over longer-term horizons, RGA’s business is subject to

inherent short-term volatility, primarily due to mortality and

morbidity experience.

Over the intermediate term, the Company continues to target

growth in operating income per share in the 5 to 8 percent range,

and operating return on equity of 10 to 12 percent. It is presumed

that there are no significant changes in the investment environment

from current levels, and the Company will deploy $300 to $400

million of excess capital, on average, annually. These guidance

ranges are based upon “normalized” results. Both the operating EPS

target range and the ROE ranges are unchanged from a year ago.

Todd C. Larson, chief financial officer, commented, “We believe

that our EPS range is appropriate, and we expect the combination of

organic growth, execution of block transactions and efficient

capital management to allow us to reach our financial targets. We

have faced significant macro headwinds in terms of weak foreign

currencies and sustained low interest rates over the past several

years, and we assume that there will be some level of ongoing

headwinds for the foreseeable future. Nevertheless, we expect that

we can overcome these challenges and achieve our goals.”

Stock Repurchase Authorization

The board of directors authorized a share repurchase program for

up to $400 million of the company's outstanding common stock,

replacing the previous share repurchase authorization. This new

authorization is effective immediately and does not have an

expiration date. Repurchases would be made in accordance with

applicable securities laws and would be made through market

transactions, block trades, privately negotiated transactions or

other means, or a combination of these methods, with the timing and

number of shares repurchased dependent on a variety of factors,

including share price, corporate and regulatory requirements, and

market and business conditions. Repurchases may be commenced or

suspended from time to time without prior notice.

Dividend Declaration

The board of directors declared a regular quarterly dividend of

$0.41, payable March 2 to shareholders of record as of February

9.

Earnings Conference Call

A conference call to discuss fourth-quarter results will begin

at 11 a.m. Eastern Time on Tuesday, January 31. Interested parties

may access the call by dialing 877-879-6174 (domestic) or

719-325-4849 (international). The access code is 1763380. A live

audio webcast of the conference call will be available on the

Company’s Investor Relations website at www.rgare.com. A replay of the conference call

will be available at the same address for 90 days following

the conference call. A telephonic replay also will be available

through Wednesday, February 8 at 888-203-1112 (domestic) or

719-457-0820 (international), access code 1763380.

The Company has posted to its website a Quarterly Financial

Supplement that includes financial information for all segments as

well as information on its investment portfolio. Additionally, the

Company posts periodic reports, press releases and other useful

information on its Investor Relations website.

Use of Non-GAAP Financial Measures

RGA uses a non-GAAP financial measure called operating income as

a basis for analyzing financial results. This measure also serves

as a basis for establishing target levels and awards under RGA’s

management incentive programs. Management believes that operating

income, on a pre-tax and after-tax basis, better measures the

ongoing profitability and underlying trends of the Company’s

continuing operations, primarily because that measure excludes

substantially all of the effect of net investment related gains and

losses, as well as changes in the fair value of certain embedded

derivatives and related deferred acquisition costs. These items can

be volatile, primarily due to the credit market and interest rate

environment, and are not necessarily indicative of the performance

of the Company’s underlying businesses. Additionally, operating

income excludes any net gain or loss from discontinued operations,

the cumulative effect of any accounting changes, and other items

that management believes are not indicative of the Company’s

ongoing operations. The definition of operating income can vary by

company and is not considered a substitute for GAAP net income.

Reconciliations to GAAP net income are provided in the following

tables. Additional financial information can be found in the

Quarterly Financial Supplement on RGA’s Investor Relations website

at www.rgare.com in the “Earnings”

section.

Book value per share excluding the impact of AOCI is a non-GAAP

financial measure that management believes is important in

evaluating the balance sheet in order to ignore the effects of

unrealized amounts primarily associated with mark-to-market

adjustments on investments and foreign currency translation.

Operating income per diluted share is a non-GAAP financial

measure calculated as operating income divided by weighted average

diluted shares outstanding. Operating return on equity is a

non-GAAP financial measure calculated as operating income divided

by average shareholders’ equity excluding AOCI.

About RGA

Reinsurance Group of America, Incorporated is among the largest

global providers of life reinsurance, with operations in Australia,

Barbados, Bermuda, Brazil, Canada, China, France, Germany, Hong

Kong, India, Ireland, Italy, Japan, Malaysia, Mexico, the

Netherlands, New Zealand, Poland, Singapore, South Africa, South

Korea, Spain, Taiwan, the United Arab Emirates, the United Kingdom

and the United States. Worldwide, RGA has assumed approximately

$3.1 trillion of life reinsurance in force, and total assets of

$53.1 billion.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

including, among others, statements relating to projections of the

earnings, revenues, income or loss, ratios, future financial

performance and growth potential of Reinsurance Group of America,

Incorporated and its subsidiaries (which we refer to in the

previous paragraphs as “we,” “us” or “our”). The words “intend,”

“expect,” “project,” “estimate,” “predict,” “anticipate,” “should,”

“believe,” and other similar expressions also are intended to

identify forward-looking statements. Forward-looking statements are

inherently subject to risks and uncertainties, some of which cannot

be predicted or quantified. Future events and actual results,

performance and achievements could differ materially from those set

forth in, contemplated by or underlying the forward-looking

statements.

Numerous important factors could cause actual results and events

to differ materially from those expressed or implied by

forward-looking statements including, without limitation, (1)

adverse capital and credit market conditions and their impact on

the Company’s liquidity, access to capital and cost of capital, (2)

the impairment of other financial institutions and its effect on

the Company’s business, (3) requirements to post collateral or make

payments due to declines in market value of assets subject to the

Company’s collateral arrangements, (4) the fact that the

determination of allowances and impairments taken on the Company’s

investments is highly subjective, (5) adverse changes in mortality,

morbidity, lapsation or claims experience, (6) changes in the

Company’s financial strength and credit ratings and the effect of

such changes on the Company’s future results of operations and

financial condition, (7) inadequate risk analysis and underwriting,

(8) general economic conditions or a prolonged economic downturn

affecting the demand for insurance and reinsurance in the Company’s

current and planned markets, (9) the availability and cost of

collateral necessary for regulatory reserves and capital, (10)

market or economic conditions that adversely affect the value of

the Company’s investment securities or result in the impairment of

all or a portion of the value of certain of the Company’s

investment securities, that in turn could affect regulatory

capital, (11) market or economic conditions that adversely affect

the Company’s ability to make timely sales of investment

securities, (12) risks inherent in the Company’s risk management

and investment strategy, including changes in investment portfolio

yields due to interest rate or credit quality changes, (13)

fluctuations in U.S. or foreign currency exchange rates, interest

rates, or securities and real estate markets, (14) adverse

litigation or arbitration results, (15) the adequacy of reserves,

resources and accurate information relating to settlements, awards

and terminated and discontinued lines of business, (16) the

stability of and actions by governments and economies in the

markets in which the Company operates, including ongoing

uncertainties regarding the amount of United States sovereign debt

and the credit ratings thereof, (17) competitive factors and

competitors’ responses to the Company’s initiatives, (18) the

success of the Company’s clients, (19) successful execution of the

Company’s entry into new markets, (20) successful development and

introduction of new products and distribution opportunities, (21)

the Company’s ability to successfully integrate acquired blocks of

business and entities, (22) action by regulators who have authority

over the Company’s reinsurance operations in the jurisdictions in

which it operates, (23) the Company’s dependence on third parties,

including those insurance companies and reinsurers to which the

Company cedes some reinsurance, third-party investment managers and

others, (24) the threat of natural disasters, catastrophes,

terrorist attacks, epidemics or pandemics anywhere in the world

where the Company or its clients do business, (25) interruption or

failure of the Company’s telecommunication, information technology

or other operational systems, or the Company’s failure to maintain

adequate security to protect the confidentiality or privacy of

personal or sensitive data stored on such systems, (26) changes in

laws, regulations, and accounting standards applicable to the

Company, its subsidiaries, or its business, (27) the effect of the

Company’s status as an insurance holding company and regulatory

restrictions on its ability to pay principal of and interest on its

debt obligations, and (28) other risks and uncertainties described

in this document and in the Company’s other filings with the

Securities and Exchange Commission.

Forward-looking statements should be evaluated together with the

many risks and uncertainties that affect our business, including

those mentioned in this document and described in the periodic

reports we file with the Securities and Exchange Commission. These

forward-looking statements speak only as of the date on which they

are made. We do not undertake any obligations to update these

forward-looking statements, even though our situation may change in

the future. We qualify all of our forward-looking statements by

these cautionary statements. For a discussion of the risks and

uncertainties that could cause actual results to differ materially

from those contained in the forward-looking statements, you are

advised to see Item 1A - “Risk Factors” in the 2015 Annual Report,

as updated by Part II, Item 1A - “Risk Factors” in the Company's

Quarterly Report on Form 10-Q for the period ended June 30,

2016.

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIESReconciliation of Consolidated Net Income to

Operating Income(Dollars in thousands)

(Unaudited)

Three Months EndedDecember 31,

Twelve Months EndedDecember 31,

2016 2015 2016 2015 Net income $

190,149 $ 163,127 $ 701,443 $ 502,166 Reconciliation to operating

income: Capital (gains) losses, derivatives and other, included in

investment related (gains) losses, net 66,640 40,203 (21,322 )

30,020 Capital (gains) losses on funds withheld, included in

investment income, net of related expenses (5,355 ) 161 (18,330 )

(10,640 ) Embedded derivatives: Included in investment related

(gains) losses, net (72,343 ) (6,004 ) (40,302 ) 85,789 Included in

interest credited (25,977 ) (917 ) (18,289 ) (8,178 ) DAC offset,

net 17,957 (8,542 ) 30,787 (31,996 ) Investment income on

unit-linked variable annuities (2,741 ) — (8,535 ) — Interest

credited on unit-linked variable annuities 2,741 — 8,535 —

Non-investment derivatives 188 (78 ) (1,389 ) (77 )

Operating income $ 171,259 $ 187,950 $ 632,598

$ 567,084

Reconciliation of Consolidated Income

before Income Taxes to Pre-tax Operating Income(Dollars in

thousands)

(Unaudited)

Three Months EndedDecember 31,

Twelve Months EndedDecember 31,

2016 2015 2016 2015 Income before income taxes $ 295,543 $ 206,743

$ 1,043,946 $ 744,795 Reconciliation to pre-tax operating income:

Capital (gains) losses, derivatives and other, included in

investment related (gains) losses, net 103,944 64,034 (22,082 )

49,586 Capital (gains) losses on funds withheld, included in

investment income, net of related expenses (8,238 ) 246 (28,200 )

(16,370 ) Embedded derivatives: Included in investment related

(gains) losses, net (111,297 ) (9,236 ) (62,003 ) 131,984 Included

in interest credited (39,964 ) (1,412 ) (28,137 ) (12,582 ) DAC

offset, net 27,625 (13,142 ) 47,364 (49,225 ) Investment income on

unit-linked variable annuities (4,217 ) — (13,131 ) — Interest

credited on unit-linked variable annuities 4,217 — 13,131 —

Non-investment derivatives 289 (120 ) (2,137 ) (118 )

Pre-tax operating income $ 267,902 $ 247,113 $

948,751 $ 848,070

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIESReconciliation of Pre-tax Net Income to Pre-tax

Operating Income(Dollars in thousands)

(Unaudited) Three Months Ended December 31,

2016

Pre-tax netincome (loss)

Capital(gains) losses,derivativesand

other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 131,492 $ (336 ) $ (1,811 ) $

129,345 Financial Solutions: Asset Intensive 72,261 35,800 (1)

(61,363 ) (2) 46,698 Financial Reinsurance 14,447 — —

14,447 Total U.S. and Latin America 218,200 35,464

(63,174 ) 190,490 Canada Traditional 37,026 (2,272 ) — 34,754

Canada Financial Solutions 4,065 — — 4,065

Total Canada 41,091 (2,272 ) — 38,819 EMEA Traditional

15,826 — — 15,826 EMEA Financial Solutions 41,328 (4,600 ) —

36,728 Total EMEA 57,154 (4,600 ) — 52,554 Asia

Pacific Traditional 18,464 — — 18,464 Asia Pacific Financial

Solutions (11,966 ) 5,846 — (6,120 ) Total Asia

Pacific 6,498 5,846 — 12,344 Corporate and Other (27,400 ) 1,095

— (26,305 ) Consolidated $ 295,543 $ 35,533

$ (63,174 ) $ 267,902 (1) Asset Intensive is

net of $(60,462) DAC offset. (2) Asset Intensive is net of $88,087

DAC offset. (Unaudited) Three Months Ended December 31, 2015

Pre-tax netincome (loss)

Capital(gains) losses,derivativesand

other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 79,483 $ 203 $ (696 ) $

78,990 Financial Solutions: Asset Intensive 30,874 124,163 (1)

(107,441 ) (2) 47,596 Financial Reinsurance 15,936 —

— 15,936 Total U.S. and Latin America 126,293 124,366

(108,137 ) 142,522 Canada Traditional 44,640 446 — 45,086 Canada

Financial Solutions 3,420 — — 3,420

Total Canada 48,060 446 — 48,506 EMEA Traditional 12,859 — — 12,859

EMEA Financial Solutions 28,145 (9,366 ) — 18,779

Total EMEA 41,004 (9,366 ) — 31,638 Asia Pacific Traditional

37,415 (1,706 ) — 35,709 Asia Pacific Financial Solutions 5,467

(17 ) — 5,450 Total Asia Pacific 42,882 (1,723

) — 41,159 Corporate and Other (51,496 ) 34,784 —

(16,712 ) Consolidated $ 206,743 $ 148,507 $ (108,137

) $ 247,113 (1) Asset Intensive is net of $84,347 DAC

offset. (2) Asset Intensive is net of $(97,489) DAC offset.

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIESReconciliation of Pre-tax Net Income to Pre-tax

Operating Income(Dollars in thousands)

(Unaudited) Twelve Months Ended December 31,

2016

Pre-tax netincome (loss)

Capital(gains) losses,derivativesand

other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 371,101 $ (339 ) $ 4,568 $

375,330 Financial Solutions: Asset Intensive 224,142 (52,840 ) (1)

33,680 (2) 204,982 Financial Reinsurance 59,238 — —

59,238 Total U.S. and Latin America 654,481 (53,179 )

38,248 639,550 Canada Traditional 134,705 (9,056 ) — 125,649 Canada

Financial Solutions 7,945 — — 7,945

Total Canada 142,650 (9,056 ) — 133,594 EMEA Traditional 30,059 (5

) — 30,054 EMEA Financial Solutions 138,007 (15,595 ) —

122,412 Total EMEA 168,066 (15,600 ) — 152,466 Asia

Pacific Traditional 113,928 (16 ) — 113,912 Asia Pacific Financial

Solutions 4,063 (6,473 ) — (2,410 ) Total Asia

Pacific 117,991 (6,489 ) — 111,502 Corporate and Other (39,242 )

(49,119 ) — (88,361 ) Consolidated $ 1,043,946 $

(133,443 ) $ 38,248 $ 948,751 (1) Asset

Intensive is net of $(81,024) DAC offset. (2) Asset Intensive is

net of $128,388 DAC offset. (Unaudited) Twelve Months Ended

December 31, 2015

Pre-tax netincome (loss)

Capital(gains) losses,derivativesand

other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 235,771 $ 201 $ (2,507 ) $

233,465 Financial Solutions: Asset Intensive 152,946 (37,872 ) (1)

84,488 (2) 199,562 Financial Reinsurance 55,017 — —

55,017 Total U.S. and Latin America 443,734 (37,671 )

81,981 488,044 Canada Traditional 124,175 (364 ) — 123,811 Canada

Financial Solutions 13,902 — — 13,902

Total Canada 138,077 (364 ) — 137,713 EMEA Traditional 48,410 (338

) — 48,072 EMEA Financial Solutions 108,445 (10,359 ) —

98,086 Total EMEA 156,855 (10,697 ) — 146,158 Asia

Pacific Traditional 105,654 — — 105,654 Asia Pacific Financial

Solutions 19,619 2,899 — 22,518 Total

Asia Pacific 125,273 2,899 — 128,172 Corporate and Other (119,144 )

67,127 — (52,017 ) Consolidated $ 744,795 $

21,294 $ 81,981 $ 848,070 (1) Asset

Intensive is net of $(11,804) DAC offset. (2) Asset Intensive is

net of $(37,421) DAC offset.

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIESPer Share and Shares Data(In thousands, except per

share data)

(Unaudited)

Three Months EndedDecember 31,

Twelve Months EndedDecember 31, 2016

2015 2016 2015 Earnings per share from net income:

Basic earnings per share $ 2.96 $ 2.49 $ 10.91 $ 7.55 Diluted

earnings per share $ 2.92 $ 2.46 $ 10.79 $ 7.46 Diluted

earnings per share from operating income $ 2.63 $ 2.84 $ 9.73 $

8.43 Weighted average number of common and common equivalent shares

outstanding 65,124 66,247 64,989 67,292

(Unaudited) At December 31, 2016 2015 Treasury shares 14,835 13,933

Common shares outstanding 64,303 65,205 Book value per share

outstanding $ 110.31 $ 94.09 Book value per share outstanding,

before impact of AOCI $ 92.59 $ 83.23

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIESCondensed Consolidated Statements of Income(Dollars

in thousands)

(Unaudited)

Three Months EndedDecember 31,

Twelve Months EndedDecember 31,

2016 2015 2016 2015 Revenues: Net

premiums $ 2,493,163 $ 2,328,501 $ 9,248,871 $ 8,570,741 Investment

income, net of related expenses 497,227 467,468 1,911,886 1,734,495

Investment related gains (losses), net: Other-than-temporary

impairments on fixed maturity securities (4,142 ) (27,605 ) (38,805

) (57,380 ) Other-than-temporary impairments on fixed maturity

securities transferred to accumulated other comprehensive income 74

— 74 — Other investment related gains (losses), net 14,261

(17,204 ) 132,926 (107,370 ) Total investment related gains

(losses), net 10,193 (44,809 ) 94,195 (164,750 ) Other revenue

68,715 77,431 266,559 277,692 Total

revenues 3,069,298 2,828,591 11,521,511

10,418,178 Benefits and expenses: Claims and other policy

benefits 2,116,045 2,015,929 7,993,375 7,489,382 Interest credited

64,089 105,032 364,691 336,964 Policy acquisition costs and other

insurance expenses 370,134 300,329 1,310,540 1,127,486 Other

operating expenses 175,634 158,556 645,509 554,044 Interest expense

41,422 35,820 137,623 142,863 Collateral finance and securitization

expense 6,431 6,182 25,827 22,644 Total

benefits and expenses 2,773,755 2,621,848 10,477,565

9,673,383 Income before income taxes 295,543 206,743

1,043,946 744,795 Provision for income taxes 105,394 43,616

342,503 242,629 Net income $ 190,149 $

163,127 $ 701,443 $ 502,166

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170130006085/en/

Reinsurance Group of America, IncorporatedJeff Hopson,

636-736-7000Senior Vice President - Investor Relations

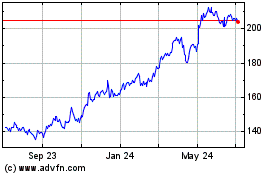

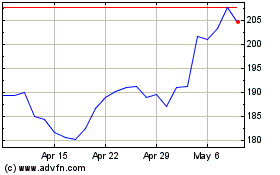

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Apr 2023 to Apr 2024