- Earnings per diluted share: $3.64 from

net income, $2.80 from operating income*

- ROE 8 percent and Operating ROE* 11

percent for the trailing twelve months

- Reported net premiums increased 10

percent

- Quarterly shareholder dividend raised

11 percent

Reinsurance Group of America, Incorporated (NYSE: RGA), a

leading global provider of life reinsurance, reported net income of

$236.1 million, or $3.64 per diluted share, compared with

$130.4 million, or $1.94 per diluted share, in the prior-year

quarter. Operating income* totaled $181.2 million, or $2.80

per diluted share, compared to $130.3 million, or $1.94 per diluted

share, the year before. Net foreign currency fluctuations had an

adverse effect of $0.06 per diluted share on net income, and $0.04

per diluted share on operating income. A tax-related adjustment

added $0.12 per diluted share in the quarter.

Quarterly Results

Year-to-Date Results ($ in thousands, except per share

data) 2016 2015 2016

2015 Net premiums $ 2,346,945 $ 2,129,043 $ 4,503,950

$ 4,152,895 Net income 236,103 130,391 312,575 255,505 Net income

per diluted share 3.64 1.94 4.81 3.76 Operating income* 181,228

130,270 301,978 252,048 Operating income per diluted share* 2.80

1.94 4.65 3.70 Book value per share 118.32 97.61 Book value per

share, excluding Accumulated Other Comprehensive Income (AOCI)*

87.33 80.30 Total assets 53,876,703 47,435,240

* See ‘Use of Non-GAAP Financial Measures’

below

Consolidated net premiums totaled $2.3 billion this quarter, up

10 percent from last year’s second quarter, primarily due to

organic growth and in-force transactions. Current-period premiums

reflect net adverse foreign currency effects of approximately $45.7

million. Excluding spread-based businesses and the value of

associated derivatives, investment income increased 7 percent over

year-ago levels, reflecting an increase in average invested assets

of approximately 10 percent, offset by the impact of lower yield on

new money and reinvested assets. The average investment yield,

excluding spread businesses, was down 17 basis points to 4.71

percent from the second quarter of 2015, but was 25 basis points

higher than the first-quarter yield. Variable investment income was

strong in both this quarter and the year-ago period, whereas it was

weak in the first quarter of this year.

The effective tax rate was approximately 33.2 percent on net

income, and was approximately 33.7 percent on operating income this

quarter, slightly below an expected range of 34 percent to 35

percent. This was primarily due to generating a

greater-than-expected portion of earnings in jurisdictions that

have lower income tax rates than the U.S. statutory rate. The $0.12

per diluted share tax adjustment primarily affected interest

expense; see further explanation in the Corporate section.

Greig Woodring, chief executive officer, commented, “We are

pleased with the quarter in practically all respects, as the

bottom-line number was very strong. In addition, there were

positive developments in many areas across segments and

geographies, and our investment results reflected

higher-than-normal variable investment income. After a solid first

quarter, our year-to-date EPS and operating EPS were up

considerably over the year-ago period, despite ongoing

macroeconomic headwinds from lower interest rates and relatively

weak foreign currencies. The negative effect of foreign currency

translation on earnings year-to-date was equal to $0.14 per diluted

share.

“Highlights of the quarter included improvement in Canada due to

favorable mortality, continued momentum in our U.S. Asset-Intensive

business, and another good quarter from Asia Pacific. Our U.S.

Traditional operations reported its best quarter in some time,

based upon strong variable investment income and mortality results

that were in line with expectations. Finally, top-line growth was

particularly strong this quarter, based upon solid organic growth

and in-force transactions.

“We repurchased approximately 120,000 RGA common shares during

the quarter, and we continue to pursue a balanced approach to

capital management in terms of deployment into in-force and other

attractive transactions, share repurchases, and shareholder

dividend increases over time. The board of directors increased the

quarterly dividend 11 percent to $0.41 per share. We closed some

smaller in-force transactions during the quarter, and the pipeline

continues to be healthy. Our deployable, excess capital position

was approximately $1.0 billion at June 30, and included the effects

of our senior notes and subordinated debentures offering. Ending

book value per share this quarter was $118.32 including AOCI, and

$87.33 excluding AOCI, a 9 percent increase over that of a year

ago.

“Looking forward, the macroeconomic environment remains

challenging overall, but we continue to see good demand from

clients for our solutions. We expect to continue to execute in both

our traditional and transactional businesses.”

SEGMENT RESULTS

U.S. and Latin America

Traditional

The U.S. and Latin America Traditional segment reported pre-tax

net income of $111.4 million, compared with $82.8 million

in the second quarter of 2015. Pre-tax operating income totaled

$112.3 million for the quarter, compared with

$79.4 million in last year’s second quarter. The

current-period results reflected higher-than-normal variable

investment income, the additive impact of in-force transactions and

mortality experience that was in line with expectations, whereas

last year’s second quarter was affected by elevated individual

mortality claims.

Traditional net premiums increased 12 percent from last year's

second quarter to $1,307.4 million.

Non-Traditional

The Asset-Intensive business reported pre-tax net income of

$94.0 million compared with $55.8 million last year.

Second-quarter pre-tax operating income totaled $54.3 million

compared with $56.4 million last year. Results were strong in both

periods due to favorable investment spreads, while the current

quarter benefited from the impact of a recently added new in-force

block as well.

The Financial Reinsurance business continued to perform well,

reporting pre-tax net income and pre-tax operating income of $14.9

million, up slightly from $14.6 million the year before.

Canada

Traditional

The Canada Traditional segment reported pre-tax net income of

$43.3 million compared with $22.7 million in the second quarter of

2015. Pre-tax operating income totaled $40.9 million compared with

$23.8 million in the second quarter of 2015. The

current-quarter's very strong results were primarily due to

favorable mortality experience. The negative effect of a weaker

Canadian dollar adversely affected pre-tax net income by $2.2

million and pre-tax operating income by $2.1 million.

Reported net premiums increased 7 percent to $240.1 million. Net

premiums suffered adverse effects from foreign currency exchange

rates totaling $11.6 million.

Non-Traditional

The Canada Non-Traditional business segment, which consists of

longevity and fee-based transactions, reported pre-tax net income

and pre-tax operating income of $2.1 million this quarter versus

$3.1 million in the prior-year quarter. Pre-tax net income and

pre-tax operating income included an adverse effect of $0.1 million

due to a relatively weaker Canadian dollar.

Europe, Middle East and Africa (EMEA)

Traditional

The EMEA Traditional segment reported pre-tax net income and

pre-tax operating income of $6.8 million versus $9.2 million in

last year’s second quarter, reflecting unfavorable claims

experience, most notably in the U.K.

Net reported premiums increased 4 percent and totaled $286.9

million, compared with $275.7 million in last year's second

quarter. Foreign currency exchange rates adversely affected net

premiums by $20.2 million.

Non-Traditional

The EMEA Non-Traditional business segment includes longevity,

asset-intensive and fee-based transactions. Pre-tax net income

totaled $27.5 million compared with $31.4 million in the year-ago

period. Pre-tax operating income decreased to $26.1 million

compared with a strong $31.8 million in the year-ago period. The

current-period results showed continued favorable experience in

both the asset-intensive and longevity business, while the year-ago

period experience was unusually favorable. Net foreign currency

fluctuations adversely affected pre-tax net income by $2.0 million

and pre-tax operating income by $1.8 million.

Asia Pacific

Traditional

The Asia Pacific Traditional segment's pre-tax net income and

pre-tax operating income rose to $34.5 million, from $4.3

million in the prior-year period. This quarter reflected solid

results collectively across the Asian operations, most notably Hong

Kong. Additionally, this year's results were modestly profitable in

Australia, a significant improvement versus the year-ago period

that reflected poor results in individual and group morbidity

product lines. Net foreign currency exchange rate fluctuations had

a favorable effect of $0.5 million on pre-tax net income and

pre-tax operating income.

Reported net premiums rose 16 percent to $454.6 million

from $390.5 million in the prior-year period, attributable to

strong overall results in Hong Kong and the effects of new

business, newer treaties in particular. Net premiums reflected a

negative effect of $7.7 million from foreign currency exchange

rates.

Non-Traditional

The Asia Pacific Non-Traditional business segment includes

asset-intensive, fee-based and other various transactions. Pre-tax

net loss in this segment totaled $0.1 million compared with a

pre-tax loss of $1.4 million last year. Pre-tax operating

losses were $6.0 million this quarter versus pre-tax operating

income of $0.7 million in the prior-year quarter, primarily

attributable to poor results in a small number of treaties. Net

foreign currency exchange rate fluctuations had a favorable effect

of $0.2 million on pre-tax net income and an adverse effect of $0.1

million on pre-tax operating income.

Corporate and Other

The Corporate and Other segment’s pre-tax net income increased

to $18.8 million contrasted with a pre-tax net loss of $8.7 million

the year before. Pre-tax operating losses were $12.8 million,

moderately higher than the year-ago pre-tax loss of $9.9 million,

but less than a more typical run rate of approximately $20 million,

attributable mainly to a reduction in tax-related interest expense

resulting from the effective settlement of uncertain tax positions

during the quarter.

Dividend Declaration

The board of directors increased the quarterly dividend 11

percent, to $0.41 from $0.37, payable August 30 to shareholders of

record as of August 9.

Earnings Conference Call

A conference call to discuss second-quarter results will begin

at 11 a.m. Eastern Time on Friday, July 29. Interested parties may

access the call by dialing 877-718-5099 (domestic) or 719-325-4784

(international). The access code is 1371535. A live audio webcast

of the conference call will be available on the Company’s Investor

Relations website at www.rgare.com. A

replay of the conference call will be available at the same address

for 90 days following the conference call. A telephonic replay

also will be available through Saturday, August 6 at 888-203-1112

(domestic) or 719-457-0820 (international), access code

1371535.

The Company has posted to its website a Quarterly Financial

Supplement that includes financial information for all segments as

well as information on its investment portfolio. Additionally, the

Company posts periodic reports, press releases and other useful

information on its Investor Relations website.

Use of Non-GAAP Financial Measures

RGA uses a non-GAAP financial measure called operating income as

a basis for analyzing financial results. This measure also serves

as a basis for establishing target levels and awards under RGA’s

management incentive programs. Management believes that operating

income, on a pre-tax and after-tax basis, better measures the

ongoing profitability and underlying trends of the Company’s

continuing operations, primarily because that measure excludes

substantially all of the effect of net investment related gains and

losses, as well as changes in the fair value of certain embedded

derivatives and related deferred acquisition costs. These items can

be volatile, primarily due to the credit market and interest rate

environment, and are not necessarily indicative of the performance

of the Company’s underlying businesses. Additionally, operating

income excludes any net gain or loss from discontinued operations,

the cumulative effect of any accounting changes, and other items

that management believes are not indicative of the Company’s

ongoing operations. The definition of operating income can vary by

company and is not considered a substitute for GAAP net income.

Reconciliations to GAAP net income are provided in the following

tables. Additional financial information can be found in the

Quarterly Financial Supplement on RGA’s Investor Relations website

at www.rgare.com in the “Quarterly

Results” tab and in the “Featured Report” section.

Book value per share excluding the impact of AOCI is a non-GAAP

financial measure that management believes is important in

evaluating the balance sheet in order to ignore the effects of

unrealized amounts primarily associated with mark-to-market

adjustments on investments and foreign currency translation.

Operating income per diluted share is a non-GAAP financial

measure calculated as operating income divided by weighted average

diluted shares outstanding. Operating return on equity is a

non-GAAP financial measure calculated as operating income divided

by average shareholders’ equity excluding AOCI.

About RGA

Reinsurance Group of America, Incorporated is among the largest

global providers of life reinsurance, with operations in Australia,

Barbados, Bermuda, Brazil, Canada, China, France, Germany, Hong

Kong, India, Ireland, Italy, Japan, Malaysia, Mexico, the

Netherlands, New Zealand, Poland, Singapore, South Africa, South

Korea, Spain, Taiwan, the United Arab Emirates, the United Kingdom

and the United States. Worldwide, RGA has assumed approximately

$3.1 trillion of life reinsurance in force, and total assets of

$53.9 billion.

Cautionary Statement Regarding Forward-looking

Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

including, among others, statements relating to projections of the

earnings, revenues, income or loss, ratios, future financial

performance and growth potential of Reinsurance Group of America,

Incorporated and its subsidiaries (which we refer to in the

previous paragraphs as “we,” “us” or “our”). The words “intend,”

“expect,” “project,” “estimate,” “predict,” “anticipate,” “should,”

“believe,” and other similar expressions also are intended to

identify forward-looking statements. Forward-looking statements are

inherently subject to risks and uncertainties, some of which cannot

be predicted or quantified. Future events and actual results,

performance and achievements could differ materially from those set

forth in, contemplated by or underlying the forward-looking

statements.

Numerous important factors could cause actual results and events

to differ materially from those expressed or implied by

forward-looking statements including, without limitation, (1)

adverse capital and credit market conditions and their impact on

the Company’s liquidity, access to capital and cost of capital, (2)

the impairment of other financial institutions and its effect on

the Company’s business, (3) requirements to post collateral or make

payments due to declines in market value of assets subject to the

Company’s collateral arrangements, (4) the fact that the

determination of allowances and impairments taken on the Company’s

investments is highly subjective, (5) adverse changes in mortality,

morbidity, lapsation or claims experience, (6) changes in the

Company’s financial strength and credit ratings and the effect of

such changes on the Company’s future results of operations and

financial condition, (7) inadequate risk analysis and underwriting,

(8) general economic conditions or a prolonged economic downturn

affecting the demand for insurance and reinsurance in the Company’s

current and planned markets, (9) the availability and cost of

collateral necessary for regulatory reserves and capital, (10)

market or economic conditions that adversely affect the value of

the Company’s investment securities or result in the impairment of

all or a portion of the value of certain of the Company’s

investment securities, that in turn could affect regulatory

capital, (11) market or economic conditions that adversely affect

the Company’s ability to make timely sales of investment

securities, (12) risks inherent in the Company’s risk management

and investment strategy, including changes in investment portfolio

yields due to interest rate or credit quality changes, (13)

fluctuations in U.S. or foreign currency exchange rates, interest

rates, or securities and real estate markets, (14) adverse

litigation or arbitration results, (15) the adequacy of reserves,

resources and accurate information relating to settlements, awards

and terminated and discontinued lines of business, (16) the

stability of and actions by governments and economies in the

markets in which the Company operates, including ongoing

uncertainties regarding the amount of United States sovereign debt

and the credit ratings thereof, (17) competitive factors and

competitors’ responses to the Company’s initiatives, (18) the

success of the Company’s clients, (19) successful execution of the

Company’s entry into new markets, (20) successful development and

introduction of new products and distribution opportunities, (21)

the Company’s ability to successfully integrate acquired blocks of

business and entities, (22) action by regulators who have authority

over the Company’s reinsurance operations in the jurisdictions in

which it operates, (23) the Company’s dependence on third parties,

including those insurance companies and reinsurers to which the

Company cedes some reinsurance, third-party investment managers and

others, (24) the threat of natural disasters, catastrophes,

terrorist attacks, epidemics or pandemics anywhere in the world

where the Company or its clients do business, (25) interruption or

failure of the Company’s telecommunication, information technology

or other operational systems, or the Company’s failure to maintain

adequate security to protect the confidentiality or privacy of

personal or sensitive data stored on such systems, (26) changes in

laws, regulations, and accounting standards applicable to the

Company, its subsidiaries, or its business, (27) the effect of the

Company’s status as an insurance holding company and regulatory

restrictions on its ability to pay principal of and interest on its

debt obligations, and (28) other risks and uncertainties described

in this document and in the Company’s other filings with the

Securities and Exchange Commission.

Forward-looking statements should be evaluated together with the

many risks and uncertainties that affect our business, including

those mentioned in this document and described in the periodic

reports we file with the Securities and Exchange Commission. These

forward-looking statements speak only as of the date on which they

are made. We do not undertake any obligations to update these

forward-looking statements, even though our situation may change in

the future. We qualify all of our forward-looking statements by

these cautionary statements. For a discussion of the risks and

uncertainties that could cause actual results to differ materially

from those contained in the forward-looking statements, you are

advised to review the risk factors in our Annual Report on Form

10-K for the year ended December 31, 2015.

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIES

Reconciliation of Consolidated Net Income

to Operating Income

(Dollars in thousands)

(Unaudited) Three Months EndedJune 30, Six Months EndedJune

30, 2016 2015 2016 2015 Net income $

236,103 $ 130,391 $ 312,575 $ 255,505 Reconciliation to operating

income: Capital (gains) losses, derivatives and other, included in

investment related (gains) losses, net (46,490 ) 27,152 (68,217 )

12,567 Capital (gains) losses on funds withheld, included in

investment income, net of related expenses (7,577 ) (1,951 )

(10,816 ) (9,363 ) Embedded derivatives: Included in investment

related (gains) losses, net (31,739 ) (18,056 ) 69,134 (209 )

Included in interest credited (11,287 ) (6,817 ) 7,660 (114 ) DAC

offset, net 42,147 (770 ) (7,889 ) (6,589 ) Investment income on

unit-linked variable annuities (1,928 ) — (2,193 ) — Interest

credited on unit-linked variable annuities 1,928 — 2,193 —

Non-investment derivatives 71 321 (469 ) 251

Operating income $ 181,228 $ 130,270 $ 301,978

$ 252,048

Reconciliation of Consolidated Income

before Income Taxes to Pre-tax Operating Income

(Dollars in thousands)

(Unaudited) Three Months EndedJune 30, Six Months EndedJune

30, 2016 2015 2016 2015 Income before

income taxes $ 353,223 $ 213,790 $ 460,803 $ 397,915 Reconciliation

to pre-tax operating income: Capital (gains) losses, derivatives

and other, included in investment related (gains) losses, net

(67,100 ) 41,526 (99,068 ) 20,580 Capital (gains) losses on funds

withheld, included in investment income, net of related expenses

(11,657 ) (3,002 ) (16,640 ) (14,404 ) Embedded derivatives:

Included in investment related (gains) losses, net (48,829 )

(27,780 ) 106,360 (322 ) Included in interest credited (17,364 )

(10,488 ) 11,785 (175 ) DAC offset, net 64,841 (1,187 ) (12,137 )

(10,138 ) Investment income on unit-linked variable annuities

(2,966 ) — (3,374 ) — Interest credited on unit-linked variable

annuities 2,966 — 3,374 — Non-investment derivatives 110 493

(721 ) 385 Pre-tax operating income $ 273,224

$ 213,352 $ 450,382 $ 393,841

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIES

Reconciliation of Pre-tax Net Income to

Pre-tax Operating Income

(Dollars in thousands)

(Unaudited) Three Months Ended June 30, 2016

Pre-tax netincome (loss)

Capital

(gains) losses,

derivatives

and other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 111,430 $ 1 $ 881 $ 112,312

Non-Traditional: Asset Intensive 93,979 (64,277 ) (1) 24,621 (2)

54,323 Financial Reinsurance 14,875 — — 14,875

Total U.S. and Latin America 220,284 (64,276 ) 25,502

181,510 Canada Traditional 43,309 (2,402 ) — 40,907 Canada

Non-Traditional 2,128 — — 2,128 Total

Canada 45,437 (2,402 ) — 43,035 EMEA Traditional 6,834 — — 6,834

EMEA Non-Traditional 27,469 (1,341 ) — 26,128

Total EMEA 34,303 (1,341 ) — 32,962 Asia Pacific Traditional 34,482

— — 34,482 Asia Pacific Non-Traditional (73 ) (5,925 ) —

(5,998 ) Total Asia Pacific 34,409 (5,925 ) — 28,484 Corporate and

Other 18,790 (31,557 ) — (12,767 ) Consolidated $

353,223 $ (105,501 ) $ 25,502 $ 273,224

(1) Asset Intensive is net of

$(26,854) DAC offset.

(2) Asset Intensive is net of

$91,695 DAC offset.

(Unaudited) Three Months Ended June 30, 2015

Pre-tax netincome (loss)

Capital(gains) losses,derivativesand

other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 82,793 $ (2 ) $ (3,358 ) $

79,433 Non-Traditional: Asset Intensive 55,750 25,739 (1) (25,087 )

(2) 56,402 Financial Reinsurance 14,643 — —

14,643 Total U.S. and Latin America 153,186 25,737 (28,445 )

150,478 Canada Traditional 22,736 1,023 — 23,759 Canada

Non-Traditional 3,094 — — 3,094 Total

Canada 25,830 1,023 — 26,853 EMEA Traditional 9,159 — — 9,159 EMEA

Non-Traditional 31,432 402 — 31,834

Total EMEA 40,591 402 — 40,993 Asia Pacific Traditional 4,315 — —

4,315 Asia Pacific Non-Traditional (1,405 ) 2,056 —

651 Total Asia Pacific 2,910 2,056 — 4,966 Corporate and

Other (8,727 ) (1,211 ) — (9,938 ) Consolidated $ 213,790

$ 28,007 $ (28,445 ) $ 213,352

(1) Asset Intensive is net of

$(11,010) DAC offset.

(2) Asset Intensive is net of

$9,823 DAC offset.

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIES

Reconciliation of Pre-tax Net Income to

Pre-tax Operating Income

(Dollars in thousands)

(Unaudited) Six Months Ended June 30, 2016

Pre-tax netincome (loss)

Capital(gains) losses,derivativesand

other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 162,528 $ 66 $ 2,916 $

165,510 Non-Traditional: Asset Intensive 63,149 (80,359 ) (1)

116,801 (2) 99,591 Financial Reinsurance 30,809 — —

30,809 Total U.S. and Latin America 256,486 (80,293 )

119,717 295,910 Canada Traditional 63,404 (3,133 ) — 60,271 Canada

Non-Traditional 2,720 — — 2,720 Total

Canada 66,124 (3,133 ) — 62,991 EMEA Traditional 5,718 (5 ) — 5,713

EMEA Non-Traditional 52,893 (1,154 ) — 51,739

Total EMEA 58,611 (1,159 ) — 57,452 Asia Pacific Traditional 75,642

(16 ) — 75,626 Asia Pacific Non-Traditional 8,480 (7,036 ) —

1,444 Total Asia Pacific 84,122 (7,052 ) — 77,070

Corporate and Other (4,540 ) (38,501 ) — (43,041 )

Consolidated $ 460,803 $ (130,138 ) $ 119,717 $

450,382

(1) Asset Intensive is net of

$(13,709) DAC offset.

(2) Asset Intensive is net of

$1,572 DAC offset.

(Unaudited) Six Months Ended June 30, 2015

Pre-tax netincome (loss)

Capital(gains) losses,derivativesand

other, net

Change invalue ofembeddedderivatives,

net

Pre-taxoperatingincome (loss)

U.S. and Latin America: Traditional $ 100,636 $ (1 ) $ (886 ) $

99,749 Non-Traditional: Asset Intensive 97,890 2,347 (1) (3,501 )

(2) 96,736 Financial Reinsurance 27,008 — —

27,008 Total U.S. and Latin America 225,534 2,346 (4,387 )

223,493 Canada Traditional 45,463 (4,531 ) — 40,932 Canada

Non-Traditional 7,225 — — 7,225 Total

Canada 52,688 (4,531 ) — 48,157 EMEA Traditional 19,641 (49 ) —

19,592 EMEA Non-Traditional 51,066 (597 ) — 50,469

Total EMEA 70,707 (646 ) — 70,061 Asia Pacific Traditional

56,963 — — 56,963 Asia Pacific Non-Traditional 8,740 2,035

— 10,775 Total Asia Pacific 65,703 2,035 —

67,738 Corporate and Other (16,717 ) 1,109 — (15,608

) Consolidated $ 397,915 $ 313 $ (4,387 ) $ 393,841

(1) Asset Intensive is net of

$(6,248) DAC offset.

(2) Asset Intensive is net of

$(3,890) DAC offset.

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIES

Per Share and Shares Data

(In thousands, except per share data)

(Unaudited) Three Months EndedJune 30, Six Months EndedJune

30, 2016 2015 2016 2015 Earnings per share from net

income: Basic earnings per share $ 3.68 $ 1.97 $ 4.86 $ 3.80

Diluted earnings per share $ 3.64 $ 1.94 $ 4.81 $ 3.76

Diluted earnings per share from operating income $ 2.80 $ 1.94 $

4.65 $ 3.70 Weighted average number of common and common equivalent

shares outstanding 64,796 67,120 65,008

68,030

(Unaudited)

At June 30,

2016 2015 Treasury shares 15,068 12,716 Common shares outstanding

64,070 66,422 Book value per share outstanding $ 118.32 $ 97.61

Book value per share outstanding, before impact of AOCI $ 87.33 $

80.30

REINSURANCE GROUP OF AMERICA, INCORPORATED

AND SUBSIDIARIES

Condensed Consolidated Statements of

Income

(Dollars in thousands)

(Unaudited) Three Months EndedJune 30, Six Months EndedJune

30, 2016 2015 2016 2015 Revenues: Net

premiums $ 2,346,945 $ 2,129,043 $ 4,503,950 $ 4,152,895 Investment

income, net of related expenses

507,666

450,539

924,932

877,430 Investment related gains (losses), net:

Other-than-temporary impairments on fixed maturity securities (846

) (4,137 ) (34,663 ) (6,664 ) Other investment related gains

(losses), net 119,110 (12,041 ) 32,041 (1,931 ) Total

investment related gains (losses), net 118,264 (16,178 ) (2,622 )

(8,595 ) Other revenue 66,193 66,936 125,376

129,223 Total revenues

3,039,068

2,630,340

5,551,636

5,150,953 Benefits and expenses: Claims and other

policy benefits 1,997,502 1,866,183 3,884,266 3,641,634 Interest

credited 95,849 77,246 183,754 197,924 Policy acquisition costs and

other insurance expenses 405,681 300,412 639,444 577,455 Other

operating expenses

159,895

131,600

317,319

253,218 Interest expense 20,331 35,851 53,138 71,478 Collateral

finance and securitization expense 6,587 5,258 12,912

11,329 Total benefits and expenses

2,685,845

2,416,550

5,090,833

4,753,038 Income before income taxes 353,223 213,790

460,803 397,915 Provision for income taxes 117,120 83,399

148,228 142,410 Net income $ 236,103 $

130,391 $ 312,575 $ 255,505

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160728006603/en/

Reinsurance Group of America, IncorporatedJeff Hopson,

636-736-7000Senior Vice President - Investor Relations

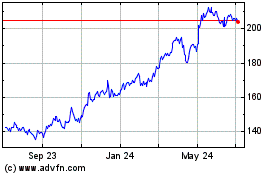

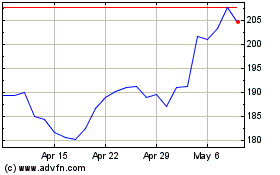

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Apr 2023 to Apr 2024